Easy Peasy: Using Capital One Miles to Cover Travel Purchases

6 min readIf words like “award chart,” “transfer partner,” and “travel portal” are enough to make your head explode, I’ve got just the thing for you.

There’s no easier way to use points and miles to book free(ish) travel than Capital One’s option to cover travel purchases – formerly known as the “Purchase Eraser.” Whether you’ve got the tried and true *capital one venture card* or the premium *venture x*, you can use your miles to cover nearly any travel purchase … and it only takes a few clicks.

Here’s how it works: Use your card to make a travel purchase – an airline ticket, hotel stay, or even a golf trip – then go back and use your miles to cover it once it finalizes on your account. When you use your miles this way, each one is worth 1 cent – so you could cover a $250 plane ticket with 25,000 miles or a $100 hotel room with 10,000 miles.

Is this the most valuable use of Capital One miles? Not always. But it is the simplest – and as the saying goes, “time is money.” Plus, it opens up an incredibly easy avenue to cover many travel expenses

Let’s take a look at how and why you should use Capital One miles to cover your travel purchases.

How it Works

No credit card company makes it easier to redeem points and miles toward travel than Capital One. Just charge your flight, hotel, Airbnb, or almost any other travel expense to your Capital One card, go back and cover the cost with miles, and you’re done.

Here’s the list of eligible Capital One cards:

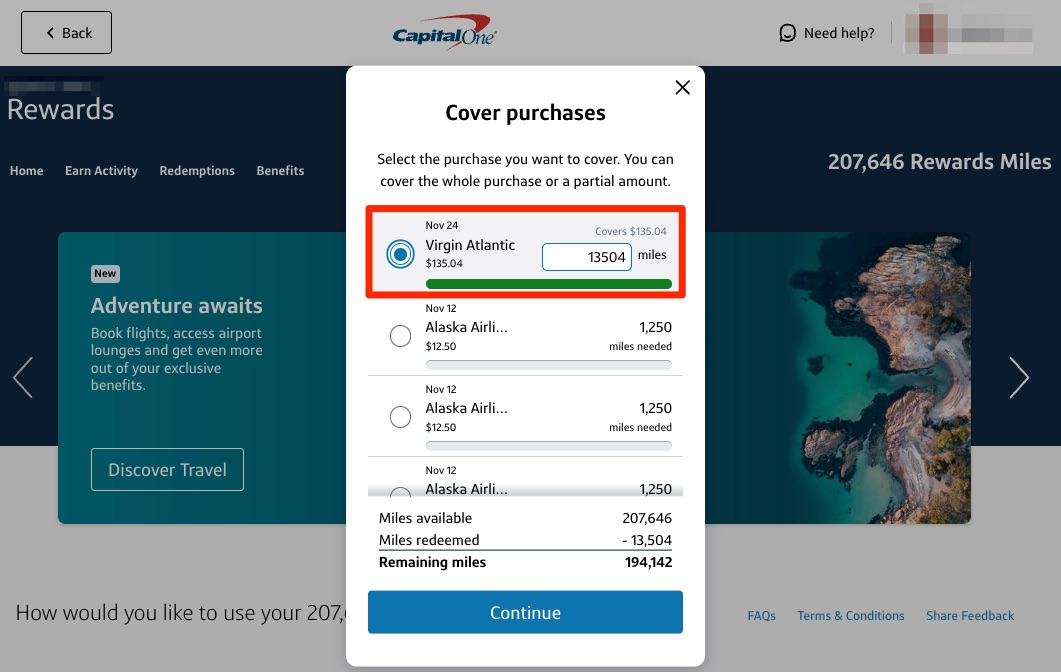

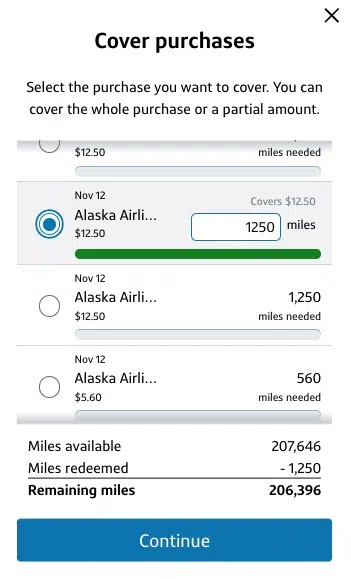

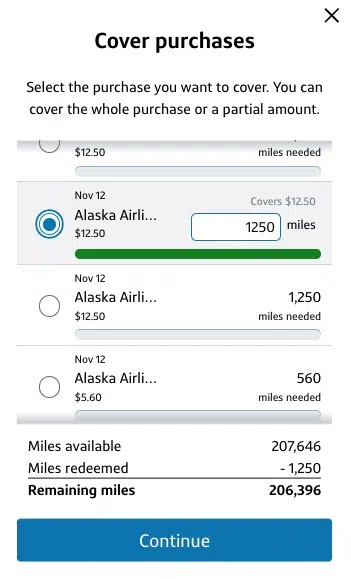

So long as you have one of those cards and you use it to make a travel purchase, you’re all set. Once that charge posts to your account – typically within a day or two – you’ve got 90 days to go back in and use your miles to cover it. To do so, simply log in to your Capital One account, click on “View rewards” and then “Cover travel purchases.”

