New Bonus! Earn 60K Points (& $300 Travel Credit) with the Chase Sapphire Preferred® Card

11 min readChase just rolled out a brand-new, limited-time offer on its popular *chase sapphire preferred*: Earn 60,000 bonus points after $4,000 in purchases in your first three months from account opening. Plus, get up to $300 in statement credits on Chase Travel℠ purchases within your first year.

While the 60,000 bonus points remain the same, the addition of a $300 statement credit for purchases made through Chase Travel℠ makes this a significantly better offer.

Considering Chase Ultimate Rewards can easily be redeemed through Chase Travel at a rate of 1.25 cents per point, this bonus is worth a bare minimum of $1,050 towards travel! But you can squeeze far more value out of those points from either card by sending them to Chase’s excellent airline and hotel transfer partners.

Beyond the crazy amount of value you can get from this new offer, the Sapphire Preferred is a worthwhile addition to the wallets of travelers new and old. With lucrative spending categories like dining and travel, you’ll be racking up points well beyond the initial bonus. Plus, this card comes with some of the best travel protections of any card on the market and even includes an annual $50 hotel credit. All that for a modest $95 annual fee … what’s not to love about that?

We don’t know how long this new offer will be around, but we do know it won’t last forever. If you’ve been on the fence about getting this card, now is a great time to apply!

Just keep in mind: Credit cards are serious business. Adding a new card to your wallet just for the big bonus isn’t worth it if you can’t afford to pay off every dime in spending it takes to earn those points.

Read on for everything you need to know about this exciting new bonus offer – and why you should take advantage.

Already have a Sapphire card in your wallet? With a bit of legwork, you might still be eligible to earn another bonus!

Chase Sapphire Preferred® Card Benefits Overview

- Welcome Offer: bonus_miles_full

- 3x points per dollar spent on dining, including eligible delivery services

- 3x points per dollar spent on online grocery purchases (excluding Target, Walmart, and wholesale clubs like Costco and Sam’s Club)

- 3x points per dollar spent on select streaming services

- 2x points per dollar spent on travel purchases

- Earn 5x total points on travel purchased through the Chase Travel Portal, excluding hotel purchases that qualify for the $50 Anniversary Hotel Credit.

- Earn up to $50 in statement credits each year for hotel stays booked through Chase Travel℠

- 10% Annual Points Bonus: Receive a 10% points bonus on your total spending during the account anniversary year at a rate of 1 point for every $1 spent.

- Travel Insurance: Trip cancellation & trip interruption coverage, baggage delay and lost luggage coverage, and primary rental car protection

- Foreign Transaction Fees: None

- Annual Fee: $95

Read our full review of the Chase Sapphire Preferred!

Learn more about the *csp*.

Just How Good is This Bonus?

Really, really good. While the total amount of points you can earn isn’t the absolute biggest, the addition of a $300 Chase Travel credit makes it one of the most valuable offers we’ve seen in years.

Every so often Chase increases the bonus on this card to 75,000 or 80,000 points. And while this isn’t the same kind of bonus, it’s every bit as valuable … if not more.

What’s more, the one-time $300 travel credit that comes with this offer doesn’t even require any sort of minimum spending – it’s available right away. Simply use your Sapphire Preferred card to make a booking through Chase Travel and you’ll automatically get a statement credit, up to $300 applied to your account. Just know: You must use this credit within the first year of account opening.

A big point bonus and an instant $300 travel credit? Talk about a win-win!

What Can You Do With 60K Chase Ultimate Rewards Points?

The beauty of Chase points is just how valuable – and flexible – they are. So, what can 60,000 points get you? In two words: A lot.

Those reward points are worth a minimum of $750 toward flights, hotels, and other travel expenses booked through Chase Travel. If you add in the card’s one-time $300 travel credit you’re now north of $1,000 in value from the sign-up bonus alone.

But you might be able to do even better by leveraging Chase’s transfer partners and sending those points to airlines like Air Canada Aeroplan, Air France/KLM Flying Blue, British Airways Avios – or even a top-notch hotel partner like Hyatt – instead.

Here’s a quick list of some of the best ways to use this bonus.

This list is just the start! Read our full guide on the best ways to redeem a big Chase bonus!

