No Bonus, No Problem: How to Keep Earning Points Without a Welcome Offer

7 min readThere’s no better way to travel more for less than using credit card points and airline miles – and these days, the easiest way to earn them fast is with a big welcome bonus on a travel credit card. Open a new card, spend a few thousand dollars, and you can earn up to 100,000 points or more.

But what about after that? Once you’ve earned and spent those points, how are you supposed to earn enough to book another (nearly) free flight or hotel? Others might tell you to throw that card in a drawer and open another one to earn yet another bonus … but that isn’t always an option – nor is it always a financially responsible move.

From being strategic with your spending on the cards you have to using shopping and dining portals to referring friends and family for your card, there are plenty of ways to pad your stash of points beyond a lucrative signup bonus. Each of these methods of earning points may not rival a big signup bonus, but they can add up fast.

Here are the some of the best (and easiest) ways to keep racking up points and miles after that big bonus hits.

Maximize Your Everyday Spending with Bonus Categories

With most travel rewards cards, you’ll get at least 1x point per dollar you spend on anything. But you can do much better.

From airfare and dining to gas stations and streaming services, you can earn 2x, 3x, or even 10x the points by shifting your spending in those areas to the card that will net you the most rewards.

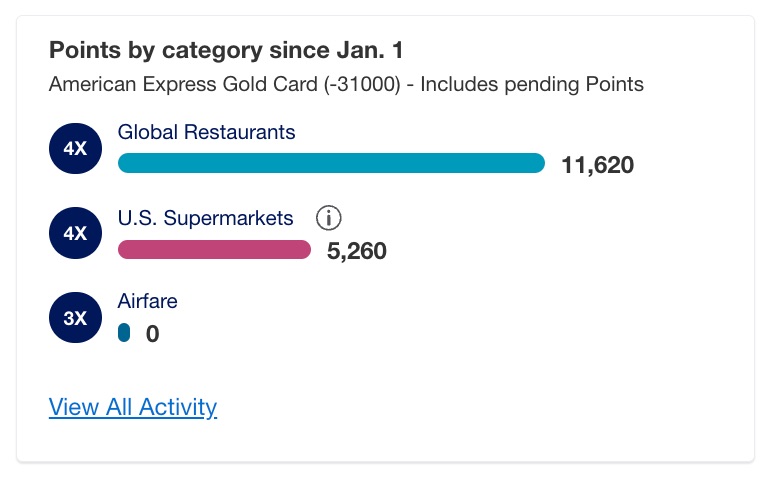

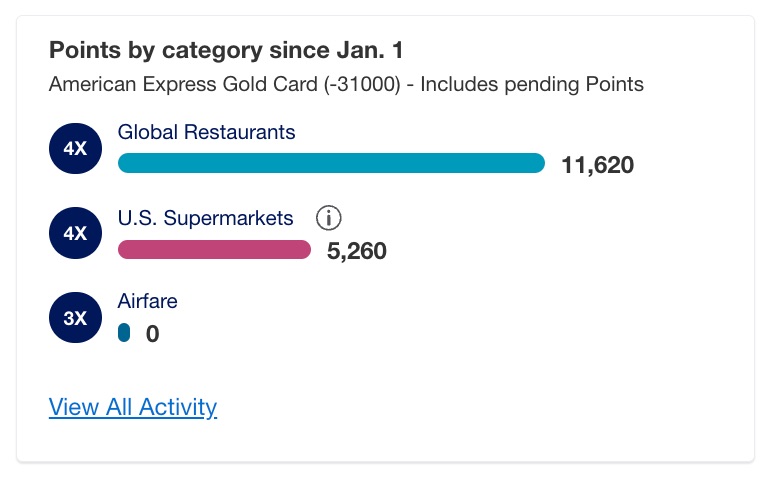

Take the *amex gold*, for instance. It earns 4x points per dollar at restaurants, plus 4x per dollar at U.S. supermarkets (on up to $25,000 each year, and 1x points thereafter) – two of the biggest expenses for most households, including mine. This year alone, I’ve already earned nearly 17,000 Membership Rewards by using my Gold card at restaurants (including takeout and delivery) and for groceries.

