Delta SkyMiles Platinum Card: A Companion Pass, Faster Path to Elite Status & More

16 min readAmerican Express and Delta offer a suite of co-branded credit cards, ranging from a basic, no-annual-fee card with limited benefits to a top-tier (and top-dollar) card that gets you lounge access and all the bells and whistles.

Right in the middle, you’ll find the *delta skymiles platinum card* – and if you ask us, this card might just be the best choice for routine Delta flyers looking for extra benefits without a completely unmanageable annual fee.

The Delta Platinum card comes packed with perks, most importantly, an annual companion certificate (beginning in year two), free checked bags on every single Delta flight, and help towards earning Delta elite status. Those benefits combined with monthly and annual money-saving statement credits add up quickly and can help justify the card’s $350 annual fee (see rates & fees).

Let’s take a closer look at all the benefits of the Delta SkyMiles Platinum Card and help you decide if it warrants a spot in your wallet.

Delta SkyMiles Platinum American Express Card: Card Overview

Delta SkyMiles® Platinum American Express Card

- bonus_miles_full

- Check your first bag free on every Delta flight, savings of at least $70 on each round-trip flight, per person

- Priority boarding (even with a basic economy ticket)

- Get one main cabin roundtrip companion certificate to destinations throughout the U.S. (including Hawaii, Alaska, the U.S. Virgin Islands, and Puerto Rico) as well as many destinations in Mexico, the Caribbean, and Central America, each year upon card renewal

- MQD Headstart: Get a head start on earning Medallion status with an automatic 2,500 Medallion Qualifying Dollars (MQDs) each year

- Earn 1 MQD for every $20 you spend on your card

- TakeOff 15: Get a 15% discount on SkyMiles award tickets when booking on delta.com or through the Fly Delta app

- Earn 2x SkyMiles per dollar spent at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets

- Earn 3x SkyMiles per dollar spent on eligible Delta purchases and at hotels

- Earn 1x SkyMiles per dollar spent on all other eligible purchases

- Up to a $150 Delta Stays credit: Earn up to $150 in statement credits each year when you make a Delta Stays prepaid hotel or vacation rental booking on the Delta Stays platform.

- Up to a $120 Rideshare Credit: Get up to $120 in statement credits (doled out in $10 monthly installments) a year when you use your card to pay for a ride with Uber, Lyft, Curb, Revel, or Alto.

- Up to a $120 Resy Credit: Get up to $120 in statement credits each year (doled out in $10 chunks each month) when you use your card to pay for eligible purchases on Resy, Amex’s restaurant reservation platform. This is also a use-it-or-lose-it benefit: Any unused balance won’t roll over to the following month.

- Get up to a $100 credit to cover the cost for Global Entry or TSA PreCheck once every 4.5 years for the application fee for TSA PreCheck® and every 4 years for Global Entry

- Join the complimentary upgrade queue: Even if you don’t have Delta Medallion status, your Platinum Card makes you eligible for complimentary upgrades to Delta One (within the U.S.), first class, and Delta Comfort Plus on tickets purchased

- Hertz Five Star Status: Get complimentary Hertz Five Star elite status upon enrollment.

- Get 20% off in-flight purchases such as food & drinks in the form of a statement credit

- No foreign transaction fees

- $350 annual fee (See rates & fees)

Learn more about the *delta skymiles platinum card*.

Delta SkyMiles Platinum American Express Card: Welcome Offer

When you sign up for a new travel rewards credit card, getting a big welcome offer is a nice bonus (no pun intended).

Here’s what’s currently at stake: bonus_miles_full

Wondering whether or not your eligible for this welcome offer? Traditionally, you could earn a welcome offer bonus once per card – but that’s no longer the case as Amex recently added terms that limit eligibility based on which other Delta SkyMiles cards you’ve previously had.

It’s still possible to earn a bonus on multiple Delta credit cards, but you’ll have to start at the bottom and work your way up to do it.

This means that if you have or previously had the *delta reserve*, you’re no longer eligible for the bonus on the SkyMiles Platinum Card. If you have or previously had the *delta blue* or the *delta gold*, you’re still eligible for the SkyMiles Platinum Card – and its welcome offer.

Thankfully, with Amex’s ‘Apply with Confidence‘ tool, you can quickly find out if you’re eligible for the Delta Platinum Card before submitting the application and initiating a credit inquiry.

