Choosing the Best Travel Insurance for Your Japan Trip

7 min readIn a country like Japan, anything is possible! That includes the less glamorous side of travel, from unexpected delays, medical mishaps, and lost luggage. Having the right travel insurance for...

The post Choosing the Best Travel Insurance for Your Japan Trip appeared first on Bucketlist Bri.

Disclosure: This post may contain affiliate links, which earn me a small commission from bookings at no extra cost to you. Thank you for reading and supporting my blog!

In a country like Japan, anything is possible!

That includes the less glamorous side of travel, from unexpected delays, medical mishaps, and lost luggage.

Having the right travel insurance for Japan is essential to protect both your health and your travels from unforeseen events.

(Let’s not mention the report indicating a 70-80% chance of a “megathrust earthquake” due in the next thirty years 😭 .)

I’ve been lucky enough to visit Japan 3-4 times in the last year and always went equipped—just in case—with budget-friendly travel insurance to cover my trip.

In this guide, I’ll help you choose the best travel insurance for your Japan trip, focusing on SafetyWing Nomad Insurance and its new Essential and Complete plans compared to other travel medical options.

Disclaimer: This post is sponsored in partnership with SafetyWing, but please note I’ve been a user since 2018 and would recommend this service anyway. As always, all reviews and opinions on my blog are my own, sponsored or otherwise. I genuinely only recommend services and tools I use.

Should You Get Travel Insurance for Japan? Yes!

Even though Japan is safe, travel insurance is meant to cover unexpected medical emergencies, trip cancellations, lost baggage, and more.

Compared to other popular travel destinations, Japan’s high-quality healthcare system, although streamlined and strict (as you’d expect for Japan), can be expensive for tourists.

Insurance is a must for any trip! But for Japan, it can help you cover high medical costs even for a minor emergency.

My Top Pick for Travel Insurance in Japan: SafetyWing Nomad Insurance

As a user since 2018, SafetyWing Nomad Insurance is my top choice for digital nomads, but it is also the best solution for non-remote workers.

Whether you travel solo or visit Japan as a couple or as a family with kids, you shouldn’t opt out of travel insurance just because it’s Japan and you think everything is orderly and tidy!

Mishaps and emergencies can happen anywhere at any time.

You can get your health AND trip insured for less than the cost of two sushi dinners in Tokyo. (The Essential Plan only costs $56 every four weeks!).

Now, SafetyWing offers two plans designed to meet different travelers’ needs based on your trip length.

For most people, only the Essential Plan is needed. Here’s a peek at the differences.

