The Perfect Two-Card Combo for (Most) Delta Flyers

12 min readAfter the slew of changes Delta has made to earning elite status, entering Sky Clubs lounges, and most recently, to the airline’s co-branded American Express credit cards, many frequent Delta flyers are rethinking whether their pricey Delta cards are worth it.

But if you’re not ready to give up on Delta just yet, the two-card combination of the *amex gold* and *delta skymiles gold card* can get you the best of both worlds. Better yet, even with both of these cards, you’d be paying around the same amount in annual fees or less than if you held just one of Delta’s top-tier credit cards.

These two travel rewards cards are great on their own. But put them together and you’ve got the perfect two-card combination for earning SkyMiles and getting valuable perks on Delta Air Lines flights like free checked baggage, priority boarding, and more. Not to mention you’ll also be earning flexible transferrable points that you can turn into Delta SkyMiles – or use to book flights on other airlines, too.

Here’s everything you need to know about why this two-card combination deserves a spot in your wallet.

Card Benefits Overview

Before we dive deeper into what makes these two cards the perfect pair, let’s take a look at the benefits offered by both cards.

Both cards come with a sign-on bonus that can earn you valuable points and miles you can use to fly Delta. But the type of travel rewards you earn with each card – and how you earn them – is vastly different, as are the travel perks they provide.

Here’s a quick look at the features of both cards.

The American Express Gold Card

- Welcome bonus offer: bonus_miles_full

- Earn 4x points per dollar spent at restaurants worldwide, including takeout and delivery in the U.S. (now capped up to $50,000 per year)

- Earn 4x points per dollar spent at U.S. supermarkets (up to $25,000 per year)

- Earn 3x points per dollar spent directly with airlines or at amextravel.com

- Earn 2x points per dollar spent on prepaid hotels, car rentals, and cruises at amextravel.com

- Earn 1x point per dollar spent on other eligible purchases

- Changed! $120 Dining Credit: Enroll and earn up to $10 in statement credits monthly (up to $120 annually) when you pay with the Gold Card at Five Guys, Grubhub, The Cheesecake Factory®, wine.com, and Goldbelly

- $120 Uber Cash: Add the U.S. Consumer Gold Card to your Uber account to receive $10 in monthly Uber Cash credits (up to $120 annually) towards Uber Eats or Uber Rides.

- New! $100 Resy Credit: Get up to $50 in semi-annual statement credits ($100 per year) after you enroll and pay with the Gold Card at U.S. Resy restaurants or on other eligible Resy purchases.

- New! $84 Dunkin’ Credit: Get up to $7 per month ($84 per year) in statement credits after you enroll and pay with the Gold Card.

- No foreign transaction fees

- Increased! Annual fee: $325 (see rates and fees).

Read our full review of the Amex Gold Card!

Learn more about the *amex gold*

Delta SkyMiles® Gold American Express Card

- Welcome Offer: bonus_miles_full

- Check your first bag free on every Delta flight – savings of at least $70 on each round-trip flight, per person

- Priority boarding (even with a basic economy ticket)

- Earn 2x SkyMiles per dollar spent at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets

- Earn 2x SkyMiles per dollar on eligible Delta purchases

- Earn 1x SkyMiles per dollar spent on all other eligible purchases

- Up to a $100 Delta Stays credit: Earn up to $100 in statement credits each year when you make a Delta Stays prepaid hotel or vacation rental booking on the Delta Stays platform.

- Earn a $200 Delta flight credit if you spend $10,000 on the card in a calendar year

- Get 15% off SkyMiles award tickets with TakeOff 15 when booking on delta.com or through the Fly Delta app

- Get 20% off in-flight purchases such as food & drinks in the form of a statement credit

- No foreign transaction fees

- $0 introductory annual fee – then $150 each year after that (See rates & fees)

Read our full review of the Delta SkyMiles Gold Card!

Learn more about the *delta skymiles gold card*.

What Makes This Combo So Perfect?

Despite recent changes to Delta’s suite of co-branded credit cards, the Delta Gold Card still offers plenty of value for Delta flyers with travel perks like free checked bags and priority boarding that make it worth having in your wallet.

But if you want to rack up points faster, that’s where the Amex Gold Card shines. You’ll earn more transferrable points in a variety of different spending categories that you can easily turn into Delta SkyMiles…or send to nearly 20 other airlines to book flights. Even after a recent price hike, we still think the card is well worth its annual fee.

Two Welcome Offers

The Amex Gold Card, along with *amex platinum* and other cards that earn Membership Rewards are the only ones on the market that have Delta Air Lines as a transfer partner. That means you can send the points you earn on your Amex Gold Card directly to your Delta SkyMiles account on a 1:1 basis (1 point = 1 Delta SkyMile).

The one small downside is that these transfers to Delta (and other U.S. airlines) incur a fee of 0.06 cents per point – up to a maximum of $99. So a transfer of 100,000 points, for example, would incur a $60 fee when you turn them into 100,000 SkyMiles.