Related reading: Why Am I Not Eligible For an Amex Welcome Offer?

Delta SkyMiles Platinum American Express Card: Annual Fee

One of the biggest factors when deciding whether or not to add a new credit card often comes down to the upfront cost.

The SkyMiles Platinum card comes with a $350 annual fee (see rates & fees) that isn’t waived for the first year. This alone puts the card in the upper range of other mid-tier travel cards on the market and nearly costs as much as the more premium *venture x*.

That alone can be a make-or-break for many travelers – but before instantly writing the card off due to its annual fee, it’s important to do the math to determine whether or not it’s worth it. And with all the benefits and statement credits you get with this card … that math just might check out.

Delta SkyMiles Platinum American Express Card: Earning SkyMiles

I hate to be the bearer of bad news, but the Delta SkyMiles Platinum card shouldn’t be your go-to for everyday spending. There are far better travel credit cards out there for racking up points on routine purchases – even if your only goal is to earn SkyMiles.

This is a key reason why we tell travelers to quit swiping their favorite airline’s co-branded credit card day in and day out: You can do much better with another, more flexible card like the (non-Delta) *amex gold*.

But if you’re adding this card for the first time, you’ll at least have to spend enough to earn that big welcome offer. Here’s what you’ll get in return: The Delta Platinum card earns 2x SkyMiles at both restaurants (including takeout and delivery) and U.S. supermarkets. And it ups the ante further by earning 3x SkyMiles per dollar spent on Delta purchases and at eligible hotels.

All other eligible purchases earn 1x SkyMiles per dollar spent.

Delta SkyMiles Platinum American Express Card: Redeeming SkyMiles

Understanding SkyMiles can be a chore because Delta stopped publishing an award chart years ago in favor of a dynamic pricing model that more closely follows the cash cost of a ticket. So without that cheat sheet that tells you how many miles you should spend to fly from point A to point B, prices change constantly.

While such uncertain pricing is no doubt frustrating – and confusing – there’s a tremendous upside: Delta SkyMiles Flash sales.

Untethered from an award chart, Delta is free to slash SkyMiles award rates as it pleases. The result is some screaming hot deals that are easily the best way to use your Delta SkyMiles. They sometimes publish available sales on their site, but many of the best deals are never advertised.

These amazing deals disappeared for a while … but they’ve made a comeback over the last year or so. It doesn’t get much better than this.

Want more award alerts like this one? Sign up for our flight deal alert service Thrifty Traveler Premium!

SkyMiles can be frustrating, but this is where they shine. Earlier this year, Delta briefly slashed award rates to Europe from airports big and small all across the U.S. With the 15% discount on SkyMiles award tickets you get with the Delta Platinum card, you could book these flights for as few as 31,000 SkyMiles roundtrip!

