Just Opened the Capital One Venture X Card? Here’s What to Do Next

10 min readIf you’re looking to add a new travel rewards credit card to your wallet, your search could very well begin and end with the *venture x*.

For starters, you can currently bonus_miles_full That bonus offer alone is worth a minimum of $750 towards travel … or perhaps much more if you’re willing to kick those miles over to one of Capital One’s travel partners for an award booking.

But the real value in holding the the Venture X card is for its ongoing travel perks and benefits. With an annual $300 Capital One Travel credit and 10,000-mile anniversary bonus (worth a minimum of $100 towards travel) each year upon renewal, it’s not hard to get more in value than the $395 fee you’re paying each year. Add in the card’s airport lounge access, rental car elite status, and top-notch travel insurance and the card becomes even more of a no-brainer.

Are you sold yet? Great!

Once your new card arrives in the mail, here’s what you need to do next.

Learn more about the *venture x*.

Earn the Bonus Responsibly

No matter how you slice it, spending thousands of dollars to earn this big bonus is no small matter. If you can’t afford to spend (and pay back) a minimum of $4,000 over the next three months, there may very well be better cards out there for you. Simply put, no amount of points or miles is worth a pile of debt and high-interest credit card payments.

Fortunately, there are plenty of ways to meet the minimum spending requirement without going on an irresponsible three-month shopping spree.

Here are a few key points to keep in mind:

- Pay attention to the details: How much do you need to spend and by what date? Set a reminder in your calendar for the weeks and months leading up to the deadline, so you can be sure you won’t miss your goal. And keep in mind that the clock starts from the date you’re approved – not when your new card arrives.

- Know how much you normally spend in a month: If you have a monthly budget spreadsheet or any other means of tracking your monthly finances, see how much total monthly spend you can feasibly put on this new card to meet your goal.

- Track your progress: Use Capital One’s mobile app to see your progress and the date by which you need to meet your minimum spending requirement.

Above and beyond these tips, here are some great ways you can pull this off responsibly:

- Put all purchases towards your goal: From the gas station to the grocery store and beyond, even seemingly small monthly costs can eat up a majority of a minimum spending requirement.

- Pay taxes with a credit card: If you owe the government money each year, you can also pay your taxes with a credit card! There is a small fee, so this may not always be the best option, but it can be a great way to hit your minimum spend on that new card. And with tax deadlines around the corner, it’s not a bad time to consider picking up a new card.

- Get help from an authorized user: Maybe you don’t have a big bill coming up … but what if a family member does? Adding them as an authorized user could help you hit the goal to earn the bonus responsibly. And Capital One allows you to add up to four authorized users on the Venture X card at no additional cost, which makes this even easier.

The Capital One Venture X card earns 2x miles on everything, so when all is said and done, once you’ve hit the minimum spending required to earn the bonus, you’ll actually have at least 83,000 miles in your account. That’s worth at least $830 towards travel, if not much, much more!

Register for TSA PreCheck or Global Entry

If you aren’t currently enrolled in TSA PreCheck or Global Entry, one of the first things you’ll want to do is sign up for one of these expedited security programs. The card will automatically reimburse you up to $120 for the application fee for either program.

Membership in both programs is good for five years and this benefit renews every four years on your Venture X Card. So long as you keep your card open, you should be able to breeze through airport security for many years to come.

If your travels take you out of the country even once or twice per year, opt for Global Entry. Not only does Global Entry include a TSA PreCheck membership, but it’s also your fast pass through customs and immigration when you’re coming back to the U.S.

To get started with Global Entry, you’ll want to apply on the Customs and Border Protection website. If you are only interested in TSA PreCheck, you can apply directly on the TSA website.

Either way, simply pay your application fee for either program with your new Venture X card, and Capital One will automatically reimburse you up to $120 for the charge.

In fact, there is no requirement that this benefit is used by you as the cardholder. If you already have membership in either program, you can use it for a friend or family member instead.

Related reading: Application to Approval in 13 Days: My Global Entry Success Story

Stop By a Capital One Lounge

Capital One is officially in the airport lounge game … and getting access for yourself and two guests is one of the best benefits of being a Venture X cardholder. You can even add up to four authorized users to your account (for free) and they each get their own individual lounge access ,with the same guest privileges, even when they aren’t traveling with you.

