2023 FIRE Wrap-Up!

7 min readHappy New Year everyone! Wow, another year is gone. Did you have a good year in 2023? It was a mix of good and bad for me. The low point ... Read more

The post 2023 FIRE Wrap-Up! appeared first on Retire by 40.

Happy New Year everyone! Wow, another year is gone. Did you have a good year in 2023? It was a mix of good and bad for me. The low point was when my mom passed away. It made me think about mortality and the short time we have. Also, I turned 50 last year. These two events made me realize we need to enjoy life now. That’s part of the reason why we became less frugal and spent more than expected.

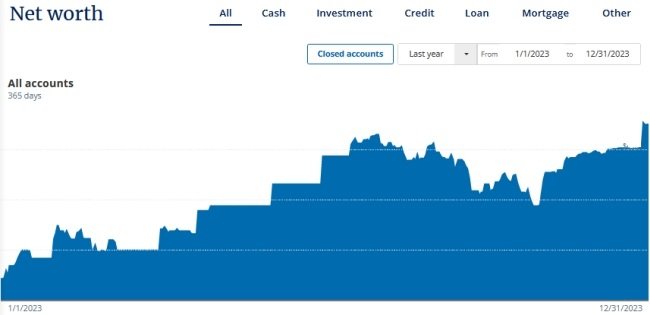

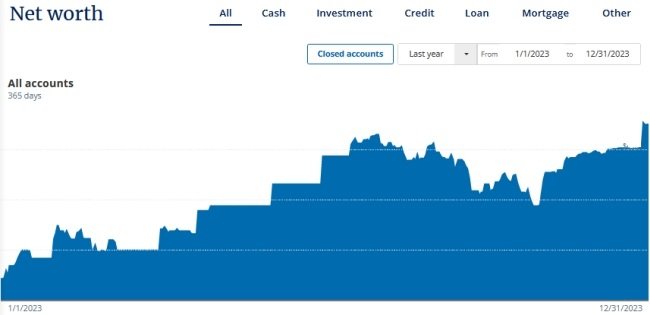

Financially, we did very well in 2023. Our net worth reached an all-time high because the stock market performed extremely well. However, our FIRE cash flow was negative. My online income decreased and we spent a lot of money on travel. This wasn’t a big deal because our investments performed so well. Anyway, it’s part of my transition to full retirement. In a few years, I’ll stop working completely and withdraw from our retirement accounts more. I’m looking forward to it.

All right, I’ll share how I did with my 2023 New Year goals. Then, I’ll go over our net worth and cash flow. Let’s go!

2023 Goals

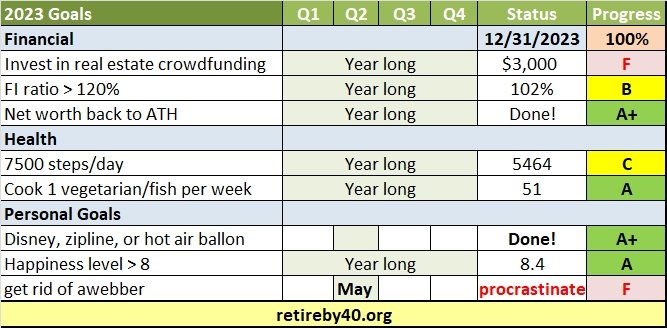

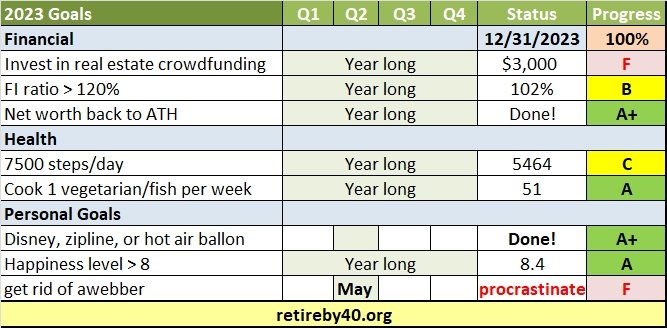

Here is my 2023 goal spreadsheet. I did pretty well on most of them. Although, I got 2 Fs. Overall, I’m pretty happy with the result.

