60K Points are Not Worth $600: How to Get More From Your Points & Miles

11 min readFew things are better than getting a free (or nearly free) flight. After all, that’s the main reason many travelers – myself included – open a travel rewards credit card and start earning points and miles, right?

With the 60,000-point bonus I earned when I opened my first travel rewards credit card, the *chase sapphire preferred*, I covered just over $600 worth in roundtrip flights to both Miami and North Carolina to visit friends – trips that I otherwise wouldn’t have taken. That easy approach is how many travelers view their points: 60,000 points are always worth $600 in travel, right?

Sure … but with a bit of extra work, you can do so much more. For instance, I’ve learned how to take less than 30,000 Chase points and use them to book roundtrip flights to Europe … that typically cost over $1,000.

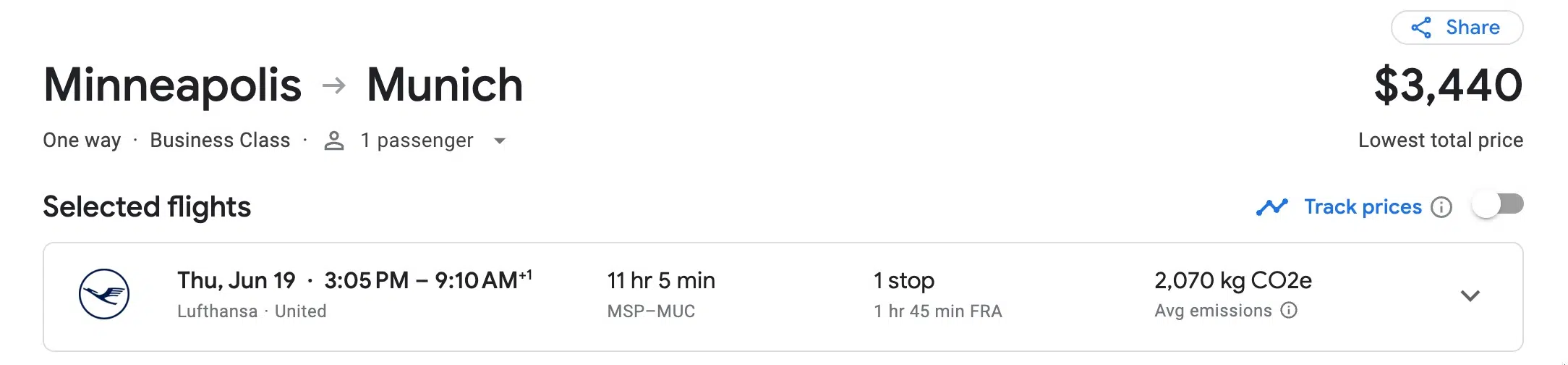

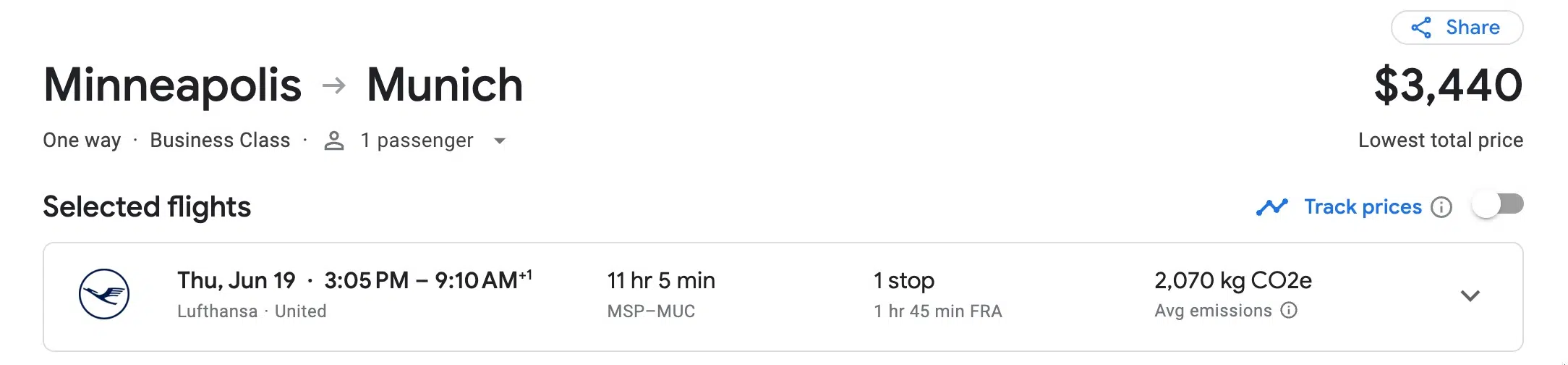

Just this past summer, I used just 70,000 points to book a $3,000-plus Lufthansa business class flight from Munich (MUC) back to Minneapolis-St. Paul (MSP) – enjoying a multi-course meal, a lie-flat bed, and bottomless drinks on the way home from catching Taylor Swift in Europe.

How can you get so much more value from my points? Instead of redeeming my credit card points directly through Chase (or Capital One, American Express, Citi, etc.), I transferred them to one of Chase’s airline partners, turning my points into airline miles I could use to book flights for fewer points. It takes more work and time, but that extra effort is worth it.

If you’re ready to take the next step and get more out of your hard-earned points, let me show you how.

Book for Less by Transferring Points to an Airline Partner

Whether you’re earning points with Amex, Capital One, Chase, Citi or another rewards program, most travelers default to using those points through their bank’s dedicated travel portal – or, with Capital One, simply covering travel purchases with miles afterward. It’s the most straightforward way to put your points to use.

This is where the the idea that 60,000 points are worth $600 comes from: Going this route, your points are (almost) always worth 1 cent each toward flights, hotels, rental cars, and other travel expenses. The more expensive the flight, the more points you’ll need to book it.

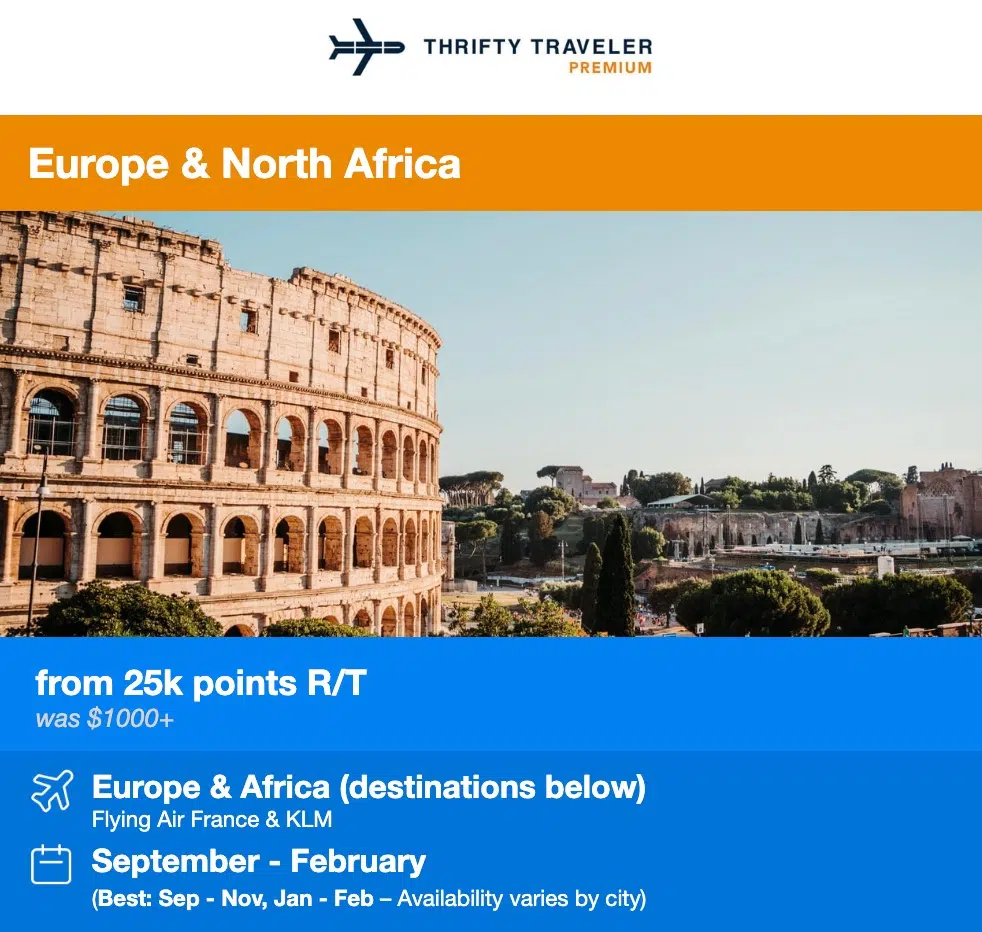

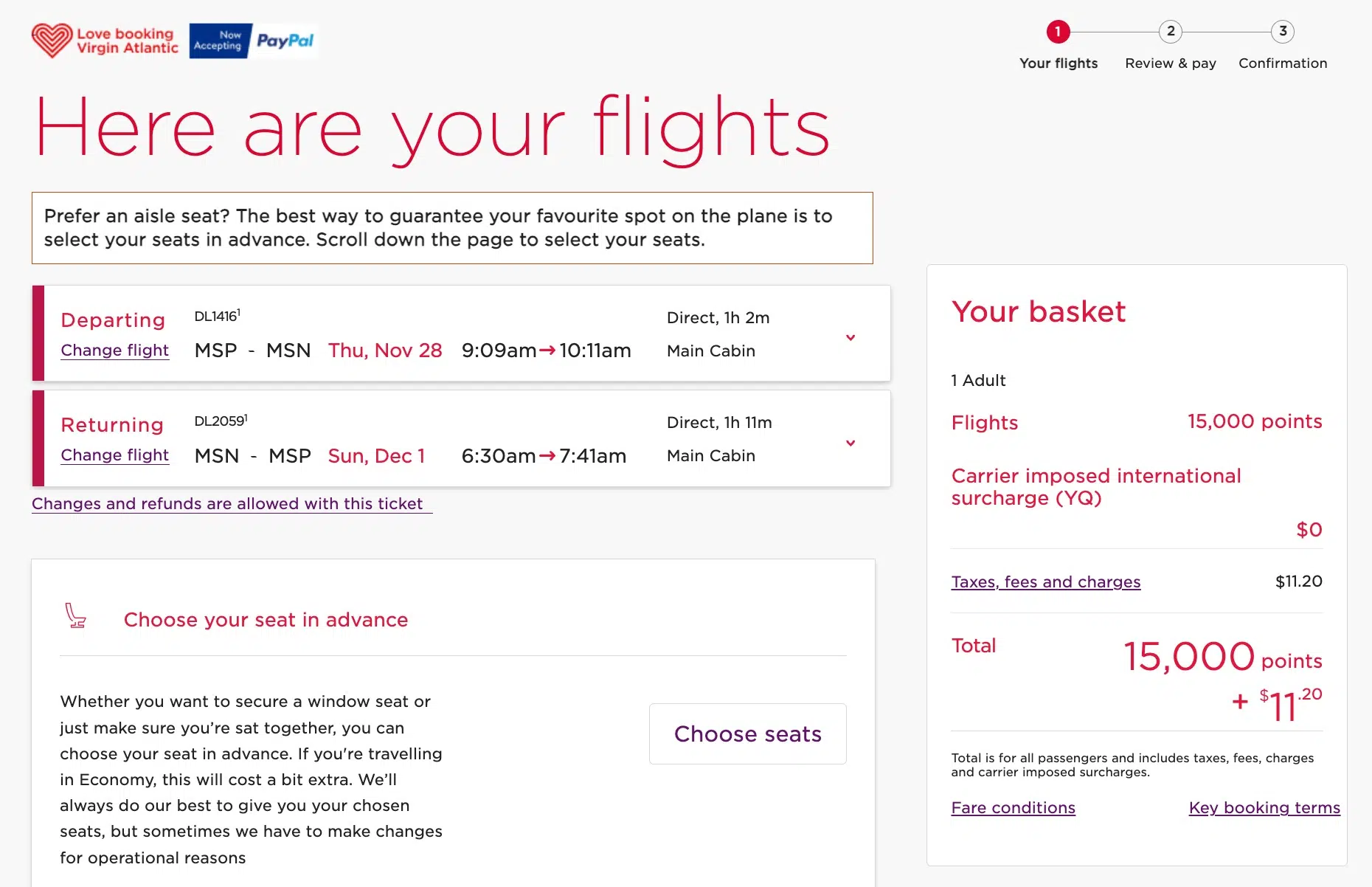

Suddenly, those 60,000 points won’t get you very far. Even these short flights from Minneapolis-St. Paul (MSP) to Madison (MSN) would cost you nearly 31,000 points.

