What’s covered by credit card travel accident and emergency evacuation insurance?

6 min readMany perks available from your credit cards are well-known and well-utilized. However, benefits such as trip cancellation insurance, delayed baggage insurance, lost baggage insurance, and trip delay protection can quite literally save the day and justify paying an annual fee.

Today, we’ll explain a couple of lesser-known benefits that you hopefully won’t have to use but, if needed, can protect you from extreme financial hardship and ensure your family and loved ones are provided for if something happens to you.

You can easily find the coverage and terms of any protection your travel credit card offers by doing a quick web search for the card’s updated benefits guide. These benefits are not exclusive to travel credit cards, and many standard credit cards come with travel protection and insurance.

Travel accident insurance

Often called common carrier insurance, this policy pays in case of death, loss of eyesight or loss of limb(s) while on a plane, train, ship or bus licensed to carry passengers and available to the public. A few cards also have travel accident insurance that offers protection for the entire duration of a trip (up to 31 days long) but pays out less than the common carrier insurance policies. To be eligible, you must typically pay for the entire fare with the credit card.

Different credit cards have different payment tables for how much your beneficiary would receive in case of death, losing one limb, losing two limbs, losing sight in one eye or becoming legally blind. Coverage is also typically extended to authorized users on the account, spouses, domestic partners, and dependent children of the cardholder on trips paid for with the card.

By default, the beneficiaries in order of precedence are spouse, then children, then estate. You can submit a letter to the card issuer to establish another beneficiary.

Emergency evacuation insurance

In the past, when traveling to remote destinations like the Maldives and Fiji, I bought third-party emergency medical evacuation insurance, not realizing the cards I already had would have covered me. There are a few crucial aspects of emergency evacuation insurance offered by credit cards that you need to understand and follow so you don’t compound your medical situation with the stress of financial hardship:

- Everything must be approved and coordinated through a benefits administrator. This is who you or your companions should call when things first start to look like you’ll need assistance. You will not be reimbursed for anything that you decide to pay for on your own.

- Evacuation does not mean repatriation. If you’re far overseas, you won’t be evacuated back to the U.S. Most policies state you’ll be moved to the nearest medical facility capable of proper care.

- Preexisting conditions may lead to your request for evacuation at the credit card provider’s expense being denied. Read your credit card’s full terms and benefits guide to see which exclude these conditions and the credit card’s definition of a preexisting condition.

- The coverage is only for the cost of evacuation and medical care during transportation. Once you’re back on the ground, you still need medical insurance to pay the doctors and staff who provide care.

- Some cards have country exclusions, so don’t expect to head into Syria or Afghanistan and rely on your credit card benefits administrator to get you to a hospital.

To get all the relevant information, download and read the entire section of the benefits guide pertaining to these coverages. Here are a few cards offering travel accident and/or emergency evacuation insurance.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

The Platinum Card® from American Express

The Amex Platinum card removed travel accident insurance in 2020. However, it still offers the most generous emergency evacuation insurance of any card.

There’s no cost cap, and benefits are extended to immediate family and children under 23 (or under 26 if enrolled full-time in school). Best of all, you don’t even have to use the card to pay for the trip.

You must be on a trip less than 90 days in length and at least 100 miles away from your residence. A Premium Global Assist (PGA) administrator must coordinate everything to not incur any cost. The benefit will also pay economy airfare for a minor under 16 to be returned home if left unattended, pay for an escort to accompany that minor if required to get them home and get a family member to the place of treatment if hospitalization of more than 10 consecutive days is expected.*

Other American Express cards offer access to the Premium Global Assist Hotline. However, anything they coordinate will be at your expense. Make sure you read your Amex card’s benefits guide carefully.

For more details, see our full review of the Amex Platinum.

Related: Your complete guide to Amex travel protections

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, cardmembers are responsible for the costs charged by third-party service providers.

Apply here: Amex Platinum

Chase Sapphire Reserve® and Chase Sapphire Preferred® Cards

The Chase Sapphire Reserve® offers two travel accident insurance benefits: common carrier travel accident insurance and 24-hour travel accident insurance. The former applies while riding as a passenger in, entering or exiting any common carrier. The latter applies any time during your trip — but you cannot be paid out on both the common carrier and 24-hour policies.

If you use your Chase Ultimate Rewards points to book your trip, you are covered under the card’s benefits.

