Wells Fargo Autograph Card Review: Bonus Points, Travel Benefits & No Annual Fee

10 min readWhat if we told you the best-kept secret in the world of travel credit cards might just be a Wells Fargo card?

The Wells Fargo Autograph Card debuted in 2022 but hasn’t generated much buzz as it gets largely overshadowed by travel rewards stalwarts like the *chase sapphire preferred* and the *amex gold*. With the bank teasing the addition of transfer partners and a new addition to the Autograph lineup … that could all change.

So what makes this card such a sleeper? Well first off you can earn a 20,000-point bonus (worth $200) after spending $1,000 in the first three months. That’s far from the biggest bonus available on a travel rewards card – but for the minimal amount of spending required, it’s still a solid offer. Then there’s the extra points you can earn many common spending categories: The card earns 3x points at restaurants, on travel (including transit), at gas stations, and even select streaming services and phone plans. All other purchases earn a standard 1x point per dollar spent.

Add in travel perks like solid cellular telephone protection, roadside dispatch assistance, and secondary car rental insurance – all on a card with no annual fee – and it’s pretty easy to see that this is a card worthy of your attention. The only real knock on the card? Wells Fargo doesn’t currently offer a stable of transfer partners (and that could be changing soon) like all the other big banks. Without this, rewards are worth a flat 1 cent each whether they’re redeemed for travel, gift cards, or even cash back.

Let’s take a closer look at all this under-the-radar travel card has to offer.

Wells Fargo AutographCard Overview

Full Benefits of the Wells Fargo Autograph Card

- bonus_miles_full

- Earn 3x points at restaurants, including take-out, catering, delivery services, and more.

- Earn 3x points on travel, including airfare, hotels, rental cars, cruises, campgrounds, and more.

- Earn 3x points at gas stations and electric vehicle (EV) charging stations.

- Earn 3x points on transit, including subways, ride shares, parking, tolls, and taxis.

- Earn 3x points on popular streaming services like Hulu, Spotify, YouTube TV, Disney+, and more. Note: Netflix is not currently included.

- Earn 3x points on phone plans, including both cell phone and landline providers.

- Earn 1x points on all other purchases.

- Cell Phone Insurance: Get up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Foreign Transaction Fee: foreign_transaction_fee

- Annual Fee: annual_fees

Learn more about the Wells Fargo Autograph℠ Card.

Earning Points

Racking up points with the Wells Fargo Autograph Card will be an easy task for many. Thanks to the card earning 3x bonus points in so many popular spending categories, this card is nearly the perfect one-size-fits-all option.

It’s billed as a travel card so let’s start with the obvious: The card earns 3x points per dollar spent on a wide-ranging travel category. Everything from airfare to cruises, hotels, rental cars, and even campgrounds will earn you bonus points.

You’ll also earn 3x points for every dollar spent at restaurants (including take-out and delivery services), gas stations, on transit (subway, taxi, rideshares, and tolls), popular streaming services, and phone plans. All other purchases earn a standard 1x points per dollar spent.

Redeeming Points

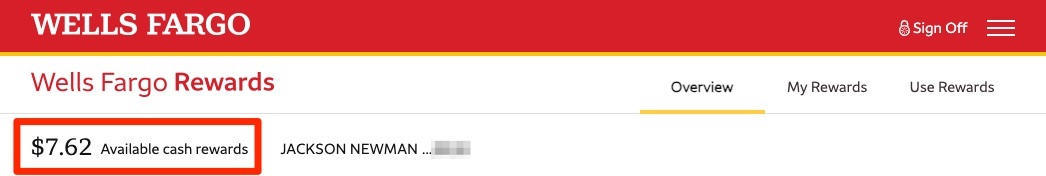

Wells Fargo Rewards points can be redeemed at a rate of 1 cent per point on a variety of things including travel, gift cards, cash, merchandise, or even as a gift to someone else. Since points are currently worth a flat 1 cent each, you’ll see your point balance displayed in terms of their cash value. This makes it easy to decipher just how much your points are worth, no matter how you choose to redeem them.