With the *chase sapphire preferred*, your points go a bit further: Each point is 1.25 cents apiece when booking through the Chase Travel℠ portal. That means this same flight would cost 24,720 points.

But there’s a much better way. This is where your list of credit card partners can shine.

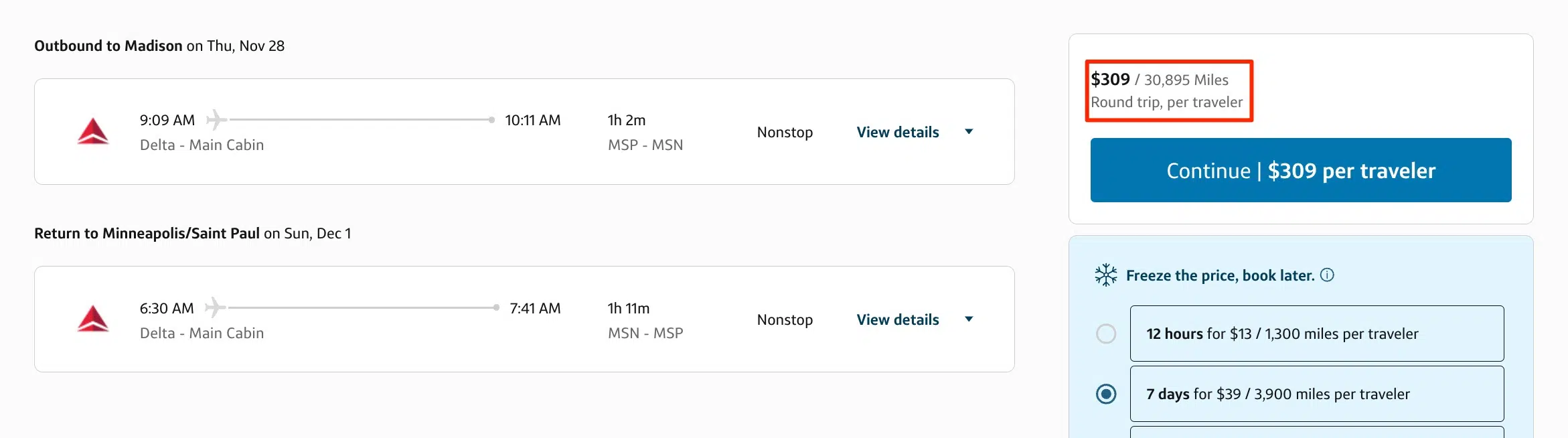

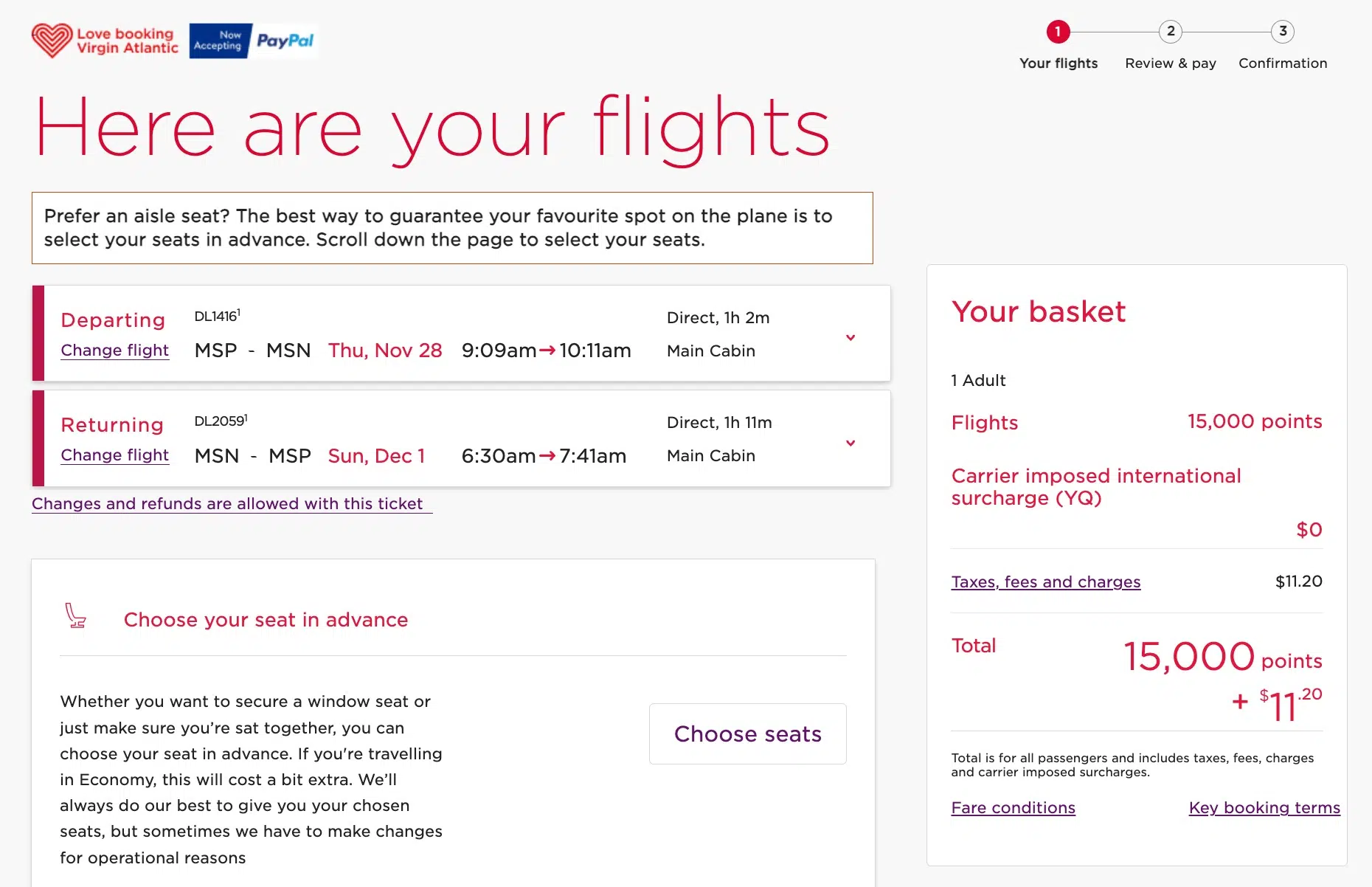

With Chase cards, for example, you can send your points to more than a dozen different Chase transfer partners … including Virgin Atlantic Flying Club, a Delta partner. Using Virgin Atlantic, you can book those exact same short-yet-pricey Delta flights to Madison and back for just 15,000 points roundtrip.

By doing some extra research and transferring 60,000 Capital One miles (or points from Amex, Chase, Citi, or Bilt – they all partner with Virgin) instead, I could fly myself and three fellow University of Wisconsin alums to Madison and back – on a Badger football game day weekend, no less. Considering four tickets would have cost a total of $1,236, you can easily see just how much more valuable your points can be.

Read more: Save Big on Short Delta Flights: Book with Virgin Atlantic Instead!

