The Cost of Raising A Child

9 min readWill kids ruin your plan to FIRE? (Financial Independence Retire Early) Kids can be expensive, but don’t let that stop you. They might change your plan a bit, but FIRE ... Read more

The post The Cost of Raising A Child appeared first on Retire by 40.

Will kids ruin your plan to FIRE? (Financial Independence Retire Early) Kids can be expensive, but don’t let that stop you. They might change your plan a bit, but FIRE won’t be out of reach. You just have to adapt your plan to include them. Many parents are inspired to work harder than ever after they have kids.

However, I choose to go the frugal route instead. I retired from my engineering career about 18 months after RB40Jr was born. Becoming a SAHD helped reduce child-related expenses tremendously. Fortunately, I had already worked for 16 years by then. That’s one advantage to having a child a bit later in life. We saved and invested for many years and already achieved financial independence.

Kids can be expensive

Diapers, daycare, formula, baby food, clothes, and health care are all costly. No wonder many prospective parents are scared. RB40Jr was born in 2011. Back then, the USDA estimated the cost of raising a child from birth to the age of 17 was $295,560. Yikes! That’s a ton of money. However, I thought this estimate was way overblown. Are kids really that expensive?

Actually, kids don’t cost that much. The parents are the real budget buster. Most parents want a bigger living space, a bigger car, childcare, and other conveniences. In particular, a bigger home costs a ridiculous amount of money today. If you can limit the expansion, kids won’t cost that much.

For example, we lived in a 2 bedroom condo when we didn’t have a child. After RB40Jr was born, we stayed in the same condo until he was 8 years old. Now, we live in a duplex. It’s just a bit bigger than our previous home. Once he starts high school, we’ll expand our living space. Our housing expenses didn’t increase much with one kid. Of course, this depends on the family. Most families want more space and they are willing to pay for a bigger home.

Similarly, we had one vehicle before we had a kid. Now, we still have one vehicle. The parents can control the cost of having a child if they really want to. There are some sacrifices, of course. Recently, Mrs. RB40 started to gripe about not having enough space. We might have to expand earlier than I planned.

Alright, RB40Jr will be 13 soon. We’re 75% done! Let’s add it up and see how much we spent so far.

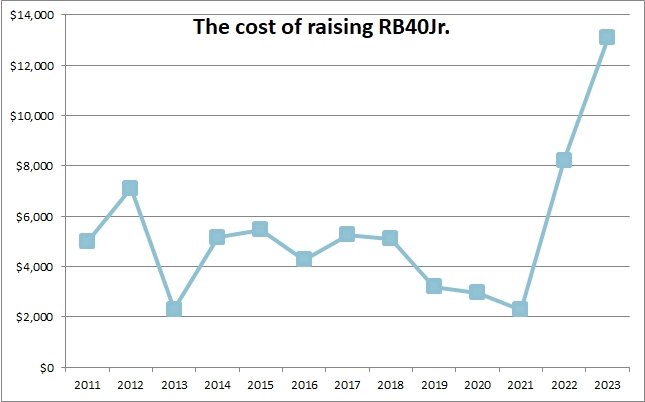

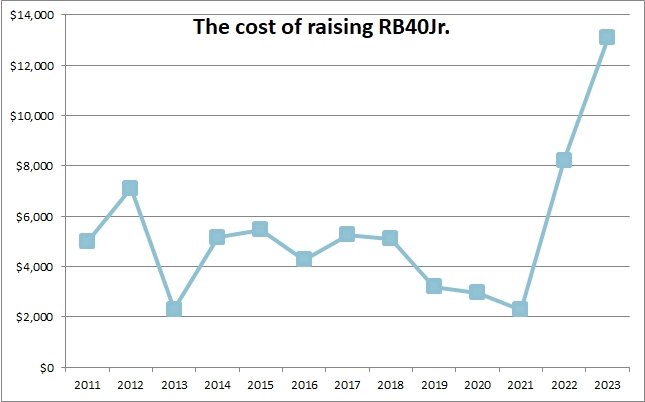

Cost of raising RB40Jr.

