Chase Sapphire Preferred Card: Our Full Review (2024)

14 min readFor over a decade, we’ve considered the *csp* the best travel rewards credit card for beginners. In 2024, that hasn’t changed … in fact, that case is arguably stronger than ever.

It’s a great option for anyone getting started with points and miles because you can easily come out way ahead on the card’s low $95 annual fee. And best of all, the card is now offering a souped up welcome offer bonus for new applicants: bonus_miles_full

Plus, other benefits like travel and rental car insurance, as well as trip delay and cancellation protection can easily make the Sapphire Preferred a mainstay in any traveler’s wallet for the long run. Whether you’re planning your next trip right now or looking further out, we don’t think you can do better than the Chase Sapphire Preferred if you’re looking for a travel card with a low annual fee.

Here’s our full review of one of the top travel cards currently on the market.

Learn more about the *csp*

Chase Sapphire Preferred® Card Review: Overview

- Welcome Offer Bonus: bonus_miles_full

- Earn 3x points per dollar spent on dining, including eligible delivery services

- Earn 3x points per dollar spent on online grocery purchases (excluding Target, Walmart, and wholesale clubs like Costco and Sam’s Club)

- Earn 3x points per dollar spent on select streaming services

- Earn 2x points per dollar spent on travel purchases

- Earn 5x total points on travel purchased through the Chase Travel℠ portal, excluding hotel purchases that qualify for the $50 Anniversary Hotel Credit.

- Earn up to $50 in statement credits each year for hotel stays booked through Chase Travel℠

- 10% Annual Points Bonus: Receive a 10% points bonus on your total spending during the account anniversary year – 1 point for every $10 spent.

- Trip Cancelation & Trip Interruption Coverage

- Baggage Delay and Lost Luggage Coverage

- Rental Car Insurance Coverage

- Recommended Credit Score: Excellent/Good

- Foreign Transaction Fees: None

- Annual Fee: $95

Chase Sapphire Preferred: Full Benefits Breakdown

Sapphire Preferred Card Sign-Up Bonus Offer

bonus_miles_full

So just how good is this bonus offer? Really, really good.

While it’s not the biggest bonus we’ve ever seen, it’s as good as it gets right now. Last spring, Chase increased the offer on the Sapphire Preferred to 75,000 points. This new offer is for fewer points, but the $300 credit can easily provide a lot of value.

In the past, we’ve seen bonuses climb as high as 100,000 points on the Preferred Card, but it’s unlikely we’ll ever see that monster welcome bonus ever again.

Regardless, getting 60,000 Chase points is still nothing to scoff at. With the added $300 travel credit, this bonus alone is worth at least $1,050 toward travel when you book through Chase Travel℠ – one of our favorite ways to book flights for free.

What’s more, the one-time $300 travel credit that comes with this offer doesn’t even require any sort of minimum spending – it’s available right away. Simply use your Sapphire Preferred card to make a booking through Chase Travel and you’ll automatically get a statement credit, up to $300 applied to your account. Just know: You must use this credit within the first year of opening your account.

Plus, you can squeeze even more out of those bonus points by using Chase transfer partners – more than a dozen airline and hotel brands to which you can directly transfer your points.

When you consider the card only charges a $95 annual fee, you’ll easily come out way ahead.

Need some ideas on using your Chase points? Read our list of the best ways to use a big Chase points bonus!

Earn 3x Points on Dining & Eligible Delivery Services

With the Chase Sapphire Preferred, you’ll earn 3x Ultimate Rewards points for every dollar you spend on dining at restaurants and on eligible delivery services. There is no cap on the amount of bonus points you can earn in these categories.

Chase doesn’t specifically define what food delivery services are eligible but services like DoorDash, GrubHub, and Uber Eats should all earn 3x points per dollar.

Additionally, through a partnership between Chase and DoorDash, Sapphire Preferred cardholders will get a complimentary DashPass membership. Simply add your Chase Sapphire Preferred as a payment method in your DoorDash account and you should get a pop-up offering you a complimentary DashPass membership, good through Dec. 31, 2027.

Earn 3x Points on Eligible Grocery Delivery Services

Sapphire Preferred cardholders will also earn 3x points per dollar spent on online grocery purchases. However, this excludes big box retailers like Target, Walmart, and wholesale clubs like Costco and Sam’s Club.