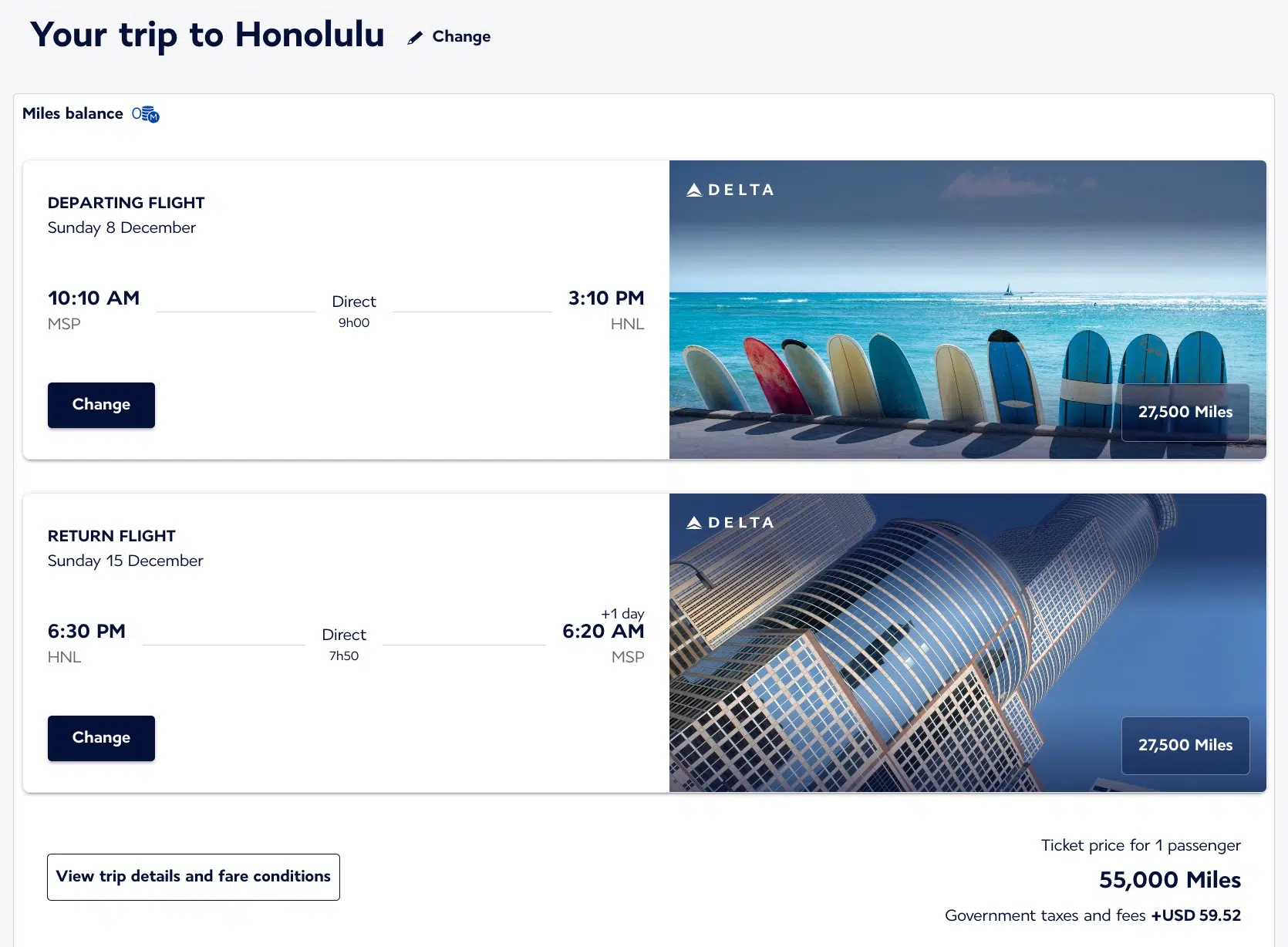

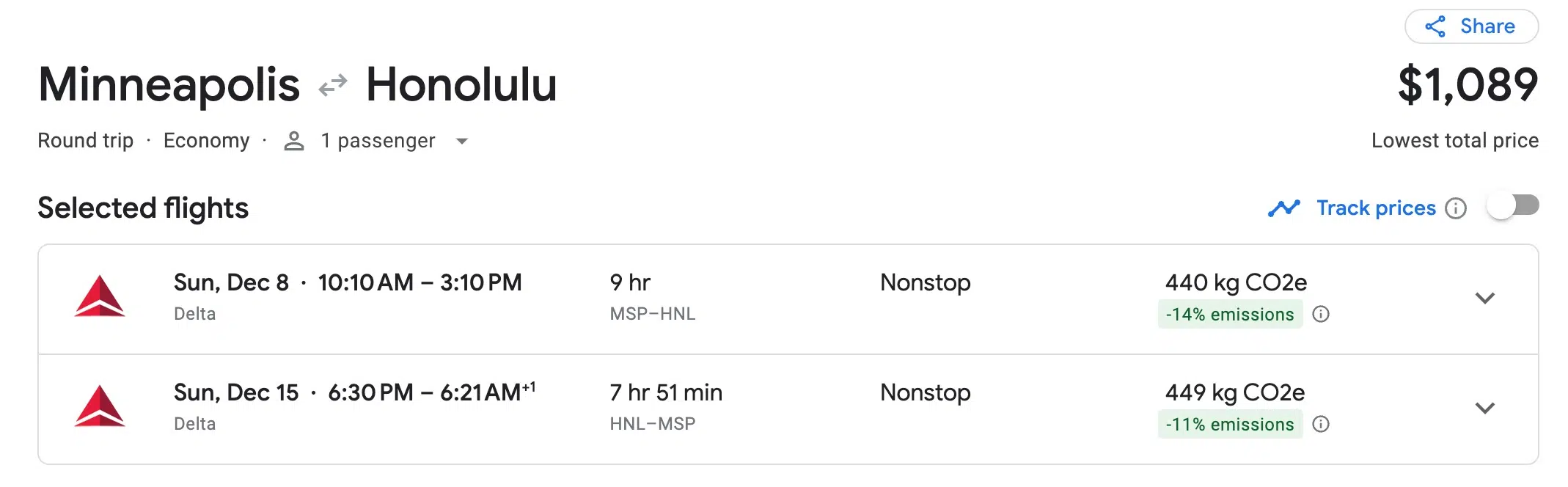

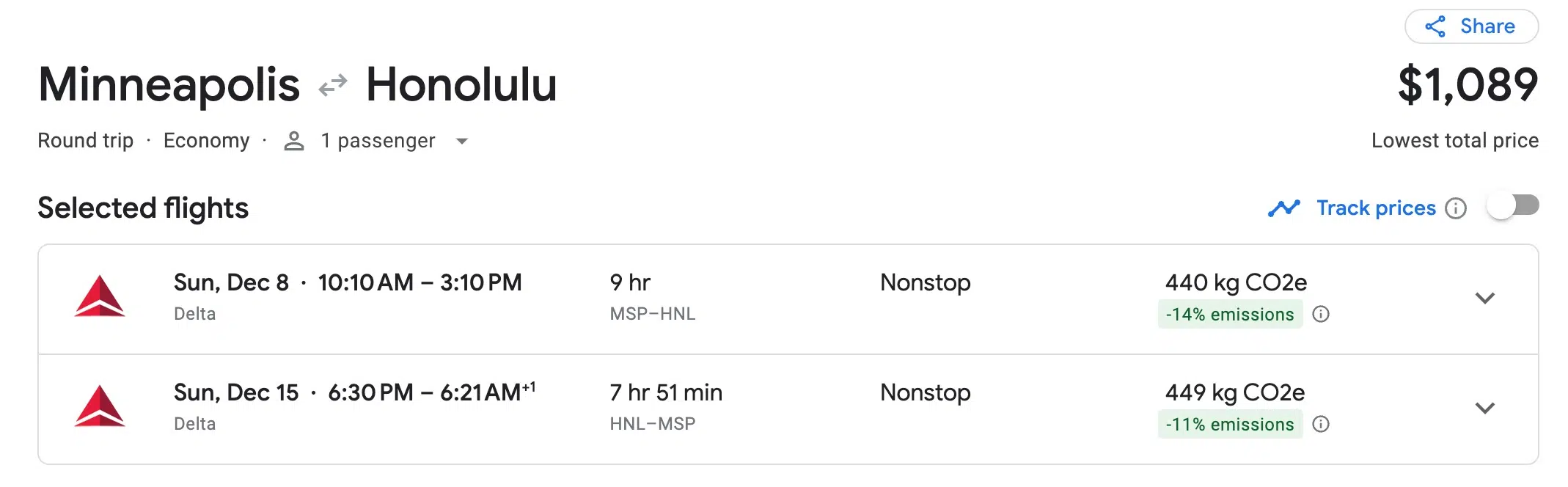

Here’s an even better example: Just 55,000 points can get you all the way to the Hawaiian Islands and back on Delta.

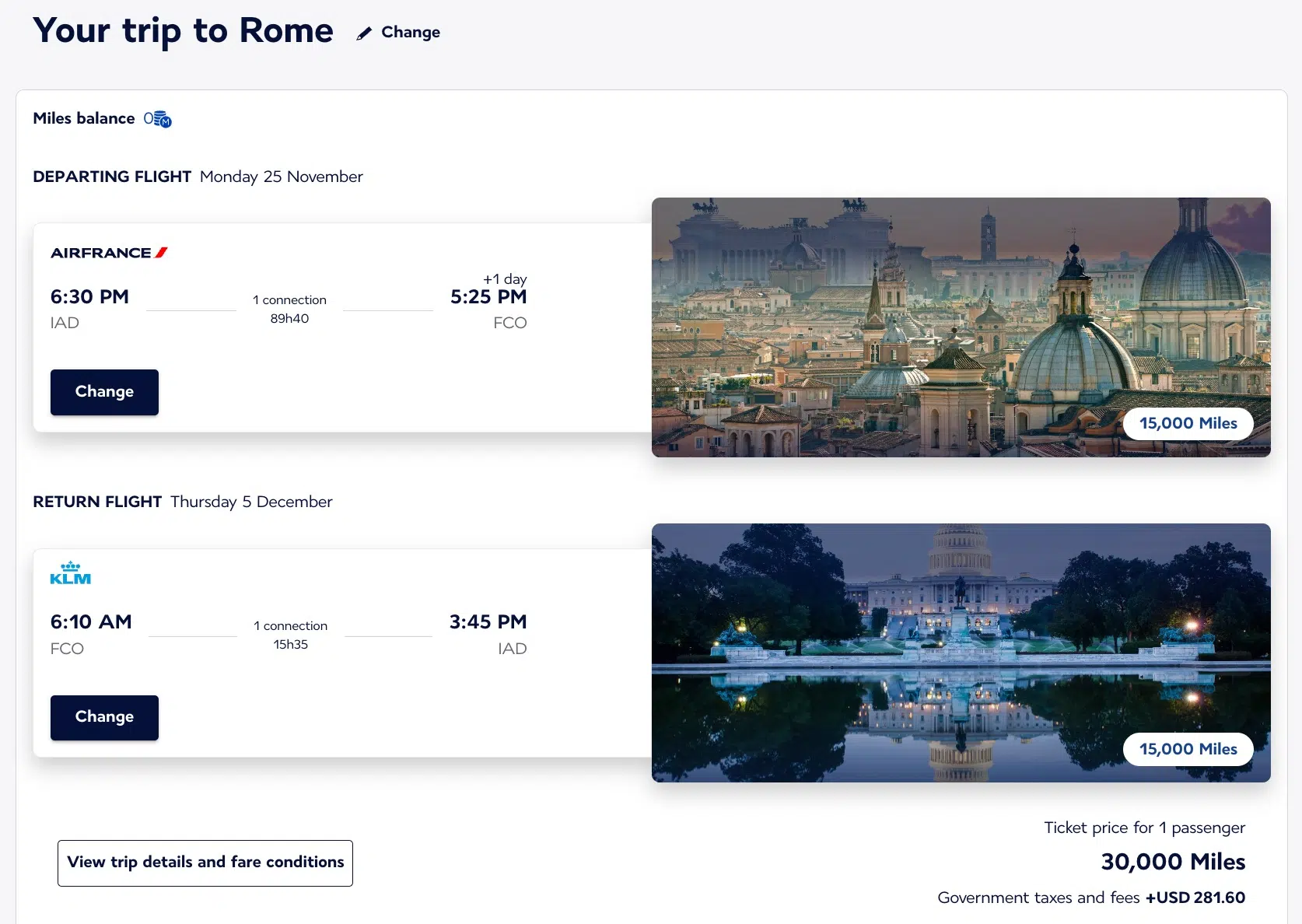

The key is to transfer your credit card points to Air France/KLM Flying Blue. Like Virgin Atlantic, the European carriers are also partner with Delta, meaning you can book Delta flights using Flying Blue miles – and often at far lower rates than what Delta itself would charge you.

Even after factoring in the $60 in taxes and fees you’ll pay through Flying Blue, that’s still an incredible deal. Get this: These flights would normally cost you nearly $1,100 each!

Think Big (Or Book Business Class)

Longer flights abroad can be expensive, especially during peak travel times. That’s where the value of credit card points (and airline transfer partners) really shines.

