Financial Independence Journey 2024 Update

8 min readBoth Mrs. T and I had a frugal uprising and learned to always spend less than we earned but we didn’t focus on our finances until our financial epiphany in 2011.

The financial epiphany allowed us to discover the financial independence retire early movement (the FIRE concept was there before 2011 but the term wasn’t). More importantly, after reading various personal finance & investment books and personal finance blogs, we honed in on the dividend growth strategy, which eventually evolved into a hybrid investing strategy by holding both individual dividend stocks and index ETFs.

We liked dividend investing due to its simplicity – invest in companies that make products that you rely on daily. We also liked indexing for the ability to diversify geographically and sectorally.

The idea of living off dividends was born after doing more research and reading stories of early retirees. It was inspiring to talk and meet folks who have been living off dividends for years and enjoying their lives and working optionally.

It also helps when I have family members who have retired in their 40s and learn about their retirement lives and what they did to get there.

When we first started, we thought we’d need between $40,000 to $50,000 in dividend income to cover our living expenses. Our spending history showed that we have been spending under $40,000 in core expenses. But core expenses exclude expenses like charitable donations, dining out, vacations, and discretionary spending.

So from an income perspective, I believe we need a total of $60,000 to sustain our current lifestyle.

But this amount doesn’t include RRSP, TFSA, and RESP contributions. When we are “retired” we most likely will stop contributing to our RRSPs. We plan to continue contributing to our TFSAs and RESPs. RESP contributions will eventually stop when both kids reach age 18 and we start making RESP withdrawals.

We will most likely spend more on travel as we’d have more time to explore the world when we “retire”. Over the last few years, we have also been focusing on gaining valuable experiences. This change in mentality led to us spending about $25,000 in travel expenses in 2023, which is much higher than in other years.

Therefore, $70,000 per year of dividend income should be a better target to aim for. Anything above $70,000 would provide us with some margin of safety.

We arbitrarily set a goal to live off dividends by 2025 when I was writing my blog bio some years ago. In our early 40s, we are extremely grateful that we’re doing well financially. It is no longer a question whether we will reach financial independence or not. It is a matter of when.

In reality, we are not too set on reaching that key financial milestone by a specific year. We are simply enjoying the journey.

