Amex Gold Card Annual Fee: Is it Worth $325 a Year?

13 min readLet’s just get to the point: The *amex gold card* has long been one of the best travel cards on the market for your everyday spending – and heck, it might just be one of the best travel rewards cards, period. But after a recent revamp and increased annual fee, many travelers might be wondering if the card is still worth it.

In the world of travel rewards credit cards, the Amex Gold’s $325 annual fee (see rates & fees) sits squarely in the middle of the road: It’s not cheap (especially at its new price point) but it’s nowhere near the priciest travel card on the market, either. But it’s what you get in return for that fee that matters most – and whether it outweighs that higher cost.

For starters, it earns 4x Membership Rewards points at U.S. supermarkets (on up to $25,000 spent each year, then 1x) and 4x Membership Rewards points at restaurants worldwide (on up to $50,000 spent each year, then 1x). That makes this card the single-best option for earning more points on food – and we all need to at, right?

You’ll also earn 3x points on airfare purchased directly with the airlines or at amextravel.com – and 2x points on prepaid hotels, car rentals, and cruises at amextravel.com. To top it off, Amex offers a slew of monthly and twice-a-year money-saving credits for select dining purchases, as well as a monthly allotment of Uber Cash.

Oh, and Amex sweetens the deal with a solid welcome bonus: You can currently earn 60,000 Membership Rewards point bonus after spending $6,000 on eligible purchases in the first six months, plus a statement credit for 20% back (up to $100) on eligible restaurant spending in the first six months. But you might be able to do even better with a targeted offer to earn 75,000 points after spending $6,000 in the first three months via CardMatch or an even bigger offer by applying through a referral link.

Add it all up, and we think this card can still easily be worth its annual fee of $325. But let’s do the math together.

Read more: Amex Membership Rewards Points: A Guide to Earning & Burning

Learn more about the *amex gold*

American Express Gold Card Benefits

American Express just made some pretty major updates to the Gold Card … but in my opinion, it’s what didn’t change that still makes this card a keeper.

While the refreshed Gold Card followed Amex’s playbook of raising annual fees in exchange for additional (sometimes questionable) statement credits, several new benefits are far less cumbersome than others and should easily be enough to offset the card’s $75 price hike.

And not that you can (or should) judge a book by its cover, but the fact that the card comes in the traditional gold, spiffy rose gold, or the new limited-time white gold design doesn’t hurt its appeal, either.

Here’s the full breakdown:

- Welcome Offer: bonus_miles_full

- Earn 4x points per dollar spent at restaurants worldwide, including takeout and delivery in the U.S. (now capped up to $50,000 per year)

- Earn 4x points per dollar spent at U.S. supermarkets (up to $25,000 per year)

- Earn 3x points per dollar spent directly with airlines or at amextravel.com

- Earn 2x points per dollar spent on prepaid hotels, car rentals, and cruises at amextravel.com

- Earn 1x point per dollar spent on other eligible purchases

- Changed! $120 Dining Credit: Enroll and earn up to $10 in statement credits monthly (up to $120 annually) when you pay with the Gold Card at Five Guys, Grubhub, The Cheesecake Factory®, wine.com, and Goldbelly

- $120 Uber Cash: Add the U.S. Consumer Gold Card to your Uber account to receive $10 in monthly Uber Cash credits (up to $120 annually) towards Uber Eats or Uber Rides.

- New! $100 Resy Credit: Get up to $50 in semi-annual statement credits ($100 per year) after you enroll and pay with the Gold Card at U.S. Resy restaurants or on other eligible Resy purchases.

- New! $84 Dunkin’ Credit: Get up to $7 per month ($84 per year) in statement credits after you enroll and pay with the Gold Card.

- No foreign transaction fees

- Increased! Annual fee: $325 (see rates and fees).

Learn more about the *amex gold*

When Will You Pay the Higher Fee?