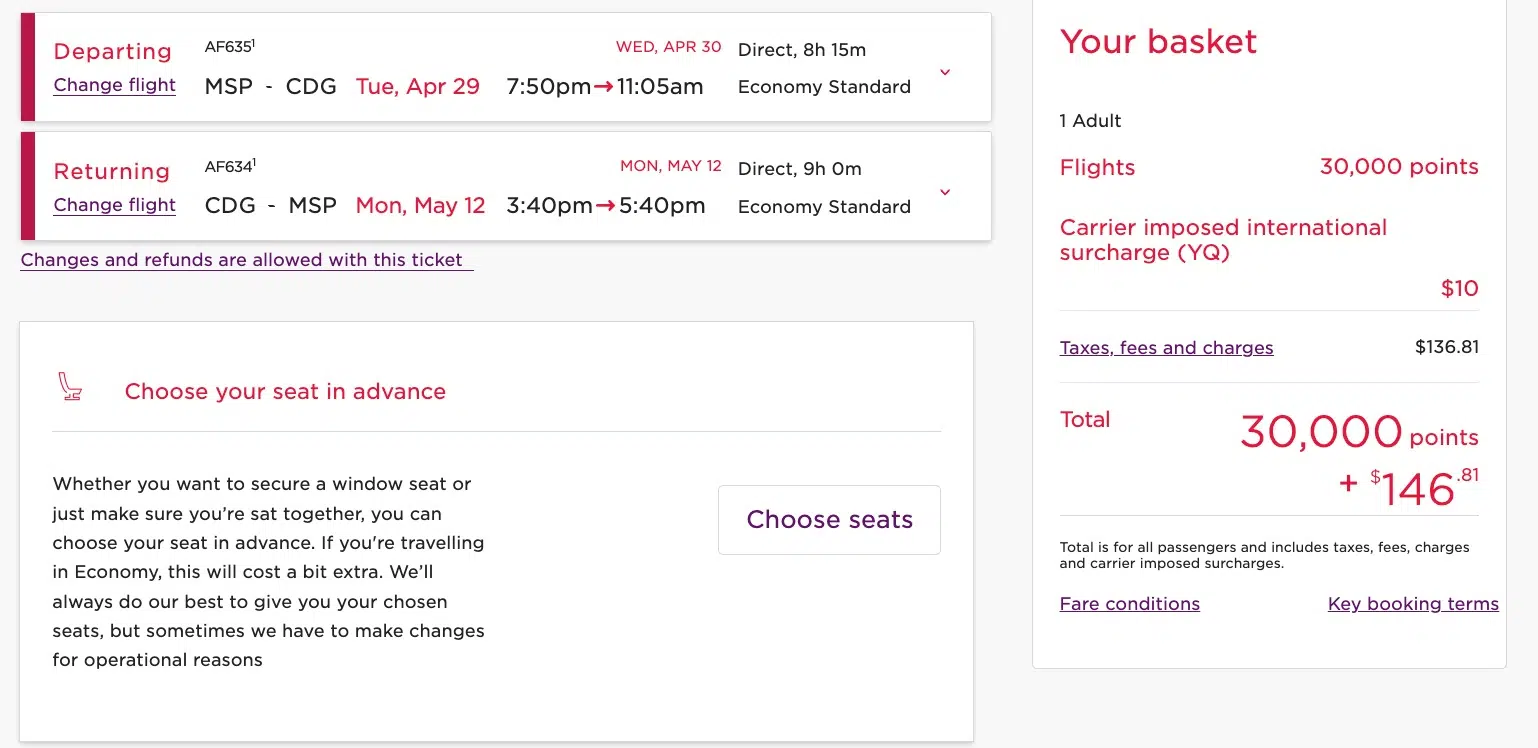

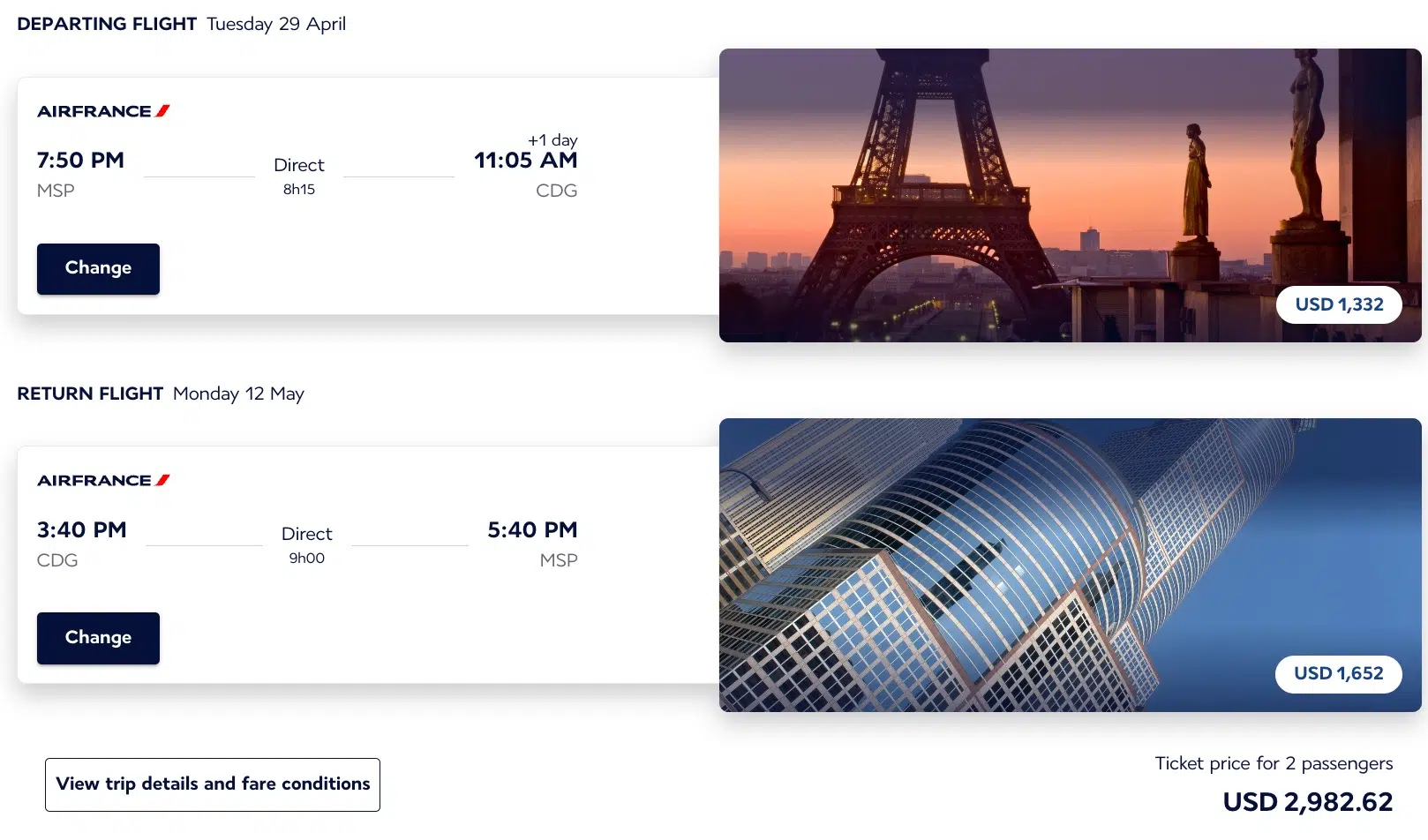

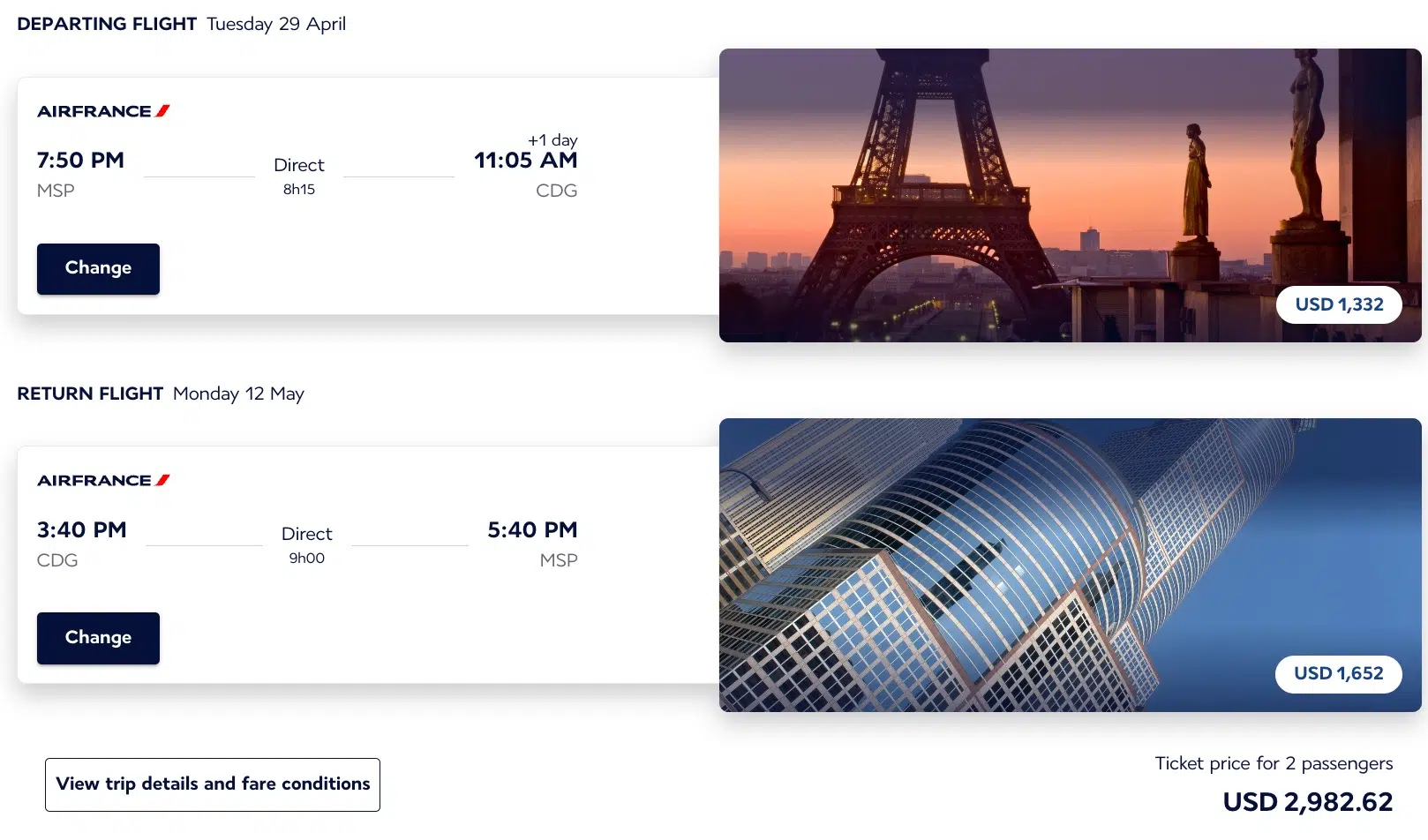

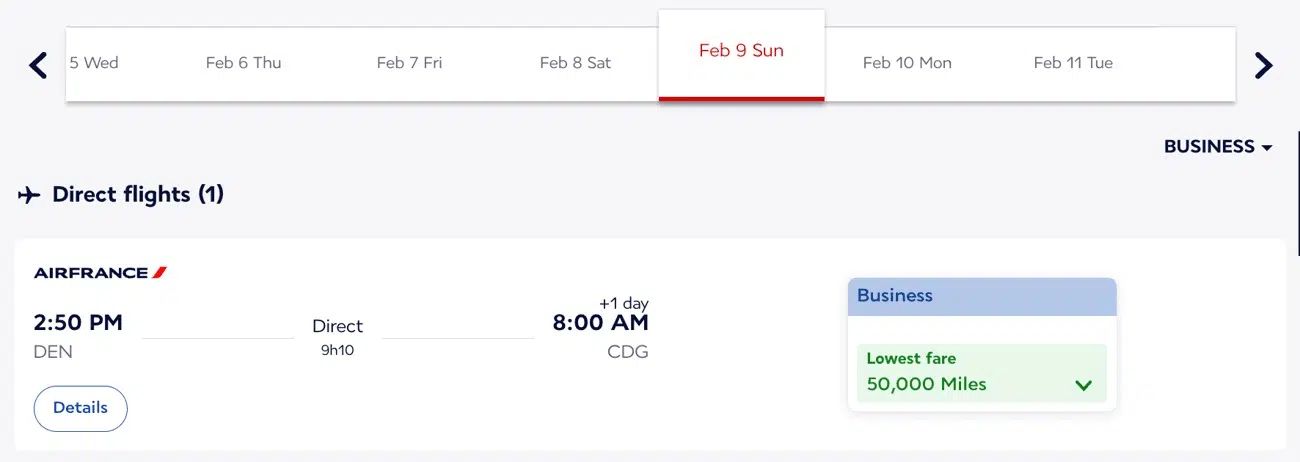

Flights to Europe can be found for as low as 30,000 points roundtrip booking through Virgin Atlantic.

So with 60,000 points, you could book two roundtrip fights to Paris-Charles de Gaulle (CDG) and back that are worth nearly $3,000.

