‘Living life on my own terms’: What is fanning the flames of the FIRE movement in India

5 min readFor decades, the image of retirement in India has been synonymous with an elderly gentleman, perhaps your grandfather’s age, seated on a porch, rocking in a wheelchair, his grey hair catching the fading light of his twilight years. However, a paradigm shift is underway. With the entry of millennials and Gen Z into the workforce, the FIRE (Financial Independence, Retire Early) movement is rewriting the narrative surrounding retirement.

Emerging in 1992 with the popularity of the book, Your Money or Your Life, the FIRE movement gained prominence because of its tantalising promise of “freedom and autonomy”, according to Dr Taranjeet, dean of the School of Behavioral and Social Sciences at MRIIRS.

While initially sounding like a pipe dream, a survey by PGIM India Mutual Fund in 2023 revealed that a staggering 67 per cent of Indians are contemplating early retirement, some eyeing it as young as 33 years of age.

So, what is so attractive about the FIRE movement?

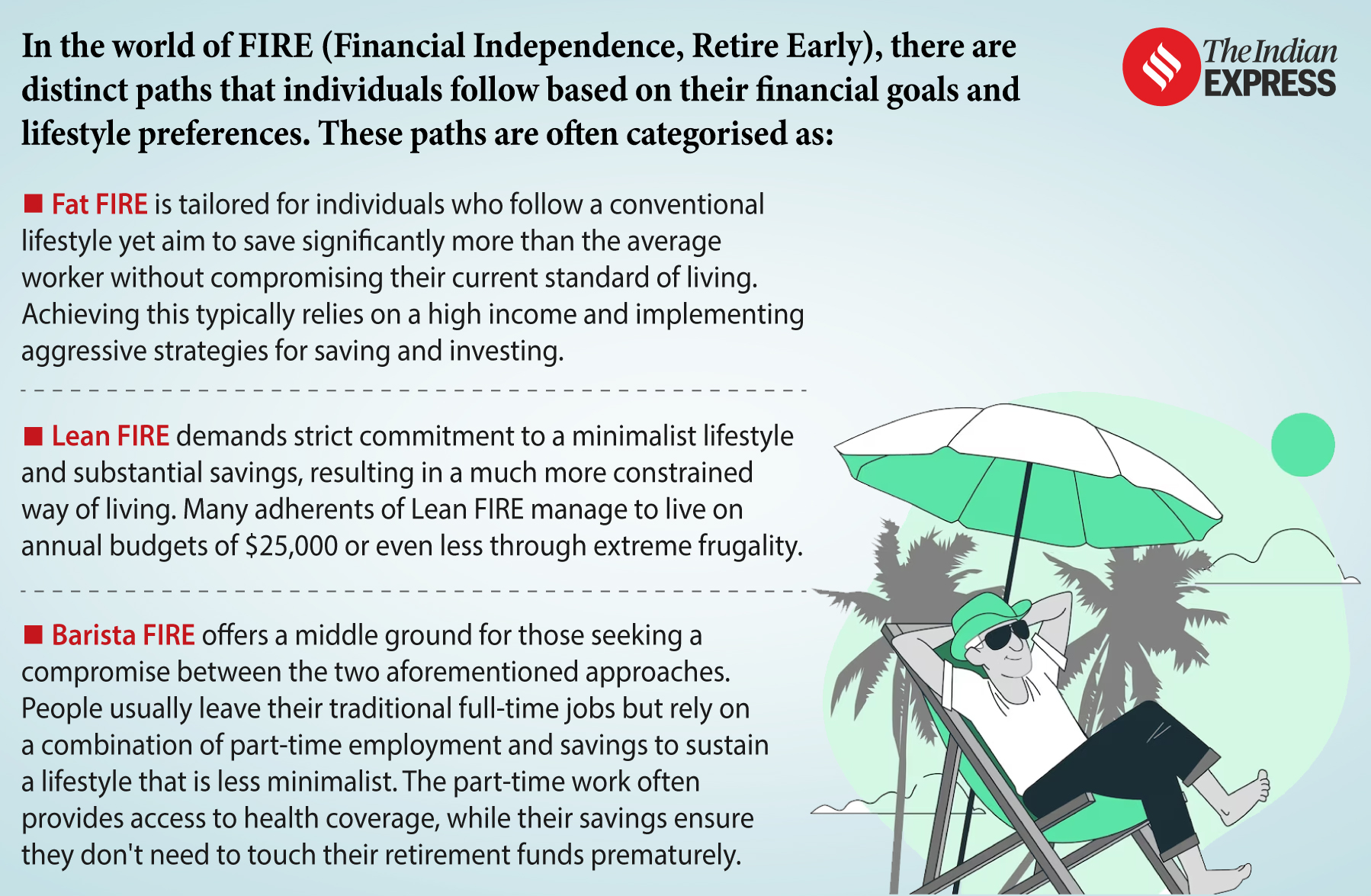

Types of FIRE. (Designed by Abhishek Mitra)

Types of FIRE. (Designed by Abhishek Mitra)

For Karan Cheema, 26, it represents the pursuit of a life lived on his terms. “By achieving FIRE, I would feel in control of my time, money, and most importantly, my destiny,” says Cheema, founder of WittyWeb Studio, a digital marketing agency.