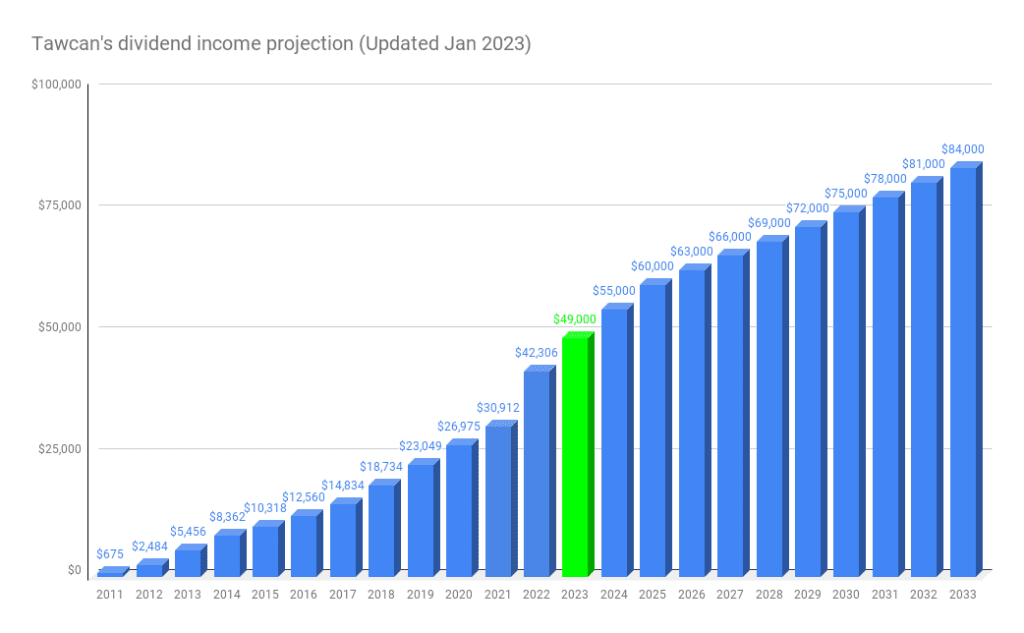

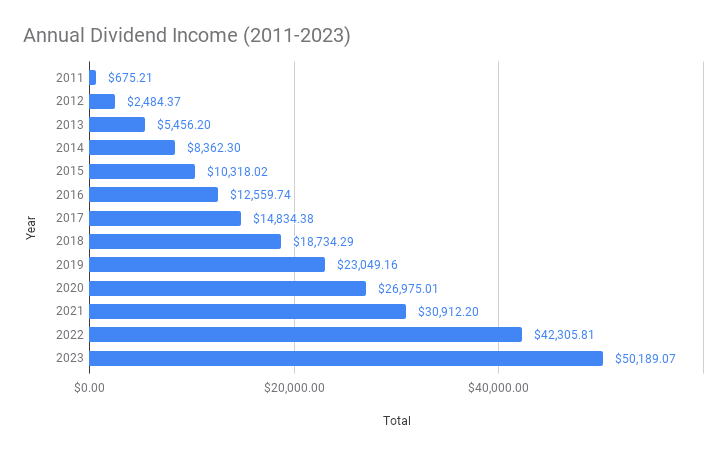

Dividend Income Progress

In 2023 we received $50,189.07 in dividend income. This was ahead of our projection of $49,000 by 2.4%.

The $50,189.07 in dividend income was able to cover over 100% of our core spending in 2023. It didn’t quite cover all of our annual expenses but that shouldn’t come as a big surprise given our significant travel spending.

It’s quite mind-blowing to see that we have more than doubled our dividend income in about four years. We have been able to consistently grow our dividend income year over year (The wonders of the dividend snowball!!).

| YOY Growth % | |

| 2011-2012 | 267.94% |

| 2012-2013 | 119.62% |

| 2013-2014 | 53.26% |

| 2014-2015 | 23.39% |

| 2015-2016 | 21.73% |

| 2016-2017 | 18.11% |

| 2017-2018 | 26.29% |

| 2018-2019 | 23.03% |

| 2019-2020 | 17.03% |

| 2020-2021 | 14.60% |

| 2021-2022 | 36.86% |

| 2022-2023 | 18.63% |

It’s interesting to note that in the last five years, we have been averaging a 22% YoY growth. By coincidence, we averaged 22.2% YoY growth when we excluded the first three years of data points (we were moving large amounts of money from mutual funds & GCIs into our dividend portfolio).

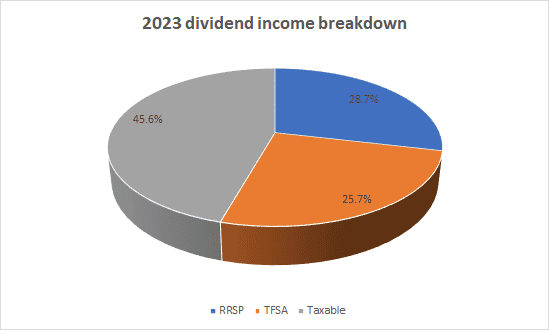

We invest in TFSA, RRSP, and taxable accounts and utilize the following strategy to be as tax-efficient as possible:

- TFSA: Canadian dividend stocks, income trusts, and REITs.

- RRSP: US & Canadian dividend stocks, income trusts and REITs

- Taxable: Canadian dividend stocks only

Every year we aim to max out our TFSAs on January 1st and use the money to invest in dividend stocks or index ETF by the first week of January (we don’t try to time the market). We then contribute money toward our RRSPs and try to max out our RRSP room by April or May. Sometimes we even purposely over-contribute to our RRSP. Once TFSAs and RRSPs are maxed out, we then invest money in our taxable accounts.

I started a self-directed RRSP with Questrade in 2012 and moved my employee portion of the work RRSP to the self-directed RRSP each year. Seeing this RRSP account performing quite well, I set up a spousal RRSP and have contributed to it since 2016. The goal is to have the two RRSP values roughly equal by the time we start making withdrawals.

It’s a lofty goal though, considering the actual dollar amount of my two RRSPs is currently about 2.5 times the spousal RRSP value, given the fact that I have been contributing to the former far longer.

Thanks to holding dividend stocks across the different all accounts, only 45.6% of our 2023 dividend income was taxable.

- RRSP: $14,384.61

- TFSA: $12,913.87

- Taxable: $22,890.59

Since my income level is higher than Mrs. T’s, our taxable dividend income wasn’t quite a 50-50 split. Rather, it’s about a 40-60 split between Mrs. T and I. While the goal is to hopefully get to an equal split, given the income level difference, that may not be possible.