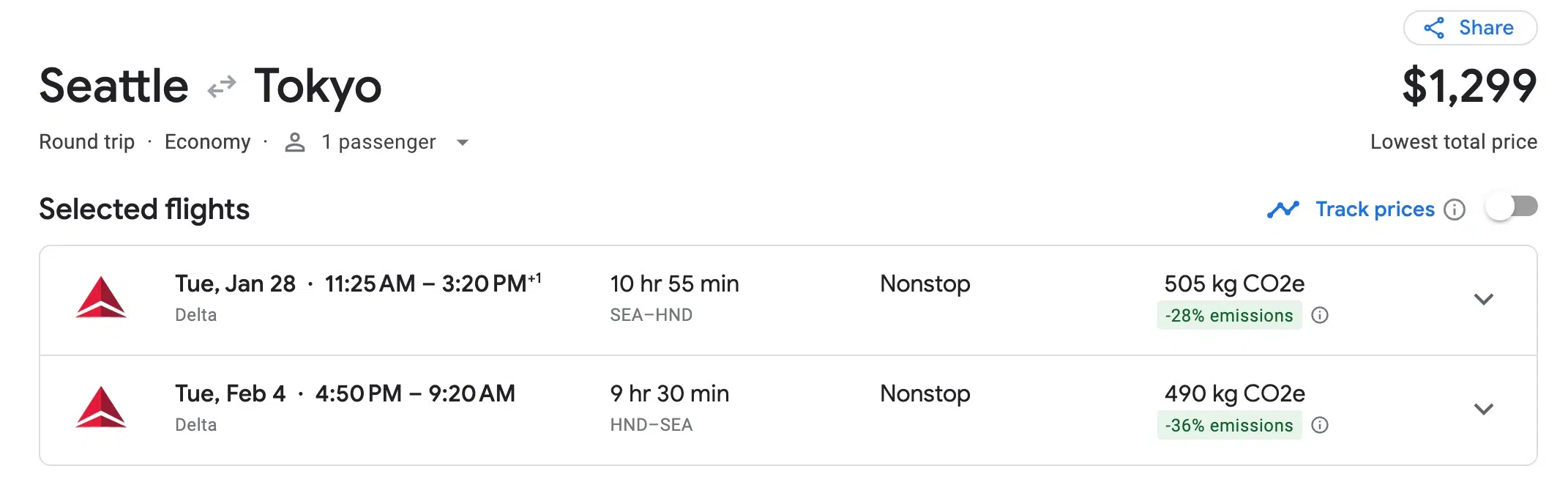

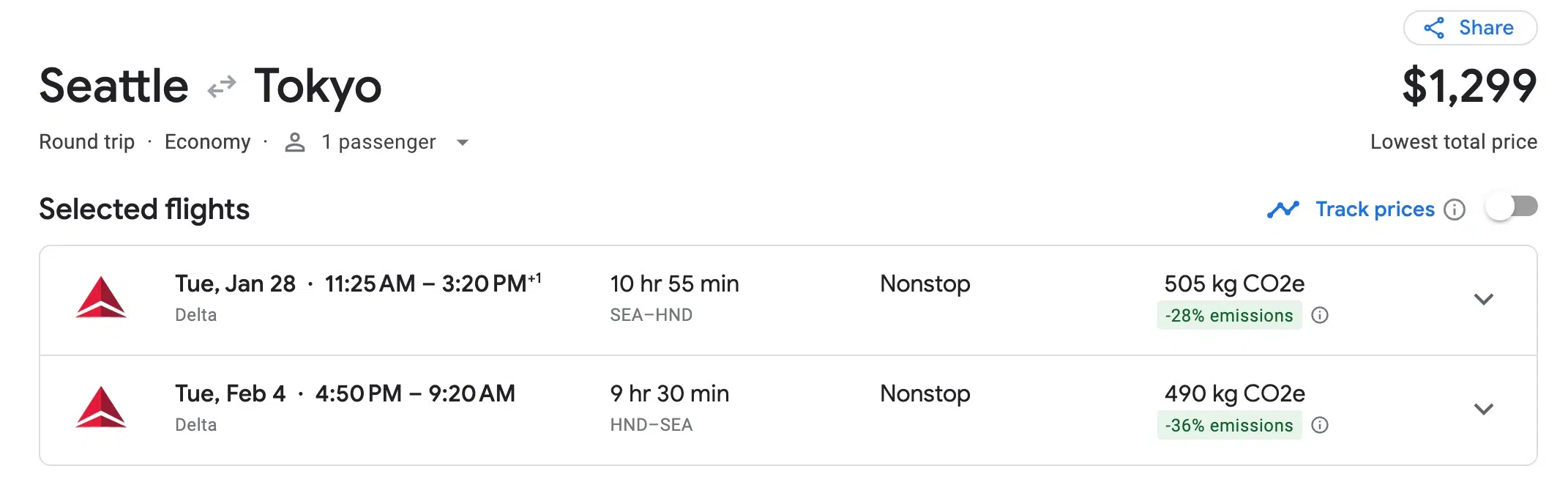

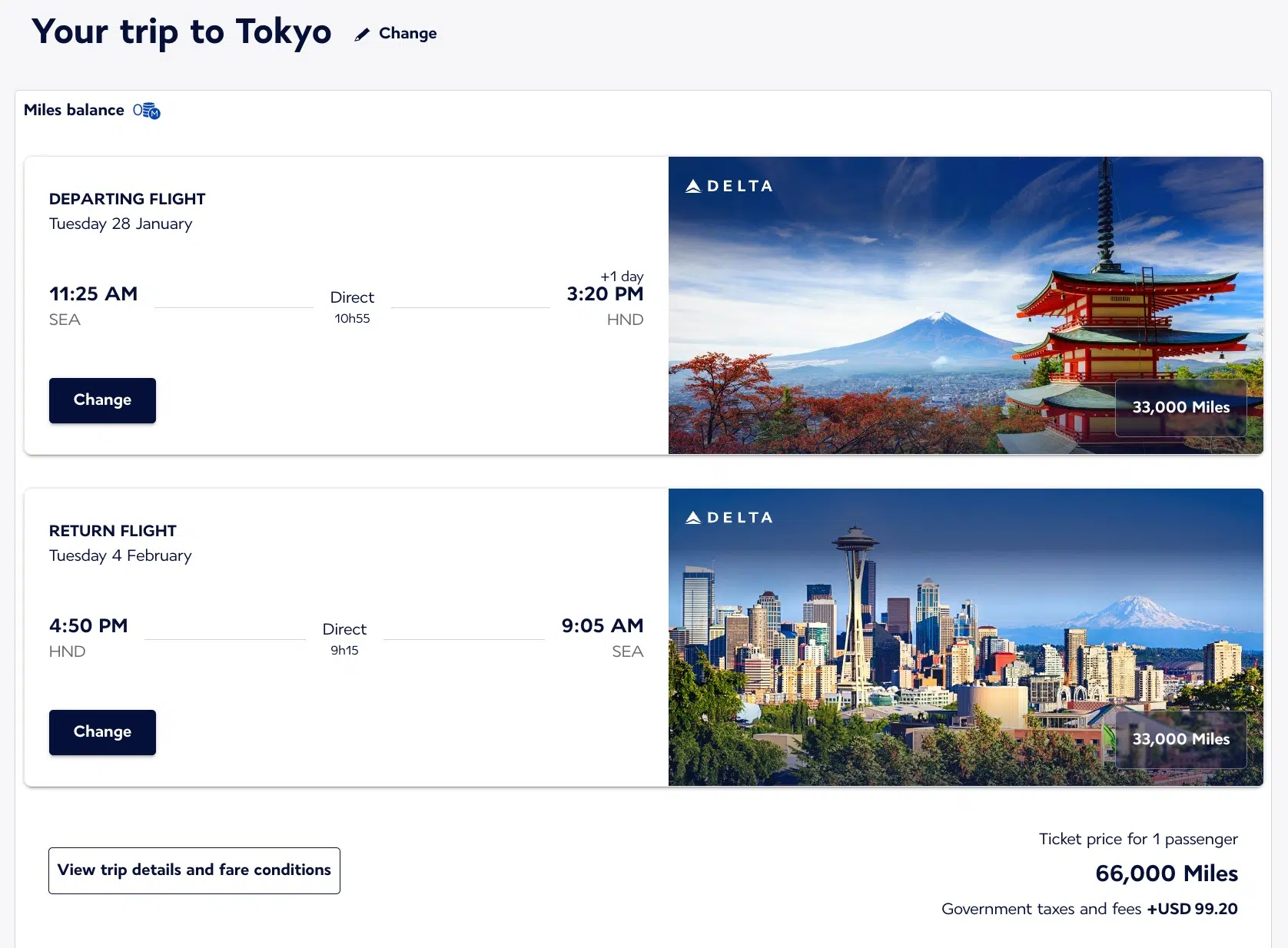

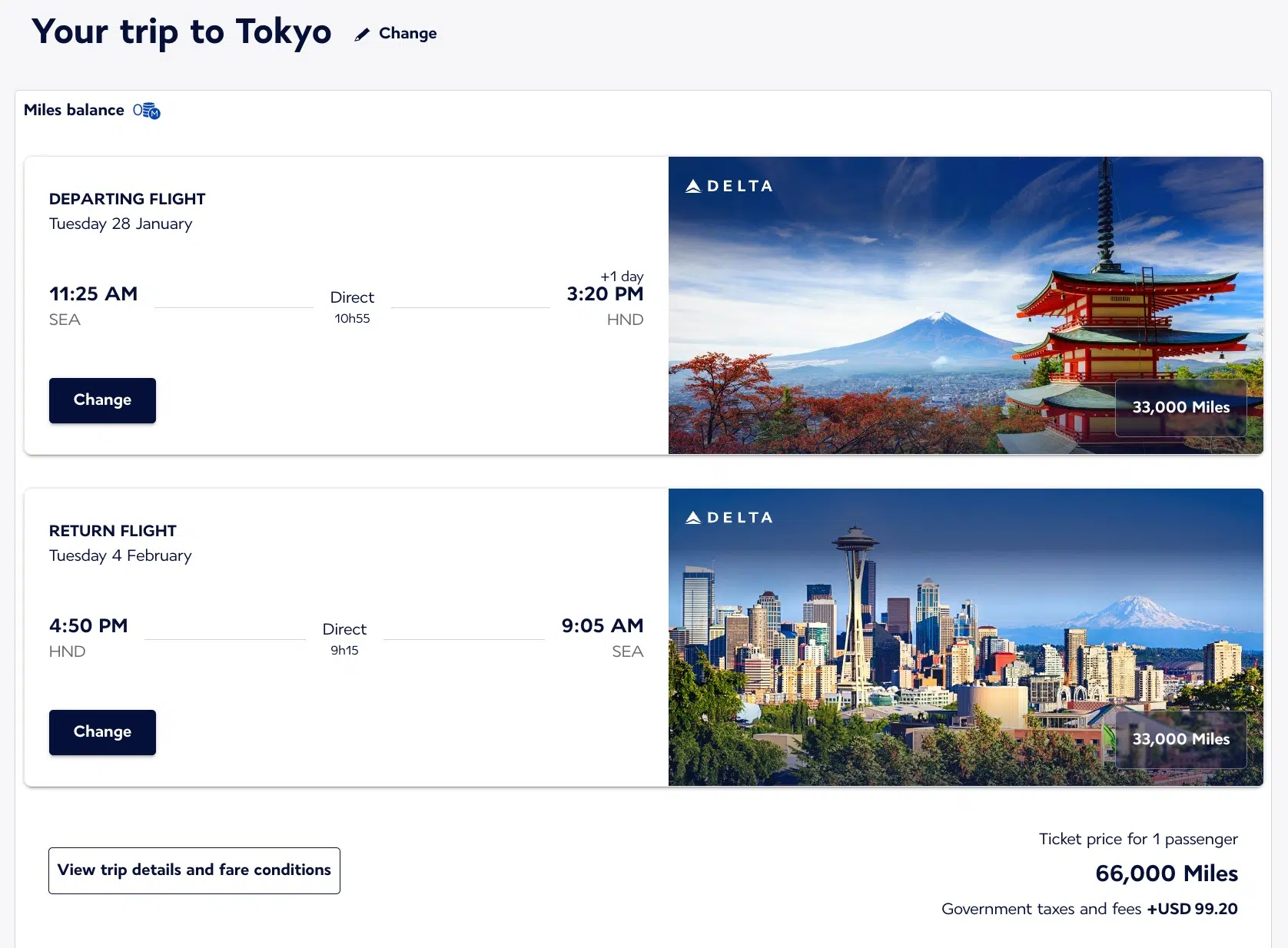

What about flying the opposite way across the globe, all the way across the Pacific Ocean? Your points and miles can get you there and back, too. Recently, my friends were dead-set on flying Delta nonstop to Japan … until they saw it would cost them $1,300 per person to get there.

Lucky for them, they had a decent stash of Capital One miles to play around with.

Going the traditional route, they could have booked these flights for about 130,000 Venture miles by booking the flight on their Capital One card, then going back to cover the purchase with miles. But using that same workaround to book Delta flights we highlighted earlier, they could transfer those miles to Flying Blue instead and get those exact flights for just 66,000 miles each.

While I’ve always been an economy kind of girl, points and miles have made it possible to fly at the front of the plane for the first time in my life. I’m still shocked at how few of them I needed to do so.

