Why It’s So Hard To Stay Retired Once You Retire Early

13 min readIt’s hard enough to retire early, say before age 45. However, I’ve discovered it may be even harder to stay retired once you retire early!

As I was going through my archives, I realized I had a master plan to re-retire by September 1, 2022, several months after my 45th birthday. Given the birth of my daughter in December 2019 and then the onset of the pandemic, I figured I might as well work more online until the pandemic ended.

Clearly, we’re well past the date and I wanted to review some reasons why I’ve continued to stay engaged with online work.

Quick Early Retirement Background

I decided to leave work behind in 2012 at age 34. The corporate finance grind had burned me to a crisp and I wanted to be free. I had no kids to take care of and my wife, who is three years younger than me, agreed to also work until age 34 before retiring early as well.

We had a blast traveling the world and doing other leisurely activities until we had our son in 2017. After he was born, I decided to become more entrepreneurial by making more money online.

I felt a great responsibility to provide for my family once he was born. Even though I ran the financial calculations multiple times to ensure we could survive off our existing passive income, it felt irresponsible to not have a day job. As a compromise, instead of getting a day job, I worked more online.

Without a traditional working spouse, like some of my male peers had, I felt greater pressure to make money. With no safety net, I couldn’t mess things up. This was my first failure to stay retired.

After two years of being more entrepreneurial, I declared on January 6, 2020 that I would re-retire within three years. I’d stop spending time on business development, no longer long to go back to a traditional job, and I’d just write whatever the heck I wanted.

Financial Requirements Needed To Re-Retire By 45

In order to re-retire by 45 in mid-2022, I created two audacious financial goals.

- Boost our net worth by $1.5 million.

- Increase total income by $5,000 a month.

Achieving one, but ideally two of the goals, would be the only way I could feel OK not working with two young children. It takes between $20,000 – $55,000 a year before tax to raise a child in San Francisco, and I wanted a buffer.

Financially, my main goal is to achieve perpetual Fat FIRE, where my investment portfolio generates at least $250,000 a year forever. Unfortunately, inflation has made so many things more expensive. Then again, inflation has also helped boost dividend and bond income.

Finances Are Not The Main Issue

In the beginning, I thought boosting my net worth by $1.5 million was a highly unlikely goal. I assigned a 30% probability this financial goal could be achieved.

Risk assets like stocks and real estate felt fully valued in January 2020. Given we were a dual NO job household, we lacked a significant financial engine to boost our net worth by $500,000 a year for three years.

Therefore, I decided to focus on trying to make $60,000 more a year instead. I knew I was leaving a lot of money on the online table, but in the past, I didn’t care partially because I didn’t have kids. If I had cared more about the money, I’d still be working! Once the children came, I became more motivated to try.

I assigned a 75% probability this financial goal could be achieved.