Financial Goals

- Invest in Real Estate Crowdfunding. My projects on CrowdStreet performed well so I wanted to invest more. There was a capital call and I sent in $3,000. However, the plan changed. My dad wants to build a beach house in Thailand. I sent him $50,000 and construction should start soon. I don’t have the cash to invest in another real estate project so that was it for 2023.

- FI Ratio > 120%. This was my main goal for 2023. FI ratio = passive income divided by expense. This shows we can maintain our lifestyle with passive income. Unfortunately, our FI ratio was the lowest I’ve seen in years. 2023 was a transition year for us. We decided to become less frugal and enjoy life more. Luckily, December was a big month for passive income and our FI ratio surged to 102%. That was below my goal, but it was good enough. I’m content with this result.

- Net worth back to all-time high. 2023 was a fantastic year for investors. Our net worth hit an all-time high at the end of the year. This was the reason why I didn’t worry about our spending. In 2023, we spent less than 2% of our net worth. That’s way below the 4% safe withdrawal rate.

Health Goals

- 7,500 steps per day. This goal was too difficult for me. I met this goal when I was in Thailand, but my step count dropped when I came back to the US. Next year, I need to set a better health goal.

- Cook 1 vegetarian/fish per week. I want to cook a healthier meal at least once per week. It worked and we eat a bit healthier. Mrs. RB40 and Junior weren’t big fans of my healthy meals, though.

Personal Goals

- Disneyland, zipline, or hot air balloon ride. We visited Disneyland in March. It was great. We enjoyed the trip tremendously. RB40Jr wasn’t impressed with the classic rides, but he loved the newer more thrilling rides. I’m glad we went.

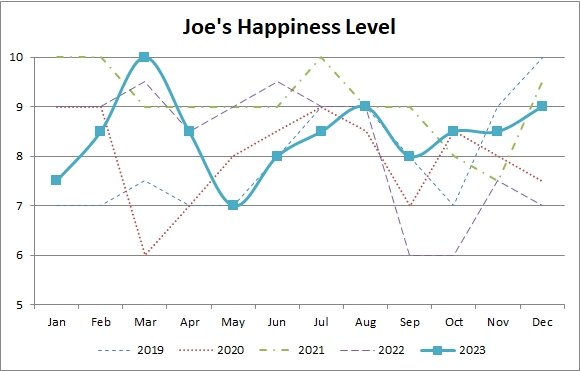

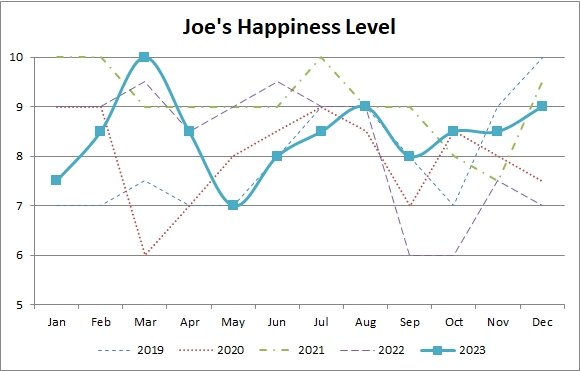

- Happiness > 8. 2023 was not a great year. The low point was when my mom passed away in May. I was sad, but also glad she didn’t suffer anymore. After that, I just tried to keep busy. The big lesson was that life is short. We should enjoy it while we are young and healthy.

- Get rid of Awebber. I wanted to transfer to a cheaper alternative, but couldn’t do it. I tried to move to another email provider over Thanksgiving, but it wasn’t successful. The new provider couldn’t do what I wanted.