Take a Flight Deal & Make it Free

One of our favorite ways to use any frequent flyer points is booking the cheap domestic or international flight deals you find via Google Flights or with a Thrifty Traveler Premium subscription. And the absolute best way to book them is with Chase Ultimate Rewards points.

That’s because with the Sapphire Preferred Card every point is worth 1.25 cents toward travel when you use them in the Chase Travel Portal. That’s why we say the 60,000-point bonus is worth at least $750 toward flights, hotels, or other travel.

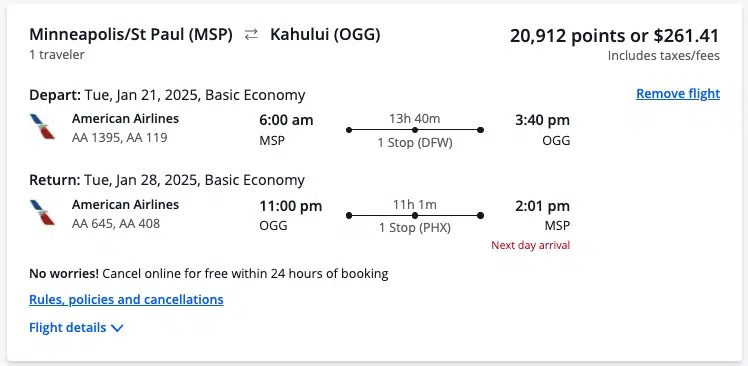

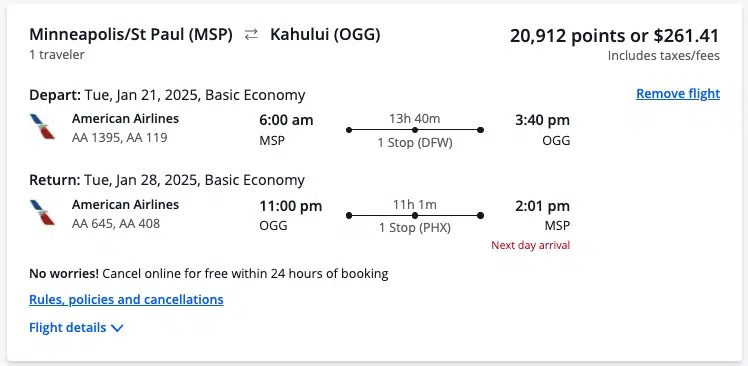

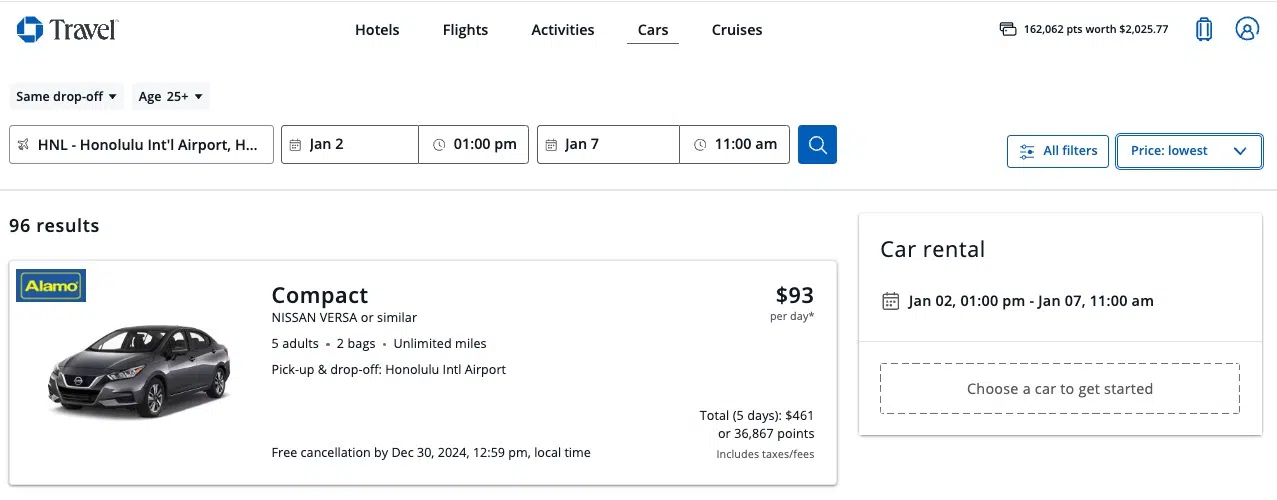

As an example, here’s a recent deal we sent to our Thrifty Traveler Premium subscribers for flights to Hawaii: You can get to many of the Hawaiian islands for under $300 roundtrip this fall and winter – peak travel season!

