How to Live in Georgia (the country) and Pay Zero or 1% Tax

8 min readGeorgia’s attractive visa policy, low tax rates, and high quality of life make it an excellent option to live, work, and invest in. This article explores the tax and lifestyle benefits for high-net-worth individuals looking to live in Georgia and pay little or even no tax. What’s not to like? Bear in mind that this […]

The post How to Live in Georgia (the country) and Pay Zero or 1% Tax appeared first on Nomad Capitalist.

Georgia’s attractive visa policy, low tax rates, and high quality of life make it an excellent option to live, work, and invest in.

This article explores the tax and lifestyle benefits for high-net-worth individuals looking to live in Georgia and pay little or even no tax. What’s not to like?

Bear in mind that this article is not professional tax advice. It will help you consider if tax-friendly Georgia is of interest. If you need a detailed tax planning strategy based on your individual needs, you can find out more here.

Why live in Georgia?

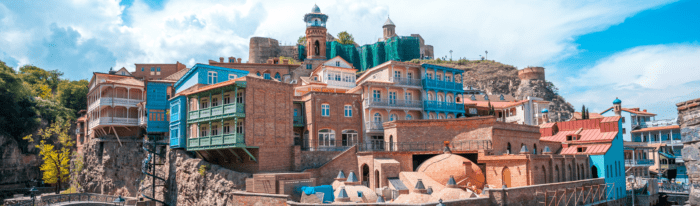

Located in Southwestern Asia, between Turkey and Russia, Georgia is part of the European Union free trade area. It is a beautiful country offering a wide variety of scenery, from the Black Sea coast to the Caucasus mountains to open forests and ski slopes.

An extensive producer of world-class wines, Georgia is home to beautiful churches, mountains, and huge forests. It is an excellent place to work and relax with beaches, casinos, and plenty of recreation options, as well as a vibrant technology-driven capital, Tbilisi, that combines the ancient and modern.

According to our Nomad Passport Index, Georgia offers a one-year visa-free window upon arrival with access to 127 countries. It has an incredibly generous tax rate of 1% for registered independent entrepreneurs.

How to Live in Georgia and Pay Zero or 1% Tax

All personal income is subject to a flat tax rate of 20% in Georgia. However, under a special tax regime, those with an annual turnover of less than 30,000 Georgian lari (GEL) who register as a micro business with no employees are not taxed on their business income.

If you earn up to 500,000 GEL a year, which equates to around US$ 150,000, you can apply for a small business certificate and pay 1% of the income. If you exceed the 500 000 GEL limit, you can still claim small business status if you stay within the income threshold for two consecutive years.

So, suppose you’re a freelancer or entrepreneur looking to relocate your businesses, someone who wants to live in Georgia and pay reduced taxes. In that case, you don’t need tax residence to benefit from the “small business” status.

But please be aware that small business status does not apply to all business activities, for example, consultation services and employment contracts. There is a list of qualifying activities for small business status to be given, and ultimately, the Georgian government has the final say. You must be accurate with your contract terms and ensure they comply with these activities.

If you don’t qualify for the 1% anymore, it goes up to 3% or the regular income tax rate; the status is not revoked immediately.

Other Options for Incorporating in Georgia

Limited Liability Company

LLCs pay 15% corporate tax & 5% personal dividend tax, which is only taxed at the time of distribution. Otherwise, 0% is taxed funds reinvested or held within the company or re-invested into other companies owned by the company.

Virtual Zone Company

These unique tax entities pay 0% Corporate tax, 5% dividend tax, and 0% VAT (the standard VAT rate is 18%). Special tax rates only apply for specific IT businesses looking to base their offices in Georgia with clients outside Georgia.

International Company Status

Get this, and you will pay 5% profit tax, 0% dividends, and only 5% salary tax. It generally applies to IT and maritime companies (or companies with divisions in those fields) looking to base their offices in Georgia and have staff here.)

Why consider Georgia for business incorporation?

- Cheap setup and maintenance costs

- Reputation as a reputable jurisdiction for banking.

- Employees with good English skills.

- Get residence and tax residence but do not have to.

- Minimize your tax burden.

Becoming a Tax Resident in Georgia

One issue, if you are not a tax resident, is that under the system of worldwide taxation, you may be taxed on the income you make in Georgia by your jurisdiction at standard rates. This negates any benefit of the 1% rate.

The best way to take full advantage of Georgia’s tax-friendly regime is to relocate there, gain tax residency, and become a citizen or resident. Another incentive is Georgia does not tax resident individuals on their foreign-source income.

You need to be located in Georgia for 183 days over a continuous 12-month period in the tax year to be recognized as a tax resident of Georgia or be a high net-worth individual to get tax residence without living there.

How To Get Georgian Citizenship

To get Georgian citizenship, you must build your case, invest wisely, and make strong connections there. However, if you meet the conditions in Georgian law, the state makes gaining citizenship possible for many.

By acquiring citizenship, you become legally equal to every other Georgian citizen and can enjoy various benefits. There are three main ways to get citizenship: Ordinary procedure, marriage, and fast-track naturalization. The conditions are;

- Being an adult that has lawfully resided in Georgia for the last ten consecutive years from the day of applying.

- Knowing the official language, history and principles of law within established limits

- Having a job or owning real estate in Georgia.