You might not have to ask yourself if it’s worth paying a higher annual fee for the Gold Card at all – not yet, anyway. You might not be on the hook to pay $325 until sometime in 2025.

Exactly when the fee increase kicks in depends on when you got your Amex Gold Card:

- New applicants will pay the higher, $325 annual fee right off the bat.

- Existing cardholders who renew their Gold Card by Sept. 30 will pay the previous, $250 fee.

- Existing cardholders whose next renewal date is Oct. 1 or onward will pay $325.

So let’s say your Amex Gold Card is set to renew in late August 2024. If that’s the case, you’ll pay $250 for one more year … then pay $325 in August 2025.

If your card renews before Oct. 1, determining whether the Amex Gold annual fee is worth it is much easier: It’s the same as it ever was.

But if not, keep reading.

Is the Amex Gold Card Annual Fee Worth It?

It’s the $325 question that’s been on many travelers’ minds since last week.

This is a thought exercise I go through each year when the annual fee on my own *amex gold card* comes due – and you should too. But with all these changes, it’s time to do the math all over again.

I originally opened the card to earn more points and both restaurants and supermarkets. What can I say: I like to eat. And the Amex Gold is one of the best options on the market for both of those categories.

But am I really getting enough value out of earning more points and extra monthly statement credits to make it a keeper? There are now more benefits than ever weighing into my decision. So let’s break them down and take a closer look.

Read More: Amex Gold vs Chase Sapphire Preferred: Which Credit Card is Right for You?

$120 Annual Dining Credit

One of the benefits you may need to consider when weighing the Amex Gold’s $325 annual fee has been around for years: A $120 annual dining credit.

The credits are split up into $10 monthly increments. This is a use it or lose it credit: If you don’t use the $10 in a given month, it won’t roll over to the next month.

More importantly, they’re only eligible for charges at select establishments: GrubHub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys.

Shake Shack and Milk Bar are also on the list, but only through Sept. 26, 2024. Five Guys is taking the place of Shake Shack – and considering Five Guys has 1,500-plus locations, that should make this credit even easier to earn.

I value this benefit at pretty close to face value as GrubHub has several restaurants in my area from which I would otherwise be getting food on a monthly basis. Sometimes, I’ll even order food for pickup to save on the pesky delivery fees.

Regardless, ordering lunch or dinner once a month through GrubHub hasn’t been an issue. I’ve made it a point to use the $10 credit most months.

Total Benefit Value: $100

$120 Annual Uber Cash

As long as you have your Amex Gold Card added to your Uber account, you’ll get $10 in Uber Cash loaded to your account on the first of every month.

Much like the others, this credit is another use-it-or-lose-it benefit that doesn’t roll over from month-to-month. Safe to say, I’ve been using it. While I don’t have ride with Uber each and every month, I do make sure to order food from Uber Eats. Did I mention that I got this card because I spend a lot on food?

Similar to ordering a meal on GrubHub, there are several participating restaurants in my area. The prices on Uber Eats are more or less in line with what I’d pay by going into the restaurant. Furthermore, Uber Eats often emails me promo codes to save a certain percentage on my order. This means I oftentimes come out ahead by ordering lunch or dinner via the app instead of directly from the restaurant.