Since we’re a travel site, let’s start with our favorite option: Using points for travel. Much like Chase and Capital One, Wells Fargo has its own travel portal where you can book flights, hotels, rental cars, and more. When you use your points like this, they’ll be worth 1 cent each – just like all the other redemption options. To redeem your points for travel, simply login to your Wells Fargo Rewards account to begin your search.

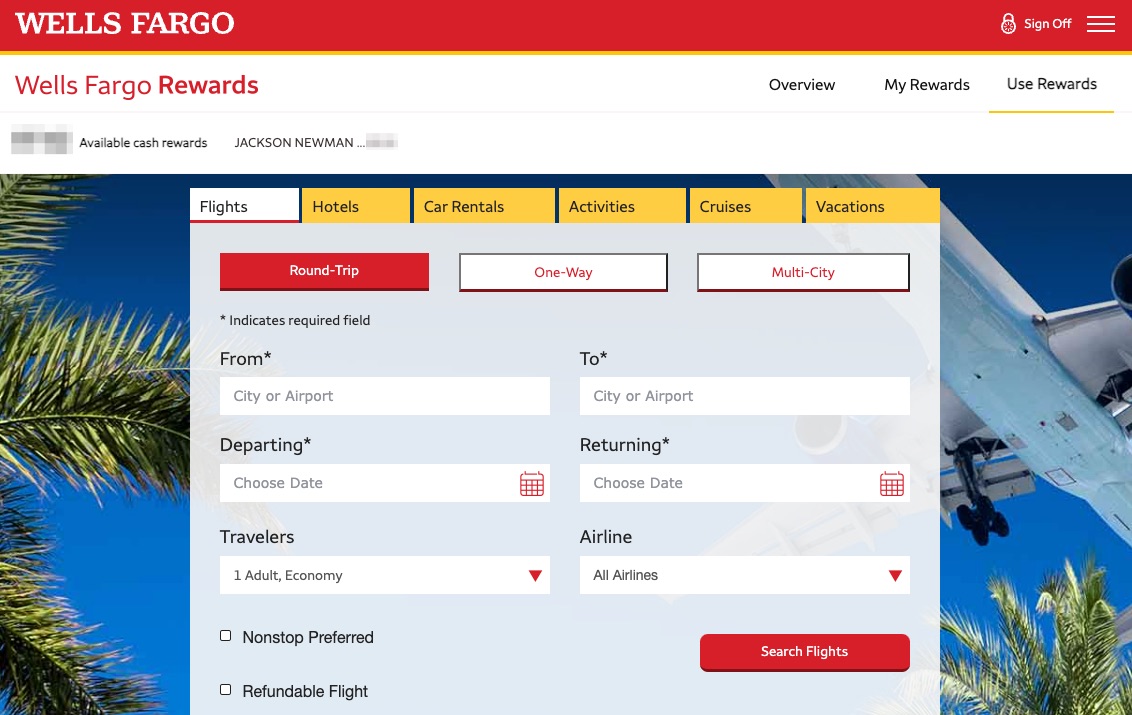

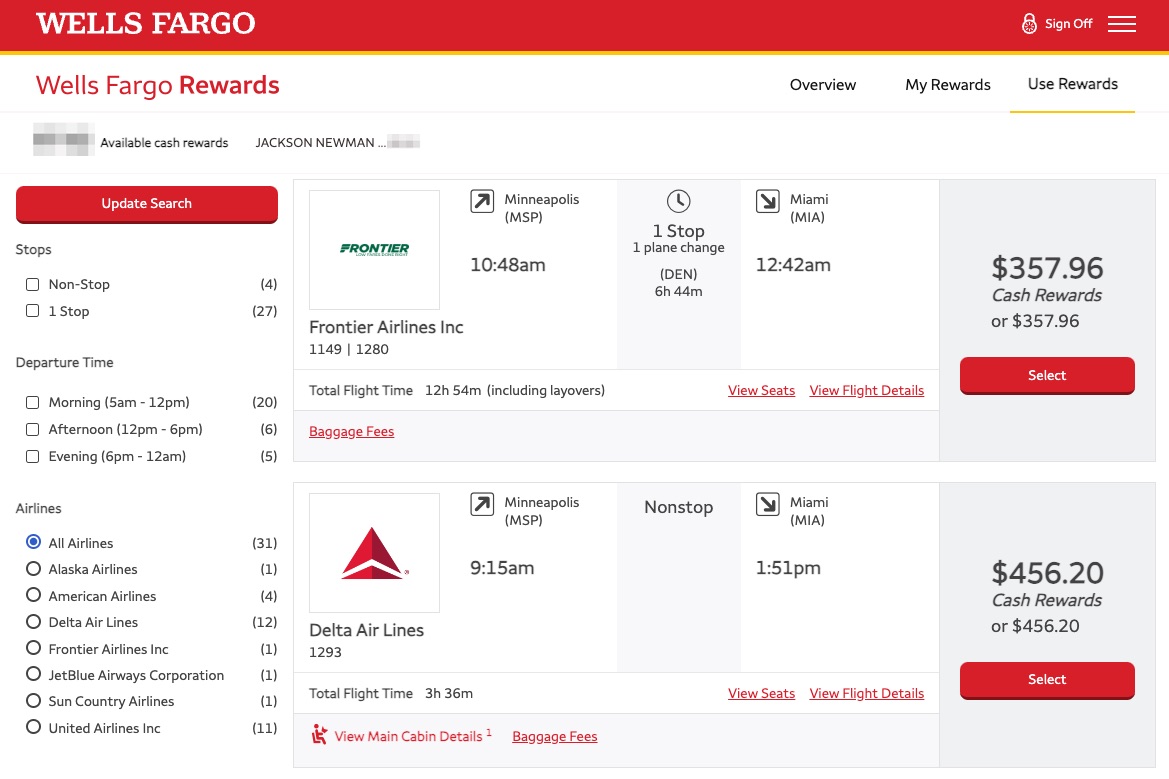

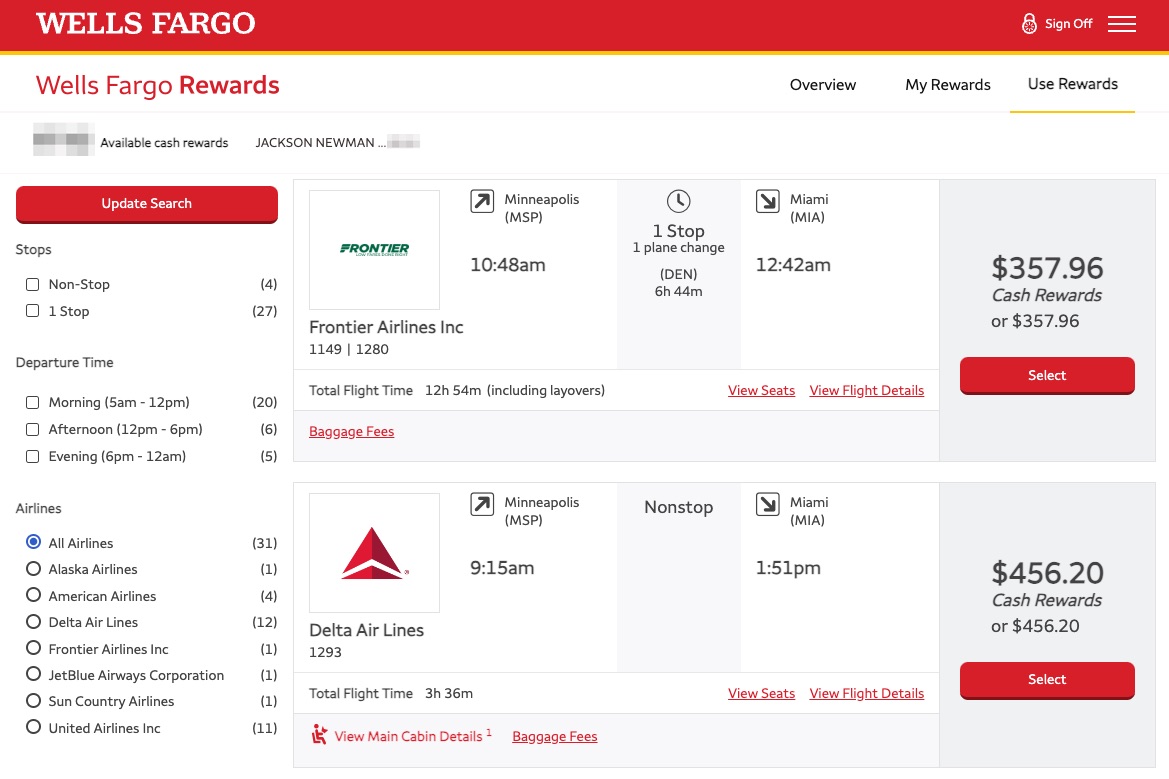

As an example, let’s look at booking flights from Minneapolis – St.Paul (MSP) to Miami (MIA). Once you’re logged into your rewards account, you’ll select travel from the list of redemption options. This pulls up a search engine similar to what you’ll find using other online travel agencies (OTAs) like Priceline or Expedia.

Simply put in your destination, origin, and desired travel dates, and hit search. You can also adjust the number of travelers and choose to search for one-way or multi-city flights, in addition to roundtrip. After running your search, you’ll see all the available flight options – including low-cost carriers like Frontier and Sun Country.