Since opening its very first lounge in Dallas-Fort Worth Airport (DFW), to coincide with the Venture X Card’s launch back in 2021, the bank has added two more locations in Washington, D.C.-Dulles (IAD) and Denver (DEN). Each of these spaces are unique in what’s offered but you can generally count on a locally-inspired food and drink menu, comfortable seating with power outlets throughout the lounge, and a first of its kind grab-and-go section for those short on time.

It goes by a slightly different name, but the Venture X will also get you into the newly-opened Capital One Landing at Washington, D.C.’s Reagan National Airport (DCA). This hybrid restaurant-airport lounge concept provides a complimentary sit-down dining experience for travelers, plus paid takeout service. While not nearly as large as a full-blown Capital One Lounge, Capital One Landing is an exciting new option for Capital One cardholders passing through Washington, D.C.

Capital One has plans to open more lounges at Las Vegas (LAS) and New York City (JFK), but opening dates have not been announced for either location yet. Meanwhile, another Capital One Landing at New York City-LaGuardia (LGA) should be opening soon.

Read our complete guide to Capital One Lounges!

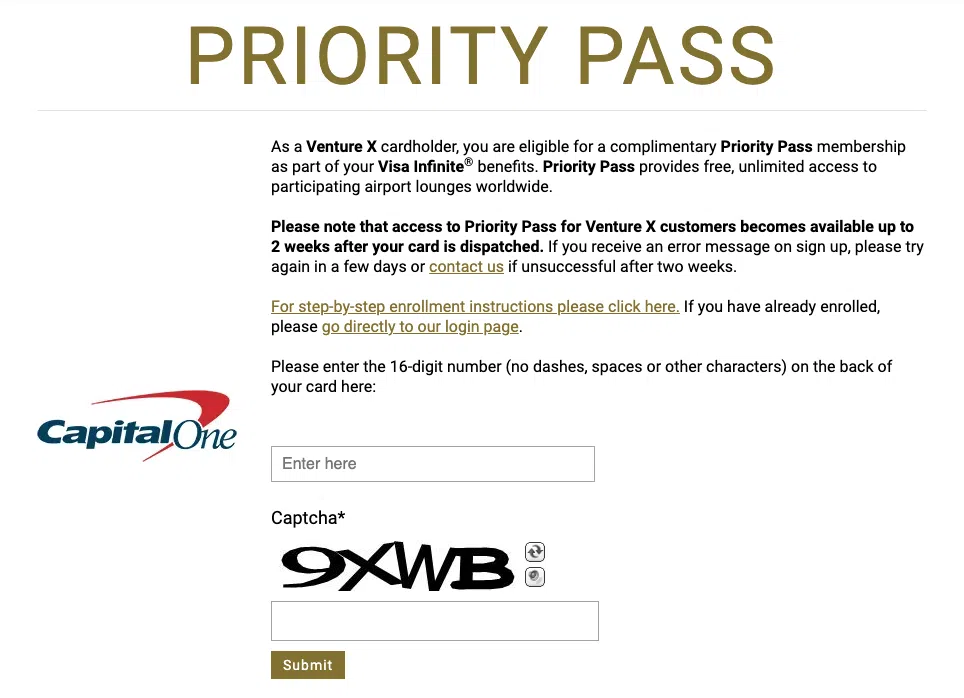

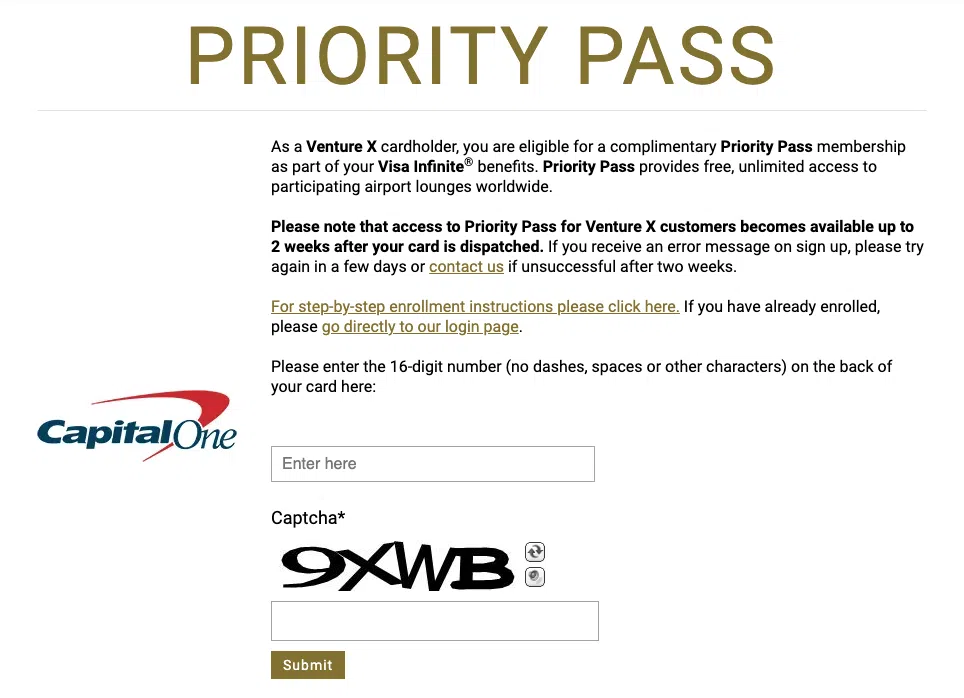

Register for Priority Pass

Capital One Lounge access isn’t all you’ll get with the Venture X card – you also get a complimentary Priority Pass Select membership that gets you and an unlimited number of guests complimentary access to over 1,300 lounges around the globe.

But you can’t just flash your Venture X Card at these lounges to get access – at least not right away. You’ll need to activate your membership within your Capital One account first.