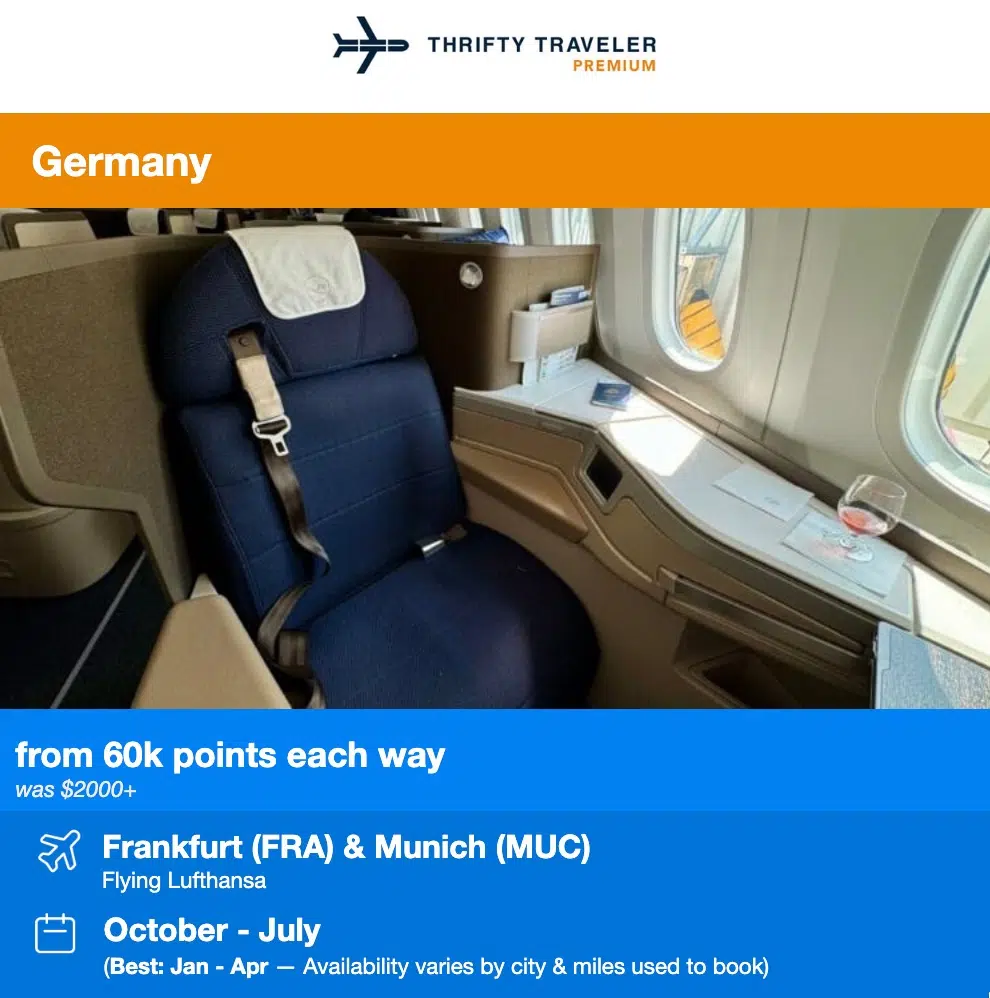

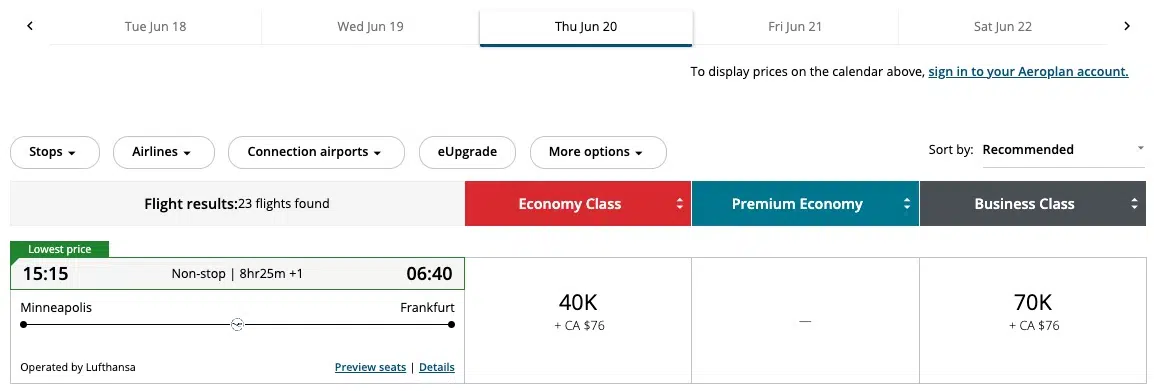

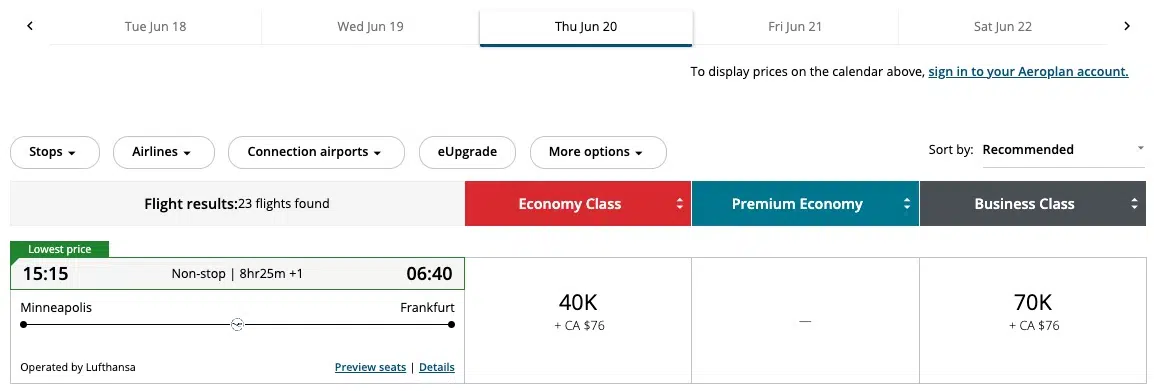

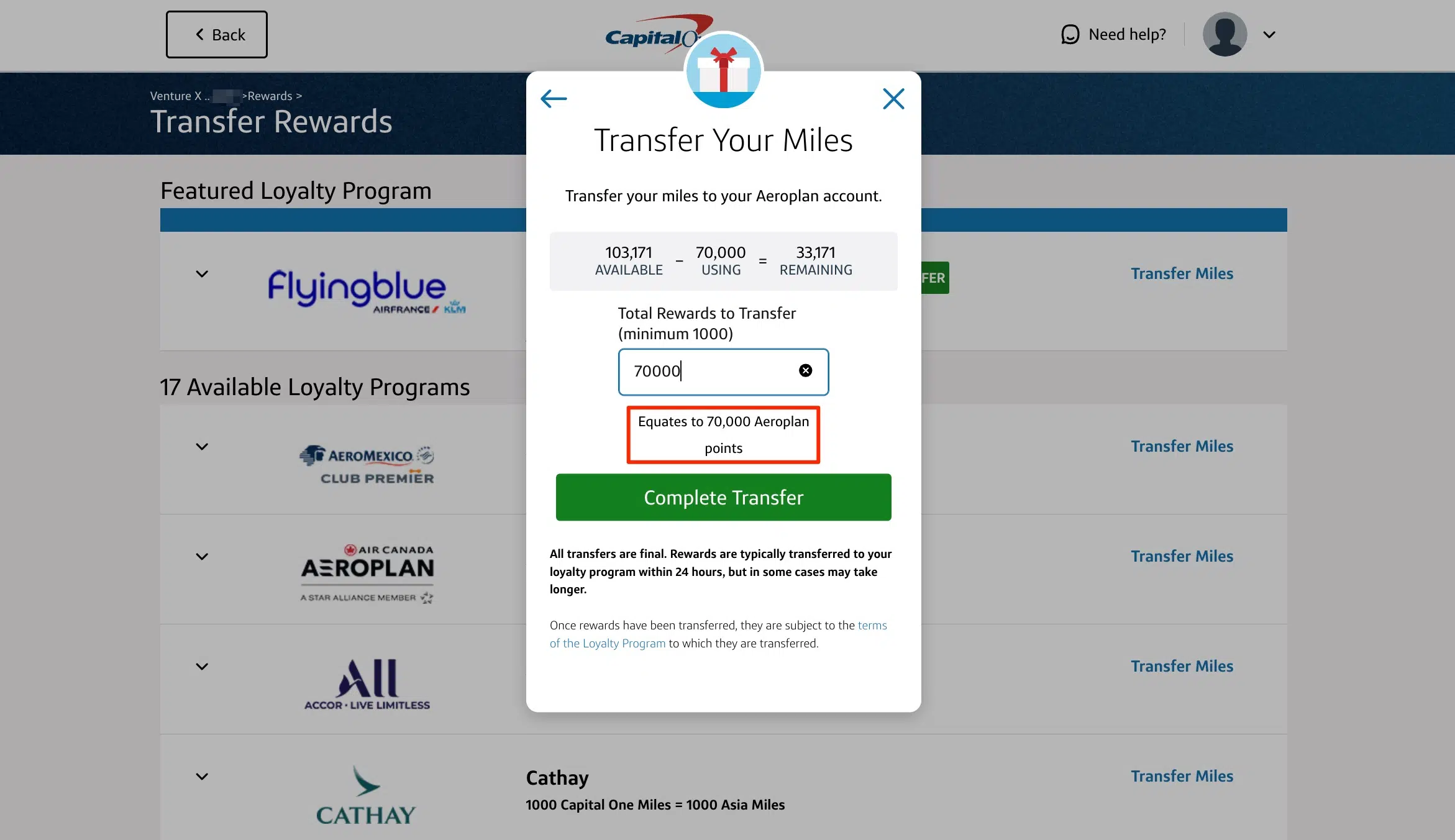

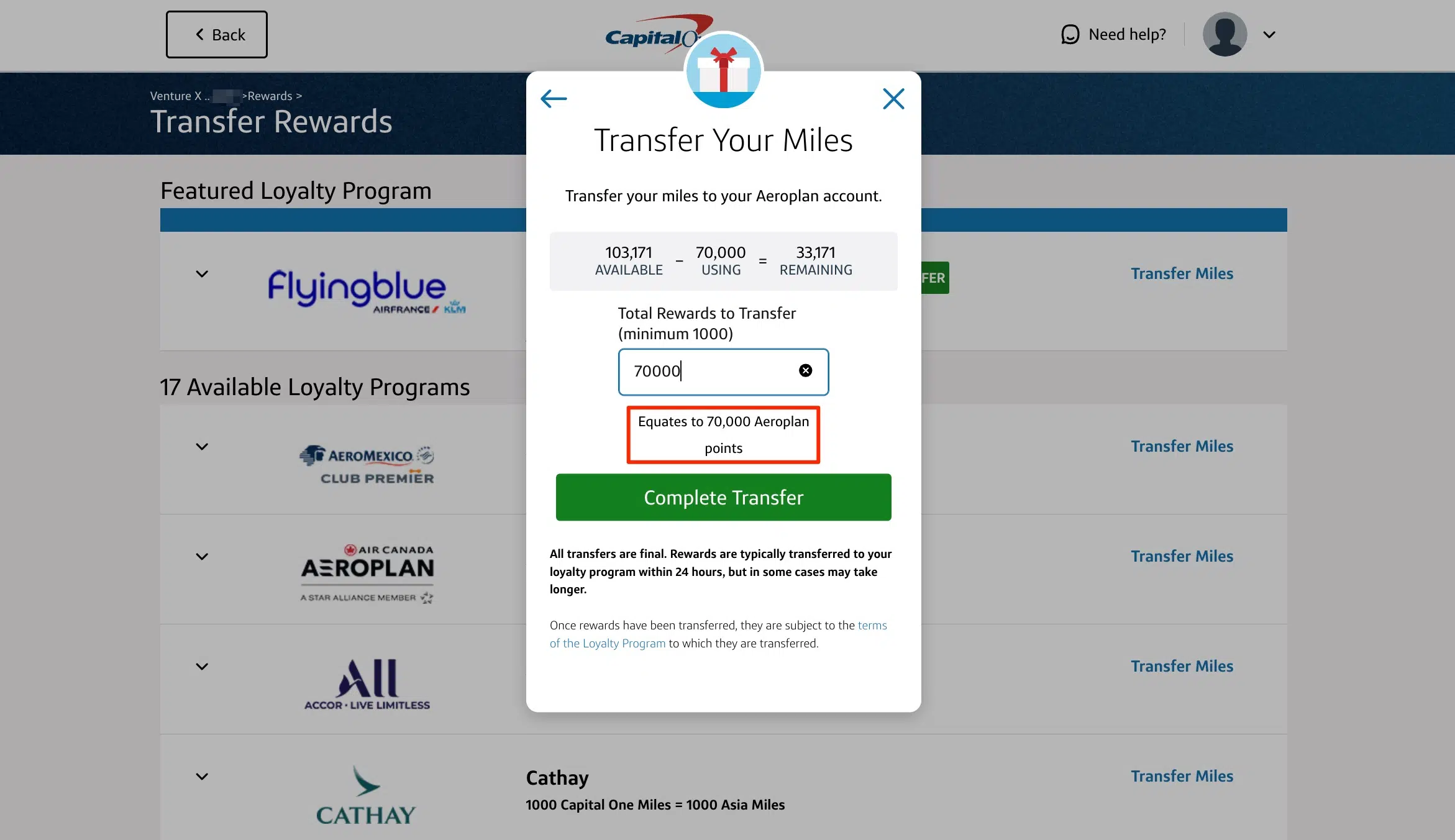

I flew this lie-flat Lufthansa business class seat to Europe this summer using points earned on my *venture x*. Booking through Air Canada, these Lufthansa business class flights cost just 60,000 points each way from the East Coast or 70,000 points from my home airport of Minneapolis-St. Paul (MSP) in the Midwest.

It may seem odd to use miles from a Canadian Airline to book flights to Europe on a German carrier, but bear with me.

Air Canada Aeroplan is one of the best airline mileage programs, period – you can use these points to book flights on dozens of airlines all around the globe. And since Air Canada is a transfer partner with Capital One, I could turn the points I earned with my card into the Air Canada Aeroplan points I needed to buy these flights.