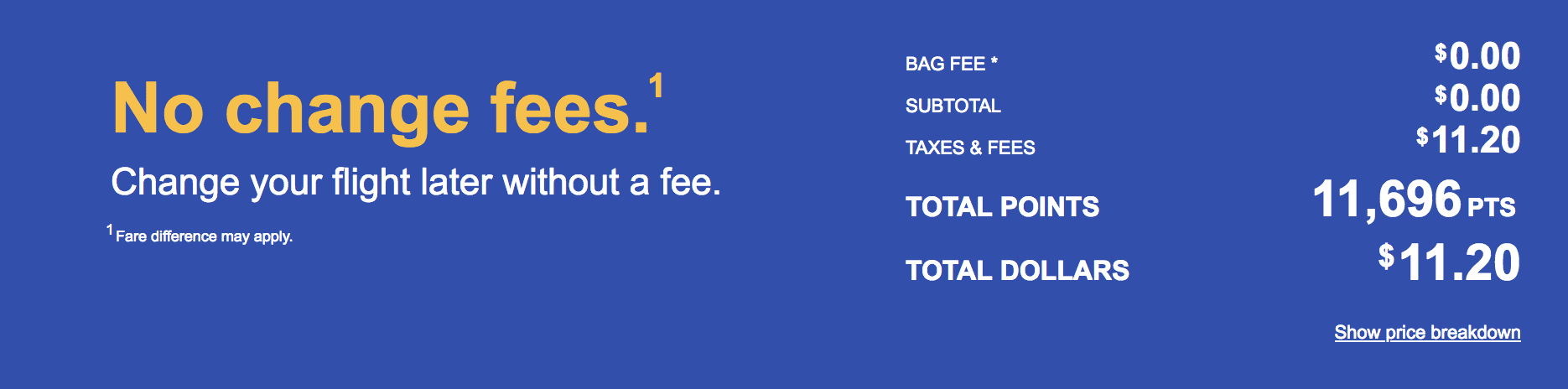

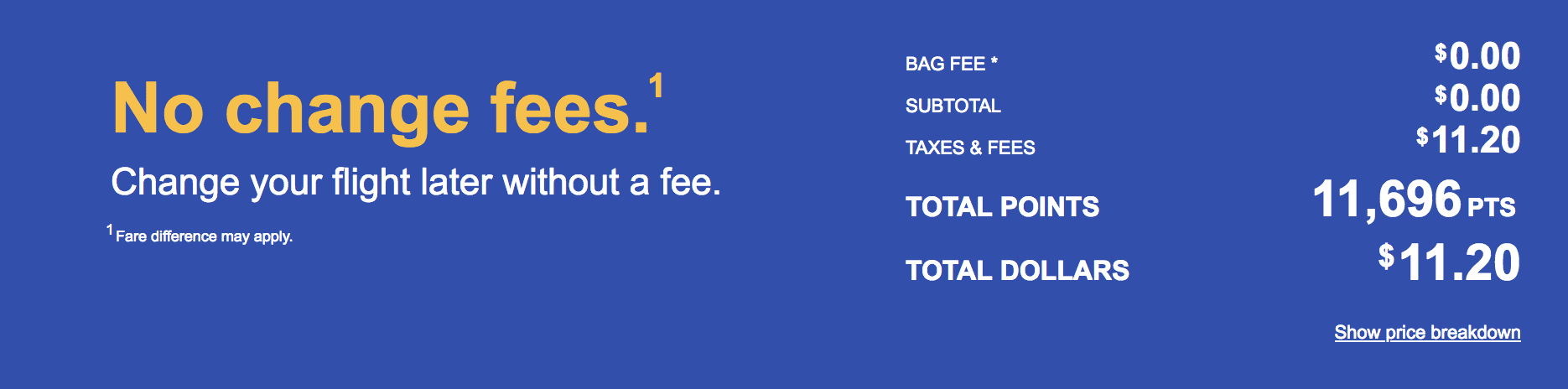

Booking this flight with bonus points from your Chase Sapphire Preferred? It would cost you less than 21,000 points. By the time you finished meeting the Sapphire Preferred’s minimum spending requirement, you’d have at least 64,000 points – enough to book three roundtrips! You could then use the card’s $300 travel credit for a rental car or put it towards a hotel to round out your vacation.