He envisions reaching the pinnacle of Maslow’s hierarchy of needs. “I will finally be able to close my laptop, stop my brain from thinking, and just enjoy life as it comes,” he adds.

Another advantage, Cheema feels is the opportunity to travel and pursue his hobbies. “Every day could bring a new adventure, a new hobby,” he muses. However, his ultimate aspiration is “a life free from fear, full of peace and happiness.”

Aanandita Vaghani, founder and mental health counselor at UnFix, echoes this sentiment: “Early retirement provides freedom from the shackles of work deadlines, particularly for those in demanding professions. It allows individuals to explore passions that may be stifled by the demands of work, fostering increased physical activity and promoting better mental health.”

Advertisement

On the other hand, Chetna Arora, 23, is attracted to the independence the FIRE life offers. Having battled stereotypes and sexism as a woman from a middle-class family, Arora sees financial independence as a gateway to a “sorted life”, which motivates her to strive for it. “Financial independence is liberating, especially for a woman. Adding the prospect of early retirement means I can afford a comfortable life for me and my family,” she says.

Agreeing, Dr Taranjeet explains that the appeal of FIRE lies in escaping the 9-to-5 grind and reclaiming time for meaningful pursuits. “It resonates with many, especially Gen Z, who crave autonomy and fulfilment. Offering self-oriented success, FIRE focuses on experiences over material possessions and promotes balanced, purpose-driven living,” she says.

As for S Ravi, founder of Ravi Rajan & Co., the FIRE movement attracts those who prioritise time over traditional career trajectories. “It’s driven by the belief that time is a precious commodity, and achieving financial freedom affords greater control and satisfaction in life,” he says.

However, it’s not all hunky-dory.

A recent survey by the Transamerica Center for Retirement Studies found that only 17 per cent of early retirees do so willingly after saving enough money. The remaining are either “kicked out, edged out, or quit due to ill health.”

Advertisement

Cheema, too, acknowledges the “tremendous toll pursuing the FIRE lifestyle will take on the body. There will be a lot of stress, pressure, and the fear of failure, which will affect both the mind and the body, and that will lead to health-related issues.”

While Anushree Gupta, 23, a counselling psychologist, considers this a structured strategy to foster goal attainment, she says it carries the risk of burnout. “The singular focus may lead to emotional and physical duress, potentially impacting relationships and self-care,” she says.

Some critics also argue against its sustainability and feasibility. “Unless you have a really fat salary package at a very young age, most individuals will have to undertake stricter saving methods to attain the FIRE life,” explains S Ravi. “Achieving early retirement often requires aggressive and planned saving. For normal-wage workers, huge penances might be required, influencing leisure activities. Unanticipated situations like illness, big fat weddings, or monetary slumps can also upset plans,” he adds.

Moreover, Gupta emphasises the trade-off between present enjoyment and future security inherent in saving and investing for FIRE. The relentless pursuit of financial goals may inadvertently isolate individuals from social interactions and experiences, she cautions.

Advertisement

Not only this. Early retirement can pose risks to mental health, as Vaghani explains. “The absence of meaningful work can lead to a sense of purposelessness, impacting psychological well-being. Additionally, the cognitive challenges and social interactions inherent in work are vital for maintaining executive functioning skills and emotional intelligence,” she opines.

Here are expert-approved to attain the FIRE life. (Source: Freepik)

Here are expert-approved to attain the FIRE life. (Source: Freepik)

Here are tips to attain a FIRE life:

- Set clear goals and budget: Pre-define the target savings amount, budget, and personal goals while setting practical timelines to achieve the same.

- Increase income, lower expenses: Embrace a minimalist lifestyle by focusing on essentials and avoiding unnecessary expenses while increasing income sources through side hustles, freelancing, and upskilling.

- Build an emergency fund: This will help you cover unexpected costs without having to dip into your long-term investments.

- Invest wisely and monitor progress: Channel your additional income toward strategically planned investments. Regularly review your financial progress and adjust your strategies as needed.

- Prioritise self-care: Keep your physical and mental health through self-care habits to maintain resilience and productivity. Ensure you have adequate insurance coverage for health, property, and other risks.

- Seek support: Surround yourself with like-minded individuals or join online communities for support, encouragement, and shared knowledge.

- Enjoy the journey: While working towards financial independence, remember to enjoy the present moment and appreciate the process of pursuing your goals.

Ultimately, the pursuit of a FIRE lifestyle demands long-term commitment, flexibility, and customisation to your circumstances and risk tolerance. “Remember, financial security in any form is valuable, even without the early retirement goal,” S Ravi concludes.

Discover more from Slow Travel News

Subscribe to get the latest posts sent to your email.