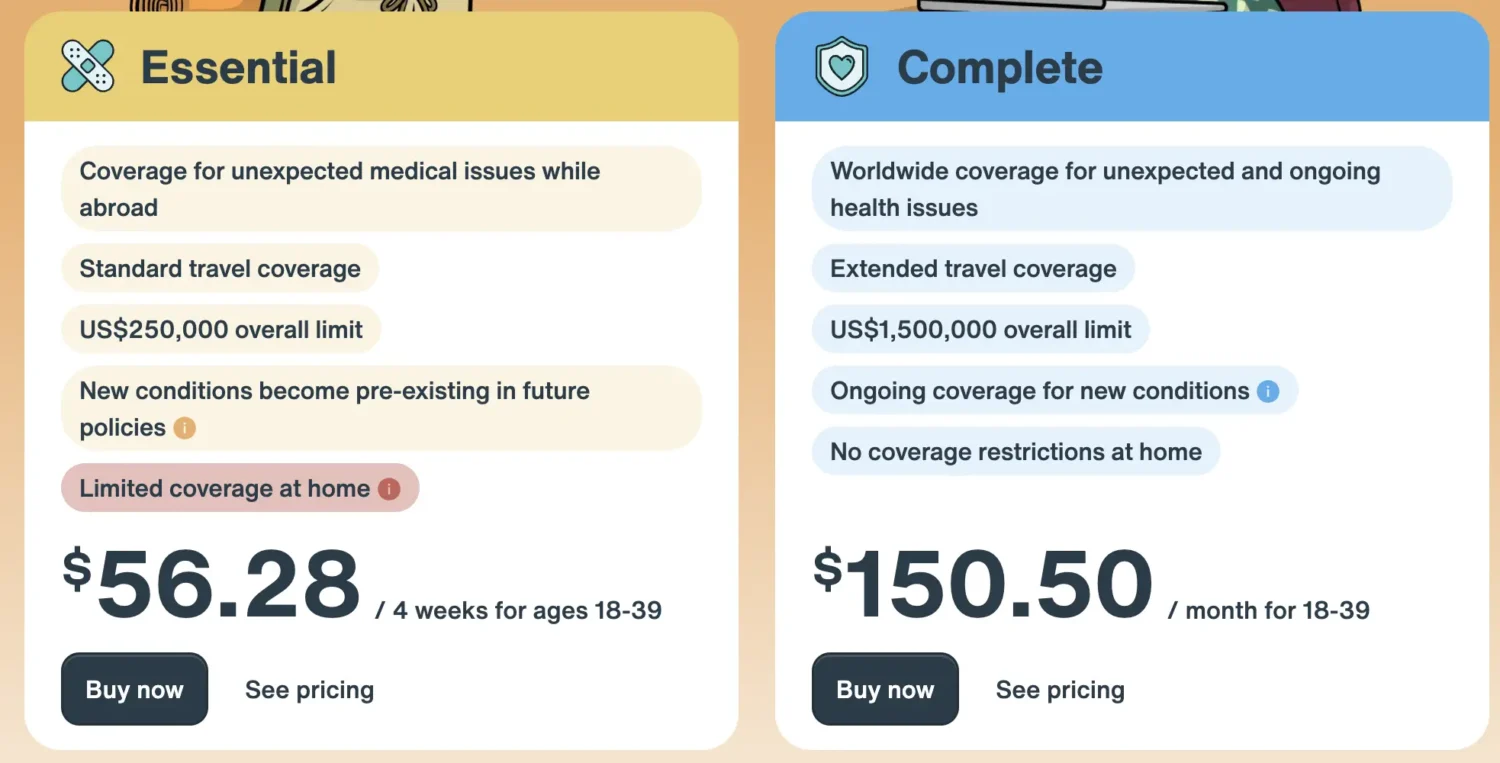

1. Nomad Insurance Essential

- Travel Medical Insurance

- Coverage Limit: $250,000

- Key Features:

- Covers unexpected medical emergencies abroad

- Limited home country coverage

- No coverage for pre-existing conditions, maternity care, or cancer treatments

- Cost: Approximately $56.28 per 4 weeks for individuals aged 18-39

- ➡️ Get policy details here

For example, if your Japan trip is ten days, the cost of getting insured under the Essential Plan would roughly be $28. Not bad, right?

2. Nomad Insurance Complete

- Global Health + Travel Medical Insurance

- Coverage Limit: $1,500,000

- Key Features:

- Includes maternity care, cancer treatments, and new conditions

- Comprehensive home country coverage (US, Hong Kong, and Singapore are add-ons)

- Worldwide coverage for ongoing and unexpected health issues

- Cost: Around $150.50 per month for individuals aged 18-39

- ➡️ Click here to learn more

Are you unsure what the cost would be for you based on age and nationality? You can quickly check using SafetyWing’s calculator here:

Key Differences Between SafetyWing’s Essential and Complete Plans

| Feature | Essential Plan | Complete Plan |

|---|---|---|

| Coverage Limit | $250,000 | $1,500,000 |

| Pre-existing Conditions | Not covered | Not covered |

| Maternity Care | Not included | Included |

| Home Country Coverage | Limited | Comprehensive |

| Monthly Cost | $56.28 | $150.50 |

How SafetyWing Compares to Other Insurances for Your Japan Trip

As I mentioned, travel insurance isn’t one-size-fits-all.

Everyone has specific travel and medical needs, so please keep that in mind while you’re doing your research.

Here are other potential travel insurance options to protect your Japan trip.

World Nomads

World Nomads is well-known for its flexibility, allowing travelers to buy or extend coverage while already abroad. It was founded in 2002 and is based in Australia.

Most of all, WN caters to adventurous travelers, offering insurance that covers over 200 activities, including skiing, scuba diving, and bungee jumping.

Its policies also support nomads with comprehensive protection for trip cancellations, medical emergencies, and lost belongings, similar to SafetyWing.

- Highlights:

- Plans for adventure activities

- Extend policies while traveling

- Comprehensive coverage for medical emergencies, trip cancellations, and lost luggage

- Best For: Active and long-term travelers, especially adventure travelers

Heymondo

Heymondo is a Spain and app-based company specializing in “user-friendly travel insurance solutions.”

One of its cool features is its dedicated mobile app, where travelers can easily manage claims, access emergency assistance, and get medical support.

The company emphasizes simplicity and transparency, offering plans with no upfront payments required for medical services.

- Highlights:

- High medical limits

- Upfront payments

- 5% discount through promotions

- Best For: Travelers seeking hassle-free claims

IMG Global

If you’re from the United States, you’re probably familiar with the International Medical Group (IMG Global) company, which has provided international health plans since 1990.

They offer tailored options for expats, missionaries, and senior travelers. IMG is recognized for its extensive network of healthcare providers worldwide and its focus on flexible, customizable plans.

IMG is what I used pre-SafetyWing to get coverage for my mom (aged 70+) when we traveled to Costa Rica together.