In the searches I ran, flight prices appeared to be an exact match to what you’d find when searching with Google Flights or directly with the airline however, the Wells Fargo Travel portal didn’t pull any basic economy flights. We generally caution against booking these bare-bones fares anyway but if you’re someone looking for the absolute cheapest ticket from Point A to Point B, you’ll likely need to look elsewhere.

Thrifty Tip: If you also hold the no longer available Wells Fargo Visa Signature® Credit Card, your points are worth 1.5 cents each when redeemed through the Wells Fargo travel portal for airfare.

Aside from travel, you can cash out your points at the same 1 cent per point valuation in a variety of ways. You’re able to do this at an ATM (assuming you also have a Wells Fargo bank account), as a statement credit, or as a direct transfer to a linked checking or savings account. You can also use your points to purchase hundreds of third-party gift cards in varying denominations. Or you can even redeem them directly with select merchants.

Travel Benefits & Insurance Coverage

Like any good travel rewards credit card, the Wells Fargo Autograph Card comes with some perks and protections to make your trip more enjoyable and worry-free.

Since the Autograph Card is a Visa Signature® Card, you’ll get access to a Visa Signature Concierge. This complimentary, 24/7 concierge service can help you make travel arrangements, make dinner reservations, and even get tickets to certain events. You’ll also have access to the Visa Signature Luxury Hotel Collection where you can choose from a premium collection of properties and receive perks like complimentary room upgrades, a $25 food and beverage credit, complimentary breakfast for two, and even a late checkout (when available).

As for travel protections, the Autograph Card comes with secondary car rental coverage on domestic rentals – and for rentals outside of the U.S. coverage, it’s primary coverage. While this level of coverage isn’t nearly as good as the primary coverage offered by several top travel cards, it’s still better than nothing and certainly worthwhile when renting a vehicle abroad.

If your car breaks down, the Autograph Card does come with a roadside assistance benefit which can help you in a pinch if you run out of gas, lock your keys in the car, or need a tow.

Finally, the Wells Fargo Autograph Card comes with top-notch cellular telephone protection. If your cell phone is lost, damaged, or stolen, you’re eligible for up to $600 per claim (minus a $25 deductible) and up to $1,200 per year in coverage. Protection starts on the first day of the month following the wireless bill posting to your card.

Annual Fee

The Wells Fargo Autograph Card has a $0 annual fee so carrying the card year after year won’t cost you anything.

What Travel Cards Does It Compete With?