In 2024 I decided to be a bit more conservative with our dividend income projection. This is simply to prevent us from buying and adding high-yield stocks for the sake of hitting our dividend income goal and taking on unnecessary risks. If companies continue their dividend raising streaks, and we continue to drip, there’s a high chance of exceeding this target.

Since 2011, we have done a fantastic job in growing our dividend income!

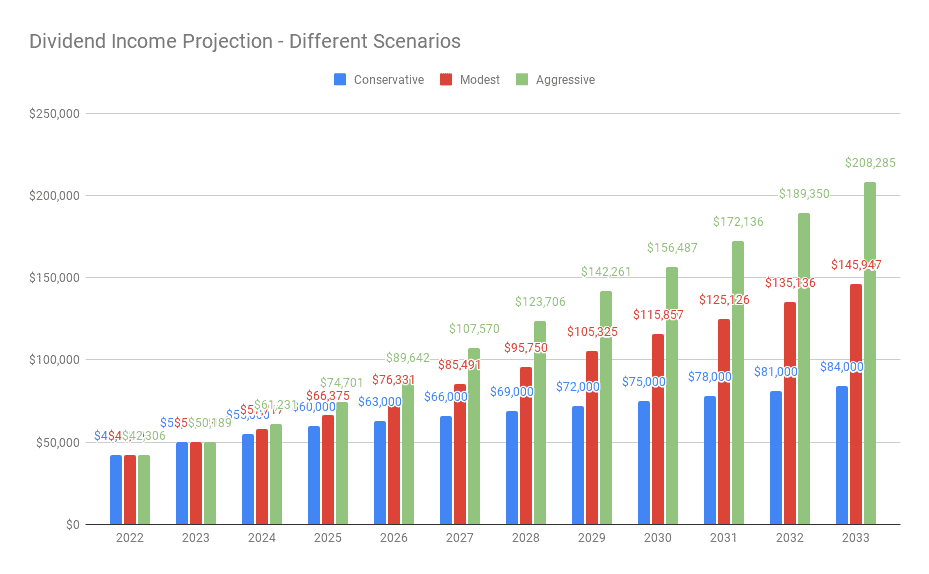

Dividend Income Projections – different scenarios

I mentioned that I opted for a conservative projection for 2024 and moving forward. But what happens if we were to take a different approach to the dividend income projection?

