A closer look at seven key travel trends in Latin America this year.

BY VALENTINA DUQUE

With air traffic finally reestablishing itself in Latin America and the Caribbean in 2024, the region’s travel and tourism industry is looking forward to full recovery in the sector. Leisure flight bookings increased by 37% to Brazil in March 2023 compared to 2019; by 43% to Mexico, and 129% to Jamaica. That was in spite of the economic slowdown felt last year, which hit several industries hard, including the automotive industry, retail and fashion.

With this panorama in view, it is worthwhile focusing on the experience of consumers—their travel preferences and tastes considering what is the new normal—for marketers to take maximum advantage of the upturn in the tourism industry. Presented below are seven travel trends to and from Latin America in 2024.

No. 1. Generation Z is the Generation That Travels the Most

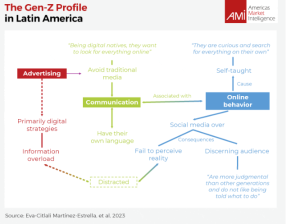

According to Visa’s report on Global Travel Trends for 2024, worldwide, Generation Z is the generation that does the most travel for pleasure. Insights from the firm m1nd-set show that Generation Z is a high-potential segment in Latin America’s retail travel industry.

On that basis, investment is needed in well-thought-out marketing strategies for Gen Zs, who are often careless shoppers, who have little interaction with staff at duty free stores, and who spend much less than other generations. Their purchases do, however, tend to be more impulsive: 63% are for themselves (rather than gifts for others).

In Latin America, Gen Zs (or “centennials”) make up 22% of the population, and this will continue up to 2030, with a 1% variation. Gen Zsview influencers as “media role models.” Reaching them with digital advertising is key (see graph).

No. 2. Latin Americans Are Aspiring Toward Sustainable Tourism

Eco-tourism is still growing in Latin America. Mexican travelers will choose eco-friendly travel options if they cost the same or less than the alternative. And in Brazil, 71% of travelers are very interested in trying sustainable tourism. These two data points are just some examples of the impact of sustainability on the tourism industry in Latin America, according to the Visa study (2023). m1nd-set (2023) also says that 60% of Latin American buyers consider it important to find a line of sustainable products at duty free stores.

According to Visa, Latin American travelers view the following activities as related to green tourism:

- Choosing accommodation that presents sustainability initiatives

- Not buying single-use plastic products (like water bottles)

- Choosing eco-efficient transportation methods

- Shopping for flights that emit less carbon

- Visiting destinations noted for their natural environment

Businesses, starting with airlines, are trying to take full advantage of this trend, in tandem with their corporate net zero aims. Chilean-based airline LATAM Airlines reports having reduced its CO2 emissions by 14 tons, simply by changing how it does digital advertising. With the help of SeenThis—a firm specializing in online sustainability—they implemented interactive ads at prices similar to regular display ads in order to decrease their data usage by 25%.

No. 3. United States: The Top International Destination for Latin American Travelers

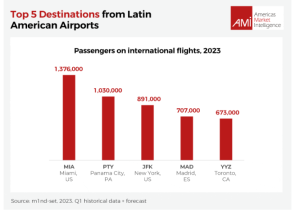

According to Mastercard (2023), the United States is the leading international tourist destination for travelers in Latin America, followed by Canada and the United Kingdom. The gap is striking: USA has by far the highest share of inbound tourism, as the graph below shows.

These figures coincide with reports from m1nd-set (2023) showing New York and Miami among the top 3 destinations from Latin America by number of passengers (see graph). They also coincide with insights from Visa showing that Latin Americans prefer travel to the United States and Europe as these destinations “tend to be associated with high social status.”

No. 4. Trips Combining Work and Pleasure Are Soaring

Although the term “digital nomad” is nothing new anymore, the reality of it in Latin America it has only recently begun to sink in. Today’s travelers are combining leisure trips with business, by working remotely from different corners of the world. Lately, this has generated new business models, including hotels with shared workspaces (such as the Selina hotel line), or airlines that offer multiple-day stopovers in strategic cities. Governments in countries like Colombia, Brazil, Costa Rica, Panama, and Mexico are also reacting to this by offering digital-nomad visas.

In Latin America, the cities most sought after by digital nomads are Buenos Aires, Mexico City, Medellin, Lima, and Guadalajara. Globally, Americans account for the largest share of digital nomads by nationality (50%), according to data collected by Bloomberg Línea. In turn, 70% of digital nomads worldwide are said to be earning between US $50,000 and US $250,000 per year.

Though much has been said about the negative socioeconomic impact that the trend is having in Latin American markets, it is outside the scope of this article.

No. 5. Latin American Travelers Have Matured Digitally

As Gen Zs become the dominant segment for travel in Latin America, we should expect tourism to be influenced by social networks, as well as online bookings for flights, hotels, and more recently, activities and experiences. According to Visa, 62% of adult Gen Zs report using technology to save money on their travel, which in turn has influenced the vacations of the entire family. Similarly, a study by Marriott International10 found that travelers arriving in Latin America are already using AI chatbots to book their vacation.

It is also worth noting that the phenomenon of “gig-tripping” (trips based on concerts and live events) is happening in Latin America. The Marriott International study mentions that the Estéreo Picnic festival in Bogotá and the Corona Capital festival in Mexico City are among the top destinations.

No. 6. Travel Based on “Experiences” Will Dominate Tourism

Tourism no longer means travelling around buying lots of items and gifts. In Latin America, the best travel experience is one based on the experience itself. This is according to Mastercard’s Travel Sector Trends 2023 study. In Mexico, spending on experiences grew by 117% in 2023 compared to 2019, that is, in restaurants, recreational activities, casinos, nightclubs, bars, and events. By contrast, there was only a 65% increase in shopping at chain stores, on items like clothing, cosmetics, sporting goods, jewelry, and shoes.

The Visa study underlines this point:

- 28% of travelers in Latin America enjoy new and exotic experiences that they cannot find locally

- 27% of travelers in Latin America want to create exciting memories with their family or travel companions

- 25% of travelers in Latin America aspire to new challenges and adventures that take them out of the comfort zone

No. 7. Latin American Travelers Demand Flexibility

The golden age of all-inclusive travel seems to have reached its end. With the arrival of Gen Zs to the tourism market, and with digital maturity, travelers now embrace flexibility in the fullest sense of the term. Searches are based on activities that have excellent reviews online, and on the smart choice of the best provider for these activities. This trend is being seen worldwide, with 58% of travelers saying they book everything separately, and just 16% saying they prefer all-inclusive experiences, according to the Visa report.

Latin America is no exception. The same report notes that 65% of Brazilian prefer trips that are wholly or partially independent. In other words, they avoid buying package holidays. And in Mexico, 40% of travelers are willing to pay more in exchange for the flexibility to change their travel activities.

Valentina Duque is a Marketing Associate at Americas Market Intelligence. This article is based on an overview by AMI. Republished with permission.

RELATED ARTICLE

Latin America: The Tourism Winners