- Having business interest there or having an interest or shares in a Georgian enterprise.

You should provide a document proving a legal and uninterrupted stay in Georgia, a visa, residence permit, or a stamp verifying entry. A special commission tests the language and history component and generally is easy. You should get language lessons if you need them.

Citizenship by marriage is granted to a person married to a Georgian citizen who has legally resided in the country for an uninterrupted five years. The language, history, and legal requirements also apply here. The duration of the marriage isn’t taken into account; the primary condition is continuous presence in the territory of Georgia for five years plus the marriage.

Applications for citizenship can be submitted in person or through an authorized representative at the territorial offices of the public service agency or a community center. If you live outside Georgia, you can apply to a diplomatic mission or consular office or online via the public service website. The documents to be submitted are a marriage certificate, documents showing your spouse’s citizenship, proof of continuous residence for five years, and an ID card or passport.

The President of Georgia may grant citizenship to a foreigner who has contributed exceptional merit to Georgia or based on the state’s interest. This is what is called fast-track naturalization. The following circumstances are taken into account.

Foreign citizens shall make an investment that contributes substantially to the development of the state’s economy. The question is, how do you acquire that? It was a more straightforward process before recent changes to the legislation. You used to be able to invest in Georgian real estate or promote Georgia, but that is no longer enough.

Now, you must make ties with Georgia by investing in businesses that contribute to tourism, health, and wellness, building hotels in the mountain regions, etc.

The President of Georgia has discretion over who is accepted, but in the event of an adverse decision, you can reapply after one year.

The granting of citizenship comes into effect on the renunciation of foreign citizenship by the individual. The whole thing takes a maximum of 80 days, after which an interview with the commission is held. You also need letters of recommendation from at least two Georgian citizens or legal entities and a letter from the Georgian ministry approving your investment.

Doing Business in Georgia

Large foreign direct investment inflows have driven rapid economic growth in Georgia over the past two decades. A liberal investment environment for foreign investors makes the country an attractive destination to live, work, and invest,

Georgia is a highly efficient country for doing business; it does not impose foreign ownership restrictions, and bureaucracy is minimal. It is strategically located with access to European and Asian markets. As well as being a transport hub with many ports, it is a significant energy corridor with oil pipelines linking Asia with Europe.

Tbilisi is the business and investment capital of the country. Georgia is part of the European Union free trade area and is 7th on the World Bank’s’ ease of doing business’ list.

Business Opportunities in Georgia

The best business opportunities to pursue are hospitality, tourism, agriculture, energy, marketing, transportation, real estate, food and restaurants, information technology, and the beauty industry.

The agricultural sector employs over half of the state’s labor force. Georgia counts several million tourists on an annual basis. Real estate is a significant contributor to the Georgian economy and is still growing.

Investing in Georgian real estate can be very successful whether buying, selling, renting, or doing holiday lets. There are various ways to approach this area. Hotel occupancy is high, so opening your own business might be very profitable.

Manufacturing is another excellent opportunity, with a growth-friendly tax environment, free trade agreements, a US$2.3 billion market, a young skilled labor force, and low utility costs in the region.

Georgia is a good outsourcing and remote business location with a young, energetic, and employable workforce with favorable tax and support for IT services. By obtaining virtual zone company status, you can enjoy a 0% profit tax on services delivered outside Georgia and 0% VAT.

The Georgian government encourages foreign investment in many ways. Low corporate tax and co-financing opportunities are available from Enterprise Georgia. There are also funds available to facilitate the development of regional tourism. There are free zones where favorable tax and customs legislation applies to manufacturing, agriculture, and IT.

Conclusion

As a fast-developing country, Georgia has all the ingredients for those looking to live a beneficial lifestyle, reduce their tax bill, and go where they are treated best. And that, in a nutshell, is our Nomad Capitalist philosophy.

It is sometimes about moving to a recognized tax haven. Yes, you can legally reduce your taxes there, but it’s not always the best option for digital nomads and entrepreneurs.

Georgia is not a far-flung location; it’s a beautiful, vibrant, tax-friendly country that’s very much connected to opportunities for both travel and business in Europe and Asia.

Georgia has become one of the most capitalist countries in the world, with plenty of opportunities for business and wealth creation. If you choose to gain residency there, you can join a small business scheme where you can pay as little as 1% tax every year.

Most of your worldwide income is tax-free, and it’s one of the cheapest places to live in.

If you don’t fancy the idea of lugging a suitcase around the globe or continually settling into a new location, Georgia is an excellent place to settle down for at least some time. It’s also one of the most stable offshore banking jurisdictions, with its tax policies and ease of doing business.

If small business isn’t a term that sits well with you, Georgia offers a simplified tax system, including a flat 15% corporate profits tax.

Georgia offers an excellent tax and lifestyle-friendly environment for those seeking to establish companies, open bank accounts, apply for residency or citizenship, and pay little or no tax.

This is all about choosing your tax rate and legally reducing your taxes while living your desired lifestyle by getting out from under your own country’s tax system.

At Nomad Capitalist, we call it our tax-friendly quadrant to legally reduce your tax bills, diversify and protect your assets, become a global citizen, and maximize your freedom.

With proper planning, all of that can be achieved, and Georgia is just a place where, as part of a bespoke strategy, you can make it happen.

We have helped 1,500+ HNWI clients and can help you, too. Find out how here.