Booking this way, those 70,000 miles are getting me just just a bit over $700 in value…

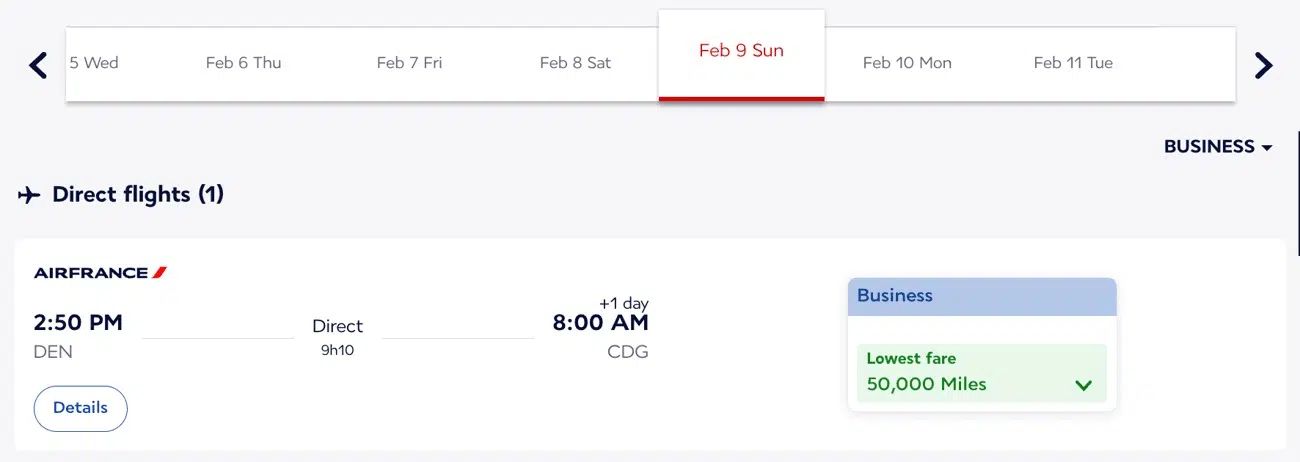

This isn’t a cherry-picked example either. We’ve got a whole roundup of business class flights you can book just 50,000 points or less!

Of course, all of this comes with a big caveat that it takes work to actually find and book these award flights: the flights you can book with points and miles. Unlike booking through your bank’s travel portal – where you can redeem points for virtually any flight you may find – you may have to search through months and months of flights on an airline’s site to find one that’s actually bookable with points – and for the lowest rates.

Read next: Finding Award Space: The Key to Locking Down Availability with Points & Miles

There’s also the taxes and fees to consider.

While you might be booking a business class flight for just 60,000 points, you’ll still have to fork over about $56 each way for that Lufthansa business class example above. The final taxes and fees you’ll pay can vary wildly – from just $5.60 to nearly $1,000 or more – based upon which airline you’re flying, whose miles you’re using, where you’re departing from, and where you’re flying.

How to Earn Points (& Which Points to Earn)

If you’re just earning miles with one particular airline, like Delta SkyMiles or American Airlines AAdvantage miles, you’re stuck paying whatever the airline charges for a given flight. Your eggs are all in one basket.

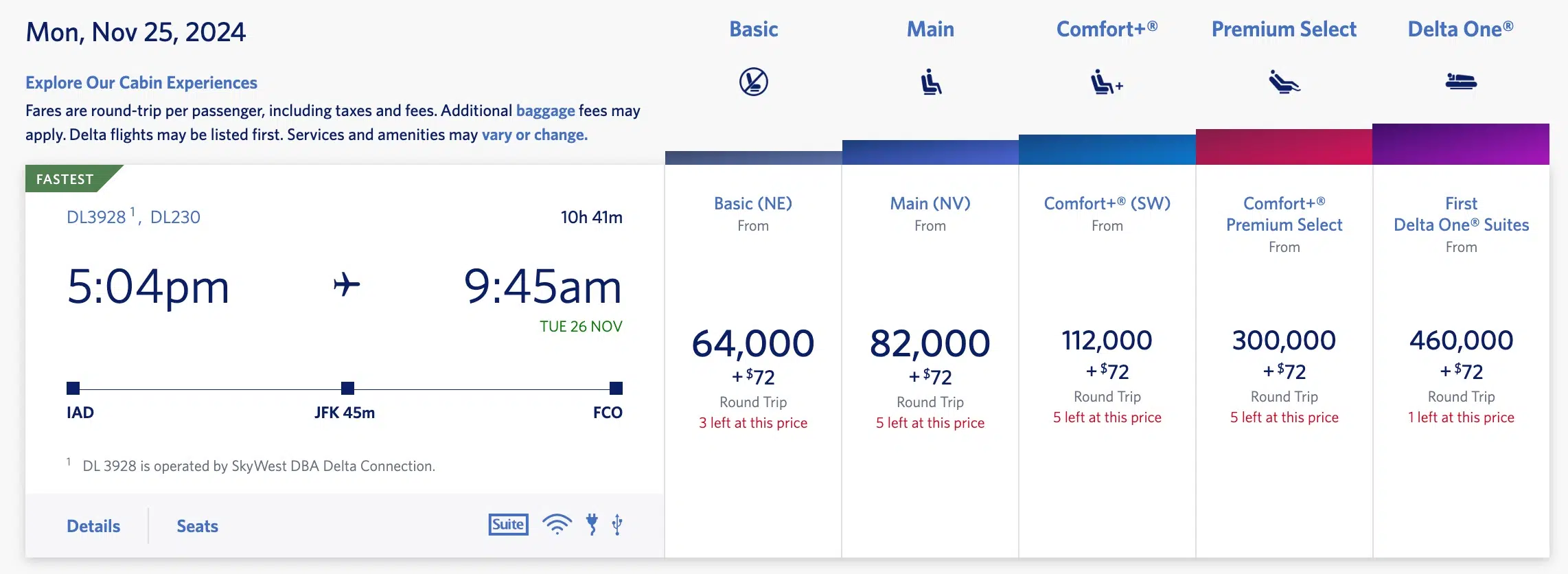

So if Delta is charging a boatload of SkyMiles to fly from Washington, D.C.-Dulles (IAD) to Rome (FCO) this fall, you have no other option. You can’t transfer SkyMiles to Air France/KLM’s Flying Blue program to book flights for 30,000 points instead.

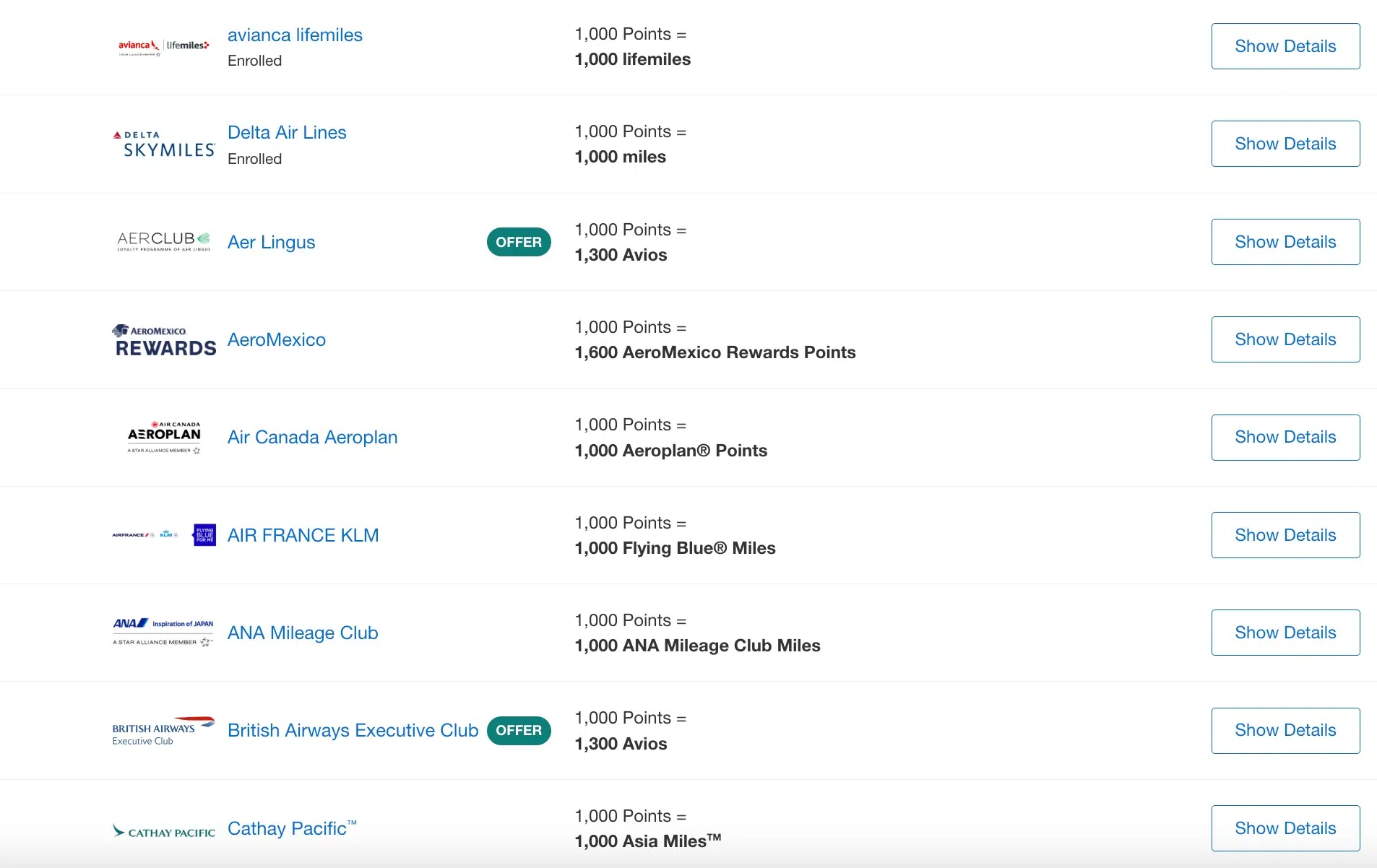

That’s why flexible credit card points are so powerful. Earning credit card points like American Express Membership Rewards, Capital One miles, Chase Ultimate Rewards, and others gives you the option to move those points to a variety of different airline programs to get the best deal possible. Regular transfer bonuses of 20% to 50% or more can make the savings even better.

So how do you actually earn those points? Opening a new travel rewards credit card and earning a big welcome bonus is the easiest way to get a big stash of flexible and transferable points.

The *chase sapphire preferred* and the *capital one venture card* card are two of the best travel cards for beginners, each with a manageable $95 annual fee. With the Chase Sapphire Preferred, you can earn 60,000 Ultimate Rewards points when you spend $4,000 on purchases within the first three months of opening the card. Right now, the Capital One Venture card is out with a welcome offer that lets you earn 75,000 Capital One miles when you spend $4,000 within the first three months of card membership.

If you’re willing to pay a higher fee in exchange for a few more travel perks, the *amex gold* and *venture x* are two of our favorite travel cards on the market right now.

Once you’ve earned a big welcome bonus (or already spent it), there are plenty of ways to keep piling up points.

- Shift your certain spending to the card that will earn bonus points in that area. If you have the Amex Gold card, for example, you’ll earn 4x points anytime you swipe the card at restaurants or when buying groceries.

- Utilize shopping portals. Most banks have an online shopping portal where you can earn additional points and miles for almost any purchase you make. If you’re doing any online shopping, remember to click through one of these portals instead of going straight through the store’s website – or download the browser extension, if there is one.

- Get a referral bonus. If you have friends or family who are thinking of opening the same travel card, have them apply through your referral link. You’ll get between 10,000 and 25,000 points (depending on the bank) for each successful referral, all without spending a dime on your card!

Read more: No Bonus, No Problem: How to Keep Earning Points Without a Welcome Offer

Focus on The Best Airline Mileage Programs

There are dozens of credit card transfer partners … and hundreds of airlines. How on earth are you supposed to keep track of the airline programs that matter most?

Head your credit card rewards account – or scroll through our master guide – and it’s easy to get overwhelmed by the number of transfer partners. I’m a travel editor and I’d never heard of (and still have never flown) some of these airlines.

Don’t stress. If you’re just dipping your toes in the waters of transfer partners, the truth is that there are just a few airlines truly worth focusing on. Here are some of our favorites.

Air France/KLM Flying Blue

If it wasn’t obvious already, Air France and KLM’s joint loyalty program, Flying Blue, is one of our favorite mileage programs. And it’s not just us who are fans: the award travel tool point.me recently declared it the top airline airline mileage program on the planet.

Flying Blue charges fewer miles than many (if not most) airlines for countless routes. You’ll get hit with some slightly higher cash fees when redeeming miles and you might encounter some quirks when booking award tickets online. But that’s worth it for those lower award rates and the ease of finding award availability to actually book with your miles – especially for business class flights abroad.

It doesn’t get much better than flying Air France business class or KLM business class to Europe for just 50,000 miles each way … from anywhere in the U.S.!

