Is an Annual Fee Hike on the Capital One Venture X Card Inevitable?

7 min readNearly three years ago, Capital One made a huge splash by launching its very first premium travel rewards credit card: *venture x* a card with an with an impressive list of benefits yet an annual fee of just $395 – much lower than alternatives from both American Express and Chase.

In a 2021 interview with Thrifty Traveler, Lauren Liss, Capital One’s managing vice president of U.S. cards at the time, said: “Right now, there is a gap in the market as (travelers) are looking for the right travel card. They don’t want to pay $600 for a card that has travel benefits. And they don’t want to have to take the time to continue to track a laundry list of benefits that they have to remember to register for.”

It was clear Liss was referring to both the *chase sapphire reserve* and *amex platinum*: cards with annual fees of $550 and $695 (see rates & fees), respectively. The Amex Platinum Card, in particular, is notorious for its laundry list of benefits that cardholders struggle to use in order to justify that big out-of-pocket cost.

In comparison, the Venture X Card is a breath of fresh air: It’s got many of the premium benefits that travelers prize at a far cheaper price point than similar competitors. And while $395 a year isn’t cheap, no other card makes it easier to come out ahead on that annual fee … with just two benefits.

The Venture X has tweaked a few perks and cut some others altogether, yet its overall value proposition remains unchanged nearly three years later … as does its annual fee. That’s a lifetime in the ever-changing world of travel credit cards, so it has us wondering…

Is the current $395 annual fee on the Venture X is sustainable? Can we expect an annual fee increase in the future?

Read our full review of the Capital One Venture X Card!

A History of Fee Hikes on Other Premium Cards

American Express first launched the Platinum Card in 1984 with an annual fee of just $250. At the time, it was an invitation-only card and the only premium card geared toward American travelers. It held its position as the lone option in the marketplace until 2016 when Chase launched the Sapphire Reserve.

By way of inflation and the addition of new benefits, that annual fee eventually jumped to $450, and then to $550 back in 2017. After another refresh with the addition of a handful of new benefits in 2021, that annual fee now sits at $695 each year. And Amex’s CEO Steve Squeri has repeatedly made clear that the annual fee on the Platinum Card would keep rising.

American Express’ strategy with the Platinum Card has largely been adding sponsored benefits from brands like Saks 5th Avenue, the New York Times, Disney, and others, which don’t cost the bank much but allow them to show perceived value on the card and keep hiking the annual fee.

Read more: We’ve Had It: Amex Statement Credits are Out of Control

Chase made its first foray into the premium travel card segment in 2016 with the launch of the Chase Sapphire Reserve, building on the success of their mass market travel card: the *chase sapphire preferred*. When the Reserve first launched, it did so with an annual fee of $450.

The card was so popular at launch that Chase ran out of the metal it was used to produce the physical cards. Chase later indicated that the launch of the Reserve cost the bank hundreds of millions of dollars.

Sure enough, just a few short years later, Chase added a few new benefits to the card and hiked the annual fee on the Sapphire Reserve up to $550, where it currently sits today.

Read our review of the Chase Sapphire Reserve®

There’s no question that when Capital One launched Venture X to compete in the premium travel card space. They wanted to be a disruptor. And the easiest way to do that was with a much lower annual fee and benefits that aren’t nearly as complicated to use as other cards on the market.

That’s easier said than done, but there’s no question Capital One has succeeded. The lower fee and easy-to-use benefits has made the Venture X Card incredibly popular – especially among occasional and even fairly frequent travelers who can’t stomach $500-plus in annual fees.

Is it sustainable at that price, though? That’s another question.

A Recent Pull Back of Venture X Benefits

To date, Capital One has been tight-lipped on the financial impact of launching the Venture X card. But based on recent activities, it’s clear that the bank is looking for ways to lower the costs associated with the card.

Cuts to the Priority Pass Select Membership

Capital One started off 2023 by dealing the card’s complimentary Priority Pass airport lounge membership a big blow.

At launch, the Priority Pass membership issued to Venture X cardholders provided access to both Priority Pass lounges and additional experiences like access to the growing list of Priority Pass restaurants. That was big: Long after American Express removed Priority Pass restaurant credits from its own flagship card, Venture X cardholders could continue getting $28 for a meal at select airport restaurants … or $56 with a registered guest.

However, on Jan. 1, 2023, Capital One removed access to Priority Pass restaurants for Venture X cardholders. Earlier this year, Chase also removed this benefit from the Sapphire Reserve.

Cuts to the Capital One Travel Portal & Tweaks to the $300 Travel Credit

More recently, Capital One rolled out some negative changes to the Capital One Travel Portal – a cornerstone for Capital One cardholders.

When the bank first rolled out its new travel booking portal, it offered some novel benefits meant to entice travelers to book their travel through the bank rather than book directly, like Price Drop Protection and a Price Match Guarantee. If you found a cheaper price after booking, you could submit a claim for a refund back to your card. In the case of price drop protection, those cash refunds happened automatically.

But last year, Capital One quietly updated the terms and conditions to note that the Price Drop protection benefit will now issue a travel credit of up to $50 when prices on select flights drop after booking – not money back to your card as was previously the case.