- Highlights:

- Options for seniors

- Covers pre-existing conditions

- Best For: Comprehensive medical needs

WorldTrips

WorldTrips is a global travel insurance provider similar to SafetyWing travel medical insurance.

The US-based company has operated since 1998, serving students, tourists, and digital nomads.

- Highlights:

- Coverage tailored for international travel

- Emergency medical evacuation and repatriation

- Short-term and long-term travelers

- Best For: Students, digital nomads

Here’s how each compares to SafetyWing in terms of pricing:

- SafetyWing: $56.28 per 4 weeks for individuals aged 18-39 (Essential) and around $150.50 per month for individuals aged 18-39 (Complete).

- World Nomads: Starts around $100-$150 monthly depending on age, trip duration, and coverage level.

- Heymondo: Typically ranges from $50 to $80 per month for standard coverage.

- IMG Global: Basic travel medical insurance costs $50 per month.

- WorldTrips: Plans start at $51-75 per month, depending on coverage options and traveler needs.

SafetyWing’s flexible options allow you to choose based on your needs.

If you’re simply vacationing in Japan—whether for a few days up to several weeks—the Essential plan is the most affordable and comprehensive.

10 Things to Consider When Choosing Travel Insurance for Japan

1. Choose Emergency Medical Coverage or Comprehensive Coverage

Ensure the plan covers at least medical emergencies, including hospitalization, treatment, and doctor visits.

Japan’s healthcare system is high-quality but can be expensive for tourists.

Also, look for a plan with a high coverage limit, for example, above $100,000.

Check if the policy excludes pre-existing conditions or offers limited coverage.

2. Decide If You Need Adventure Activities Coverage

If you plan to go skiing/snowboarding in Japan, hiking, or participate in water sports (such as diving), ensure the policy covers adventure or high-risk activities!

Note: SafetyWing includes adventure in its Complete plan but is an add-on in the Essential plan.

3. Trip Cancellation and Interruption

Look for coverage that reimburses non-refundable expenses if you need to cancel or cut short your trip due to unforeseen circumstances like illness, accidents, or family emergencies.

4. Travel Delays and Missed Connections

Japan’s public transportation system is highly efficient, with rare delays.

However, for plane travel in particular, unforeseen delays may still occur. Coverage for missed flights or connections can save you from significant extra expenses!

Insurances such as SafetyWing will reimburse lost or delayed luggage fees.

5. Lost or Stolen Belongings

Japan is typically extremely safe, but lost luggage or stolen belongings can happen anywhere. Ensure the plan covers personal items like electronics, passports, and luggage.

I once left my passport (and entire bag) behind at the Osaka Kansai airport. Luckily, when I returned two hours later, it was still there! (Ah, Japan 💕.)

6. Home Country Coverage

If you plan to return to your home country during the trip (e.g., for holidays or emergencies), check whether the insurance provides any coverage during those periods.

SafetyWing includes up to 15 days of coverage for U.S. residents on the Essential plan.

7. Natural Disasters

This is probably the most pertinent in Japan’s case… as the country is prone to earthquakes and tsunamis. I couldn’t believe how many tremors we felt during our three months in Tokyo!

Ensure your plan includes coverage for trip cancellations or delays caused by such events. 🫣

8. Evacuation and Repatriation

Coverage for medical evacuation or repatriation in case of serious illness or injury is a must-have in any insurance plan. While most include this as a basic feature, just check. This feature ensures you can be transported back home safely if necessary.

9. Policy Exclusions

Read the fine print for exclusions like specific illnesses, extreme sports, or alcohol-related incidents.

10. Duration and Frequency of Travel

For short trips, single-trip policies are cheap and budget-friendly.

Under SafetyWing, you can protect your trip starting at just $56 per four weeks, meaning if you have a 2-week trip, it’ll cost about half that!

If you’re a digital nomad or frequent traveler, consider long-term or multi-trip plans like SafetyWing Nomad Insurance Complete.

The most important thing is to select a policy that meets your needs and ensures security and flexibility while exploring Japan.

Final Pick: SafetyWing Nomad Insurance for Japan

The right travel insurance for Japan is crucial to ensure a stress-free trip. SafetyWing’s Essential and Complete plans offer flexible and reliable coverage, making them the ideal choice for most travelers.

However, if their plans don’t suit your needs for one reason or another, check out alternatives like World Nomads, Heymondo, IMG Global, and WorldTrips.

Above all, with all that Japan has to offer, it’s not worth spoiling your trip by worrying about the unexpected!

Travel insurance does more than protect your finances and health, it also gives you peace of mind. Pick your SafetyWing Nomad Insurance plan today.

If you have questions, please drop a comment below! Meanwhile, happy and safe travels in Japan. 🇯🇵

<!–

–>