But thanks to some lucrative welcome offers and excellent bonus categories for spending, you can typically earn even more SkyMiles with a traditional Amex card than you would with one of Delta’s co-branded cards.

Here’s the current offer on the *amex gold*: bonus_miles_full

But first, be sure to check and see if you qualify for a bigger offer via CardMatch or through a personal referral.

Meanwhile, the *delta skymiles gold card* comes with a generous welcome offer of its own: bonus_miles_full.

Add up the SkyMiles you’d earn from the Delta Gold Card’s welcome offer and the points you’d get with the Amex Gold signup bonus and you’d have more than enough SkyMiles to take advantage of the next Delta SkyMiles flash sale.

Earn More SkyMiles

Beyond the signup bonus, you’ll earn more SkyMiles swiping your non-Delta Gold Card.

That’s because the Amex Gold Card earns 4x the Membership Rewards points for every dollar you spend at restaurants worldwide (up to $50,000 annually, then 1x). You’ll also earn 4x points per dollar spent at U.S. supermarkets (up to $25,000 annually, then 1x). Meanwhile, the Delta SkyMiles Gold Card only earns 2x Delta SkyMiles at restaurants and U.S. supermarkets.

So just by using the Amex Gold Card for these purchases instead of your co-branded Delta American Express Card, you’ll earn at least twice as many points for the same amount of spending.

The American Express Gold Card also earns 3x Membership Rewards points on all flights booked directly with any airline or through amextravel.com, whereas the Delta SkyMiles Gold American Express Card earns 2x SkyMiles per dollar spent on Delta flights.

Since the Delta SkyMiles Gold Card only earns a bonus if you are booking travel with Delta, having the Amex Gold is even more valuable.

Read more: Is the Amex Gold Card Worth Its Annual Fee?

Book Delta Flights for Less

Let’s make one thing clear: Amex Membership Rewards points are simply more valuable than Delta SkyMiles. And even if flying Delta (and only Delta) is your primary goal, you’re almost certainly better off earning Amex points instead of Delta SkyMiles.

That’s because Delta’s dynamic award pricing puts SkyMiles at a disadvantage, with award rates (how many miles you need to book a flight) that fluctuate wildly based largely on the cash cost of a flight. Unless you stumble into a Delta SkyMiles flash sale, you might see exorbitant rates to book a flight on Delta or other airlines. And if you only have SkyMiles, you’re stuck paying those prices.

Other airlines do things differently, with lower, more predictable award rates. And that includes Delta’s partner carriers like Air France/KLM and Virgin Atlantic … even when you’re using their miles to book Delta flights.