Net Worth (+20% YTD)

I’ve been tracking our net worth since 2006. It is very motivating to see the progress we’ve made. The power of compounding is unbelievable. 2023 was a banner year for investors. Many people expected a recession, but it never came. Inflation slowed down, the job market stayed strong, and the economy rolled right along. The Fed guided us in for the elusive soft landing! It’s pretty amazing. Our net worth benefited from the strong stock market and increased 20%. To put it in perspective, the gain was more money than I made from working over the last 10 years. This is why you need to invest.

***Important*** My best advice is to stay the course. Do not stop investing. You have to keep investing when the stock market is going up or down. Eventually, the stock market will hit a new high and you will do very well as long as you keep investing.

Here is a chart of our net worth from Empower. (Personal Capital is now Empower.) Sign up for a free account at Empower to help manage your net worth and investment accounts. I log in frequently to check our net worth and use their free tools. It’s a great site for DIY investors.

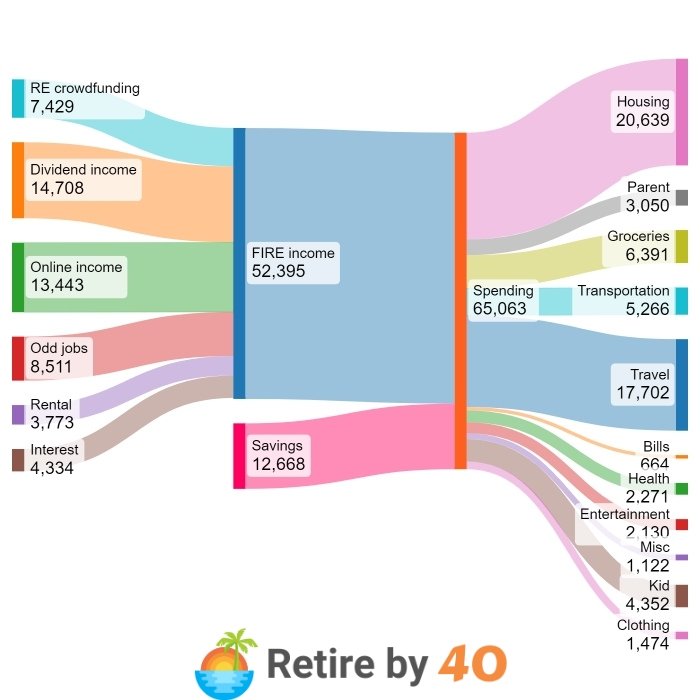

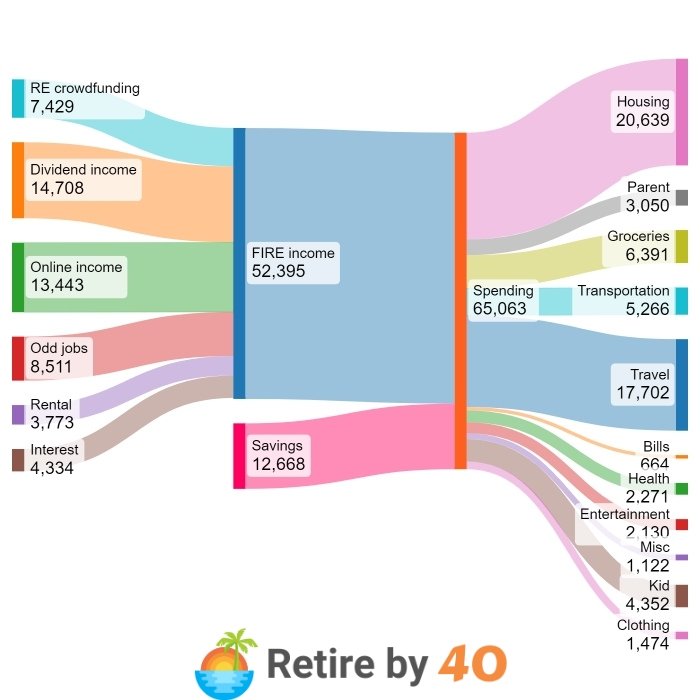

2023 FIRE Cash Flow

This FIRE cash flow chart includes my online income, side gigs, and taxable passive income. Mrs. RB40’s income isn’t here because she’ll retire in a few years. We’re preparing for the transition.