Booking flights directly through the Chase travel portal is one of the easiest ways to redeem points for travel, period. You’ll even earn miles when you take your free flight! Best of all, you can book flights on almost any airline using this method.

Read more: How to Book Flights Through the Chase Travel Portal

4 (or More!) Roundtrip Tickets to Hawaii

That’s not the only way to get to Hawaii, though. You can book two, four, or more round-trip tickets to with a big Chase bonus like this. So much for Hawaii being an expensive place to get to, right?

This is where turning to Chase transfer partners really shines, as you have several options to book round-trip flights to the Hawaiian islands for about 25,000 points each – or much less.

If you time it right, you can get to Hawaii for under 12,000 Southwest Rapid Rewards points, as with this round-trip flight from Oakland (OAK) to Maui (OGG). And because Chase points transfer to Southwest on a 1:1 basis, 12,000 Chase points is all you need.

Read more on our favorite ways to get to Hawaii using points!

A RoundTrip for 2 to Europe – Or 1 in Business Class

This 60,000-point bonus can be enough to get two people to Europe and back … or fly solo in style.

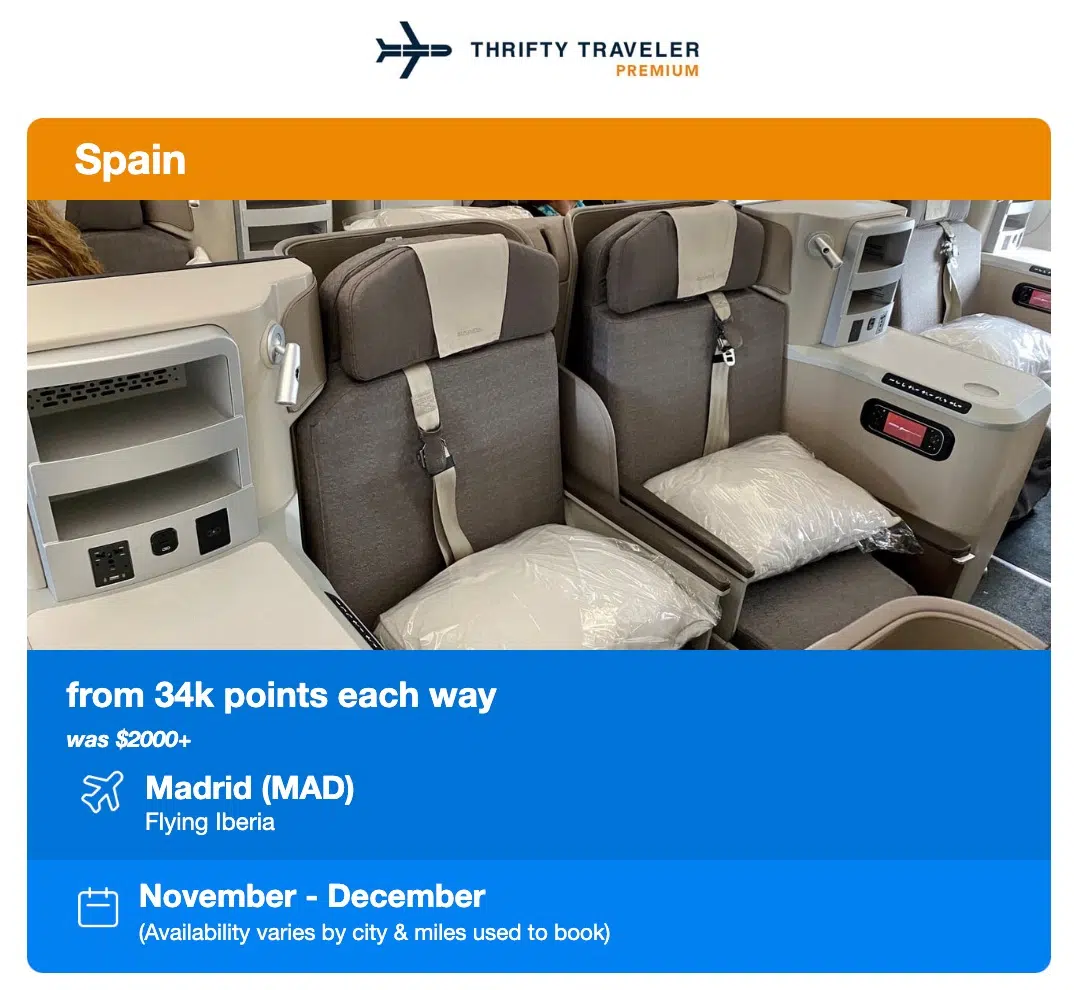

The trick is turning to Iberia, a Spanish airline and yet another Chase transfer partner. Using Iberia, you can fly from Boston (BOS), New York City-JFK (JFK), Washington, D.C.-Dulles (IAD), or Chicago-O’Hare to Madrid (Madrid) for as low as 34,000 miles roundtrip. Since Chase points typically transfer to Iberia on a 1:1 basis, a stash of 60,000 points is almost enough to cover two roundtrip flights to Europe.