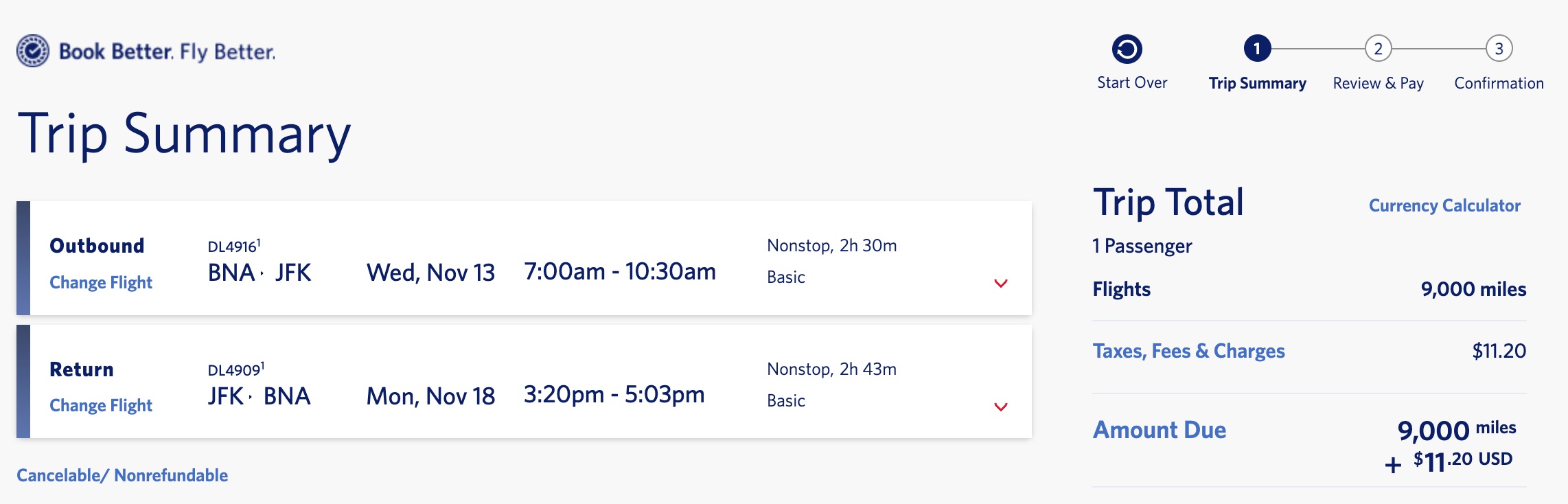

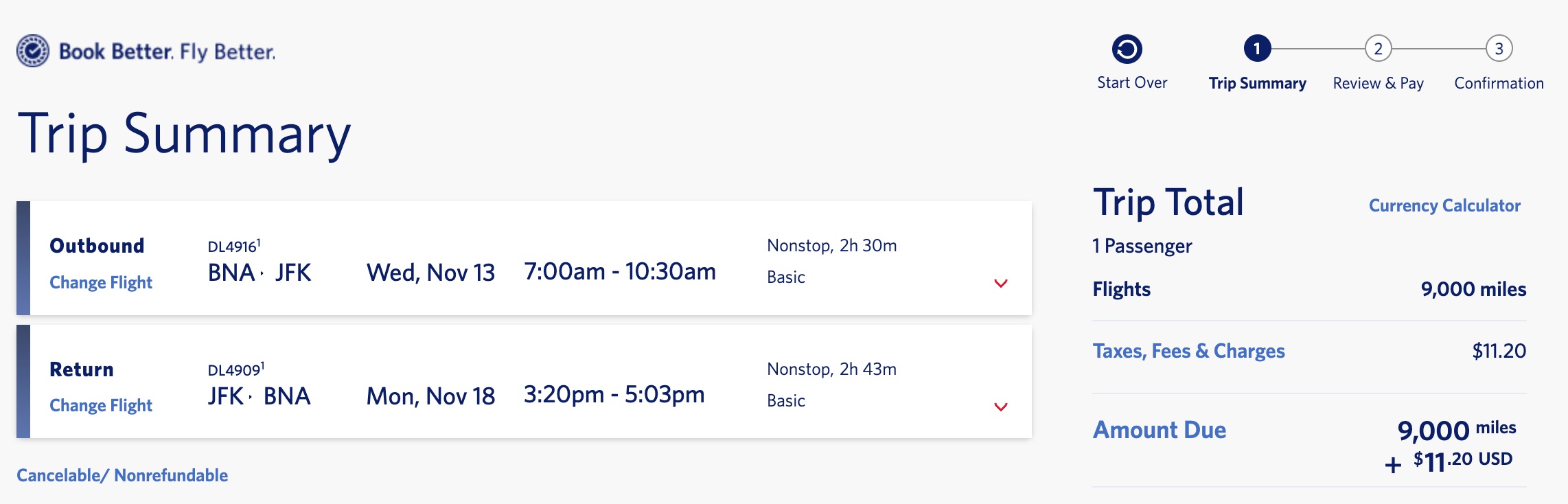

We typically warn travelers against using their miles for short domestic flights, but it’s actually a sweet spot with Delta. With these shorter routes, it’s fairly easy to find round trips for 10,000 SkyMiles or less. Flights shorter than 750 miles seem to be easiest to snag at this price, but even some longer flights make the cut. Be sure to book well ahead of your flight to ensure the lowest-priced SkyMiles award space is available.

For all the faults of Delta SkyMiles, you’ll rarely find roundtrip domestic flights this cheap through other airline programs. Booking a cheap domestic flight like this one from Nashville (BNA) to New York (JFK) for just a few thousand miles is one of the best moves you can make with SkyMiles.

Check out our roundup of the cheapest domestic SkyMiles deals we’ve found lately!