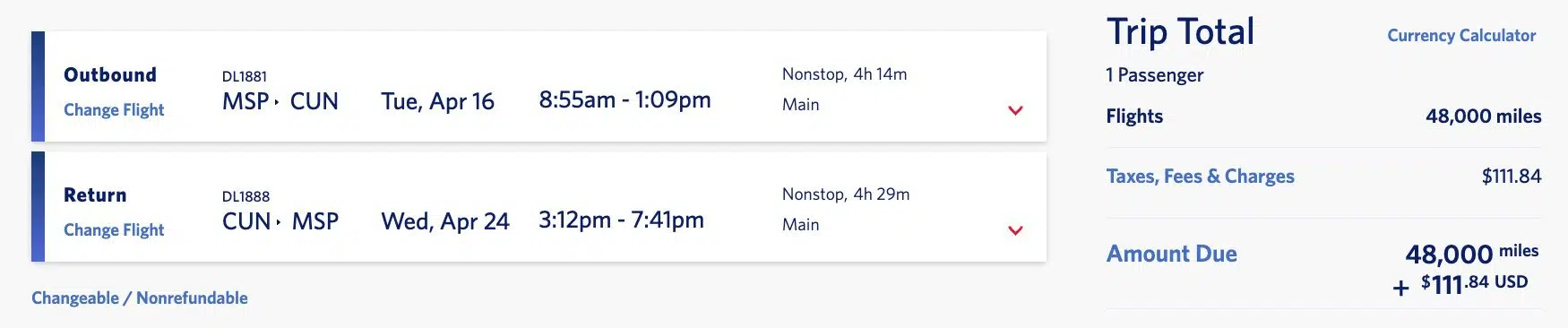

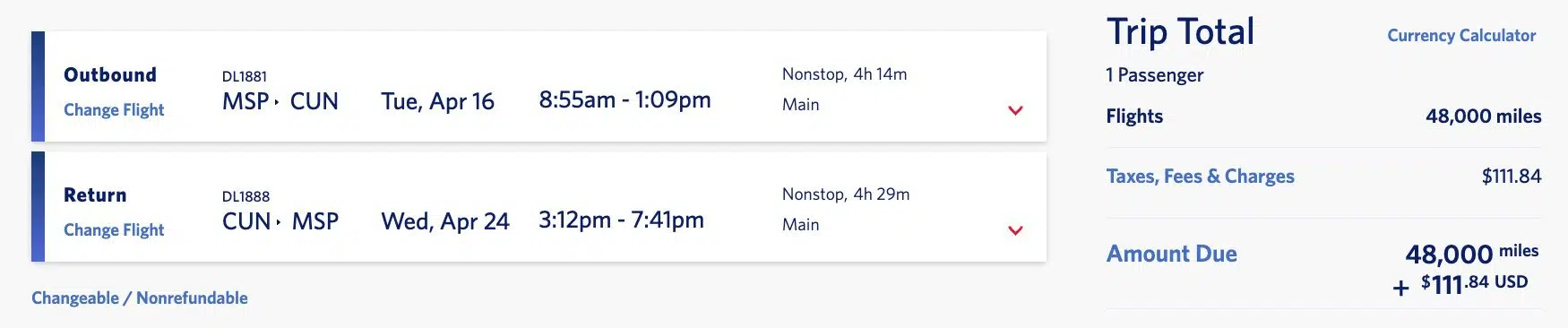

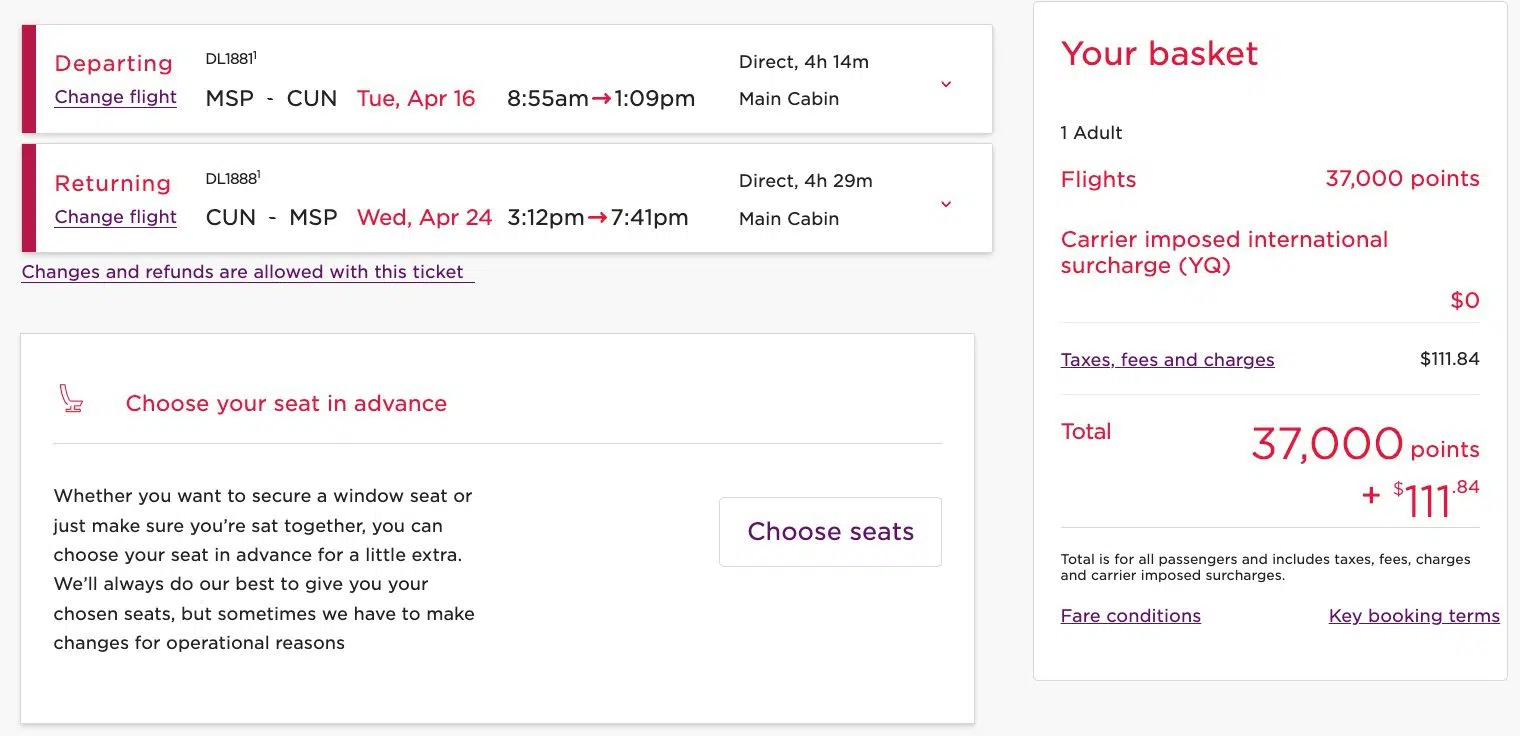

So if Delta is charging 48,000 SkyMiles to fly roundtrip in main cabin economy from Minneapolis (MSP) to Cancún (CUN) this spring…