Total Benefit Value: $120

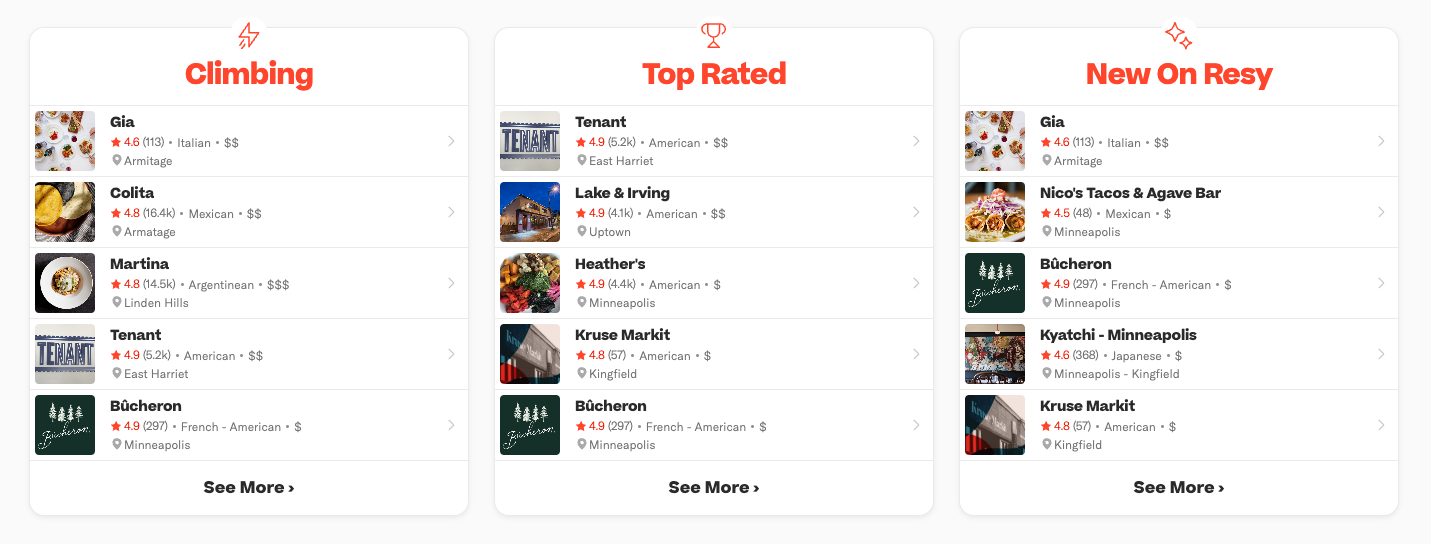

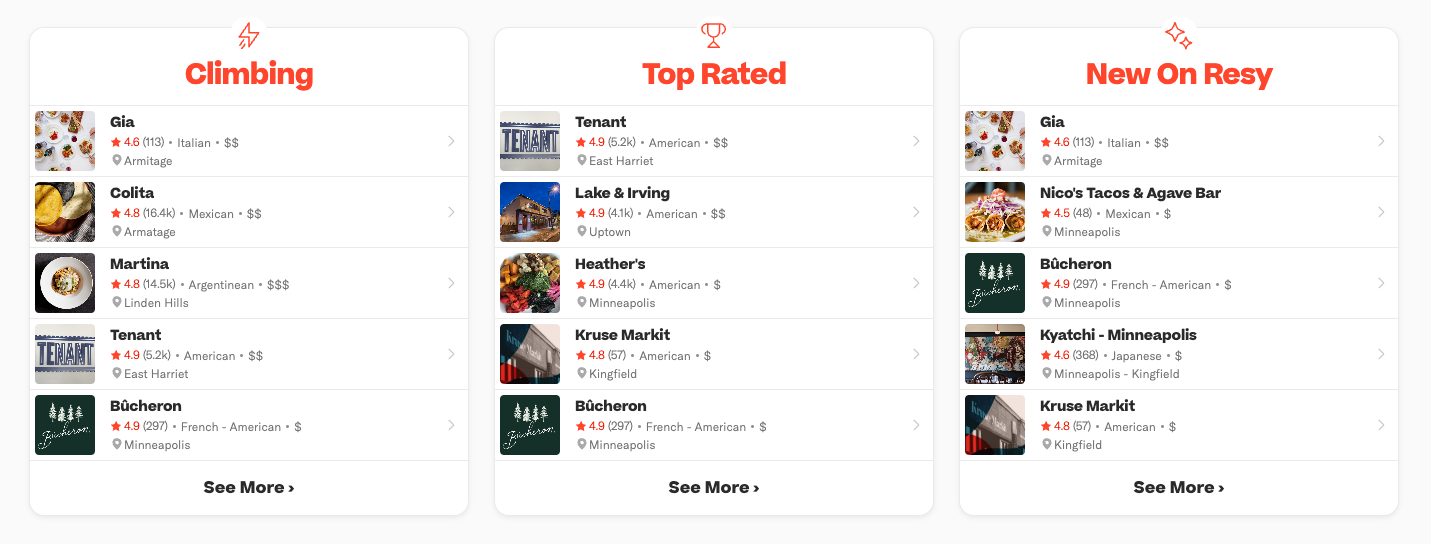

$100 Resy Credit

Amex first introduced Resy statement credits when it refreshed the suite of Delta SkyMiles cards earlier this year. Thankfully, the new credit that now comes with the Amex Gold will be far easier to use.

Each year, cardholders can get up to $100 in statement credits when dining at U.S. Resy participating restaurants. The statement credit is broken up twice a year: You have $50 to use from January through June and another $50 from July through December.

Read more: How to Use Amex Resy Credits

One important detail: You’ll need to enroll in this benefit online in your Amex account before dining at one of these restaurants. And like most Amex credits, this is a use-it-or-lose-it benefit. If you don’t spend the full $50 in the first half of the year, it won’t roll over to the next six months.

Having said that, I find this credit to be more or less worth face value and far easier to use than the $10 or $20 per month drips and drabs you get on the Delta cards. I ordinarily spend $50 every six months at Resy participating restaurants and since the Amex Gold card is already my go-to for dining, I don’t even have to think about what card I’m going to use.

That said, this new benefit could be harder to use – if a total dud – for travelers who don’t have a Resy-participating restaurant nearby. While Resy has a big (and growing) presence in cities across the country – as of last year according to Eater, there were more than 16,000 restaurants spread across more than 200 cities globally on Resy – it still skews toward upscale restaurants in big cities like New York City, Chicago, and Los Angeles and some midsize locations like Austin, Minneapolis, and Portland.

And only U.S. restaurants will qualify for these new credits, so don’t count on putting them to use on your international travels, either.

For me, though, this is an easy $100 in value.