The Autograph Card finds itself in a crowded field of introductory travel cards and that’s likely one reason it has been overlooked. Several other cards on the market offer similar point earning and benefits, but in most cases the competing cards also carry an annual fee – something you don’t have to worry about with the Autograph Card.

Let’s see how the Wells Fargo Autograph Card measures up to cards from other banks.

Chase Sapphire Preferred

The *chase sapphire preferred* has long been our favorite card for beginners. That’s due in large part to the current bonus: *CSP Bonus*

While the card carries a *95* annual fee that is not waived for the first year of card membership, it offers a ton of value that easily outweighs that charge. Beyond the points, you get strong travel insurance coverage on flights booked using your Preferred Card as well as a rental car insurance policy that is second to none. Add in 3x points earned on dining purchases, 2x on travel, and an annual $50 hotel credit when booking through Chase Travel and it’s not hard to get your money’s worth out of this card year after year.

Read our full review of the Chase Sapphire Preferred for all the details!

Learn more about the *csp*

Capital One Venture Rewards

Just like the Chase Sapphire Preferred Card, the *capital one venture card* has an annual fee of *95* each year. That makes it one of the cheapest travel cards to cover the cost of enrolling in either TSA PreCheck or Global Entry, with up to $100 in statement credits every four years.

Most importantly, this card offers a welcome bonus of 75,000 Venture Miles after spending just $4,000 in the first three months of card membership. Since you earn at least 2x miles on every purchase you make with your card, you’ll end up with at least 83,000 miles once you meet that minimum spending requirement.

If you don’t want to deal with the hassle of transferring points and jumping through hoops to book a free flight or hotel, this is the right option for you. You won’t find an easier way to use your miles than by covering your travel charges with Capital One miles after the fact.

Here’s our full review of the Capital One Venture Rewards Card!

Learn more about the *capone venture*

American Express Gold

Admittedly, the *amex gold* is a bit outside of the Wells Fargo Autograph Card’s weight class. With an annual fee of $$250 (see rates & fees), it’s a significantly more expensive option than the other competitors.

With that annual fee, Amex provides up to $120 a year in dining credits and up to $120 a year in Uber Cash – each doled out in $10 monthly increments. If you’re able to make decent use of those two credits, it puts the Amex Gold annual fee right in line with the other competitors.

On top of the statement credits, the Amex Gold is a great choice for racking up points. It all starts with the current welcome offer: *Amex Gold Bonus* Beyond earning a big bonus, you’ll get 4x points on dining worldwide (including takeout and delivery services), 4x points at U.S. supermarkets (up to $25,000 each year, then 1x) and 3x on flights booked directly with the airline or through Amex Travel. All other eligible purchases earn 1x Membership Rewards points per dollar spent.

Get all the details on the Amex Gold Card here!

Learn more about the *amex gold*

Bilt Rewards

The *Bilt Mastercard* is a unique competitor as it’s a card also issued by Wells Fargo. Bilt Rewards points are entirely separate from Wells Fargo Rewards and can even be transferred to airline and hotel partners for an award booking.

Unlike the other cards on this list, the Bilt Card doesn’t come with an official sign-up bonus – although, there have been reports of many new cardmembers getting targeted for an unofficial offer to earn 5x Bilt points on nearly all purchases for the first five days of having the card. Similar to the Wells Fargo Autograph Card, you won’t have to worry about paying an annual fee with the Bilt Card and it’s the only one on our list that allows you to earn points when paying your rent, all without an additional transaction fee.

So long as you make at least five transactions each billing cycle, the Bilt Card earns 3x points at restaurants, 2x points on travel, and 1x points on all other purchases. On the first of each month, Bilt awards double points on all purchases (excluding rent) in honor of “Rent Day.”

The Bilt card also includes some outstanding travel benefits like trip delay and cancellation coverage, primary rental car coverage, and cellular telephone protection.

Learn more about the *bilt rewards card*

Bottom Line

The Wells Fargo Autograph Card is one of the most underrated travel rewards credit cards on the market. With a respectable welcome offer, excellent 3x bonus point-earning categories, and no annual fee, it’s a card worthy of a spot in any traveler’s wallet.