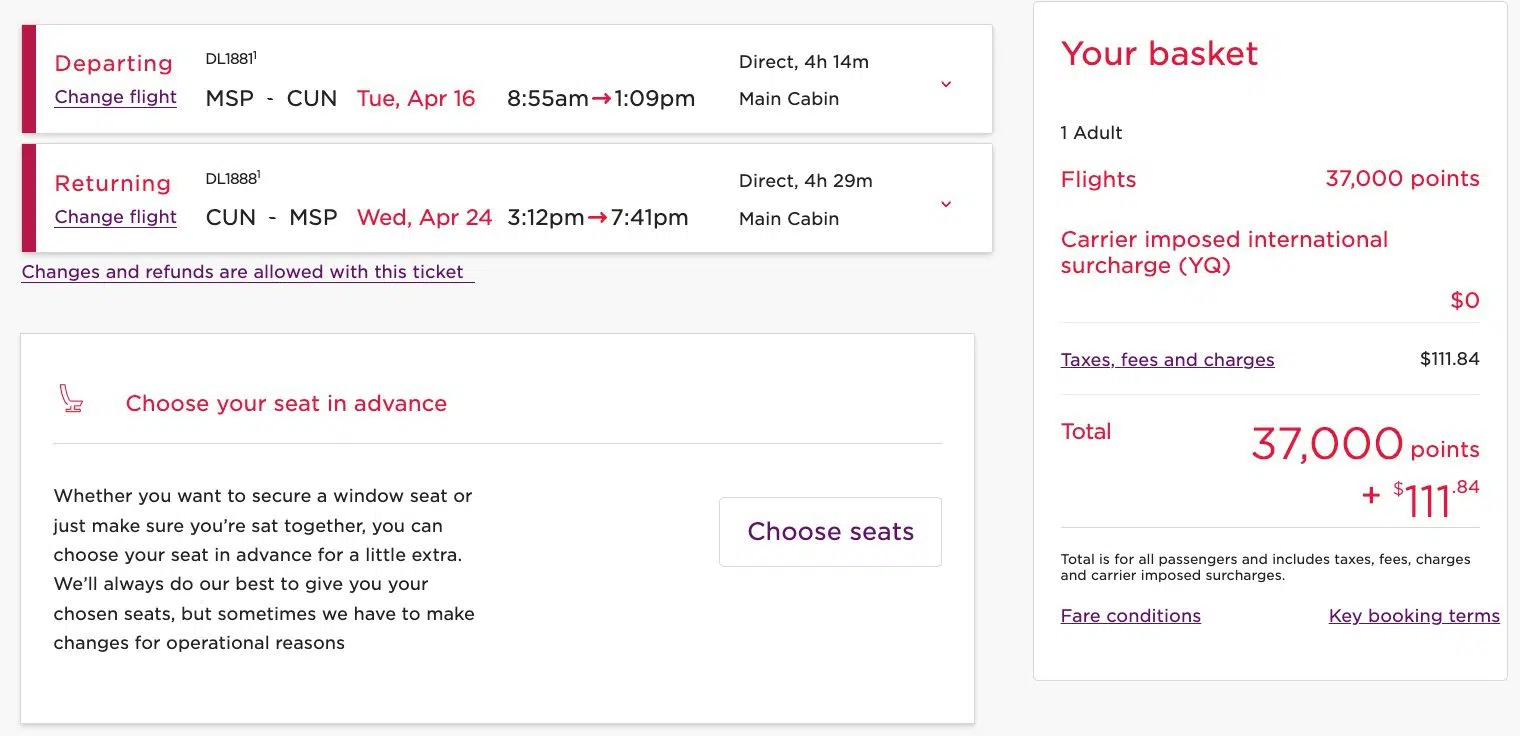

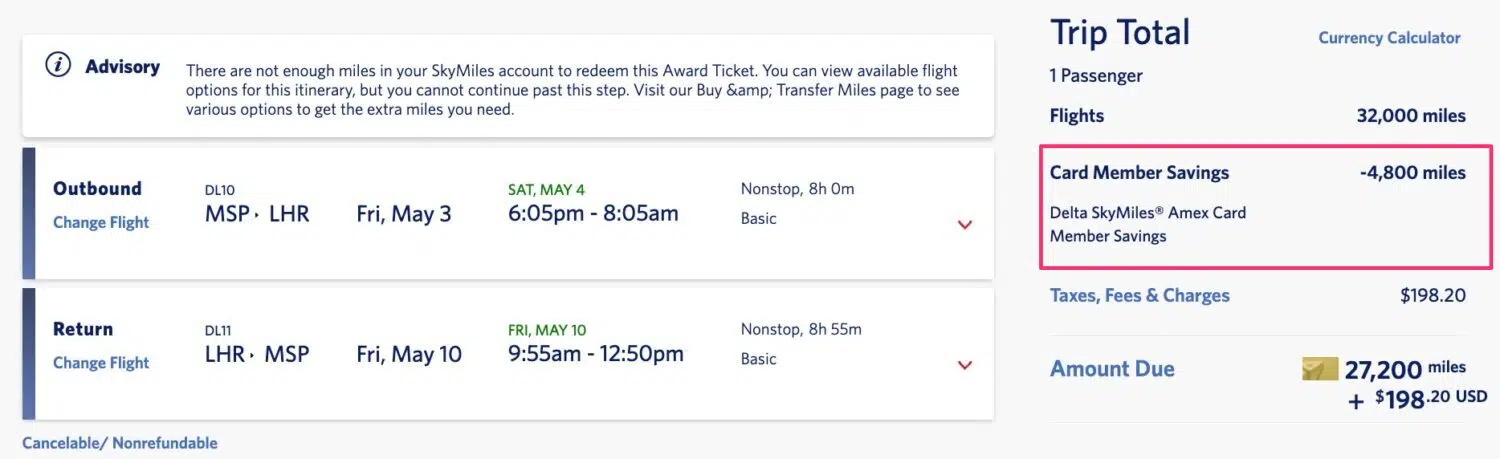

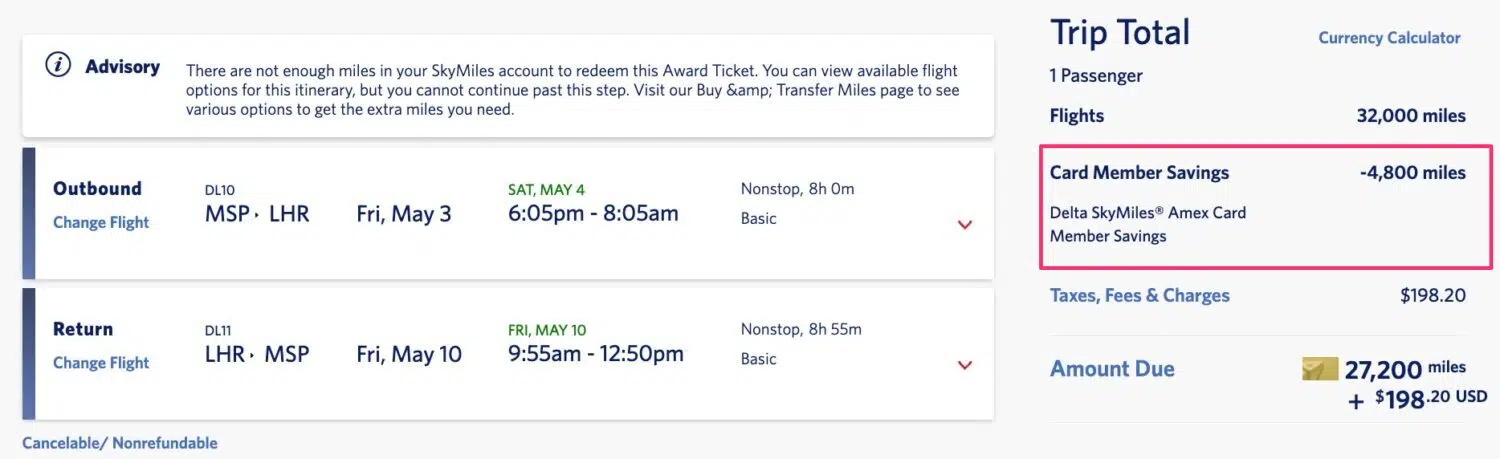

…you transfer those Amex points to partner carrier Virgin Atlantic instead and book those exact same Delta flights for less. Even after a recent increase, Virgin is charging just 37,000 points roundtrip.

Air France/KLM Flying Blue might even be a better option to turn to when you want to book flights for fewer points.