But if you time it right, you might be able to multiply your points by taking advantage of a transfer bonus. Right now, Chase is offering a 30% bonus on transfers to Iberia – as well as British Airways and Aer Lingus. By taking advantage of a bonus like this, a 60,000-point bonus is more than enough for two roundtrip flights to Europe … with points left to spare.

Or you could splurge for this:

That’s right: 60,000 Chase points (with a transfer bonus) is more than enough for two one-way flights (or one roundtrip) to Europe in Iberia business class – but even without a transfer bonus, you’d only be a few thousand points shy. It costs just 34,000 miles each way or 68,000 miles roundtrip! That’s a fraction of what most other airlines charge to fly business class to Europe.

Considering these business class flights typically cost $4,000 or more when paying cash, it’s a phenomenal way to use those Chase points. And with a Thrifty Traveler Premium alert like this one, it’s fairly easy to book as long as you have the points.

Read our step-by-step guide on how to book Iberia business class!

Book Free Hotel Nights with Hyatt

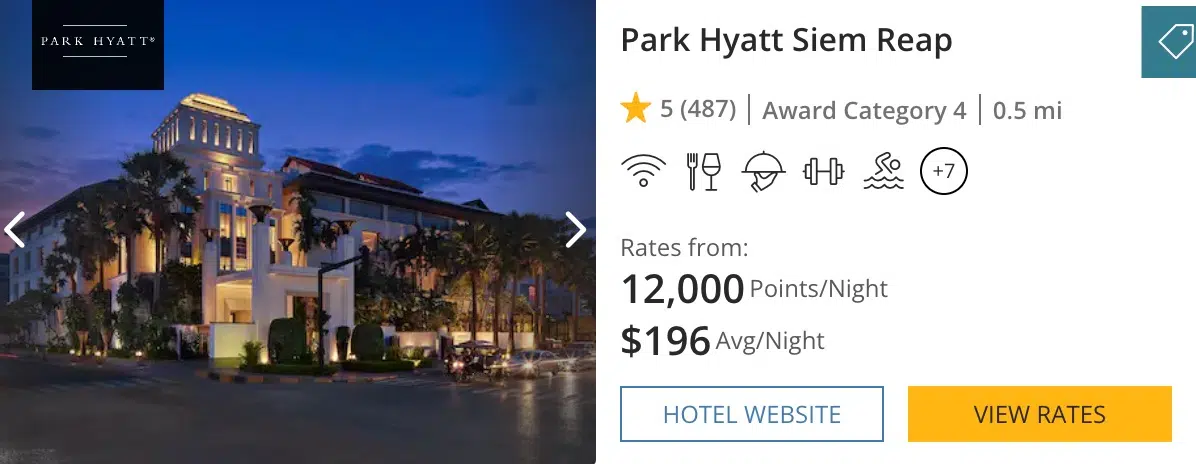

It’s not just flights. You can also book hotels using this 60,000-point bonus. And with Chase points, you’ve got an ace in the hole: Hyatt.