Achieving The First Goal

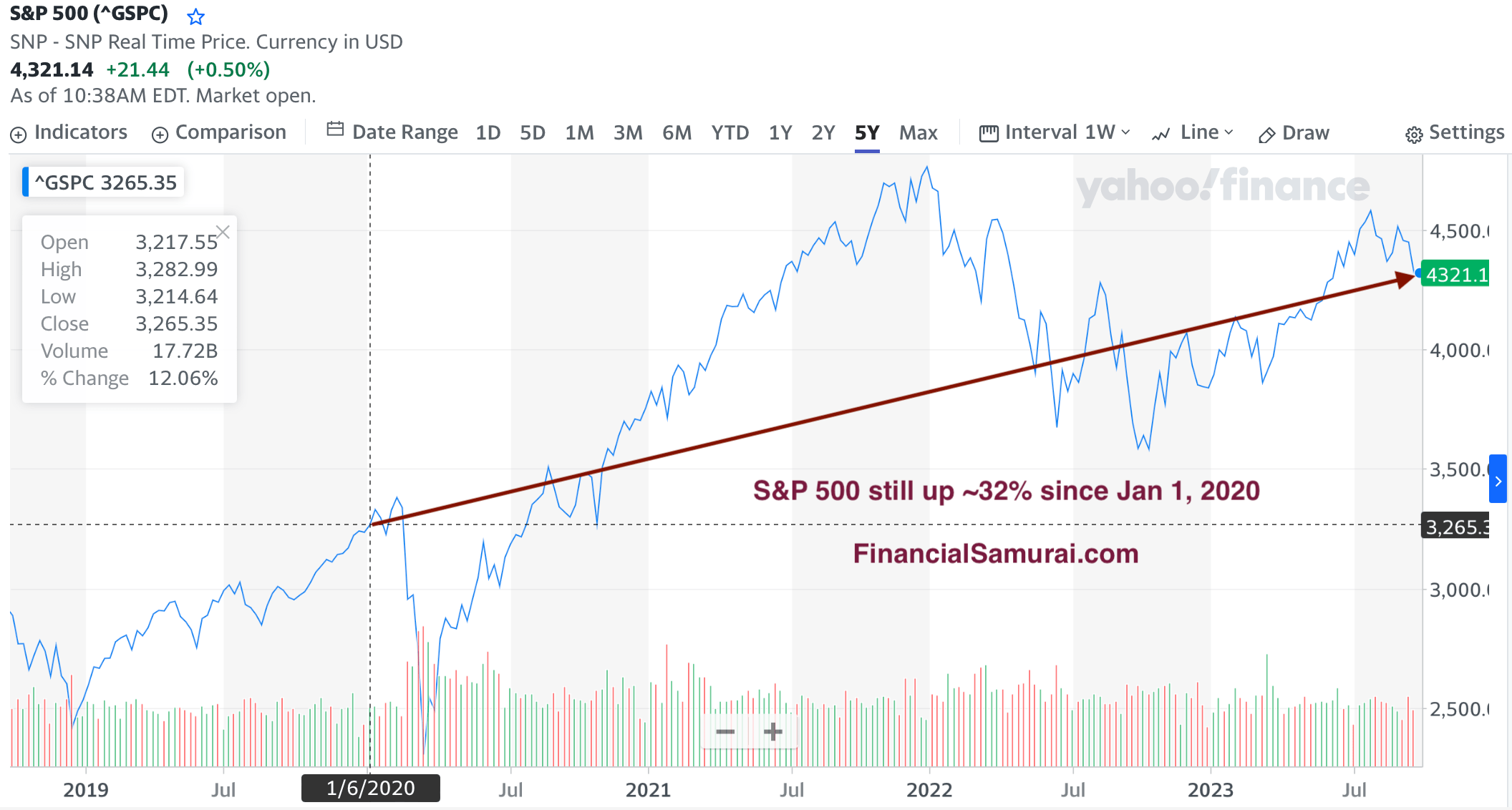

To my surprise, my net worth goal was achieved because stocks and real estate both surged higher since January 2020.