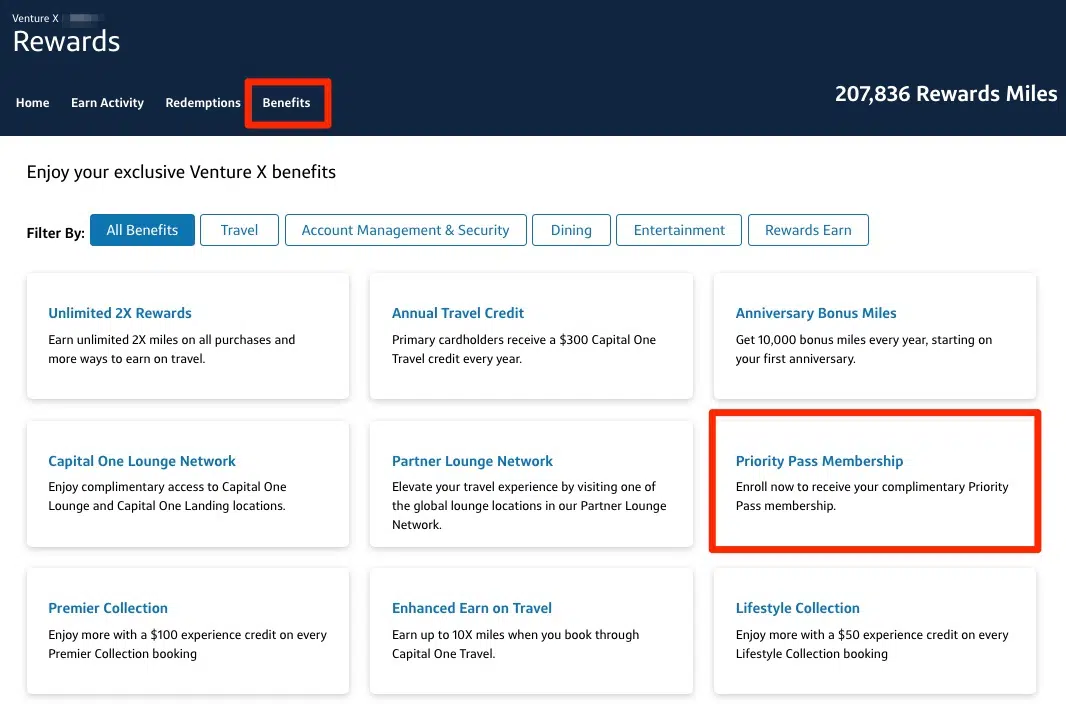

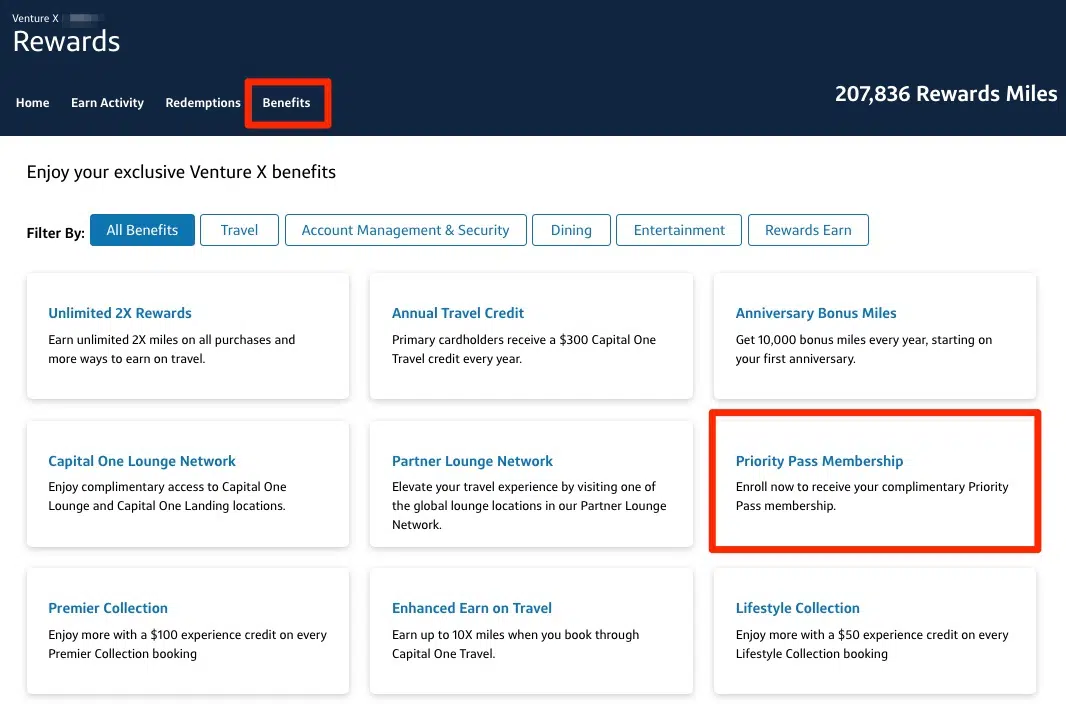

To do this, simply log in to your Capital One online account, go to the “Explore rewards and benefits” option and hit “View Rewards”.

From here, click on the “Benefits” tab at the top and then navigate to the “Priority Pass Membership” button to enroll.

From here, you’ll be directed to a page to register for your Priority Pass access. You’ll need to enter your 16-digit Venture X card number and fill out the captcha form.

You’ll then get Priority Pass login credentials which you can use to log into the Priority Pass app and generate a digital membership card … and eventually get a physical card in the mail, too. But roughly 12 hours after registering your card, you can simply use your Venture X Card at each lounge to get in.