With free nights starting as low as just 3,500 points per night, World of Hyatt is easily the most valuable hotel loyalty program … and it’s not even close. Chase points also transfer to Hyatt 1:1.

So with 60,000 points in hand, you could:

- Cover up to 17 nights at the cheapest Hyatt properties!

- Book up to two free nights at the brand-new, all-inclusive Secrets Tulum Resort & Spa

- Get up to three free nights at the Park Hyatt Zanzibar – some of Hyatt’s top-tier hotels, like the Park Hyatt Siem Reap in Cambodia, are bookable from just 12,000 points per night!

Read More: Why Hyatt is the Best Hotel Rewards Program

Score a Business Class Suite to Tokyo

This isn’t just business class. It’s ANA’s The Room business class. And you can book your trip to Japan flying this with your Chase bonus.

All Nippon Airways (ANA) might not be a Chase transfer partner, but Virgin Atlantic is … and even after a recent devaluation, this is still one of the cheapest ways to fly in style. You can fly from the western U.S. to Tokyo and back for just 105,000 Virgin Atlantic points or 120,000 points from Chicago-O’Hare (ORD) or East Coast cities. One-ways are half the price.

If you time it right with one of the frequent 30% transfer bonuses from Chase to Virgin, you’ll have nearly enough points for a roundtrip to Tokyo in business class.

What About the $300 Travel Credit?

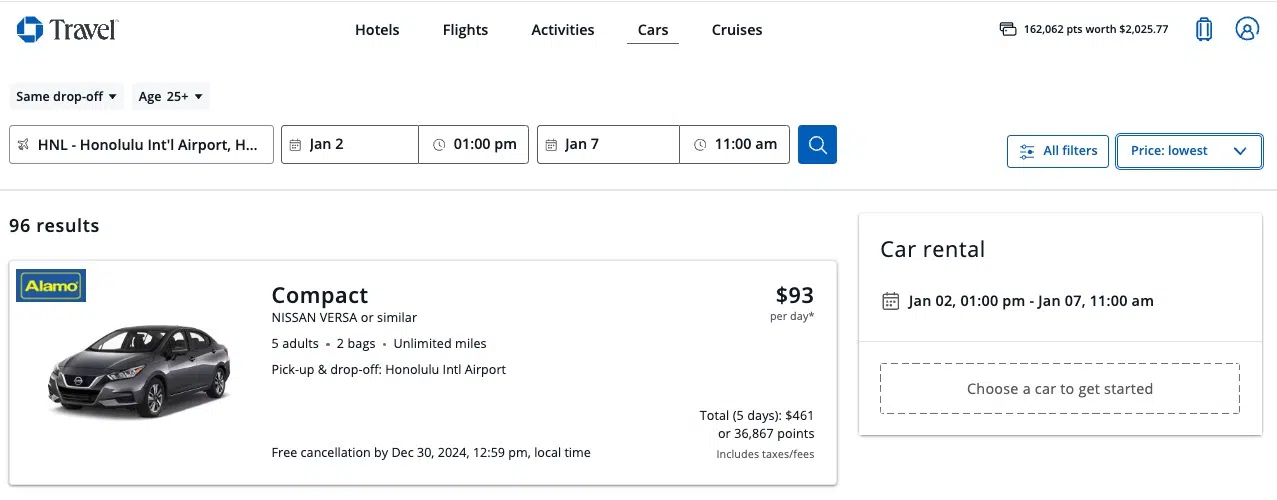

With all the different examples we highlighted using Chase points, we think it’s pretty clear that there’s a ton of value to be had when leveraging Chase’s travel partners or even booking directly through the portal. But as much as we love using points and miles to travel for free(ish), there are just some things that points don’t cover. And that’s where the Sapphire Preferred’s $300 travel credit shines!

Maybe you used your points to book dirt cheap flights to Hawaii but now you need a rental car to get around the island. No problem!