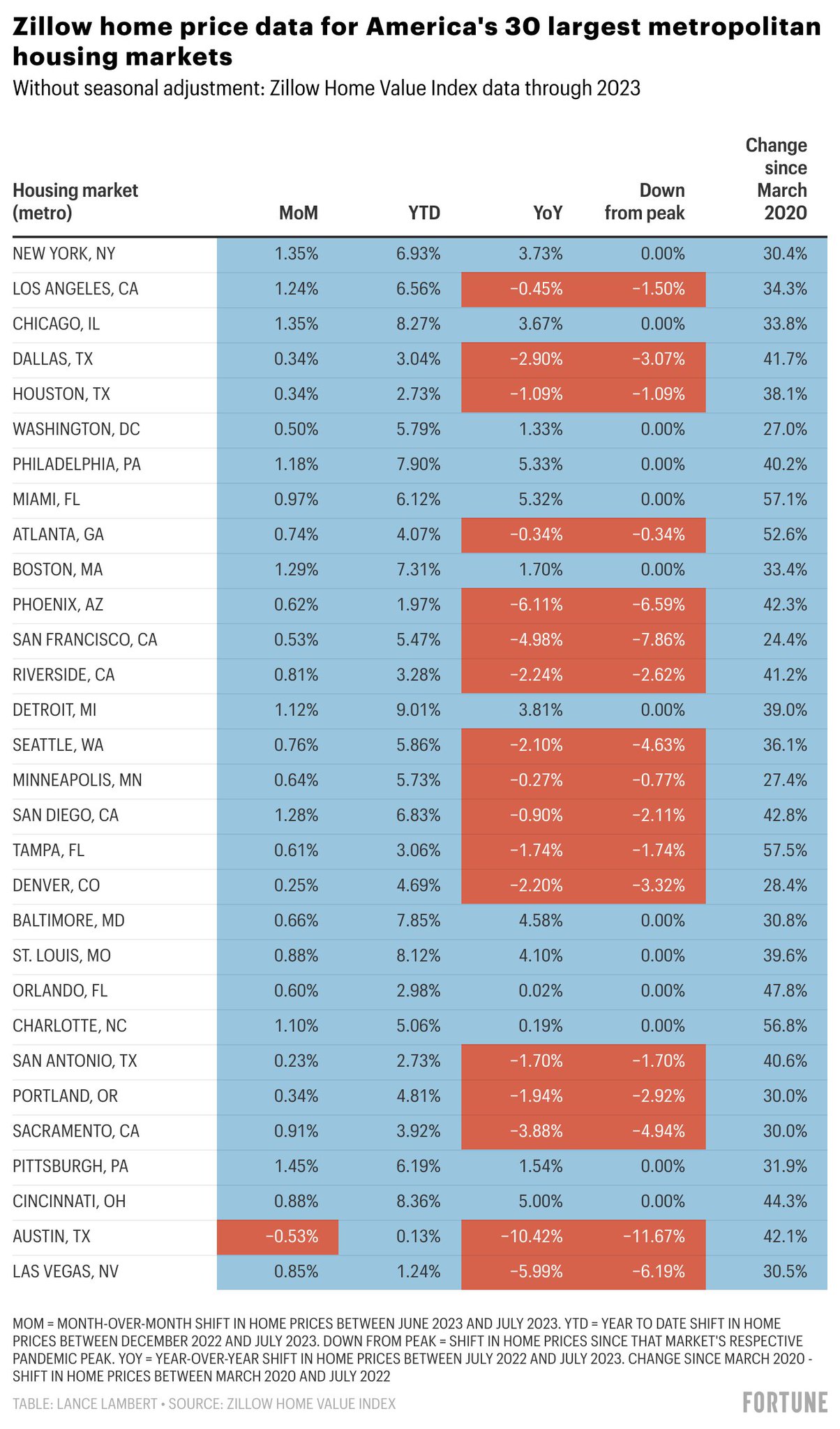

Even after the 2022 bear market, the S&P 500 is still 30%+ higher today than it was in January 2020. Meanwhile, San Francisco real estate prices are still up 15%+ since January 2020, despite the pullback since May 2022.

Given the majority of my net worth is exposed to risk assets, I was able to benefit from the rise in prices. Hence, the lesson here is to save aggressively and stay invested for the long term. 70% of the time, good things tend to happen.

Doing nothing and making money from your investments feels good. However, part of the price of entry is to stomach the pain of potentially losing a lot of money as well. We experienced a gut-wrenching March 2020 and a dismal 2022.

Achieving The Second Goal Was A Matter Of Effort

Making $5,000 more a month was straightforward. I just decided to say “yes” a little more often to the many companies that have asked to partner with Financial Samurai.

I still had to evaluate carefully each company before featuring it because there are so many companies out there and not all will survive or offer great products. It took time to test out the products myself. However, once I opened the site up to business, more business came.

The lesson here is that you can probably make more money than you currently are – whether from your day job or your platform. But it’s up to you to find the optimal balance between time and money. Adjust the ratios as your situation changes.

Main Reasons Why I Didn’t Re-Retire

Despite achieving both financial targets, I didn’t stop working online. The following reasons will highlight how difficult it is to completely let go of work.They will also expose how our attitudes towards money change over time.

The earlier you retire, the harder it is to stay retired.

1) Hard to break old habits

I’ve been publishing three posts a week without fail since July 2009. If you’ve ever done something consistently, after a while, like going to the gym, it becomes a part of who you are.

To end my 13-year writing streak in 2022 would have made me feel like a failure, so I didn’t want to stop. Besides, there were simply too many fascinating things to write about to quit.

I also viewed editing and hosting a well-written sponsored post as a partial reprieve from my publishing schedule. If an expert could write about farmland investing, the fine art market, wine, Sunbelt real estate, or the latest financial habits of its clients, I was all for it.

Related: The Secret To Your Success: 10 Years Of Unwavering Commitment

2) The fear of losing a lot of money again

Boosting our net worth by $1.5 million required practically no effort. After buying a forever home in mid-2020, we mainly just let our investments do their thing.