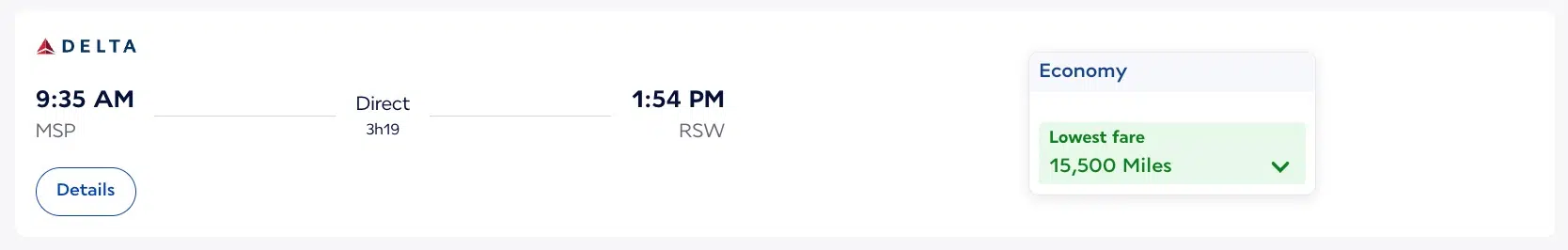

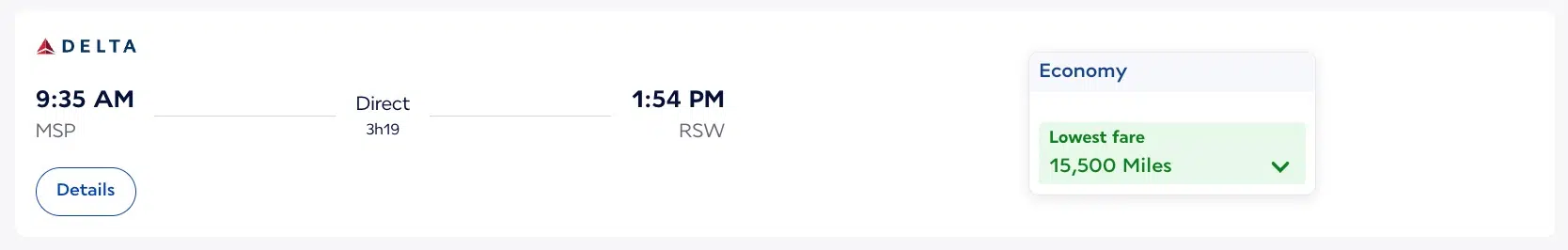

For example, you can book this Delta flight from Minneapolis-St. Paul (MSP) all the way to Fort Myers, Florida (RSW) in economy for as few as 15,000 miles each way, or 30,000 miles roundtrip.

That’s cheaper than what Virgin now charges at 16,500 points each way.

Read more: This is Now the Best Workaround to Book Delta Flights for Fewer Points

You can transfer Amex points to either of these partner airlines, so when it comes to deciding between transferring to Delta or one of the other programs, the choice is easy. Critically, Delta SkyMiles cannot be transferred to another airline, not even partner carriers like Virgin or Air France/KLM. That flexibility is what makes Amex points so valuable.

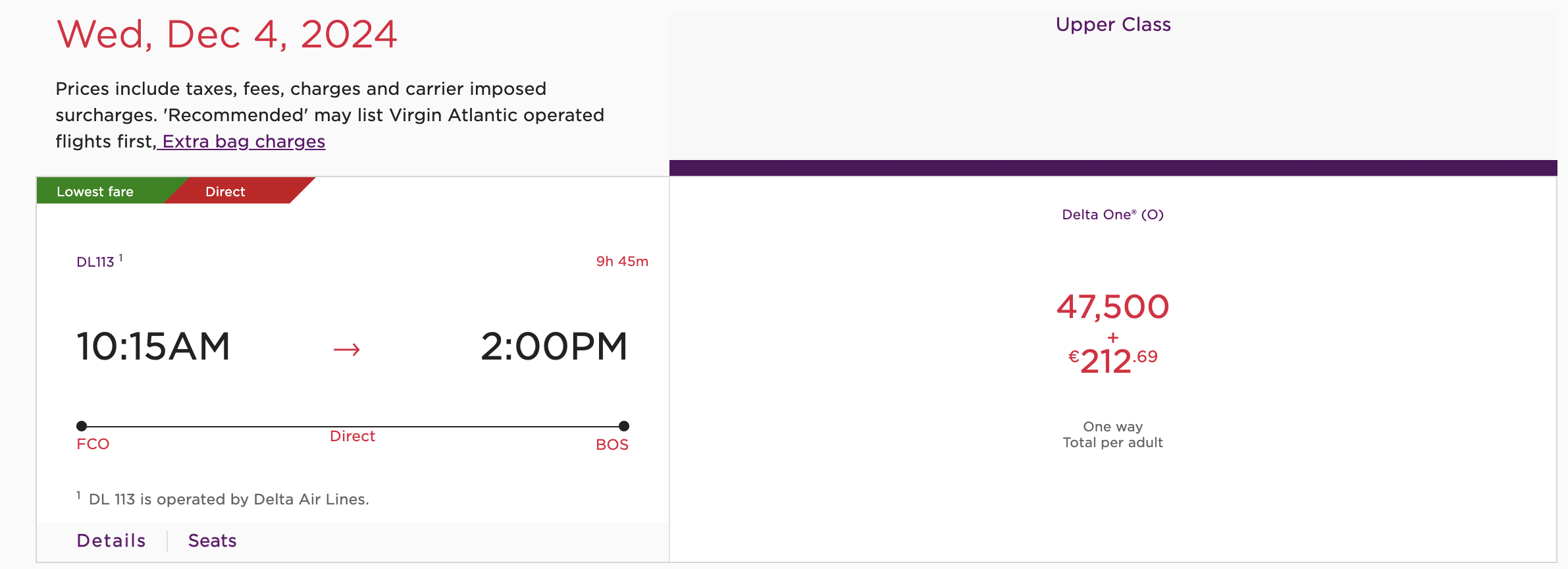

Want to fly business class on Delta? You’re way better off earning Amex points than Delta SkyMiles since the airline consistently charges 300,000 SkyMiles or more for a seat in it’s swanky Delta One cabin.