The online grocery category includes purchases for grocery pickup and delivery that are placed online with grocery stores, and through services like Instacart and DoorDash. Meal kit delivery services like Hello Fresh and Blue Apron and more are also included in the online grocery 3x category.

In addition to the complimentary DashPass that Sapphire Preferred cardholders get, Chase’s expanded partnership with DoorDash now includes a monthly coupon of up to $10 off on grocery, convenience, and other non-restaurant orders. This benefit largely replaces a previous partnership with Instacart that expired at the end of July.

Earn 3x Points on Select Streaming Services

Sapphire Preferred cardholders also earn 3x points per dollar spent on select streaming services.

Chase lists the following merchants that will qualify for the 3x earn rate in this category:

- Apple Music

- Apple TV

- Disney+

- ESPN+

- Fubo TV,

- Max

- Hulu

- Netflix

- Pandora

- Paramount+

- Peacock

- Showtime

- SiriusXM

- Sling

- Spotify

- YouTube Premium

- YouTube TV

- Vudu

Earn 2x Points on Travel Purchases

The Sapphire Preferred is a great card for your general travel spending as you’ll earn 2x points per dollar spent on this category.

Chase lists the following purchases that will qualify to earn 2x points, covering a vast majority of your travel spending:

- Airlines

- Hotels

- Motels

- Timeshares

- Car Rental Agencies

- Cruise Lines

- Travel Agencies

- Discount Travel sites

- Campgrounds & Operators

- Passenger trains

- Buses

- Taxis & Rideshare

- Ferries

- Toll Bridges & Highways

- Parking Lots & Garages

Additionally, through March 2025, you’ll earn 5x points per dollar spent on Lyft rides when you pay with your Sapphire Preferred.

Earn 5x Points On Travel Purchased Through Chase Travel℠

When you use your Sapphire Preferred to book flights, hotels or rental cars through Chase Travel℠, you’ll earn 5x points per dollar spent.

However, there is one exception: You won’t earn 5x points per dollar spent on purchases that qualify for the annual $50 hotel credit – more on that soon…

Read more: How to Book Flights (and more) Through the Chase Ultimate Rewards Travel Portal

An Annual $50 Statement Credit for Hotels Booked Through Chase Travel℠

The Chase Sapphire Preferred Card offers a $50 credit to both new and existing cardholders each year that can be used towards booking a hotel through Chase Travel℠.

To take advantage, all you need to do is use your Sapphire Preferred Card to book and pay for a hotel stay through Chase Travel℠ and you will receive an automatic statement credit for up to $50 each year. This credit follows your account member year instead of the calendar year. So for example, if you opened your Chase Sapphire Preferred Card in May, you would receive a new $50 hotel credit each year after renewing your account in May.

Here’s what you need to know:

- You must book your hotel through Chase Travel℠ to get this $50 credit. Booking a stay with a hotel directly won’t trigger the credit.

- Unlike other credit cards offering benefits like this, there is no minimum spend or length of stay requirement.

- No registration is required! This statement credit kicks in automatically

Read more: How to Use the $50 Hotel Credit on the Chase Sapphire Preferred

A 10% Annual Points Bonus

Each year on your account anniversary, Sapphire Preferred cardholders will get a 10% anniversary points bonus.

It doesn’t factor in any bonus points earned from categories like dining, travel, or streaming service, but rather just a straight 10% of your total spending. That means for every $10,000 you spend each year, you’ll get 1,000 bonus points.

Trip Cancelation & Interruption Coverage

Chase’s trip cancellation and interruption insurance covers you in the event your trip is canceled or cut short by sickness, severe weather, and other covered situations.

If you encounter one of these events, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid non-refundable travel expenses.

Chase lists the following examples as situations that would be covered while noting it isn’t an exhaustive list:

- Accidental bodily injury, loss of life, or sickness experienced by the cardholder, a traveling companion, an immediate family member of the cardholder, or a traveling companion.

- Severe weather that prevents the start or continuation of a covered trip.

- Terrorist action or hijacking.

- Jury duty or a court subpoena that cannot be postponed or waived.