Finally, Delta’s “Pay with Miles” feature sets a floor value for how much your SkyMiles are worth. This perk is only available to Delta Cardholders and bases the miles you need on the cash fare – making every SkyMile worth a cent toward your flight. So long as you’ve got at least 5,000 SkyMiles in your account, you can use them to pay for all or a portion of your flight.

Related reading: How to Find & Book the Best Delta SkyMiles Deals

Delta SkyMiles Platinum American Express Card: Statement Credits

With a $350 annual fee right out of the gate, the Delta SkyMiles Platinum card won’t be a no-brainer for every traveler.

So what could possibly make paying that fee worth it? Money-saving statement credits sure help.

Delta Stays

As part of a major refresh earlier this year, the SkyMiles Platinum card now comes with an annual credit for hotel bookings through Delta Stays.

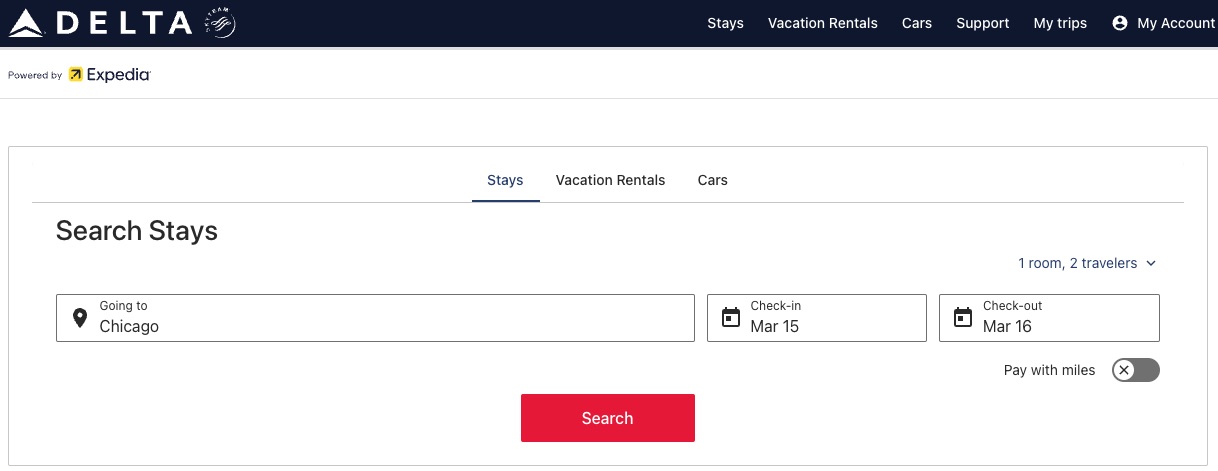

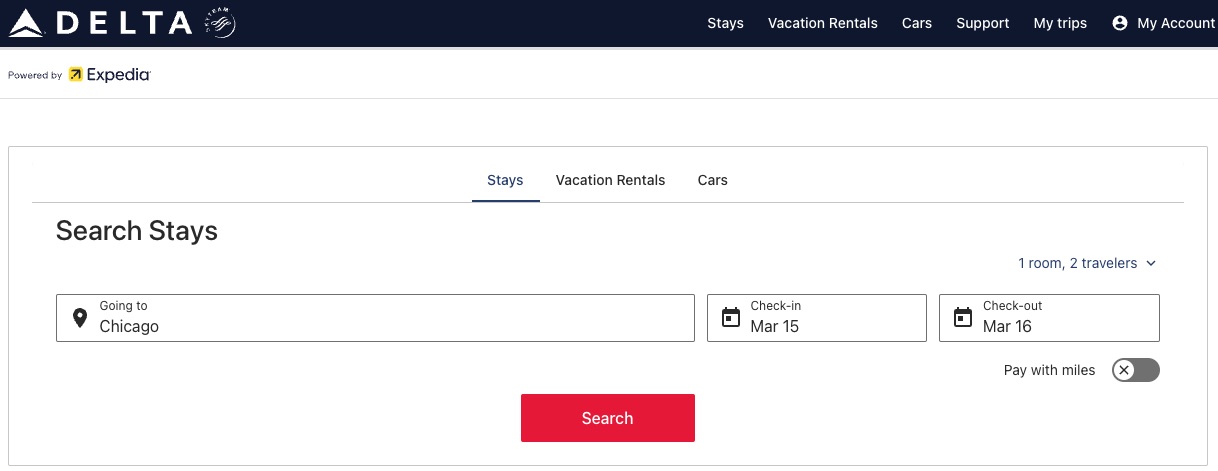

If you’re unfamiliar with Delta Stays, it’s similar to other online travel agencies (OTAs) in that you can easily search for hotel and vacation rentals in thousands of cities worldwide. You’ll see results from all the major hotel chains, smaller boutique hotels, and even vacation rentals similar to those you’ll find on Airbnb or Vrbo.