Here is a chart for a quick overview. You can see the chart has ups and downs. Generally, parents pay a lot for daycare after a baby is born. We spent a good chunk on daycare until our son was 18 months old. At that point, I became a SAHD and we didn’t have to pay for childcare for about a year.

After that, we put our son in preschool to help him learn to spend time with other kids. Preschool cost much less than daycare. He also took classes geared for his age group, like cooking and tumbling. Once he started public school, childcare expenses dropped to zero. However, other expenses ramped up. We signed him up for soccer, swimming, basketball, Wushu, and other activities. We set a limit of two activities concurrently so he wasn’t overwhelmed.

Child-related expenses decreased during the pandemic. We stayed home for a few years and didn’t do much.

Over the last 2 years, child-related expenses spiked. This is due to a couple of reasons. First, he is growing and eating more. Since 2022, I attributed 1/3 of our food and entertainment expenses to him. Second, we are spending more on travel. He goes on our trips so I attributed 1/3 of travel to him as well. Travel is a lot more costly now due to inflation.

Let’s look at the details.

(2011) Baby: $5,000

Mrs. RB40’s insurance covered almost all of the birthing expenses. From what I recall, we paid very little. I heard this process is more expensive now even with insurance coverage. For the first 6 months, we didn’t have to pay for childcare. Mrs. RB40 took maternity leave, her parents came to help, and I took a sabbatical from my engineering job. We both went back to work after RB40Jr turned 6 months old and put him in childcare. It cost around $1,000 per month in 2011. He was in childcare for 4 months that year. The other expenses were diapers, a crib, baby formula, toys, clothes, and other baby stuff. The total cost for that was around $500 for the year. We’ll round it up to $1,000 in case I missed logging anything in my monthly cash flow spreadsheet.

1 year old: $7,100

2012 was a big year for us. I decided to retire from my engineering career to become a SAHD. The childcare was good, but we didn’t like other people raising our son. RB40Jr was in daycare for 6 months in 2012. That’s about $6,000. The rest of the kid stuff was around $1,100 that year.

2 years old: $2,300

2013 was a cheap year for us. I took RB40Jr to do a lot of free activities around town. We went to summer concerts, explored parks, hiked, and played with other kids. Toward the end of the year, RB40Jr started preschool. It was just a few hours on Tuesdays and Thursdays. That cost $430 per month in 2013. He also grew out of diapers and baby formula that year.

3 years old: $5,160

We changed to a co-op preschool for about 6 months. The co-op preschool was a bit cheaper, but I needed to volunteer occasionally. RB40Jr didn’t like it so we went back to the previous preschool. That year, he spent 3 days per week at the preschool. The price of preschool went up to $500 per month. No school in the summer. Food expenses for RB40Jr were minimal because he ate so little. I assigned 10% of our grocery expenses to him and increased the percentage as he got older.

4 years old: $5,450

This year, he went to preschool 4 days per week and took some additional classes afterward. The price increased to $600 per month. We didn’t do many other organized activities at this point. We had plenty of free things to do.

5 years old: $4,260

We had preschool for 5 months before summer. Then, RB40Jr started kindergarten at the local public school. It was awesome. No more paying for preschool! He started doing more activities this year. We signed him up for soccer, swimming, and some other stuff.

6 years old: $5,259

RB40Jr had more extracurricular activities this year. He did Wushu and soccer. We also started to travel more. That year, we went to Hawaii, California, and Cancun. I assigned 1/3 of the travel expense to RB40Jr.

7 years old: $5,098

He quit Wushu because he got frustrated when he couldn’t get things right on the first try. He switched to basketball and continued soccer. Basketball was at the community center so it was relatively cheap at $100 per month. He quit basketball after a season, though. He just got too frustrated when he missed the basket. We visited Iceland and Thailand that year.