Given little effort was required, it doesn’t feel like the net worth gain was real. Instead, it felt like funny money that could disappear overnight. And much of it did in 2022!

During the process of giving up a lot of gains in 2022, when the September 1, 2022 deadline came to hang up my boots, I kept them on. Who knew how long the blood-letting would go on? It turns out the recent stock market bottom was in October 2022, the very next month.

When you’re losing lots of money in a bear market, it can sometimes feel like you’ll continue to lose money forever. Oftentimes there are “dead cat bounces” or “bear market rallies” that give you shimmers of hope. Sadly, said hope is dashed when the market resumes its sell-off.

As the Fed aggressively raised rates, I felt I had no choice but to keep battling. My wealth boat was sinking and I urgently needed to dump water out to stay afloat.

3) A whirlwind of busyness

Buy This Not That came out on July 22, 2022, which meant I was busy marketing the book for a couple of months after publication. I had little time to think about re-retirement when I was busy going on a bunch of podcasts and doing live TV interviews.

If you want to feel anxiety, spend two years writing a book, then publicize it on live TV! The experience will awaken scintillating emotions you never knew you had!

Once the lion’s share of the marketing was done, after October 1, 2022, I did take it easier for a month. But taking it easier was really just going back to my pre-book normal routine of ~15-20 hours a week online. Truly dialing things back would have meant going from 30 hours a week down to 10 hours a week.

But I did not do so because spending time on the book had necessitated spending less time on Financial Samurai. I felt like I had to catch up on some neglected items, such as updating old posts and cleaning up backend technical stuff.

4) A large new bill came

At two years nine months old, we decided to send our daughter to preschool two days a week starting in August 2022. As a result, we took on a new $1,400 a month bill.

Although my goal of making $5,000 more a month was in anticipation of these types of new expenses, the reality hits differently once you actually get the bill!

Once we started having to pay $1,400 a month for preschool, I told myself I needed to make $2,000 more a month gross to cover this new expense. Because if I didn’t, I would feel like I was losing progress.

Eventually, her preschool cost will eventually go up to $2,500+ a month once she starts going five days a week in Fall 2024. Knowing this, it felt difficult to re-retire.

Psychologically, it’s hard to lose financial ground, especially when you have dependents. We constantly reset our financial expectations higher. As a result, we end up grinding longer than we may need to.

5) The desire to win back my losses and not violate the 1st rule of FI

Given the 2022 bear market, I felt bad for not selling everything during the height of the mania at the end of 2021. I did reduce my asset allocation to stocks at the beginning of 2022. But the amount was not enough to prevent me from losing ~70% of my gains 2021 gains in 2022.

As punishment, I told myself I’d continue working to make up for my losses. After all, the first rule of financial independence is to not lose money. And I had violated that rule with my investment losses in 2022.

I didn’t want to see negative net worth growth in 2022. So I did what I could to counteract the investment losses.

6) Found new excitement in podcasting

My theme for 2023 is “back to easy living.” The combination of writing and marketing my book, fatherhood, staying consistent with FS, and then losing a lot of money in my investments in 2022 wore me out.

I ended 2022 with a roughly flat net worth, which felt like a sad win after all that effort. I needed a break and wanted to spend more time with our daughter. Early retirement was back on the agenda!

To my credit, I did take things down by about 30%. For about three months, I felt like I was back in early retirement mode given I did almost zero business work. But it also felt odd doing less work given our daughter transitioned to school three days a week in July 2023. I had one more day of free time.

Then it dawned on me that I had enjoyed going on podcasts during my book marketing tour. I also wanted to pay back the podcasters who had invited me on. As a result, with my new free time, I decided to learn how to use podcasting software to enable me to interview others.

Felt Like I Was Back In 2009

The excitement I felt interviewing people for the Financial Samurai podcast (Apple or Spotify) felt similar to when I first started Financial Samurai in 2009. I was off on a new adventure!

I make no money from podcasting, but I’m having a lot of fun interviewing folks. It’s a great way to connect with interesting people and learn from other experts in their respective fields. I also think our kids, when older, will enjoy hearing what mom and dad talked about when they were younger.

When you’ve found a new challenge, it’s hard to stay retired or give it up and re-retire. Now my wife and I are slowly learning how to edit, which is a great new skill to learn.

Here’s a podcast episode where I talk about the solution to staying retired once you retire early. Have a listen and subscribe!