The *delta skymiles platinum card* comes with an up to $150 Delta Stays credit each year. If you’re able to make good use of this credit, by offsetting the cost of a hotel you would have booked otherwise, you’re effectively lowering your annual fee to a much more manageable $200 per year.

It’s worth mentioning that you get a fresh credit each calendar year, not when your card renews. That means if you’re just picking up the SkyMiles Platinum card, you’d be able to use the credit both this year and next, all while paying a single year’s annual fee.

Read our guide to using your Delta Stays credit!

Rideshare

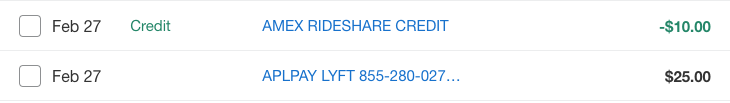

The Delta Platinum Card comes with up to $120 in rideshare credits each year, doled out in monthly installments. That means each month, cardholders can get up to $10 back as a statement credit on any eligible rideshare purchases with Uber, Lyft, Curb, Revel, or Alto.

There’s one critical point to note with these credits: Unused rideshare credits don’t roll over to the next month. This is a use-it-or-lose-it benefit so it’s important to ensure you use up these credits in full each month. And unlike the Uber Cash you get with the non-Delta Amex Platinum or Gold cards where it’s automatically loaded onto your account, you have to enroll to earn the rideshare credit.

Be sure to check out our guide to maximizing this new rideshare credit!

Resy

With the Delta Platinum card, you now have up to $120 in statement credits, doled out in $10 monthly increments, for purchases at U.S. restaurants available through Resy, Amex’s restaurant reservation platform.

To take advantage, just spend money at a Resy partner restaurant, and American Express should recognize the charge and issue a statement credit each month when you make a purchase at one of these restaurants.

Just like the monthly rideshare credit, this is a use-it-or-lose-it benefit. It’s up to you to use the credits each and every month … because if you don’t, they won’t roll over.

Read our guide to using the Resy credits on the Delta Platinum and Reserve cards!

TSA PreCheck or Global Entry

The Delta SkyMiles Platinum Card gives you a credit of up to $100 that covers the cost of Global Entry or TSA PreCheck every four years.

This benefit might seem a bit redundant, as a lot of travel credit cards offer a credit for Global Entry or TSA PreCheck these days. But even if you’re already enrolled in one of these trusted traveler programs, it could still be useful when it comes time to renew. Or you could even pay the application fee for a friend or family member and make their next airport experience a little less stressful.

Here’s how it works: Just pay the application fee with your card and poof – the credit kicks in to automatically cover the cost. Once enrolled, membership lasts for five years – that means as long as you keep the card open, your enrollment will stay up to date with either program.

Can’t decide? Go for Global Entry, as that also comes with TSA PreCheck benefits as well as getting you into a designated customs and immigration line when returning to the U.S. from abroad.

Delta SkyMiles Platinum American Express Card: Perks When Flying Delta

If you’re able to make good use of all those statement credits, you can easily come out ahead with the SkyMiles Platinum card – but there’s more reason to carry one than that alone.

The real value of having a Delta SkyMiles credit card is the perks you get when flying with the airline. While the Delta Platinum card includes most of the common benefits you’ll find on other airline cards, like a free checked bag and priority boarding, it takes things even further with an annual companion pass, discounted award tickets, and more.

Companion Certificate

Perhaps the biggest and most important benefit of the Delta SkyMiles Platinum card is the annual Delta companion certificate issued to cardholders.