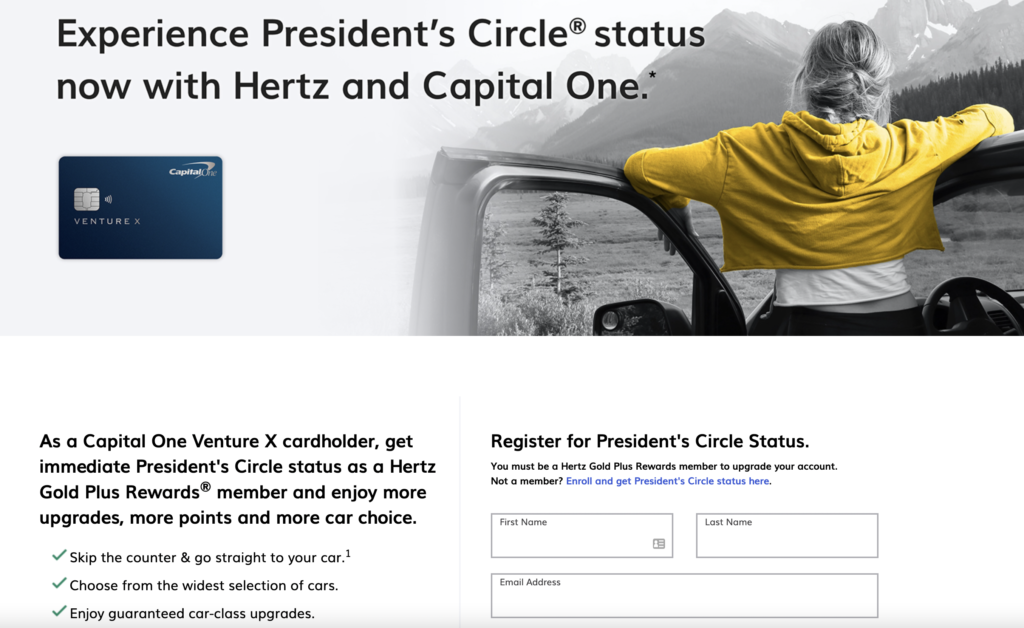

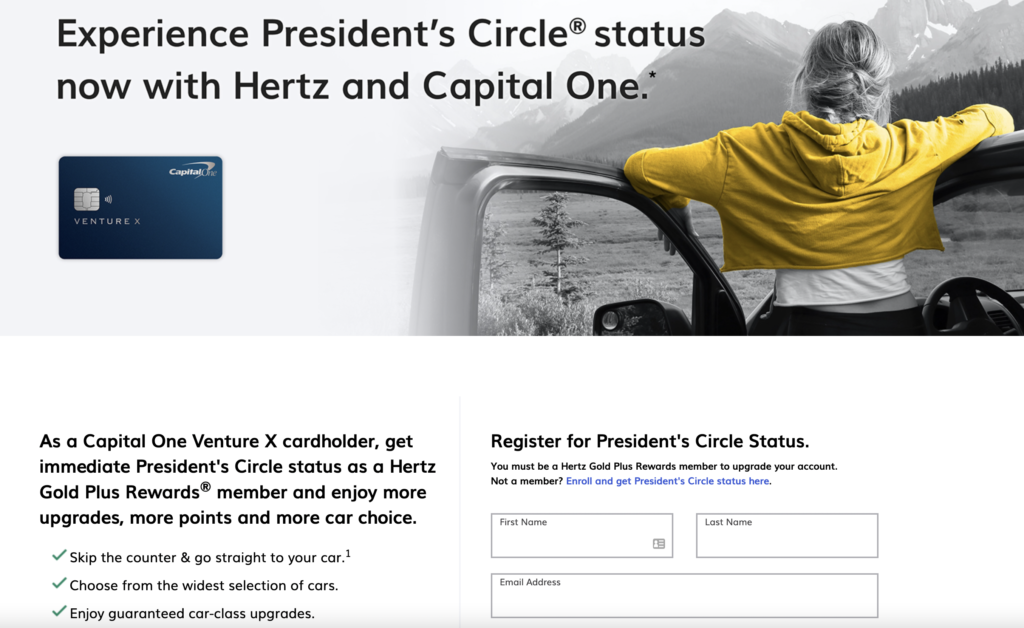

Register for Hertz President’s Circle Status

From the same benefits tab, you’ll also be able to register for Hertz’s President’s Circle status – another benefit of the Venture X card. President’s Circle status allows you to skip the counter and get a guaranteed car-class upgrade, among other benefits.

It’s as simple as entering your Hertz loyalty program number and verifying your personal details. If you’re not already a Hertz Gold Plus Rewards member, you can enroll at the same time that you register for President’s Circle status.

Use Your $300 Annual Travel Credit

Want to make the most of your new card’s benefits? This is a big one.