7) The importance of filling a void

If we want, we can send our daughter to school five days a week next month. But we’re holding off because we enjoy spending Tuesdays and Thursdays with her. Since she will be our last child, we are trying to cherish the remaining time we have with her before she turns five.

I’m both happy and sad our kids are growing up. The past 6.5 years of fatherhood have been incredibly joyful and challenging. But I would enthusiastically go back to when each was first born and do it over again.

The more time you spend with someone, the harder it will be to no longer spend as much time with them. This is one of the biggest downsides of being a stay-at-home-parent. Eventually, most of our children will leave us and live their own lives. Young children make you more aware of the speed of time.

I’ve found the best way to combat my troughs of sorrow is to stay productive, like a tuna that keeps swimming in order to survive. Not only are our children getting older, so are we, as are our parents. If I spend too much time doing nothing, I will feel like a part of me has disappeared.

8) Too many exciting opportunities to stay retired

Finally, you may be living in a city where there are simply too many exciting opportunities to stay retired. It’s like trying to go on a diet but having freshly baked cookies of different varieties pop out of the oven every hour. In such a scenario, it would be impossible to not eat at least one!

San Francisco is currently the epicenter of the artificial intelligence boom. Roughly 70% of Y Combinator’s last batch of companies are in AI. Over 50% of the new downtown office leases are coming from AI companies. Everywhere I go, whether on a playdate or on the pickleball court, I run into people either investing in or working in AI. As a result, I can’t help but feel AI FOMO.

To counteract missing out on what will be a massive wealth building opportunity, I’m investing in private funds such as the Fundrise Innovation Fund, which is investing in AI companies such as Databricks and Canva. However, why not go ALL IN and try and get a job at an AI company? So many of them are based in San Francisco. Therefore, that’s what I will try to do.

20 years from now, I don’t want my kids asking me why I didn’t invest in AI or work in AI given I had a chance to near the beginning. The only way to stay retired is for us to relocate to Honolulu or another slower-paced town. The temptation is simply too great to get involved living in San Francisco.

Money Becomes A Smaller Part Of Your Retirement Decision Over Time

Yes, being able to generate enough passive investment income to cover your desired living expenses is a necessity to be able to retire or retire early. However, over time, money’s importance for staying retired declines.

What you will long for is having a continued sense of purpose for the rest of your life. If you are still working, don’t take for granted the purpose work provides, even if you don’t always like what you do.

When you retire early, you are left with a void to fill. I’m not sure what I would have done if we didn’t have children after we left work. There’s only so much tennis and pickleball I can play before my body aches. And if I started writing more than three posts a week, I’d probably stop enjoying the activity.

Once both kids are in school full-time, I plan to give up on early retirement. The void you will feel is why it’s so hard to stay retired once you’ve retired early.

Finding a community of great people with a common mission is what I long for the most. And if I can work from home two times a week when my daughter isn’t in school, even better!

Maybe Retirement Is All In Our Heads

I’m not sure our mind ever truly retires until we die. For many years now, I’ve embraced my faux retirement given all the time I spend writing online and now writing books and podcasting regularly.

But one day, I could choose to stop all my creative endeavors and say I’m done with work for good. When that day comes, I hope it’s because my mind can no longer function. Because if I can last until then I will know that I lived a full life doing what I love.

Summary Of Why It’s So Hard To Stay Retired Once You Retire Early

- After a lifetime of work, it’s hard to completely stop doing anything productive

- There is this perpetual fear of losing money in a bear market, which are hard to predict

- Unexpected financial variables pop up all the time that need to be paid

- If your investments lose money, there is an inherent desire to try and make back your losses by taking action

- Unless your mind is gone, you’ll naturally find new passions in retirement to fill the void

- Boredom and loneliness

- You live in an exciting city filled with smart and hungry people looking to create new things and build massive wealth

As I embark on my journey to unretire, I’m now finding it difficult to get a good job after retiring for so many years! This is to be expected given I haven’t had an official job since 2012. So let’s see where this journey takes us.

Reader Questions and Suggestions

How have your finances changed since the beginning of 2020? Have you ever written out an impossible-sounding financial plan only for it to come true? Why do you think it’s so hard to stay retired once you retire early?

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

Join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Discover more from Slow Travel News

Subscribe to get the latest posts sent to your email.