Total Benefit Value: $100

$84 Dunkin’ Credit

Gold cardholders now get up to $84 per year at Dunkin’ – the artist formerly known as Dunkin Donuts. But that’s split into $7 a month installments.

Much like the new Resy credit, you’ll need to enroll your card in this benefit before taking advantage of it. Once you do, simply swipe your Gold Card when purchasing your morning coffee at Dunkin’, and you’re all set. Amex will automatically reimburse you up to $7 per month.

To be honest, I’m not quite sure how to value this credit quite yet.

I don’t regularly stop at Dunkin’ for coffee but now that I have a few bucks to spend there every month, I probably will start. The problem, for me personally, is that I don’t have easy access to a Dunkin’ location and I’m certainly not going to go out of my way for a $7 monthly credit. I imagine I’ll end up using this benefit a handful of times per year but won’t end up getting anywhere close to full value out of it.

Total Benefit Value: $28

4x Membership Rewards at Restaurants

One of my favorite benefits of the *amex gold card* is that it earns 4x Membership Rewards points at restaurants on up to $50,000 spent each calendar year.

Like many Americans, this is a category I spend a fair amount of money in each year, so it has a lot of appeal to me. There isn’t another credit card out there that regularly provides this kind of return on restaurant spending.

I like my Membership Rewards points and value them quite highly. Not only can you transfer Amex points to a number of partner airlines like Delta, Avianca, and more, but oftentimes, you can get even greater value by taking advantage of a transfer bonus – like those we often see to Virgin Atlantic and British Airways.

For the sake of this analysis, let’s say each Membership Rewards point that I earn is worth 1 cent each – and that’s an incredibly conservative valuation. And let’s also assume that I spend $100 a week at restaurants, on average – again, fairly conservative (for me).