FIRE Income: $52,395

Our FIRE income was lower than I’d like in 2023. My online income decreased due to lower traffic and the declining blog advertising environment. I guess this is part of my transition to full retirement. In a few years, I probably won’t have much active income at all. We’ll replace this income stream with retirement savings.

- Real estate crowdfunding: $7,429. Our real estate crowdfunding income was solid. You can read more on the RE Crowdfunding Passive Income page.

- Dividend Income: $14,708. Dividend was stable.

- Rental Income: $3,773. The rentals were okay in 2023. We had some repairs and maintenance expenses.

- Blog income: $13,443. Blog income decreased 30% and probably will continue to decline in the coming years. Unfortunately, I don’t think I can turn it around. The internet changed tremendously since I started blogging in 2010.

- Odd jobs: I made $8,511 from being a delivery driver. It’s a good side gig if you don’t mind driving a few hours per day.

- Interest: $4,334. We had more interest than usual. I moved some money into bonds to prepare for full retirement.

Spending: $65,063

In 2023, I plan to spend about $50,000. However, we went way over budget due to inflation and lifestyle changes. We decided to be less frugal because we’re getting older. At this point, it’s time to enjoy our wealth instead of waiting. Next year, I’ll increase our spending budget to $70,000.

- Housing: $20,639. This includes mortgage, utilities, furniture, repair, and maintenance. Our housing expenses are lower than most families because we live in a duplex. We split many expenses with our tenant.

- Transportation: $5,266. We have a paid-off vehicle so this was gas, insurance, and maintenance. I just hope our 2010 Mazda will last 5 more years.

- Travel: $17,702. We visited Disneyland, Tahiti, Washington D.C., and many closer locations. It was expensive, but we enjoyed these trips tremendously. It’s good to take memorable trips with our son while he’s young.

- Entertainment: $2,130. This was mostly eating out.

- Groceries: $6,391. My target for grocery expenses was $600 per month. We came in under budget in this category.

- Health: $2,271. Not too bad. I’m sure health-related spending will increase as we age.

- Misc: $1,122. Random stuff that didn’t fit into other categories.

- Clothing: $1,474.

- Parent: $3,050. My brothers and I send $250/month to our parents to help with expenses. They live in Thailand so their cost of living is relatively low.

Savings: –$12,668

Bottom line, our FIRE income wasn’t enough to cover expenses in 2023. My active income decreased and we spent more than expected. However, we are still in a good place financially. Our investment performed very well and our net worth increased 20%. That was more than enough to offset the shortfall. I’m not too worried. At this age, it’s time to enjoy life.

2023 wrap-up

Alright, 2023 is done! It wasn’t a great year for me, but I got through it. Let’s hope 2024 will be calmer. Although, I’m sure the presidential election will provide the whole country with plenty of drama. Let’s go! I’m ready for 2024.

What about you? Did you have a good year?

Passive income is the key to early retirement. These days, I’m investing in commercial properties with CrowdStreet. They have many projects across the United States. Go check them out!

Disclosure: We may receive a referral fee if you sign up for a service through the links on this page.

Passive income is the key to early retirement. This year, Joe is investing in commercial real estate with CrowdStreet. They have many projects across the USA so check them out!

Joe also highly recommends Personal Capital for DIY investors. They have many useful tools that will help you reach financial independence.

Latest posts by retirebyforty (see all)

Discover more from Slow Travel News

Subscribe to get the latest posts sent to your email.