What about if you encounter a delay instead of an outright cancellation? If you booked your trip with your Sapphire Preferred Card and your common carrier (airline, bus, cruise ship, or train) is delayed for a covered reason for 12 hours or more, or overnight, you can receive reimbursement for expenses like meals, lodging, toiletries, and medication up to $500 per ticket per trip.

This coverage is only applicable for a trip away from the cardholder’s city of residence – and only on trips under 365 days.

Read More: Chase Sapphire Preferred FAQs: All Your Questions Answered

Baggage Delay and Lost Luggage Coverage

Airlines have become notorious for losing and misplacing luggage, so much so that Apple Airtags have become a must-have travel accessory. This is just one of the many reasons we recommend traveling with a carry-on only, whenever possible.

But what happens if you have to check a bag and it doesn’t make it to the conveyor belt as planned? Luckily, Chase has you covered.

If you pay for your flight with your Chase Sapphire Preferred Card (or Chase Ultimate Rewards points from your card), you can get reimbursed for essential items like toiletries and clothing, when your baggage is delayed or misdirected by more than six hours. This benefit only applies when traveling on a common carrier, such as an airline, bus, cruise ship or train, while on a covered trip. Thankfully, that covers almost everyone, unless you’re flying private or on a charter, in which case you wouldn’t be eligible to receive compensation.

The cardholder, the cardholder’s spouse or domestic partner, and any immediate family will be covered for up to $100 per day for a maximum of five days. Using this benefit, even once, would cover several years worth of $95 annual fees.

Rental Car Insurance Coverage

The Chase Sapphire Preferred comes with primary rental car coverage – meaning if something happens to your rental, you can skip your own insurance and go straight to Chase for help.

In order to take advantage of this coverage, you need to charge your rental to your Sapphire Preferred card and decline the collision damage waiver that the car rental company tries to sell you. These policies will provide reimbursement for damage due to collision or theft on rental cars in both the U.S. and when traveling internationally. If you get into an accident, it will cover the costs of any damage up to the cash value of the vehicle.

Just note that this is not liability insurance. It will not cover medical bills, damage to another vehicle, or damage to property. Still, it’s some of the best car rental coverage you can get.

Additional reading: All About the Chase Sapphire Rental Car Insurance Benefit

Chase Sapphire Preferred Fees

No Huge Annual Fees

The top travel cards on the market don’t come cheap. The *csr*, the Preferred’s bigger sibling, costs $550 per year. And *amex platinum* charges $695 each year (see rates & fees). While it’s much cheaper than that, even the *cap one venture x* clocks in with a $395 annual fee upfront – though we wouldn’t be surprised if an annual fee increase on the Venture X is around the corner.

That makes the Chase Sapphire Preferred look like a bargain in comparison. With the Chase Sapphire Preferred annual fee coming in at just $95 per year, it’s easy to justify the cost when you look at what you get in return.

With the current, limited-time bonus offer, you can easily come out way ahead on that annual fee in your first year with a lot of great ways to get more than $95 in value each year after that.

Chase Sapphire Preferred Foreign Transaction Fees

Another plus when it comes to Chase Sapphire Preferred fees? When making purchases with the Chase Sapphire Preferred Credit Card outside the U.S., rest assured that there are absolutely no foreign transaction fees.

If you have a credit card that doesn’t waive foreign transaction fees, you can expect to pay 1-5% on top of any purchase you make abroad. That’s not the case with the Sapphire Preferred.

Plus, since the card is issued through Visa’s payment network, it’s widely accepted all over the world.

Easy-to-Use Points

There are plenty of great ways to use a big bonus from the Chase Sapphire Preferred Card. But sometimes, simplicity is best.

That’s what makes the Chase Travel℠ is one of our favorite ways to put these points to use. While you might get more value by transferring points to partner airlines or hotels, this is the easiest way to take a cheap flight and make it free. Plus, you can book flights on almost any airline.