Each and every year, you get an annual $300 credit to use on Capital One Travel bookings. That goes a long, long way toward offsetting the $395 annual fee you’re paying for the card.

Fortunately, it’s pretty easy to put it to good use on flights, hotels, and rental cars booked through the Capital One Travel portal. Just search and book through the portal, and you’ll instantly get a credit of up to $300 of the total purchase price. If you’re not spending $300 or more all at once, any unused credit will stay available for the remainder of your cardmember anniversary year.

With this credit, you could…

The credit will automatically kick in to cover up to $300 in travel expenses booked through the portal – every year. It’s that easy.

Put Your Capital One Miles to Use

Earning 75,000 Capital One Miles or more doesn’t do you much good if you don’t know how to use them. Thankfully, these are some of the easiest miles to redeem for free(ish) travel.

Cover Any Travel Purchase

Let’s start with the easiest route. This is what Capital One is really known for.

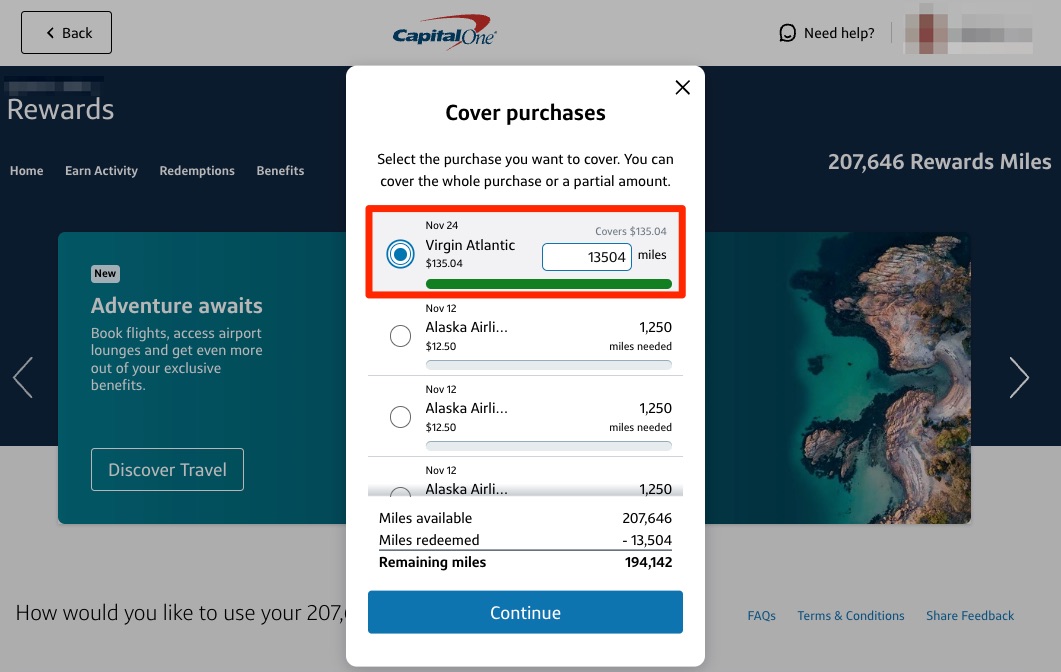

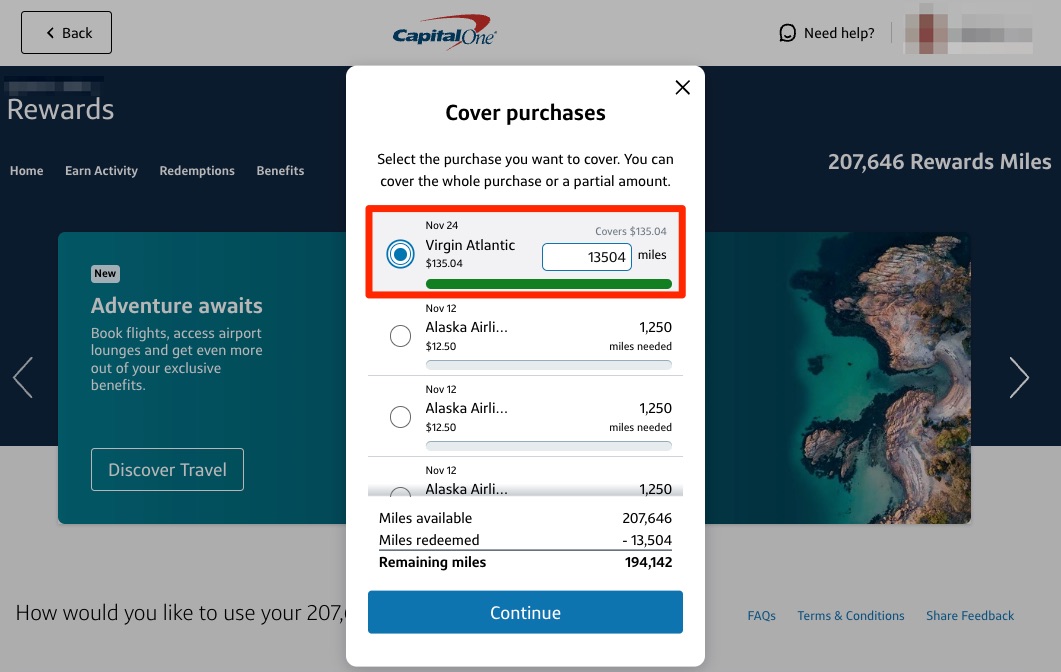

No airline, hotel, or credit card company makes it easier to redeem miles toward travel than Capital One. Just charge your flight, hotel, Airbnb, or almost any other travel expense to your Capital One card. A few days later, you can go in and cover that charge using miles.

With this method, Capital One miles are worth 1 cent each. That means you can book a $500 flight using 50,000 Capital One miles. That may not be earth-shattering value, but it’s easy as can be – and it goes far when you find a cheap flight, hotel or anything else.

Read more: 9 Unique Ways to Cover Travel Purchases with Capital One Miles

Transfer Miles to Travel Partners

If you want to get more value from your miles, you’ll want to look into Capital One’s lengthy list of transfer partners.

Capital One first added the ability to transfer miles straight to airline programs back in late 2018 and after steadily adding more and more partners, it’s now a bonafide option with some killer value out of your miles. This is far and away the best way to get more value out of your Venture Miles, especially if you’re aiming to fly first or business class.