Simply head to Chase Travel and enter the dates of your trip, just like you would with any other travel search engine, and you’ll see all the available options. Once you find something that works for you, simply use your Sapphire Preferred to book and you’ll automatically receive a statement credit of up to $300.

But you can use this credit for more than just rental cars. You can also book cruises, flights, hotels, and even excursions directly through Chase Travel and take advantage of this credit that way.

While a big point bonus is great, the unique nature of this offer also including a travel credit really makes for the best of both worlds. You can redeem the points to cover big expenses like flights and hotels – and then use the travel credit to help round out the rest of your vacation.

Are You Eligible for a Chase Sapphire Bonus?

Before applying for either card, you should consider a few things to give yourself the best chance of being approved.

You’ll Need Good-to-Excellent Credit

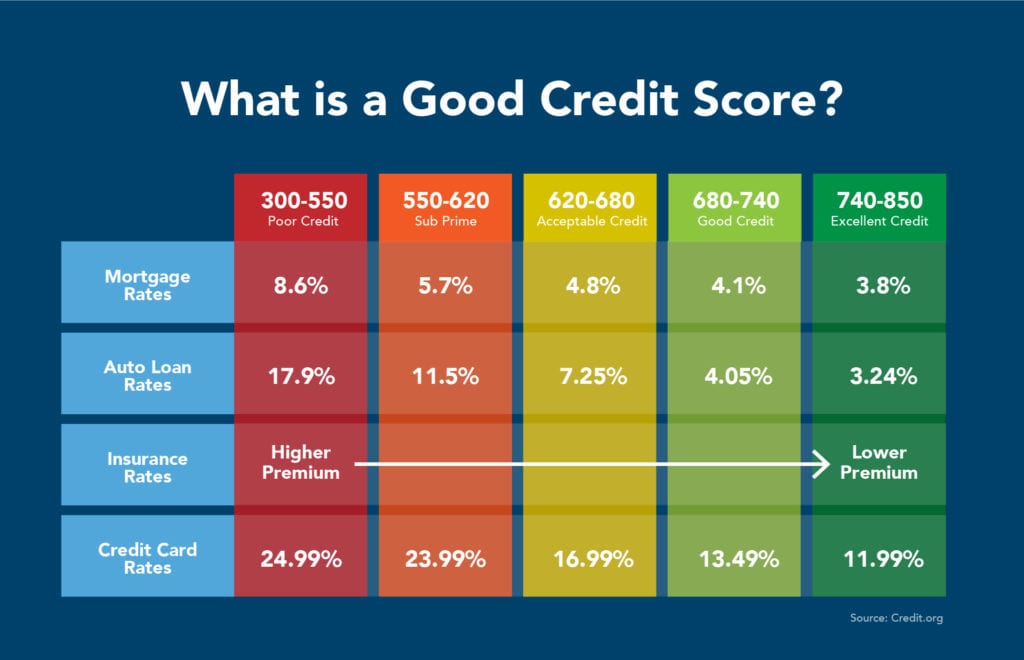

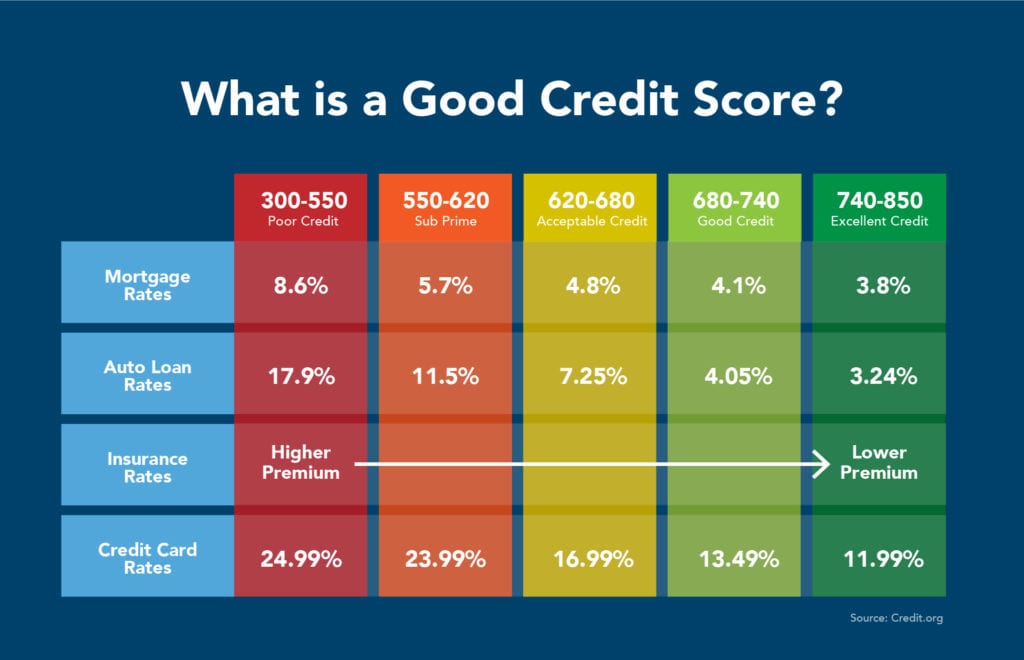

The first thing you’ll need to consider before applying for one of these Chase Sapphire Cards is your credit score.

Chase indicates that you must fall into the “Good” to “Excellent” credit buckets to be approved for both the Chase Sapphire Preferred and Sapphire Reserve Cards. As you can see, that means you’d probably need at least a 680 credit score to get approved.

But this isn’t a hard-and-fast rule. There are certainly exceptions – especially if you have a history with Chase. But your best bet for getting approved is having a credit score of 700 or higher. If your credit score is below 680, your odds of getting approved aren’t great.

Read more: What Credit Score Do You Need for the Chase Sapphire Preferred?

The Chase 5/24 Rule

The next thing you’ll need to be aware of is something called the Chase 5/24 Rule. And it can be a killer.

The Chase 5/24 rule is a restriction rolled out years ago in order to limit card applicants from opening credit cards for the sole purpose of earning the bonus rewards.

Here’s what it boils down to:

- If you have opened five or more credit cards in the past 24 months from any bank (not just Chase), you will not be approved for Chase credit cards, regardless of your credit score or history with Chase Bank.

- The rule does not count credit inquiries, but rather card products you have applied for and been approved for. That also means mortgages and other lines of credit don’t count.