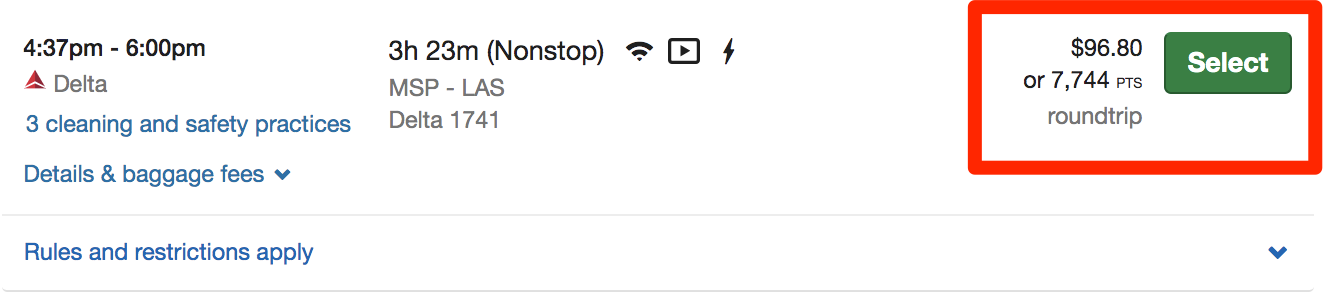

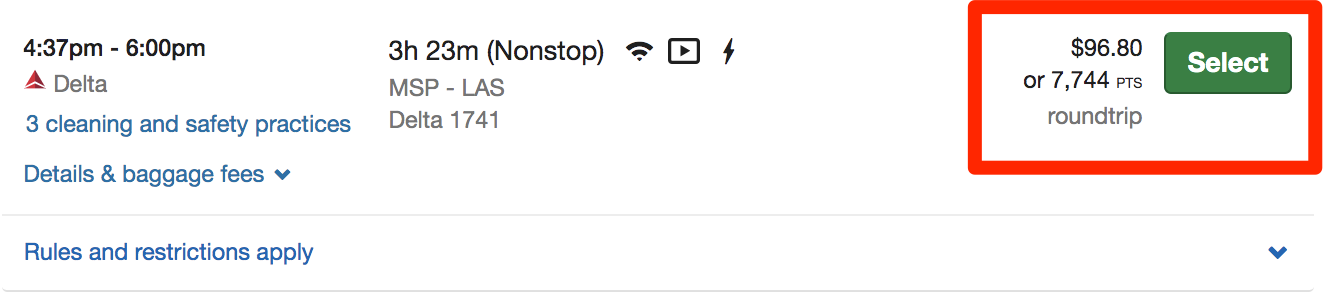

It works like this: Find a good deal using Google Flights or in your inbox thanks to a Thrifty Traveler Premium membership. The cheaper the flight, the fewer Chase points you’ll need to book it. And with the Chase Sapphire Preferred Card, you get a bonus: Every point is worth 1.25 cents toward travel.

That means you can book this $96.80 flight from Minneapolis-St. Paul (MSP) to Las Vegas (LAS) using less than 7,800 Chase points, for example.

There’s really no easier way to put these points to use. Unlike booking with airline miles, you won’t be on the hook for additional taxes and fees – this is one of the only ways to book travel completely free. And you’ll even earn miles and elite status on your flight, to boot.

Versatility is King

What’s that saying about putting all your eggs in one basket?

Over the last few years, we’ve seen airlines like Delta, United, Emirates, and Virgin Atlantic repeatedly start charging more for award redemptions. Hyatt even introduced peak and off-peak award pricing.

There’s an easy way to limit your risk of a loyalty program devaluing: Rather than earning miles with just one airline, focus on earning flexible points. And that’s an area where Chase shines. You’ve got the ability to book with almost any airline through Chase Travel℠. From there, there are more than 10 airlines and three hotel chains to which you can transfer your points.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Iberia Plus | Airline | 1:1 | Instant |

| JetBlue | Airline | 1:1 | Instant |

| Singapore Air | Airline | 1:1 | 12-24 hours |

| Southwest Airlines | Airline | 1:1 | Instant |

| United Airlines | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

| World of Hyatt | Hotel | 1:1 | Instant |

| IHG | Hotel | 1:1 | 1 day |

| Marriott Rewards | Hotel | 1:1 | 2 days |

Read our guide on how to use Chase transfer partners!

You’ve simply got more options at your disposal. Not only does that give you more freedom to find the best deal – but it also limits your risk. And as you’ll see, you can now use those points for everyday expenses.