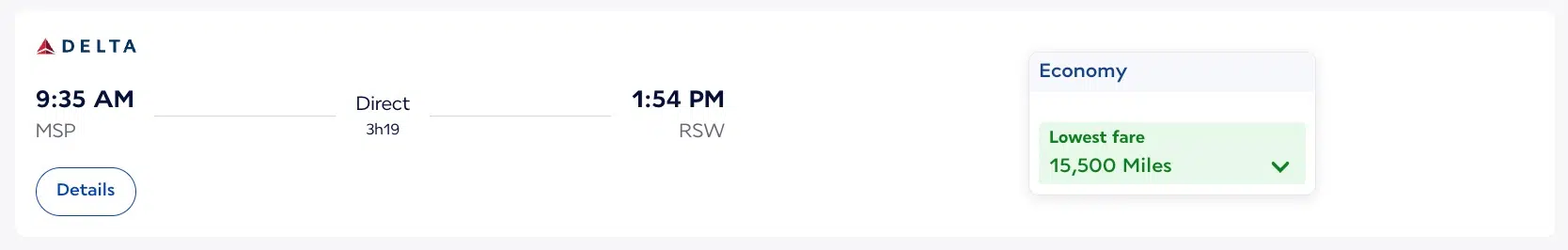

It’s now one of the best workarounds to book Delta flights, too, whether you’re flying within the U.S. or heading overseas. For example, you can book this Delta flight from Minneapolis-St. Paul (MSP) all the way to Fort Myers, Florida (RSW) in economy for as few as 15,000 miles each way – or 30,000 miles roundtrip.

See more of the best ways to use Flying Blue miles!

What’s more, Flying Blue is a transfer partner of all the major banks. So long as you’re earning any of these points, you’ll have an easy way to get Flying Blue miles with:

Read more: How to Find & Book Award Tickets with Flying Blue Miles

Air Canada Aeroplan

Aeroplan is the loyalty program of Canada’s flag carrier Air Canada … but it’s also one of the best airline loyalty programs, period – even if you never set foot on an Air Canada plane.

With straightforward (and low) award pricing and an easy-to-use site, Air Canada points can be incredibly valuable. But its biggest advantage is just how many airlines you can book using Aeroplan points: Not just fellow Star Alliance carriers like United, Lufthansa, and Turkish, but other awesome partners like Emirates and Etihad.

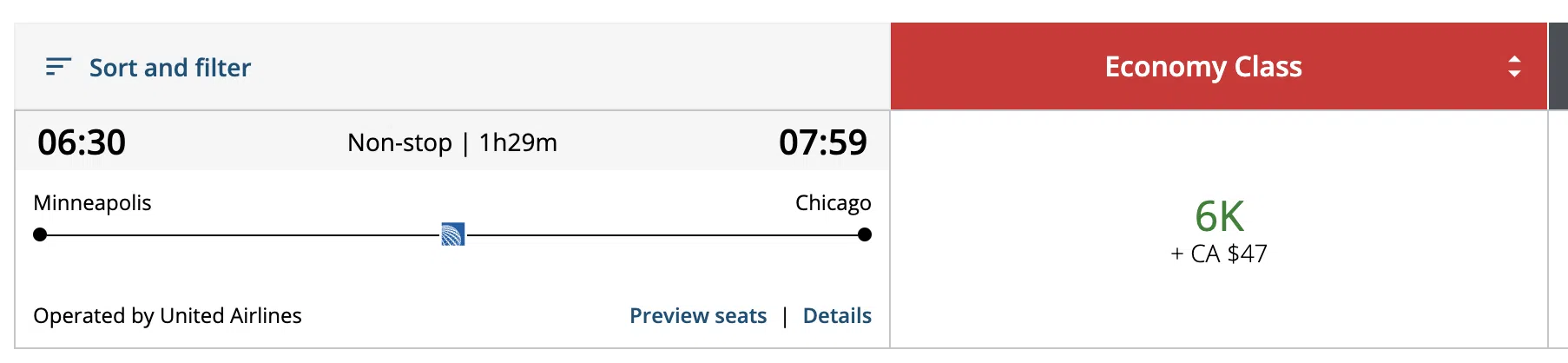

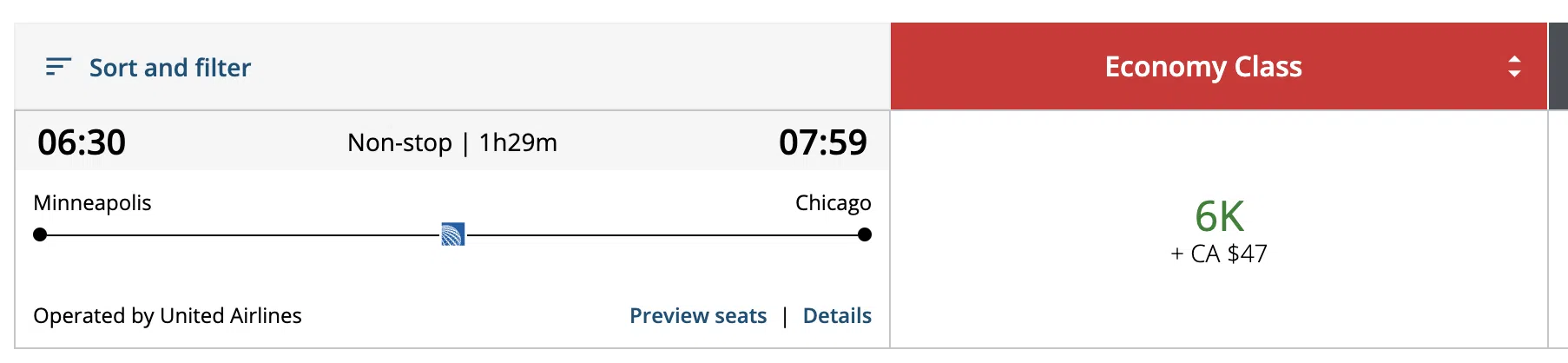

While you can book big trips abroad to Europe, the Middle East, and more for fewer miles than many other airlines charge, Air Canada points are also useful for booking domestic flights. Short United economy flights like this one between Minneapolis (MSP) and Chicago (ORD) can be found for as low as 6,000 points each way, or 12,000 roundtrip.

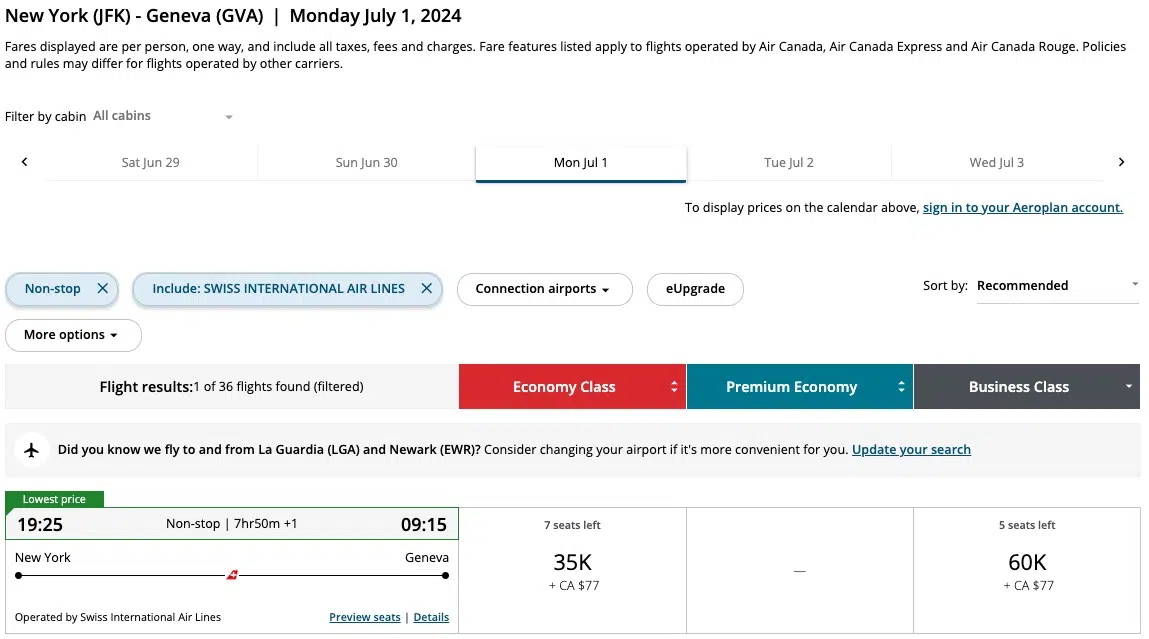

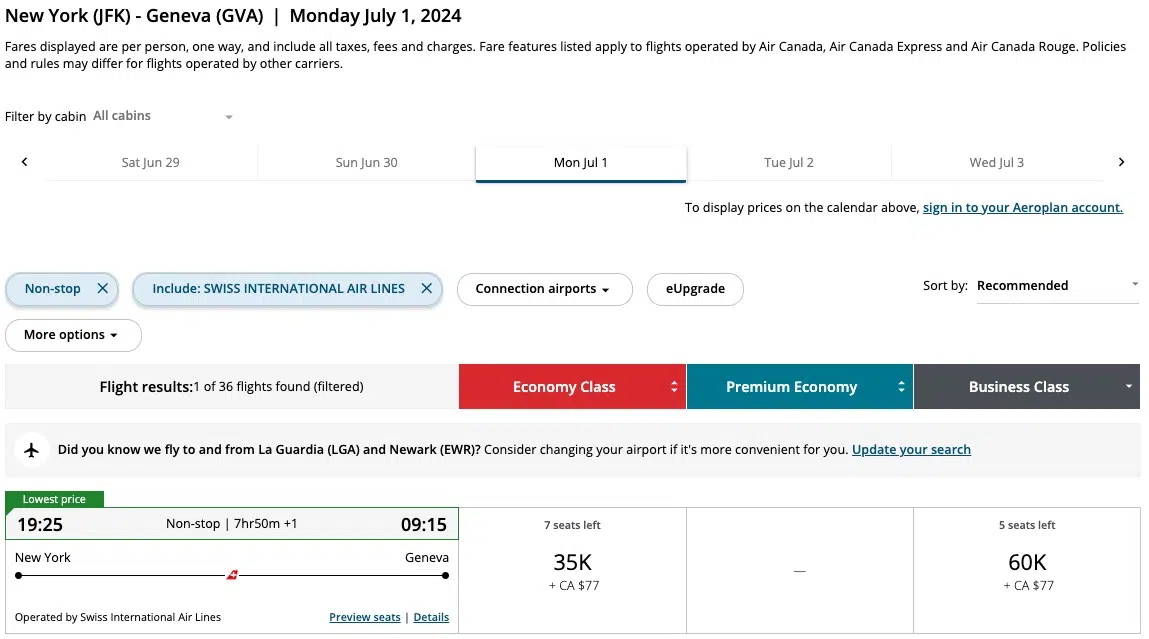

But Air Canada Aeroplan points are some of the best for booking international business class, too. Just 60,000 points each way is enough to put you in a SWISS business class seat to Europe.

To book these flights and more, you’ll want to earn any of the following flexible points that transfer to Air Canada:

- Amex Membership Rewards points

- Bilt Rewards points

- Capital One miles

- Chase Ultimate Rewards points

Read more: How to Book Award Tickets Through Air Canada Aeroplan

Avios

British Airways Executive Club and its valuable Avios mileage currency is another favorite of ours here at Thrifty Traveler – we often send our Thrifty Traveler Premium members ways to use Avios to book Qatar Airways Qsuites business class, Iberia business class, and even JetBlue Mint business class, among others. And they’re particularly useful because you can combine them between British Airways, Qatar, Finnair, Aer Lingus, and Iberia – all of which are part of the Avios system.

Avios are some of the easiest airline miles to earn, as British Airways alone is a transfer partner of nearly all the major banks. So if you’re earning any of the following credit card points, you can transfer them to British Airways (or Qatar) and move them to another program from there:

- Amex Membership Rewards points

- Bilt Rewards points

- Capital One miles

- Chase Ultimate Rewards points

- Citi ThankYou points

- Wells Fargo Rewards points

Bottom Line

Many travelers think credit card points are worth a flat 1 cent each. There’s nothing wrong with keeping things simple.

But by transferring your points to airline or hotel partners, they can be worth far, far more.

It takes extra time and effort to find flights you can book with your points and miles this way. But if you’re trying to get maximum value out of your credit card points, this is how you do it.