With few exceptions, every 1,000 Capital One miles you transfer gets you 1,000 airline miles or hotel points. Here’s the full list, but make sure to read our guide to Capital One transfer partners and learn how you can transfer your miles!

| Program | Type | Ratio | Transfer Time |

|---|---|---|---|

| Aeromexico | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| Avianca LifeMiles | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific AsiaMiles | Airline | 1:1 | Up to five business days |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Up to 1 day |

| EVA Air | Airline | 2:1.5 | Up to five business days |

| Finnair | Airline | 1:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| TAP Air Portugal | Airline | 1:1 | Same day |

| Turkish Airlines | Airline | 1:1 | Same day |

| Virgin Red | Other | 1:1 | Same day |

| Accor | Hotel | 2:1 | Up to two business days |

| Wyndham | Hotel | 1:1 | Same day |

| Choice Hotels | Hotel | 1:1 | Same day |

Consider this: By transferring just 65,000 Capital One Miles to Turkish Miles & Smiles program, you could book a one-way flight in the incredible Turkish Airlines business class all the way from the U.S. to Istanbul (IST).

Or you could instead use Turkish Miles to fly nearly anywhere in the U.S. with Star Alliance partner, United Airlines. Even after a slight price-hike earlier this, paying 10,000 miles for a one-way economy ticket to far-flung destinations like Honolulu (HNL) is still one of the best deals in all of travel.

Read more: The Best Ways to Use Capital One Miles

Bottom Line

The Capital One Venture X card is one of the best travel rewards cards on the market, period. With a current bonus offer of 75,000 miles after spending $4,000 in the first three months of card membership, you probably don’t need much convincing that this one is worth adding to your wallet.

But getting your new card is only half the battle, from earning the big sign up bonus to activating your laundry list of benefits, these are all the things you need to do next.

Learn more about the *venture x*.