- Weekly restaurant spend: $100

- X 52 Weeks in a year = $5,200

- X 4 Membership Rewards Points = 20,800

- X .01 (Membership Rewards Point Valuation) = $208

Total Benefit Value: $208

4x Membership Rewards at U.S. Supermarkets

Another key benefit of the Amex Gold Card is that it earns 4x Membership Rewards points at U.S. supermarkets (up to $25,000 annually, then 1x). This 4x earning is what makes it our choice for the best card for grocery shopping.

Again, I spend a decent amount on groceries each month, so the 4x multiplier in this category yields me quite a few points.

As mentioned above, I’m assigning a value of 1 cent each to my Membership Rewards for sake of this analysis. You should typically be able to get at least that amount out of them … and likely quite a bit more. To figure out just how lucrative the Amex Gold Card is for my supermarket spending, I’m going to estimate that on average I spend $125 a week at the grocery store.

- Weekly supermarket spend: $150

- X 52 Weeks in a year = $7,800

- X 4 Membership Rewards Points = 31,200

- X .01 (Membership Rewards Point Valuation) = $312

Total Benefit Value: $260

Amex Offers & Referral Bonuses

It’s impossible to assign a dollar amount to this category, but it’s still worth thinking about when considering whether to keep or ditch this card.

Amex Offers are money-saving digital coupons or rebates that you’ll get access to with just about any Amex Card – even the no-annual fee ones. The reason I’m taking these offers into consideration for whether or not to keep the Amex Gold is because this card typically gets better offers than any of my other Amex Cards. Yes, even better than the offers I get on Amex’s top tier *amex platinum card*.

Since I don’t typically go out of my way to use an Amex offer, the savings that I get from these offers is real money back in my pocket (or bank account).

Along those same lines, I also get better referral offers – bonuses that I can share with friends and family members who apply – with my Gold Card than any other Amex card that’s in my wallet.

Yet again, it’s tough to assign a dollar value to this benefit. But it simply adds to the increasingly lopsided math when I decide whether or not to keep the card each year. As the resident “credit card guy” among my family and friends I’m often asked what travel credit card to get – and they’re usually more than happy to apply using my referral link.

That means I’m earning more bonus points each year with this card, adding to my stash of points and taking an extra vacation that I might otherwise have been unable to afford. That’s worth something to me … even if I can’t assign it a dollar amount.

Doing the Final Math

Is the American Express Gold Card annual fee worth $325? For me, the answer is a resounding yes – though that will be different for everybody.

From my analysis above, I think that I can currently squeeze over $800 of value out of the card each year. That’s more than double the card’s annual fee and means the card is a keeper for the next year – and likely several years beyond that.

For others who spend less on food and don’t live near a Resy-participating restaurant, Dunkin’ store, or Five Guys burger shop, the math may work out far differently. You have to do the math for yourself.

If you don’t yet have the card and you think you can maximize these benefits, the math could tilt even further in your favor with a big welcome bonus.

Amex is currently offering a welcome bonus of 60,000 Membership Rewards points after spending $6,000 in the first six months of card membership – plus, you’ll earn a statement credit for 20% back (up to $100) on eligible restaurant spending in the first six months. That’s great on its own … but before applying, make sure to check CardMatch or a personal referral link: You could be targeted for an even bigger welcome offer.

Bottom Line

I always encourage travelers to do the math before ruling out cards with annual fees. Recently, it was time for me to take my own advice and I’m sure many others are doing the same.

While it’s never fun paying big annual fees, the key is figuring out whether you can get more out of it than what you’re paying. So although the Amex Gold Card’s annual fee is now a whopping $325, I can fairly easily come out ahead when factoring in the statement credits and my usual spending habits. Maybe you can, too.

And if you’re eligible to earn a big welcome offer in your first year, the math is even more in your favor.

Learn more about the *amex gold*