Using this method, every Capital One mile is worth 1 cent. That means you can book a $500 and cover the purchase with 50,000 miles. That may not be earth-shattering value, but it’s easy as can be –

Read our step-by-step guide to covering travel purchases to see how it’s done!

Putting it into Action

Take a Cheap Flight & Make it Free

What’s better than a cheap flight? A free flight. And Capital One makes it easier than any other bank to make that a reality.

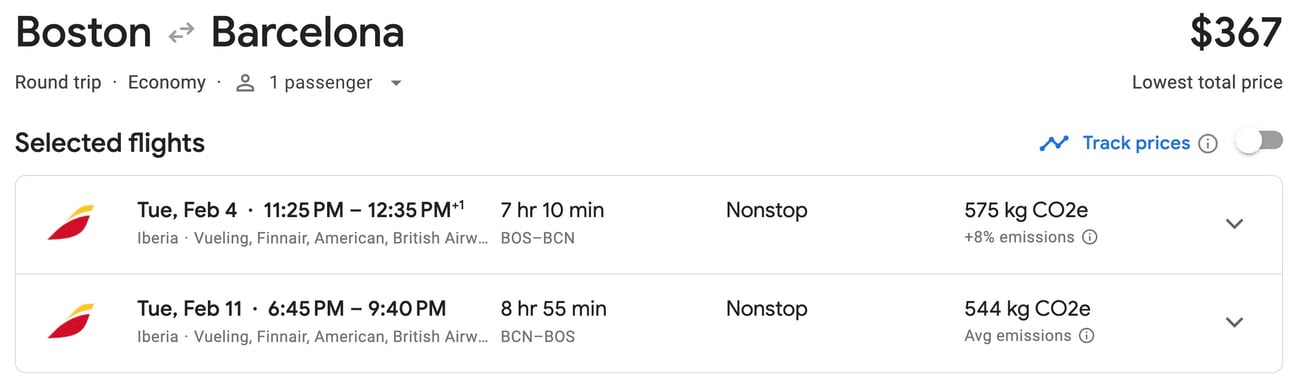

Here’s a real-world example. Let’s say you’re a Thrifty Traveler Premium member and received this alert for $367 flights from Boston (BOS) to Barcelona (BCN) next year.

Just pay for that flight with any of the Capital One cards listed above directly through the airline’s website, go to your account a few days later, and cover the charge with 36,700 miles. Don’t want to cover the whole amount? No problem: You can fine-tune exactly how much of a purchase you want to cover using miles by simply typing in how many miles you’d like to use.

There’s something to be said about the simplicity of using Capital One miles to cover nearly any travel purchase – and that versatility makes this such a valuable redemption option for beginners and experts alike.

But the real beauty of this redemption method is that it can go, far, far beyond booking flights. Think of any travel expense, and you can cover it using your miles – including expenses that other credit card points can’t cover. For example…

Award Ticket Taxes & Fees

You can get some even more value out of Capital One miles by transferring them to an airline partner to book an award ticket, but here’s the thing: That “free” ticket is never actually free. Even simple domestic itineraries charge a nominal amount of taxes and fees … and if you’re heading abroad – especially in business class – prepare to pay as much as $300 or more.

But thanks to the versatility of Capital One miles, you can completely cover those taxes and fees, restoring the joy of “free” travel. Charge those taxes with your eligible Capital One card, go back a few days later, and wipe it from your statement.