8 years old: $3,190

This year was pretty low-key. RB40Jr had soccer and a couple of summer day camps. It was 2019 and Covid was brewing. Some activities were canceled near the end of the year. We helped my mom move to Thailand this year. The trip didn’t cost much because we stayed with families.

9 years old: $2,957

2020 was not a fun year for anyone. All activities were canceled and the school went online. We spent a ton of time at home. Like most people, we purchased frivolous things to have more fun at home. We got a badminton set, baseball gloves, pop-up soccer goals, a tablet, a kiddie pool, and various other toys. We went to visit my mom in Thailand and took a side trip to Vietnam.

10 years old: $2,273

2021 was another lockdown year. We got more stuff – tennis racquets, a pickleball set, water guns, a baseball bat, and more. We went to Yellowstone for our family trip. We spent a lot of money on groceries this year for some reason. I guess because we ate pretty much every meal at home.

11 years old: $8,219

2022 was way better. Life got back to normal. RB40Jr went back to school. They had various fundraisers and we helped with that. He started Wushu again near the end of the year. We visited Thailand and the Maldives. Mrs. RB40 took a sabbatical that year and we traveled a lot.

12 years old: $13,093

Child-related expenses ramped up in 2023. Activities, clothes, shoes, gifts, summer camp, and a new bike added up to $4,352. A third of travel was $5,901. We visited Disneyland, Washington DC, and Tahiti. A third of the food was $2,840. That year, we loosened up on spending because we were getting older. We wanted to enjoy our money while we can.

Total so far: $69,359

Child expenses so far

Oh wow, that’s a lot of money to spend on a kid. But it’s still below estimate. We’re 75% of the way done so I think we should be able to stay below estimate for the rest of the way. However, child-related expenses will continue to climb. Travel is getting more expensive due to inflation. Also, we want to travel more over the next few years. Once RB40Jr goes to college, we probably won’t get a chance to travel as a family anymore. We want to maximize the next few years together. Lastly, we’ll expand our living space soon. This will increase our housing expenses by around $15,000 per year.

Most of the additional expenses are by choice. We are spending more because we are more comfortable financially. We could reduce travel and avoid expanding our living space if we really need to.

*Note: I apportioned a percentage of our grocery bill to child-raising expenses. I started at 10% when he was 3 and increased it to 33% when he was 12. He is eating a lot! Also, I assigned 1/3 of our travel expenses to RB40Jr.

Conclusion

We are spending less than the USDA estimated, but way more than my parents ever did. We travel more often and signed RB40Jr up for various activities. It’s all good, though. Every parent wants to give their children a nice childhood.

I heard child-related expenses increase during the teenage years. That’s 100% correct in our family. We are traveling more and RB40Jr is participating in more activities. Our housing expenses will double when we expand our living space in a couple of years. The next 5 years will be spendy for us.

After that, it’ll be the college years. I’m not looking forward to that at all. Hopefully, he’ll get some scholarships and financial aid. Higher education isn’t even part of the USDA estimate for child-raising expenses. We are saving for higher education with the 529 plan so that should be helpful.

I hope I didn’t scare you out of having a kid. They can cost a lot of money even when you’re frugal. Being a parent is a very rewarding experience, though. If you want to have a kid, don’t let FIRE stop you. Instead, adapt by making more money or staying frugal longer.

What about you? Do you know how much raising a child costs? I’ll send RB40Jr a bill when he’s rich.

Passive income is the key to early retirement. This year, Joe is investing in commercial real estate with CrowdStreet. They have many projects across the USA so check them out!

Joe also highly recommends Personal Capital for DIY investors. They have many useful tools that will help you reach financial independence.

Latest posts by retirebyforty (see all)

Discover more from Slow Travel News

Subscribe to get the latest posts sent to your email.