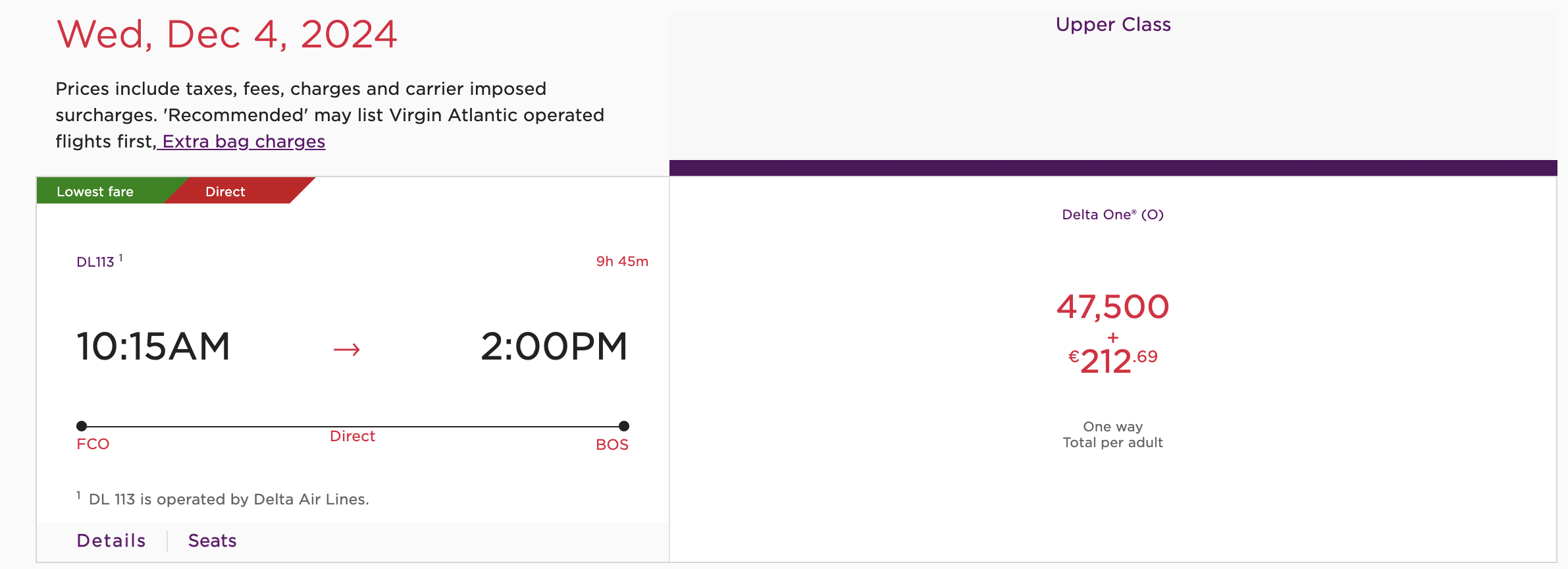

Despite Virgin gutting the holy grail (50,000-point Delta One awards) on many routes, you can still save points by booking through either Virgin Atlantic or Flying Blue. This Delta One flight from Rome (FCO) to Boston (BOS) bookable through Virgin comes in at just 47,500 points. You’ll just be on the hook for higher taxes and fees but that’s a small price to pay for the amount of points you’re saving.

The only catch is that finding flights bookable through Virgin (or Flying Blue) can be hit or miss, and many of the routes have increased the number of points required to book.

If you’re dead set on using SkyMiles to fly Delta One, or any premium cabin for that matter, your best bet is to snag these seats during a SkyMiles flash sale, upgrading from coach, using your credit card travel portal or using a different airline’s frequent flyer program.

Read more about the difference Between Amex Points and Delta SkyMiles

More Options for Redeeming Rewards

Earning all those Membership Reward points and pooling them together with your Delta SkyMiles is one thing, but the nice thing with Membership Rewards is that you can use them for non-Delta flights, too. Thankfully, the Amex Gold Card makes it simple to put your rewards to good use by earning flexible points.