| Conservative | Modest | Aggressive | ||||

| Income | YoY % | Income | YoY % | Income | YoY % | |

| 2022 | $42,306 | 18.63% | $42,306 | 18.63% | $42,306 | 18.63% |

| 2023 | $50,189 | 9.59% | $50,189 | 9.59% | $50,189 | 9.59% |

| 2024 | $55,000 | 9.09% | $57,717 | 15% | $61,231 | 22% |

| 2025 | $60,000 | 5.00% | $66,375 | 15% | $74,701 | 22% |

| 2026 | $63,000 | 4.76% | $76,331 | 15% | $89,642 | 20% |

| 2027 | $66,000 | 4.55% | $85,491 | 12% | $107,570 | 20% |

| 2028 | $69,000 | 4.35% | $95,750 | 12% | $123,706 | 15% |

| 2029 | $72,000 | 4.17% | $105,325 | 10% | $142,261 | 15% |

| 2030 | $75,000 | 4.17% | $115,857 | 10% | $156,487 | 10% |

| 2031 | $78,000 | 4.17% | $125,126 | 8% | $172,136 | 10% |

| 2032 | $81,000 | 4.17% | $135,136 | 8% | $189,350 | 10% |

| 2033 | $84,000 | 4.17% | $145,947 | 8% | $208,285 | 10% |

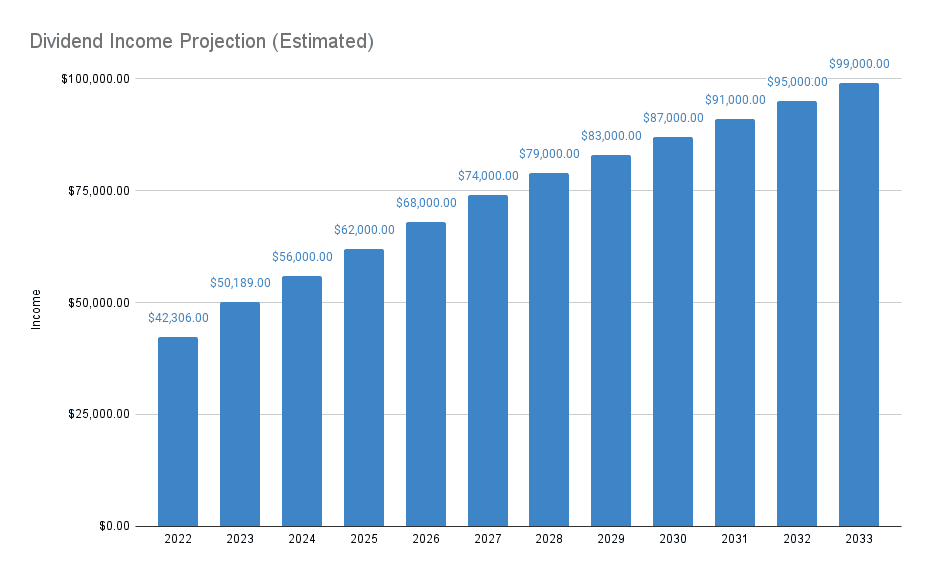

Visually it’d look something like this:

Based on these projections, we can conclude the following:

- Conservative model: live off dividends by 2029

- Modest model: live off dividends by 2026

- Aggressive model: live off dividends by 2025

But is this realistic? Let’s take a look at how much “fresh” capital would be required to generate such growth assuming a 4% dividend yield.

| Conservative | Modest | Aggressive | |||||||

| Income | YoY % | $ Required | Income | YoY % | $ Required | Income | YoY % | $ Required | |

| 2022 | $42,306 | – | – | $42,306 | – | – | $42,306 | – | – |

| 2023 | $50,189 | 9.59% | $197,075.00 | $50,189 | 9.59% | $197,075.00 | $50,189 | 9.59% | $197,075.00 |

| 2024 | $55,000 | 9.09% | $120,275.00 | $57,717 | 15% | $188,200.00 | $61,231 | 22% | $276,050.00 |

| 2025 | $60,000 | 5.00% | $125,000.00 | $66,375 | 15% | $216,450.00 | $74,701 | 22% | $336,750.00 |

| 2026 | $63,000 | 4.76% | $75,000.00 | $76,331 | 15% | $248,900.00 | $89,642 | 20% | $373,525.00 |

| 2027 | $66,000 | 4.55% | $75,000.00 | $85,491 | 12% | $229,000.00 | $107,570 | 20% | $448,200.00 |

| 2028 | $69,000 | 4.35% | $75,000.00 | $95,750 | 12% | $256,475.00 | $123,706 | 15% | $403,400.00 |

| 2029 | $72,000 | 4.17% | $75,000.00 | $105,325 | 10% | $239,375.00 | $142,261 | 15% | $463,875.00 |

| 2030 | $75,000 | 4.17% | $75,000.00 | $115,857 | 10% | $263,300.00 | $156,487 | 10% | $355,650.00 |

| 2031 | $78,000 | 4.17% | $75,000.00 | $125,126 | 8% | $231,725.00 | $172,136 | 10% | $391,225.00 |

| 2032 | $81,000 | 4.17% | $75,000.00 | $135,136 | 8% | $250,250.00 | $189,350 | 10% | $430,350.00 |

| 2033 | $84,000 | 4.17% | $75,000.00 | $145,947 | 8% | $270,275.00 | $208,285 | 10% | $473,375.00 |

As you can see, growing at a modest 15% requires a lot of fresh capital. Even the conservative model shows that a significant amount of capital is required each year.

This is exactly why as our dividend income becomes higher, it is more important to grow our dividend income via either organic dividend growth (i.e. dividend hikes) or drips.

In 2022 and 2023, I kept a monthly record of forward dividend income increases due to drips and dividend hikes I didn’t do it consistently for the previous years, oops) and the results are:

| DRIP | Div Growth | Total | $ Equvalient | |

| 2022 | $1,450.21 | $2,367.36 | $3,817.57 | $95,439.25 |

| 2023 | $2,104.99 | $2,491.14 | $4,596.13 | $11,4903.25 |

But the total of $3,817.57 and $4,596.13 are a bit misleading. Because these are the total amount at the end of the year. In reality, we typically don’t see an increase in dividend income from dividend hikes and drips until a quarter later. So drips and dividend hikes probably only added about 40-50% toward our actual annual dividend income.