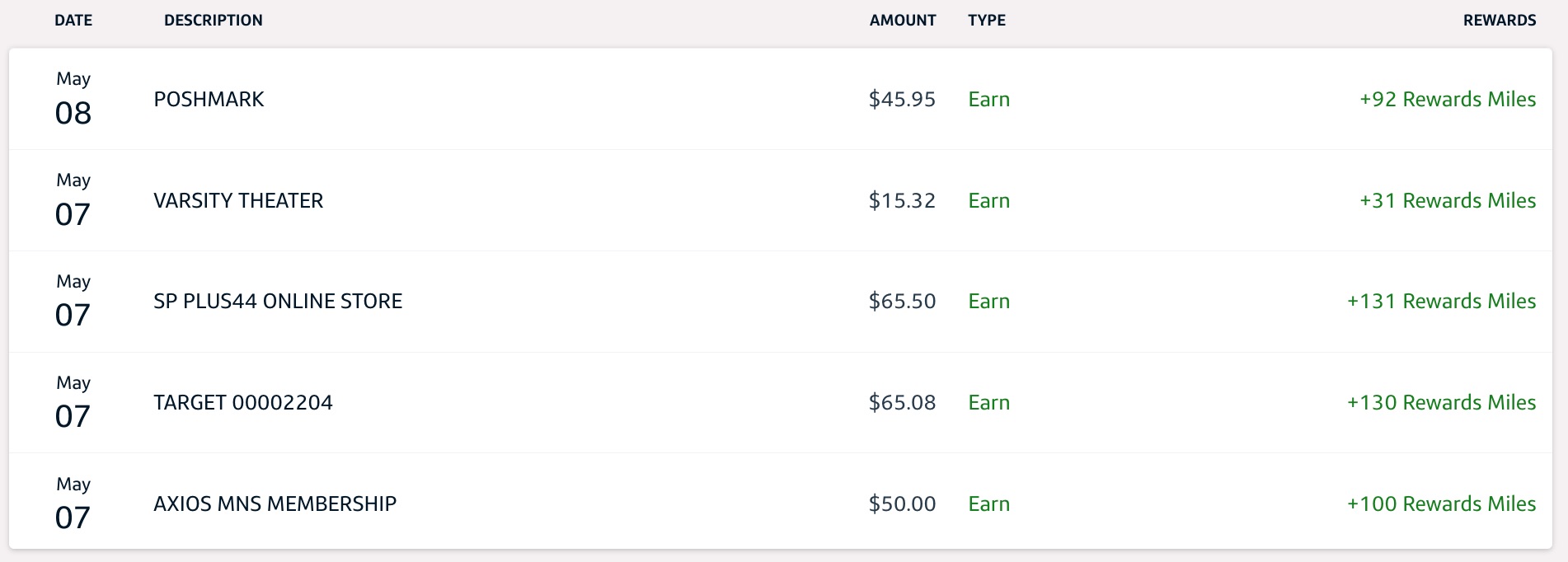

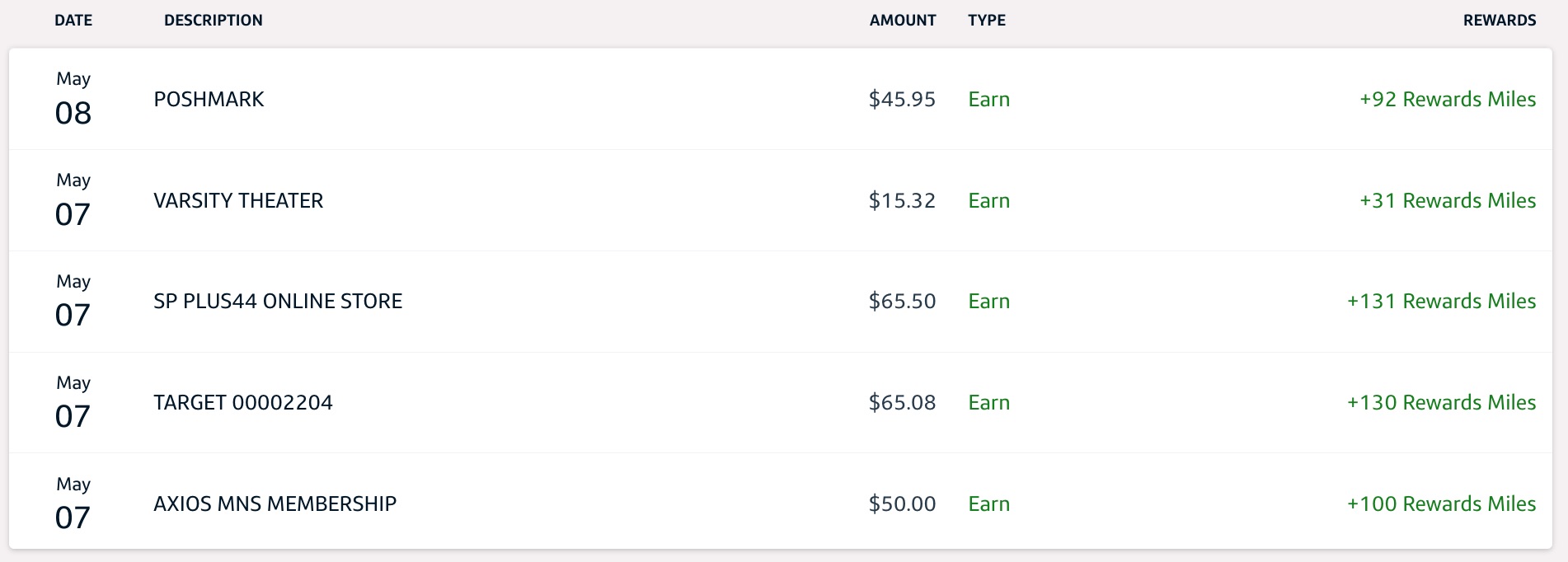

All other spending – especially any big purchases – goes on my *venture x*, which earns at least 2x miles … on everything! That should make a Venture X Card (or even the *capital one venture card*) a good catch-all card for your everyday spending.

Don’t leave points and miles on the table! Do a quick audit of the benefits and perks of your travel card and swipe it where you’ll get the most bang for your buck.

Utilize Shopping Portals

Let’s be honest: Most of us are doing our shopping online these days. If that’s you, too, take advantage of shopping portals to earn additional points and miles for almost every purchase you make online.

It’s as simple as remembering to click through one of these portals to earn those points rather than going straight to the store’s website. Many shopping portals even have handy internet browser extensions that make it easier to automatically earn bonus points.

Travelers with cards like the *chase sapphire preferred* and *chase sapphire reserve* can use Chase’s shopping portal which they brand as Shop Through Chase. You can earn bonus Chase points on any purchases you make through the shopping portal – and while you need a Chase card to use it, you don’t have to actually pay with that card to earn the points.