The rule is not officially published through any of Chase’s platforms. Case in point: If you ask about it in a Chase branch or on the phone with a Chase customer service representative, employees have likely not heard of it.

[embedded content][embedded content]

There have been some signs lately that Chase is relaxing this rule, but it’s still hit or miss. Still, your best chance at getting one of these Sapphire Cards is by being under that all-important 5/24 count.

Have You Earned a Chase Sapphire Bonus Previously?

It’s not just the number of cards you’ve opened that could be a factor. Specific cards could rule you out from earning this bonus, too.

Chase does not allow you to hold the Chase Sapphire Preferred Card and the Chase Sapphire Reserve simultaneously. That means if you currently have the Sapphire Reserve in your wallet, you won’t be eligible for this bonus.

Additionally, you will not be eligible if you earned a sign-up bonus on either the Chase Sapphire Preferred or Reserve in the last 48 months: four full years!

The four-year restriction starts from the date you earned the bonus points – not the date that you opened or closed either card. Still, that opens a window for travelers who’ve previously had the card to earn one of these bonuses.

If you previously had a Sapphire Card but downgraded it to one of the Freedom cards or closed your account long ago, you can still apply for this new bonus. Just keep in mind that when you reapply for a new Sapphire Card, you’ll still need to be under the Chase 5/24 rule and have a credit score high enough to get approved.

Read more: Master Guide to Credit Card Applications: All the Rules You Need to Know, Bank by Bank.

Bottom Line

Chase is out with a new, limited-time bonus offer on the popular *chase sapphire preferred*. With this offer, you can earn 60,000 points after spending $4,000 on purchases in the first three months. Plus, get a one-time $300 statement credit for purchases made through Chase Travel within the first year of account opening.

Add it all up and this bonus is easily worth more than $1,000 when redeemed for travel – and with a little effort, you can likely do even better than that.

If the Chase Sapphire Preferred sounds like a good fit for you (and it probably is), getting in on a limited-time bonus like this makes now the perfect time to apply!

Learn more about the *chase sapphire preferred*