Read more: Your Airline Miles are Getting Less Valuable: Here’s How to Fight Back

Why it Makes Sense to Start with Chase

Beyond the bonus and the perks, there’s a compelling reason for any traveler getting their first travel credit card to start with Chase.

The growing restrictions on getting approved for Chase credit cards mean you could miss the boat on Chase entirely if you don’t start with Chase credit cards. Chase is one of the stingiest banks when it comes to approving applications for credit cards.

If you’ve read a word about Chase credit cards, you may have come across Chase’s notorious 5/24 rule. What it means is that once you’ve opened five or more credit cards (from any bank, not just Chase) in the previous 24-month period, you will not be approved for a Chase card. Almost every Chase credit card falls under this rule, including the Chase Sapphire Preferred Card.

[embedded content][embedded content]

So what does that mean for a beginner who can’t fathom opening five cards in two years? Even if that thought makes your head spin, you should still plan ahead and prioritize Chase. Before you know it, it could be too late to get approved for a Chase card.

Think about the cards you want – and may want – before moving on to other banks like American Express, Capital One, or Citi, which aren’t nearly as restrictive when it comes to approving applications. You should be able to open those cards at almost anytime, but your window to open Chase credit cards can close fast. And there’s no better place to start than the Sapphire Preferred.

Read More:Are You Eligible for the Chase Sapphire Preferred?

Comparing & Combining Chase Sapphire Preferred

Chase Sapphire Preferred vs Reserve

There’s a lot to consider if you are comparing the Chase Sapphire Preferred to its premium sibling, the Chase Sapphire Reserve. At the end of the day, the Reserve provides far more travel benefits like airport lounge access, an annual $300 travel credit, a credit to reimburse global entry and TSA PreCheck, and much more.

But all of those additional benefits push the card’s annual fee up to $550 each year. That’s a difference of $455 right out of the gate. If you want to add an authorized user to the Sapphire Reserve to share those travel perks, that will cost an additional $75 per user each year. The Sapphire Preferred doesn’t charge for additional card users.

While there’s no question that fee can be worth it, it can no doubt provide some sticker shock – especially for those just getting started with travel rewards credit cards.

Here’s the thing: If you start with the Chase Sapphire Preferred, you can always upgrade to the Reserve later on down the line if you are interested in more premium benefits. Doing so won’t have any impact on your credit score, either.

Be sure to read our full guide comparing the Chase Sapphire Preferred vs the Sapphire Reserve for everything you need to know about these two top travel cards.

Read more: 5 Reasons to Pick Up the Chase Sapphire Preferred, Not the Reserve

Pair Chase Sapphire Preferred with the Freedom Flex or Freedom Unlimited Card

If you hold a Chase Sapphire Preferred Card, there’s an easy way to level up your points-earning on even more of your spending.

It’s possible thanks to two popular no-annual-fee cashback credit cards from Chase: The *chase freedom unlimited* and Chase Freedom Flex℠.

While these cards typically earn cash back, you can turn that cash into Ultimate Rewards points so long as you also hold a Chase Sapphire card. When you do, one cent gets you one point. And that’s significant because both cards earn bonus cash back in a number of categories that are not covered by the Chase Sapphire cards.

You can learn more about the Chase Freedom Flex vs Freedom Unlimited here to decide which one is right for you.

Have a Business? Combine Points with the Chase Ink Cards

If you have a small business, you are eligible to open one of Chase’s Ink business cards. Better yet, you can combine the points earned from those cards with the points you earn on the Sapphire Preferred.

So if you’ve got a no annual fee Chase Business card like the *ink cash*, *ink unlimited*, or the *ink preferred*, you can easily combine the points earned with your Sapphire Preferred.

Read More: How to Combine Chase Business & Personal Accounts Online

Bottom Line

The Chase Sapphire Preferred Card has been a standout option for travelers for years – especially beginners. In 2024, that hasn’t changed.

Add in the current, limited-time 60,000-point sign-up bonus – plus, up to $300 in statement credits for Chase Travel purchases – and it’s as close to a slam dunk as you’ll find if you’re looking for a great travel credit card at a low price.

Learn more about the *csp*