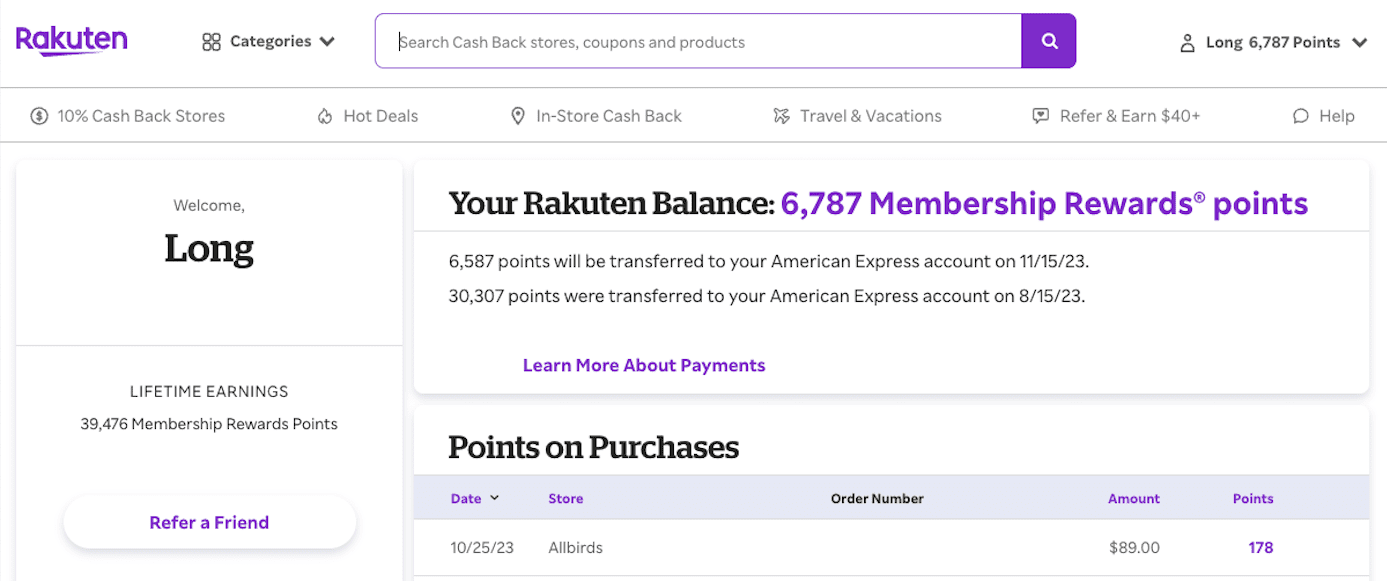

Rakuten is one of our absolute favorite shopping portals – especially if you have a card that earns Membership Rewards points like the The Platinum Card from American Express, the American Express Gold Card, or the American Express Green Card. Rather than earning cashback as normal, you can