With nearly two dozen Amex transfer partners at your disposal between airlines and hotel chains, the ability to transfer American Express points opens up a world of travel opportunities. But whether you’re a newbie to points and miles or an old hand, these transfers are a whole new can of worms, with confusing twists and considerations to keep in mind.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| AeroMexico | Airline | 1:1.6 | 3-5 days |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| ANA | Airline | 1:1 | 1-2 days |

| Avianca | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific | Airline | 1:1 | Instant |

| Delta | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Instant |

| Hawaiian | Airline | 1:1 | Instant |

| Iberia | Airline | 1:1 | Up to 24 hours |

| JetBlue | Airline | 1.25:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

Amex points give you the flexibility to find a far better way to use your points. Whether it’s booking a cheap flight to Europe for just 34,000 points roundtrip on Iberia or an ANA business class flight to Tokyo-Haneda (HND) for as low as 100,000 points roundtrip, you’ll have the option to move points to whichever program makes the most sense for your travels – and maybe even take advantage of a transfer bonus in the process. With Delta SkyMiles, none of that is possible.

Related reading: 10 Amazing Ways to Redeem Amex Membership Rewards Points

Money-Saving Travel Perks

The Amex Gold Card is great but it doesn’t come with much in the way of travel perks and benefits outside of access to transfer partners. Don’t worry though: This an area where the Delta Gold Card pulls its weight … and then some.

The Delta Gold Card is a great choice for casual Delta flyers looking to earn SkyMiles and take advantage of perks like free checked baggage (for you and up to eight other passengers booked through your SkyMiles account on the same itinerary) and priority boarding in the Main Cabin 1 group.

Considering bags cost at least $35 each way, those savings can add up fast … and you don’t even need to pay for your flight with your Delta Gold card to get free bags.

When you use your Delta Gold Card to pay for in-flight purchases like food & drinks, you’ll receive 20% off in the form of a statement credit. You can also earn a $200 credit toward any Delta purchase if you spend $10,000 on the card in a calendar year. And you’ll also get up to a $100 credit each year when you make a prepaid hotel or vacation rental booking on the Delta Stays platform.

Finally, the Delta SkyMiles Gold card will get you access to Delta’s TakeOff 15 benefit which will save you 15% when booking Delta flights with SkyMiles. Depending on how often you book flights using SkyMiles – or how many people you’re booking for – this can be a huge savings and an easy way to justify paying the card’s annual fee.

Where This Combo Falls Short

Just because the Amex Gold Card and Delta Gold Card work well for Delta Air Lines loyalists doesn’t mean it’ll be a perfect fit for every frequent flyer. There are certainly some downsides to this combo that we’ll get into below.

No Premium Travel Perks

Want premium travel perks like lounge access or statement credits to cover the cost of TSA PreCheck or Global Entry? You’re out of luck here. You won’t get access to the Delta SkyClubs or the Amex Centurion Lounges without holding the top-tier *amex platinum* or *delta reserve card*.

This means that if you’re looking for access to those lounges, you’ll need to cough up at least $650 in annual fees (see rates & fees) just to get your foot in the door. For the time being, the Delta Reserve Card will get you unlimited complimentary access to any Delta Sky Club (when flying Delta). But starting in February 2025, you’ll be limited to just 15 visits annually … unless you’re willing to spend $75,000 each year on your card.

Meanwhile, Amex’s flagship Membership Rewards-earning Platinum Card will get you into the bank’s Centurion Lounges when flying any airline, Delta Sky Clubs (when flying Delta), Priority Pass Lounges, Escape Lounges, and more.

Just like the Delta Reserve Card, the Amex Platinum’s Sky Club access will be changing next February. You’ll be limited to 10 visits each year with Amex Platinum. Unlimited Sky Club access and guest privileges at Amex Centurion Lounges can be restored with $75,000 or more in spending on your card each year.

Related reading: Which Amex Lounges Still Allow Free Guests?

No Elite Status Shortcuts

If you want to work towards earning status with Delta, this combination of cards won’t help you get ahead.

Since Delta made the switch to using Medallion Qualifying Dollars (MQDs) as the sole metric for earning elite status, they also gave some SkyMiles cardholders the ability to earn MQDs through spending and a new perk called MQD Headstart. But you won’t get that with either the Delta SkyMiles Gold or the Amex Gold.

If you opted for the *delta skymiles platinum card* instead, you’d earn 1 MQD for every $20 spent on the card and get 2,500 MQDs every year to start you on the path towards earning status. Meanwhile, the Delta Reserve Card earns 1 MQD for every $10 spent and gets the same 2,500 MQD headstart each year. Either of these cards would be a better choice for those on the hunt for elite status.

Read more: Did Delta Actually Make Earning Medallion Status … Easier?

Bottom Line

If you’re a Delta loyalist searching for the perfect two-card combination, look no further than the Amex Gold Card and Delta Gold Card. With these two cards in your wallet, you’ll get perks like free checked bags, priority boarding, discounted award tickets, and more – all while earning bonus points on your everyday spending.