Worse yet, that change also affected the bank’s “Price Match Guarantee” – a way for cardholders to force Capital One to match a lower price on Google Flights … or even bigger savings via a third-party online travel agency. That’s important because, among the few recurring complaints about Capital One and its flagship card, the Capital One travel portal clearly has a pricing problem.

Travelers routinely find lower prices for flights (and especially hotels) through other platforms than through Capital One’s booking platform. But instead of getting a refund back to your card, you’ll now also get that price match back in the form of a travel credit.

With higher prices that force you to keep booking through Capital One, that negates some of the value of one of the card’s most-important benefits: The $300 annual travel credit. And Capital One has done more on that front, too.

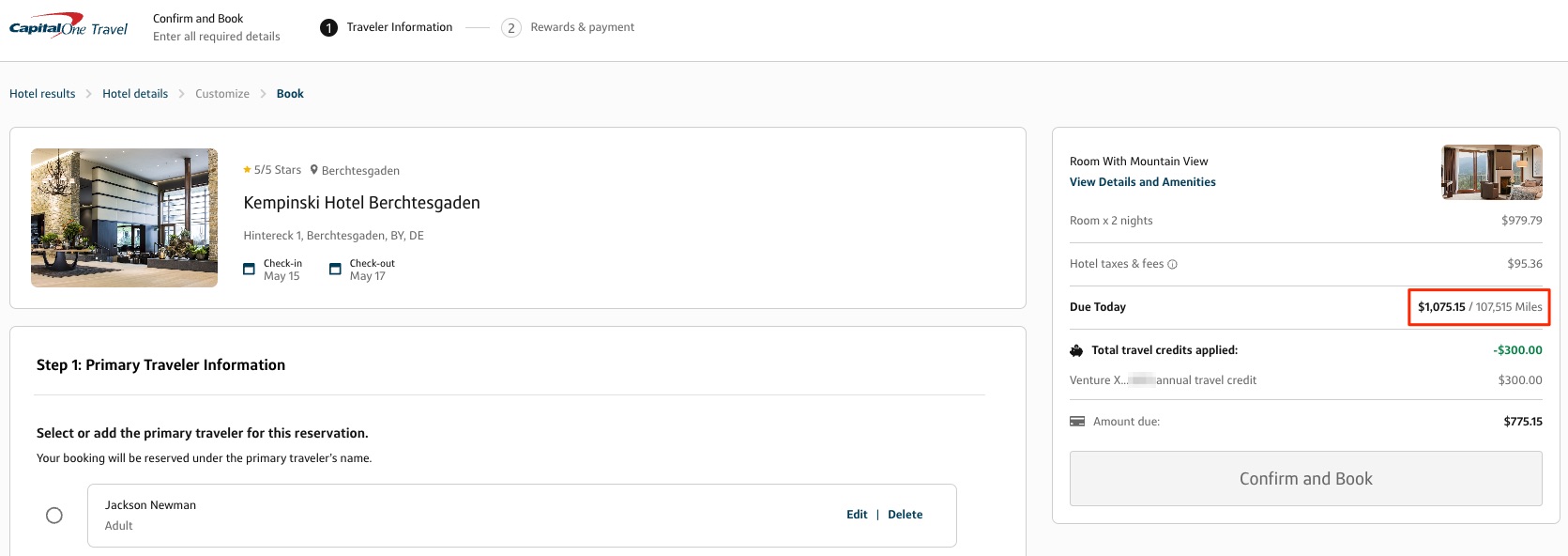

At launch, that travel credit was as straightforward as can be. Just book a flight, hotel, or rental car through the travel portal and Capital One would apply a statement credit to your account a few days later. You’d even earn 5x miles for flights – or 10x miles for hotels or rental cars – on the purchase.

Not anymore. Just over a year ago, Capital One tweaked the credit to make it function like a coupon instead: You now apply it at the time you book for a $300 discount, meaning you no longer earn bonus miles when using your travel credit. That $300 in spending also doesn’t count toward the minimum spending requirement for new cardholders to earn the 75,000-mile welcome bonus after spending $4,000 in three months, either.

To be clear, none of those are earth-shattering changes. But it does show that Capital One is consistently looking for ways to lower the costs of the Venture X without removing primary benefits.

And that means one thing: Long term, the Capital One Venture X Card might be too lucrative.

What’s Next for the Venture X?

So what does this mean? Are more Venture X benefits on the chopping block? Is a Venture X annual fee hike inevitable?

We don’t have any answers for sure just yet. But as we approach the three-year anniversary of the Venture X Card, we wouldn’t be surprised to see some major changes in the not-too-distant future.

Look at it this way: The Venture X is currently $155 cheaper each year than its next closest competitor, the Chase Sapphire Reserve. Stacked against the Amex Platinum Card, it’s a whopping $300 cheaper a year.

That means Capital One has substantial room to raise the annual fee while still maintaining its powerful claim as the cheapest premium travel card on the market. That might be easier than removing some of the card’s flagship benefits.

We hope we’re wrong .. but the writing seems to be on the wall.

Bottom Line

The $395 annual fee on the Capital One Venture X Rewards Card seems criminally low when you look at everything it provides and the annual fees of its primary competitors.

With additional annual fee hikes to other premium travel cards seemingly likely, will Capital One eventually hike the annual fee on Venture X? We can’t say for sure. But if you’re interested in the card, this may be as cheap as it gets.

Learn more about the *venture x*.