use Rakuten to earn bonus Membership Rewards points for your online shopping.

Read our full guide to using Rakuten!

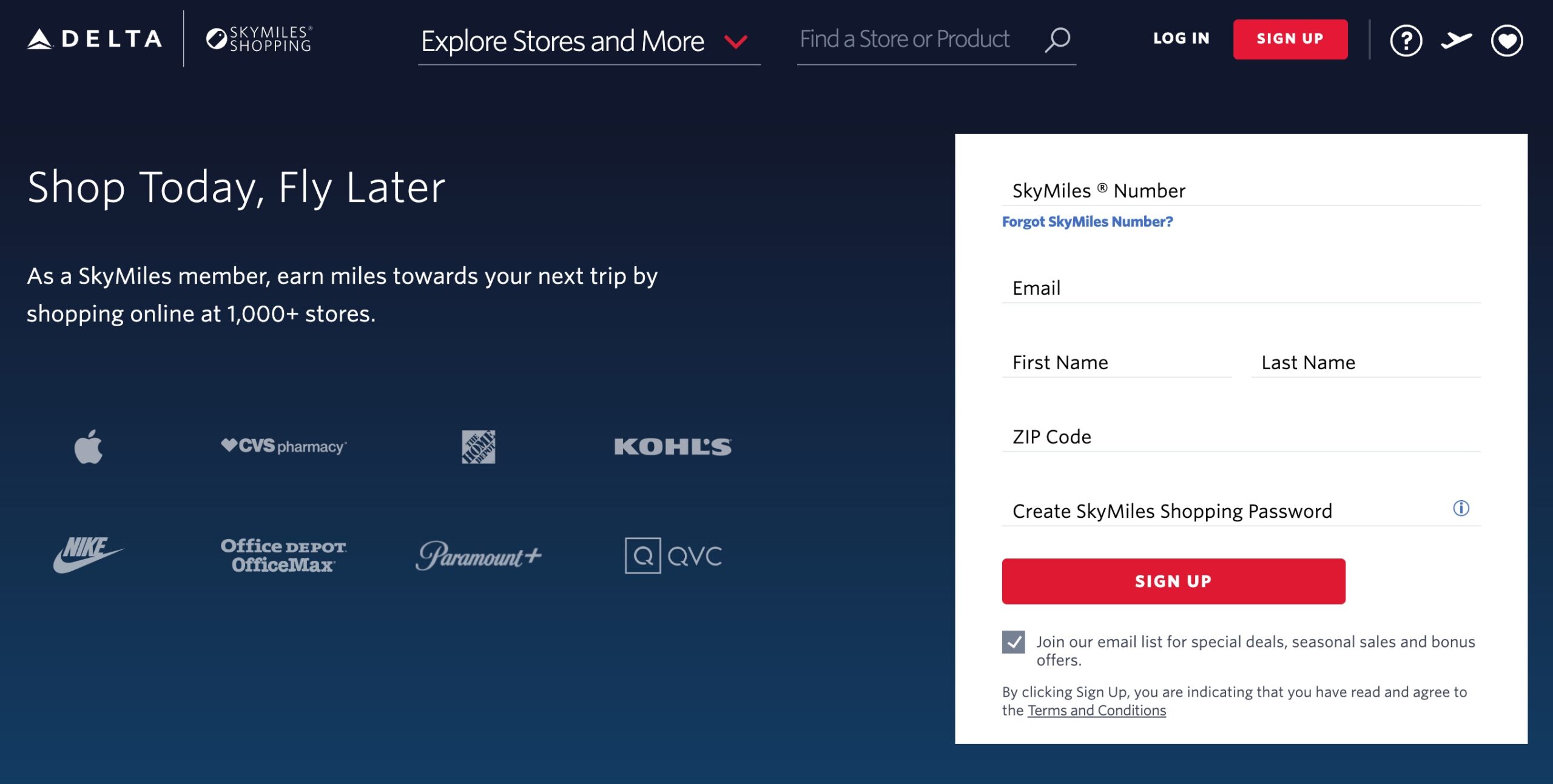

Earning more credit card points is always a wise move, but most major airlines offer their own online shopping portals that can help you earn more airline miles, including:

Not sure which site to use to get the best return? Head to Cashback Monitor.

Just type in the retailer you’re buying from, and Cashback will show you which shopping portals are offering the best bonuses. Just click through, start shopping, and earn more back.

Sign up for Dining Portals

Why not earn even more points when you’re out to eat?

Airline dining programs are an easy way to keep adding to your stash of miles. Join with your frequent flyer number, link a credit or debit card. Beyond that, you don’t need to do anything differently: You’ll earn miles whenever you dine at a participating restaurant.

For example, say I join Delta’s SkyMiles Dining program and pick up the $54 tab for a meal at Borough in downtown Minneapolis. Since I earn 3 SkyMiles for every dollar I spend at participating restaurants, I’d earn 162 SkyMiles for that meal. That’s not a ton of SkyMiles, but it adds up throughout the year.

You don’t need to hold one of the airline’s credit cards to join the dining program, either all you need is a frequent flyer account. Plus, you’ll likely get some bonus miles just by signing up: anywhere from 500 to 1,000 miles!

Plus, you can still earn points on the card you use to pick up the tab. So if I paid for that same $54 dinner on my Amex Gold Card (which earns 4x points at restaurants), I’d earn 216 Amex Membership Rewards points on top of the 162 SkyMiles through Delta’s dining program.

Refer Friends & Family

Have a friend or family member who is thinking of opening a new travel credit card? Share the love: Have them apply through your referral link.

With most banks’ referral programs, they’ll still be able to get a nice signup bonus for opening that card – it’s almost always identical to what they’d earn by applying directly with the bank. Sometimes, the welcome offer you share is even bigger, like the 175,000-point bonus we’re seeing through referral links to the Amex Platinum Card right now.

But there’s something in it for you, too: You’ll get a decent chunk of points or miles for each successful referral. It varies from bank to bank and even from card to card, but you can typically expect to earn anywhere between 10,000 to 25,000 points if your pal is approved. Most banks cap how many bonus points you can earn from referrals each year.

With my Capital One Venture X card, for example, I can earn 25,000 Capital One miles for each person I refer who gets approved for the card – for up to 100,000 miles via these referrals each calendar year.

It’s an easy way to quickly build your points balance without spending another dime on your card!

Ask for a Retention Offer Before You Renew

Retention offers are a great way to earn bonus points and miles for keeping your card open after you’ve earned that big welcome bonus. They’re the banks’ way of convincing you to stay on as a customer (and pay another year of annual fees) if you’re thinking of canceling your card.

Oh, and a little tip: You can get one of these retention offers even if you aren’t actually thinking about letting your card go.

Banks might offer anything from statement credits to discounted annual fees to a stash of bonus miles – or a combination of the three. After Delta’s recent round of changes to its slate of co-branded Amex cards, we even saw reports of up to a whopping 90,000 SkyMiles for keeping your Delta card open and spending a few thousand dollars on it. That’s like getting a new card welcome offer all over again!

Critically, you have to ask for a retention offer – or at the very least, threaten to close your card. Don’t expect the bank to come to you offering a bonus.

Simply call up the customer service line on the back of your card – or chat online (when logged into your account) – and let them know you’re thinking about canceling a credit card unless there’s a discount or other incentive to keep your card open.

Just because you ask doesn’t mean you’ll get a retention offer – it varies bank by bank and from person to person. Still, it’s worth asking, even if you’re not seriously thinking of canceling your card. The worst they can say is no.

Bottom Line

A big welcome offer for opening a new credit card is the easiest way to earn a bunch of points and miles quickly. But it’s not the only way to pile up points to redeem for flights and hotels on your next trip.

This is by no means an extensive list, but these are a few of the best ways to keep adding to your points and miles balance after you’ve already earned (and maybe spent – good for you!) your card’s big welcome bonus.