You’ll get the pass after you’ve held the card for a year, so you can’t use it immediately after opening your account. After your first card renewal, you’ll get this companion certificate good for one main cabin, roundtrip fare – and while it used to be limited to trips within the continental U.S., that’s no longer the case. As part of a broader SkyMiles credit card shakeup, Delta recently expanded the list of eligible destinations to help you and a pal fly not just within the mainland U.S. but out to Hawaii, down to Mexico, throughout the Caribbean, and beyond.

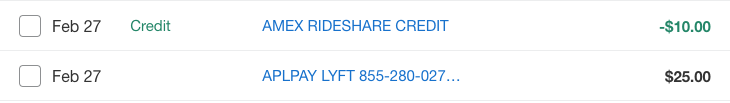

But there is an important restriction to keep in mind when using this great perk. The companion certificate only works for fare classes L, U, T, X, and V in the main cabin. That means basic economy fares are off-limits, as are some of the cheapest-priced economy fares.

In the past, many Delta flyers have had difficulty putting these companion certificates to use, though Delta recently made it easier by adding a calendar view to find more dates that work.

Still, utilizing this pass can be a great way to save money on airfare. And it should be fairly easy to get much more out of this perk than the card’s $350 annual fee.

Make sure to read our full guide to using the Delta companion certificate – including some great tips to find the fares that work!

First Checked Bag Free

The Delta Platinum card gets you – and up to eight others booked on your reservation – a free checked bag on every Delta-operated flight. If you travel a handful of times per year with Delta, this perk alone can make having the card in your wallet a worthwhile investment.

And when we say every Delta flight, we mean it. Whether it’s a regional hop operated by Delta Connection, a Delta flight to a bigger city, or a trip to Europe with Delta, you get your first checked bag free. Just know, if you’re flying exclusively with a Delta partner airline, like Air France or KLM, you will still incur a cost for checked bags on those flights.

Considering Delta now charges at least $35 each way for a checked bag, those savings can add up fast. Best of all, you don’t even need to pay for your flight with your Delta card to get that benefit.

Read more: You May Not Have to Pay With Your Airline Card to Get Free Baggage

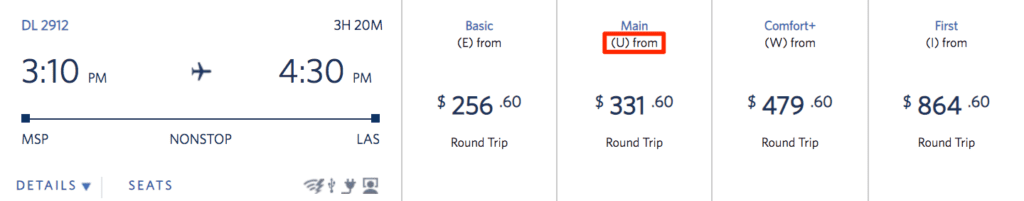

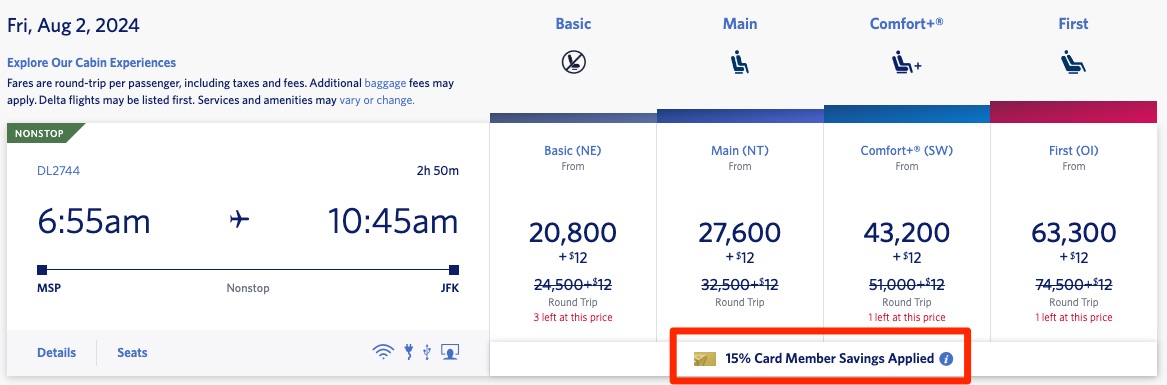

TakeOff 15

Having the SkyMiles Platinum card in your wallet automatically unlocks an excellent perk: A 15% discount anytime you’re redeeming Delta SkyMiles for an award ticket.