For projection purposes, let’s assume drips and dividend hikes would have a net effect of contributing $2,200 toward our annual dividend income and each year this number would increase by 15%.

| Conservative | Modest | Aggressive | |||||

| organic div increase | Income | $ Required | Income | $ Required | Income | $ Required | |

| 2024 | $2,642.77 | $55,000 | $54,205.63 | $57,717 | $122,130.63 | $61,231 | $209,980.63 |

| 2025 | $3,039.19 | $60,000 | $49,020.23 | $66,375 | $140,470.23 | $74,701 | $260,770.23 |

| 2026 | $3,495.07 | $63,000 | -$12,376.74 | $76,331 | $161,523.26 | $89,642 | $286,148.26 |

| 2027 | $4,019.33 | $66,000 | -$25,483.25 | $85,491 | $128,516.75 | $107,570 | $347,716.75 |

| 2028 | $4,622.23 | $69,000 | -$40,555.74 | $95,750 | $140,919.26 | $123,706 | $287,844.26 |

| 2029 | $5,315.56 | $72,000 | -$57,889.10 | $105,325 | $106,485.90 | $142,261 | $330,985.90 |

| 2030 | $6,112.90 | $75,000 | -$77,822.46 | $115,857 | $110,477.54 | $156,487 | $202,827.54 |

| 2031 | $7,029.83 | $78,000 | -$100,745.83 | $125,126 | $55,979.17 | $172,136 | $215,479.17 |

| 2032 | $8,084.31 | $81,000 | -$127,107.71 | $135,136 | $48,142.29 | $189,350 | $228,242.29 |

| 2033 | $9,296.95 | $84,000 | -$157,423.87 | $145,947 | $37,851.13 | $208,285 | $240,951.13 |

Ouch! It looks like we were way too conservative with our conservative projection (negative money required after 2026). However, one important thing to consider – when we do live off dividends, we’d withdraw money from our portfolio and turn off drips, so perhaps the conservative model isn’t completely unrealistic.

I’d like to point out that the modest projection is probably too aggressive from 2024 to 2030 and the aggressive model is completely unrealistic unless we start making more than $500k a year.

In other words, the best dividend projection probably lies somewhere between the conservative model and the modest model. If I ran the numbers again, it’d probably look something like this:

We’d hit our goal of $70,000 or more in dividend income in 2027, about 2 years longer than our arbitrary goal of 2025. Not a big deal in the grand scheme of things.

Part-time & self-employment income considerations

The projections above were all based on living off dividends only. Since we’re still in our early 40s still, there’s no way we’d just stop working completely and sit on the beach all day sipping pina colada.

Yes, in the early years of becoming financially independent and eventually stepping away from the full-time job, we probably will travel more. However, we plan to continue generating self-employment income via our side businesses. I also plan to look for part-time contract-type work to fully utilize my knowledge and experience. Perhaps a more junior-level position that won’t require me to deal with major issues and challenges (aka fires and escalations) would make more sense. Perhaps I can negotiate with my current employer and figure out a part-time arrangement that would work.

In my “Do we have enough to retire” post, I assumed that Mrs. T and I would make $35,000 combined income via self-employment and part-time work. I used a relatively small number so we wouldn’t be forced to have to work all the time. It is highly possible that we would generate more than $35k from part-time and self-employment work, which would further increase our safety buffer.

Considering a $50,000 dividend income (~25% is tax-free) and a part-time income of $35,000, we are already at a stage where we can rely on dividends and part-time income to sustain our $70,000 spending target.

Looking forward

It is comforting to see these numbers in front of us and know that we have the option to switch from full-time to part-time work. We feel very grateful and blessed. This is why we feel it’s important for us to provide a helping hand to those in need in the community regularly.

So where does that leave me in terms of my full-time work in the high tech field? Despite unpredictable hours and having to handle a lot of escalations and fires, I am still learning a lot. More importantly, I enjoy what I do at work and I enjoy working with my colleagues. I believe there’s also some potential growth for me.

For now, I think it’s about enjoying the journey. We’ll continue to build up our dividend income. Rather than focusing on the actual number, we plan to focus even more on total return and organic dividend growth. This could mean potentially adding more low dividend yield but high dividend growth stocks like ATD, Apple, Waste Connections, etc.

We will also continue to add new capital to increase our dividend income and build up the safety net. Another thing we need and plan to do is increase our cash reserve.

As mentioned, we’re at a point where we will reach financial independence in the next five years or so. It’s no longer a matter of if but when. We simply need to stay patient and continue executing the investing strategy that we started back in 2011.

Patience is indeed a virtue.