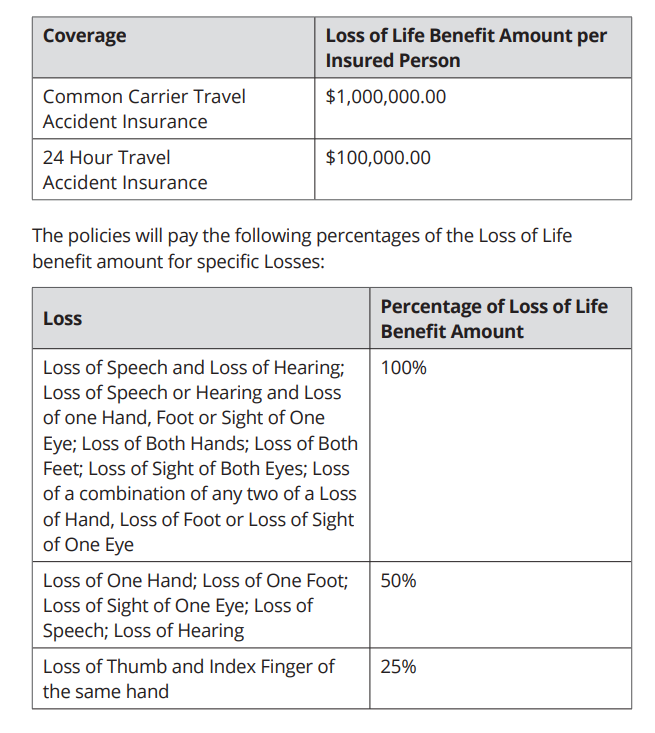

People eligible for coverage include “you, your spouse, your spouse’s or domestic partner’s children, including adopted children or stepchildren; legal guardians or wards; siblings or siblings-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephews.” Chase pays up to $1,000,000 for a common carrier loss and up to $100,000 for a 24-hour policy loss based on the following table:

Some interesting exclusions with Chase that would prevent a payout include the insured person participating in a motorized vehicular race or speed contest, the insured person participating in any professional sporting activity for which they received a salary or prize money or if the insured person traveling or flying on any aircraft engaged in flight on a rocket-propelled or rocket-launched aircraft.

The Chase Sapphire Reserve® also offers emergency evacuation insurance. If you or an immediate family member paid for at least a portion of your trip with the card, you’re eligible for up to $100,000 in emergency medical evacuation.

Your covered trip must last between five and 60 days and be at least 100 miles from your residence. If you are hospitalized for more than eight days, the benefits administrator can arrange for a relative or friend to fly round-trip in economy class to your location. If your original ticket cannot be used, you can also be reimbursed for the cost of an economy ticket home. In a worst-case situation, the benefit also pays up to $1,000 to repatriate your remains.

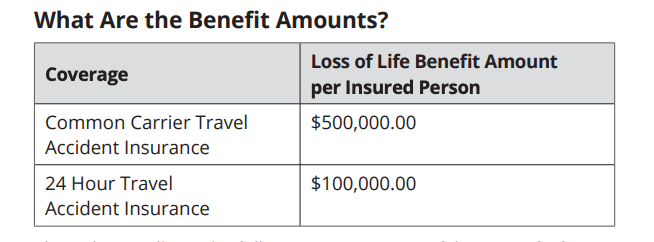

The Chase Sapphire Preferred Card offers the same travel accident insurance as the Reserve, except with lower payouts on the common carrier policy. The benefits pay up to $500,000 for a common carrier loss and up to $100,000 for a 24-hour policy loss based on the following table:

For more details, see our full reviews of the Chase Sapphire Reserve and Chase Sapphire Preferred.

Related: Your guide to Chase’s trip insurance coverage

Apply here: Chase Sapphire Reserve and Chase Sapphire Preferred

United Club℠ Infinite Card

The top-tier United Club℠ Infinite Card offers travel accident and emergency evacuation insurance. The travel accident insurance benefits pay up to $500,000 for a common carrier loss.

The card also carries the same benefit as the Chase Sapphire Reserve for emergency evacuation coverage, with up to $100,000 of coverage provided for evacuation.

For more details, see our full review of the United Club Infinite Card.

Apply here: United Club Infinite

Bottom line

We hope none of us perfectly ever have to worry about either of these policies, but it’s nice to have peace of mind if you or your family need emergency assistance. This reassurance is one more reason to ensure one of these cards is always in your wallet when traveling.

The benefit guides of all cards are updated regularly, so make sure you don’t toss them in the trash when updates show up in the mail and read the online guides for the latest terms and conditions.

Related: The best credit cards with travel insurance