Delta calls it TakeOff 15. This marquee benefit for Delta Amex credit cards officially rolled out back in February 2023 and it’s available on all the co-branded SkyMiles cards … except for the n0-annual fee Delta SkyMiles Blue.

- The TakeOff 15 discount is automatically applied while searching and at checkout when you book an award ticket with SkyMiles so long as you are logged into a Delta account with a SkyMiles credit card

- This 15% discount only applies to Delta and Delta Connection-operated flights – not flights operated by partner carriers like Air France, KLM, and other SkyTeam alliance airlines

- There is no limit to how many times you can use this discount

- You only get a 15% discount on the mileage rate – not any taxes and fees

- Per the terms and conditions, you must use your eligible Delta credit card to pay those taxes and fees

- The benefit does not apply to Pay with Miles or Miles + Cash bookings.

- The benefit also does not apply to seat upgrades made with SkyMiles after the purchase of your original flight

This is a great benefit that goes further than what you’ll find on any other major airline … with a catch. While it’s not black and white, we’ve seen signs that Delta increased award rates to book tickets with SkyMiles after introducing this TakeOff 15 discount.

Read more: How to Save SkyMiles With Delta’s TakeOff 15 Benefit

Get 20% Back for Delta In-Flight Purchases

When you use your Delta Platinum card to pay for in-flight purchases like food & drinks, you’ll receive 20% off in the form of a statement credit.

Delta offers complimentary soft drinks and a small snack on domestic flights but if you’d like something more to eat or drink, you’ll need to pay up. You’d need to travel with Delta – and buy quite a bit on-board – for this benefit alone to justify having the card. But a 20% savings is still better than nothing.

Delta SkyMiles Platinum American Express Card: Earning Delta Medallion Status

If Delta Medallion status is what you’re after, the Delta Platinum Card can help you get closer to the front of the plane … without paying for it.

MQD Headstart

Last fall, Delta made some unpopular changes to how members earn elite status by moving away from measuring how often and far you fly, in favor of the almighty Medallion Qualifying Dollar (MQD).

But in doing so, the airline threw travelers with a Delta Platinum or Reserve Card (or either cards’ business versions) a major bone: You’ll get a 2,500 MQD head start toward status.

This means that simply by carrying the Delta Platinum card, you’re already halfway to the lowest-tier Silver Medallion status before ever setting foot on a plane. And if for some reason you have both the Platinum and Reserve cards (or one of the business versions), these “headstart” benefits stack. Which means you can get Silver status with just two Delta credit cards (and annual fees). Or you can get all the way to Gold status – without flying or spending a dime on your card – if you’re crazy enough to have all four.

MQD Boost

With the MQD head start benefit that comes with the Delta Platinum Card, you’re well on your way to earning Delta elite status – but that’s not the only leg up you get.

You’ll also get an “MQD boost” for ever dollar (or really every $20) you spend on your card. It works like this: Spend $20 on your Delta Platinum Card and get 1 MQD.

This means that if you spend $50,000 per year on your card, you’d earn enough MQDs (with the $2,500 MQD Headstart benefit) for Silver Medallion status. While the amount of spending that’s required to earn a meaningful amount of MQDs is quite high, this is yet another way that you can climb the status ranks … all without flying.

Now, there’s certainly a case to be made for whether or not you should be spending that much to earn status – as we’ve discussed, other travel cards are far more rewarding. But at the end of the day, just being able to earn status or climb to a higher status tier by swiping your Delta Platinum Card is a nice option to have.

Complimentary Upgrade List

No status? No problem!

Even if you don’t have Delta Medallion status, your Platinum Card now makes you eligible for complimentary upgrades to Delta One (within the U.S.), first class, and Delta Comfort Plus on tickets purchased on or after Feb. 1, 2024. But based on how Delta determines its upgrade order, any upgrades will be a long shot – and unavailable if you bought a Delta basic economy ticket.

Bottom Line

The Delta SkyMiles Platinum American Express Card is a great option for frequent Delta travelers. The card’s welcome offer and bonus point earning make it a great option for piling up Delta SkyMiles.

Added perks like free checked luggage and an annual companion pass, combined with money-saving statement credits make keeping the card long-term an easy decision.

Learn more about the *delta skymiles platinum card*.