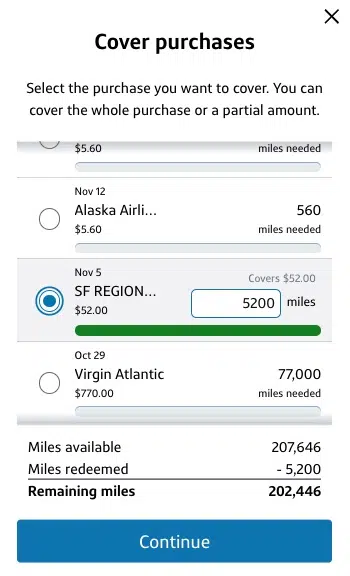

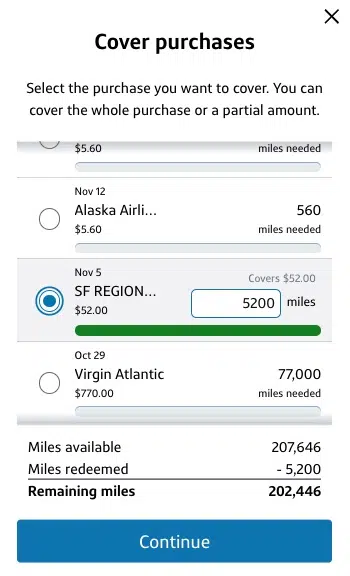

It gets better with the *venture x*. Whether you’re paying $5.60 in fees or hundreds of bucks, putting it on your Venture X Card also unlocks some excellent built-in travel insurance if things go wrong with your flight like lost luggage reimbursement, trip delay coverage, and trip cancellation and interruption policies.

Airport Parking

Leveraging points and miles has definitely helped me travel more for less, but there’s still always a cost. Take airport parking, for example: There’s no good way to offset these sometimes lofty airport parking fees with points from American Express or Citi.

But with Capital One, there is…

Since I used my Venture X Card to pay for parking after a quick weekend getaway, I’m able to completely cover that $52 charge with 5,200 Capital One miles. Again, this might not be the most exciting use of miles but it’s just another example of what’s possible. Where other bank points fall short, Capital One miles deliver.

Car Rentals

Car rentals are another notoriously tricky expense to cover using points and miles. Sure, if you’ve got Chase Ultimate Rewards points, you can use them to book a car directly through Chase Travel℠ – but in doing so, you might find more limited options or get stuck overpaying for your rental.

Once again, this is where the versatility of Capital One miles shines.

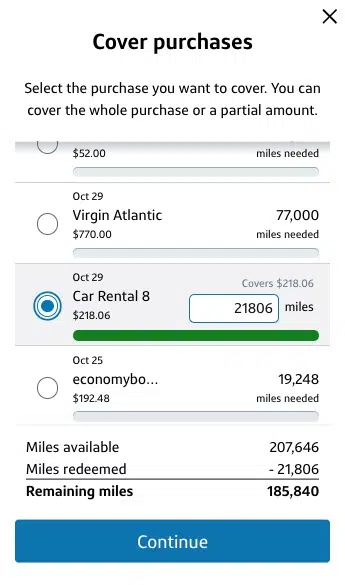

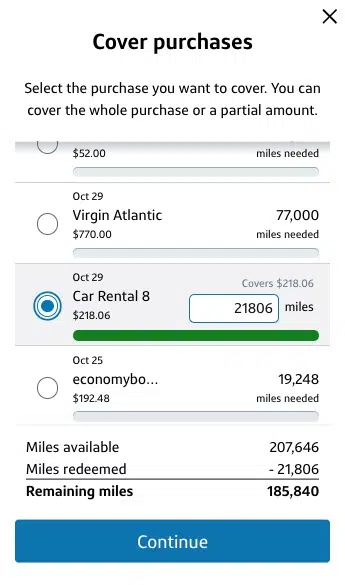

Earlier this fall, I needed a rental car and far and away the best price I could find was through an admittedly sketchy third-party travel agency called Car Rental 8. What can I say, I’m a sucker for a good deal – and thankfully it all worked out.

And since I used my Capital One Venture X Card to pay for my rental – partly for it’s top-notch car insurance coverage – I could also use my Capital One miles to cover this charge. All the Chase and Amex points in the world can’t do that.

A Boat Ride … in Bora Bora

We saved the best example for last.

Earlier this year our editor, Kyle,a trip to Bora Bora in French Polynesia to stay at the Conrad Bora Bora Nui. Ahead of his trip. he discovered a shop on the main island called La Plage Bora Bora, which allows you to rent your own boat and cruise around the crystal clear water. Incredibly, you don’t even need a boat license!

At under $200 for a four-hour rental, it’s reasonable enough … but he didn’t want reasonable: He wanted free.

So rather than booking straight with the rental company, Kyle booked the boat through Viator.com, a travel site he was 100% sure would code as travel – the key to covering that cost with Capital One miles.

Sure enough, it worked. Rather than paying $192 and change, he paid for the boat ride using 19,000-some Capital One miles.

The entire purpose of using points and miles is for experiences. And nothing will top the four hours Kyle and his wife spent chasing stingrays around the bay of Bora Bora, finding a small sandbar for a picnic, and soaking in the view of the mighty Mount Otemanu – all on their own.

Bottom Line

Points and miles can make some really incredible travel experiences feel free, but even the best redemptions have a cost … and that’s where Capital One miles shine.

With Capital One, you can cover nearly any travel purchase at a rate of 1 cent per mile, making it the most versatile redemption option for beginners and experts alike.