I’m 54 & my wife thinks we ‘can’t afford to retire’ next year even with $2m

2 min readAMERICA’S population is aging swiftly, and millions are rapidly approaching retirement age.

With the Baby Boomers and even younger Americans preparing to leave the workforce behind, many need advice.

Retirement can be a daunting decision, even for those who’ve saved up throughout their careers.

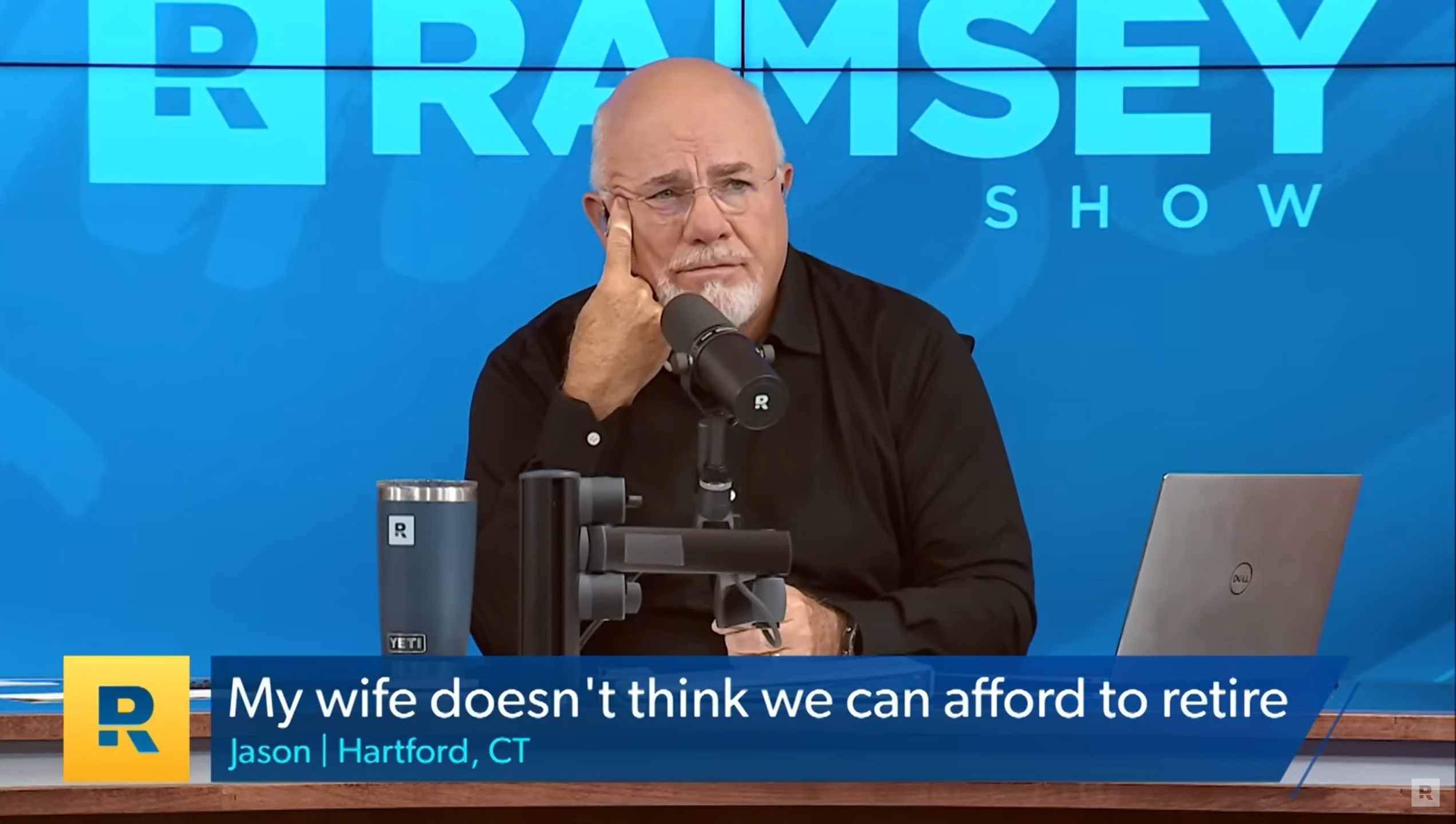

One 54 year old worker called into The Dave Ramsey Show, a financial advice podcast, to ask if he’d be able to retire early.

While he hoped to be able to start a “side-hustle” after retiring, he told the host that his wife was worried about running out of money.

THE CALL

Jason, from Hartford, Connecticut, said he was a longtime listener and money-saver.

Read More about Retirement

He was hoping to retire at age 55 — next year.

Early retirement is a dream for many, but typically remains an unrealistic possibility for most.

Jason, however, felt ready.

“I feel like I have enough savings to retire comfortably,” he told Ramsey.

Most read in Money

Thanks to a retirement savings nest-egg of $2.5 million, the corporate employee said he had enough to quit working.

He and his wife, who makes $160,000 a year and plans to continue working, cannot access all of their savings until age 59 and a half.

That’s the age at which the IRS allows penalty-free withdrawals from 401k savings accounts, per their website.

But with current expenses of just $8,000 per month, Ramsey thought he could swing it.

While the host said that based on the math, Jason could retire, he urged him to stay active in the workplace for longer.

“I’m 63 and I can’t recommend you do nothing,” he said. “It’s not worked out for most of my friends; they die.”

Though he warned against early retirement for this reason, he agreed that Jason had plenty of money.

“The math is, you’re just fine,” Ramsey said.

MORE RETIREMENT QUERIES

A number of other callers have voiced more dire concerns about their retirement situations.

In another recent call to The Ramsey Show, one 71 year old woman revealed that she was still working with no savings.

Ramsey provided her with some options to get back on track, though each required difficult choices.

A budgeting coach recently shared advice for a 43-year old with no savings.

Though the middle aged worker was starting from scratch, they still had several avenues they could take.

She urged them to enroll in a 401k program as soon as possible.

Another wannabe early-retiree recently reached out to a financial column for advice.

The U.S. Sun has listed some of the most common ways to save for retirement.

Discover more from Slow Travel News

Subscribe to get the latest posts sent to your email.