The Best Card for Delta Flyers is … Not a SkyMiles Card?!

9 min readIf you’re a frequent Delta flyer, it’s high time you reconsider swiping a card like the *delta skymiles gold card* or *delta skymiles platinum card* for every purchase.

Instead, use a (non-Delta) American Express Membership Rewards card like the *amex gold card*, which will allow you to rack up flexible points even faster. And since Delta is an Amex transfer partner, so you can still send your points to Delta if an amazing SkyMiles deal pops up … or move them to nearly 20 other airlines for even more options.

To be clear, those Delta cards still offer valuable benefits like free checked bags, a slew of statement credits, and maybe even an annual companion ticket. But just because you keep a Delta card for the perks doesn’t mean you should be using it for everyday purchases.

Even diehard Delta flyers who previously swiped their go-to airline card to fast-track Delta Medallion Status are likely better off shifting their focus toward earning more points elsewhere. And few are better for that than the non-Delta Amex Gold Card.

Read more: Want to Fly Delta? Skip SkyMiles, Use This Workaround for Huge Savings

Amex Membership Rewards Points vs Delta SkyMiles

Points and miles are not interchangeable – and they’re not created equally.

Before we dive into why the Amex Gold Card is a great option for Delta travelers, you first need to understand the difference in the points it earns versus the Delta SkyMiles credit cards.

Read more: What’s the Difference Between Amex Points and Delta SkyMiles

Membership Rewards Points

The Amex Gold Card earns Membership Rewards points. These are credit card points issued directly from Amex … and they can be used in many different ways. One of the big reasons we think they are so valuable is because of their flexibility and versatility.

Most relevant for ultra-loyal Delta fans, you can transfer them on a 1:1 basis directly to your SkyMiles account. That means 10,000 Amex points could become 10,000 Delta SkyMiles.

But Delta is just one option on a long list of Amex transfer partners. Here’s the full roster.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| AeroMexico | Airline | 1:1.6 | 3-5 days |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| ANA | Airline | 1:1 | 1-2 days |

| Avianca | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific | Airline | 1:1 | Instant |

| Delta | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Instant |

| Hawaiian | Airline | 1:1 | Instant |

| Iberia | Airline | 1:1 | Up to 24 hours |

| JetBlue | Airline | 1.25:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

Just remember, transfers to any of the Amex airline or hotel partner are a one-way street. That means once you send them to Delta, you won’t be able to get them back. Make sure you are ready to use them before you transfer. As the transfer should hit your Delta SkyMiles account instantly, there’s no need to transfer them over beforehand.

The one downside of transferring Amex points to Delta (or any U.S. airline) is that Amex tacks on a small fee of .06 cents per point, up to a maximum of $99. A transfer of 20,000 points will cost you $12. That’s annoying, but it’s a small price to pay.

Read more: The 10 Best Ways to Redeem Membership Rewards Points

Delta SkyMiles

Delta SkyMiles, on the other hand, can only be used to book travel through Delta. When you earn SkyMiles, they are stuck in that account until you use them.

You can’t transfer SkyMiles to another carrier, even to partner airlines like Air France, KLM, or Virgin Atlantic. Even transferring SkyMiles to a friend or family members’ account is exorbitantly expensive.

So in that sense, they provide much less flexibility than Amex points – and considering how much easier it is to earn Amex points, it’s a no-brainer to go that route instead.

Related reading: How Delta SkyMiles Work and How to Make Them Work for You

Earning SkyMiles with the Amex Gold Card

Let’s get this out of the way: The Amex Gold Card has an annual fee of $325 (see rates & fees). While that might sound steep, you can easily come out ahead on that fee by taking advantage of all its benefits – and there are many. That’s why we always encourage readers to do the math before ruling out credit cards with higher annual fees. Rewire your brain to think about those fees as investments in your future travel.

And when it comes to the Amex Gold Card, one of the easiest ways to recoup that annual fee is simply by earning points. You can earn a lot of them – many more than with a Delta card.

To start with, you’ll earn 4x Amex points for every dollar you spend at restaurants (up to $50,000 each year, then 1x). You’ll also earn 4x points per dollar spent at U.S. supermarkets on up to $25,000 of spending each calendar year (then 1x). Both the Delta SkyMiles Gold and Platinum Cards earn only 2x Delta SkyMiles at restaurants and at U.S. supermarkets. Heck, the top-dollar SkyMiles Reserve card only earns 1x point per dollar spent in this category.

So just by using the Amex Gold Card for these purchases instead of your co-branded Delta Amex Card, you’ll earn at least twice as many points for the same amount of spending. Compared to the Delta Reserve Card, you’ll earn quadruple the points.

Next, the Amex Gold Card earns 3x Membership Rewards points on all flights booked directly with any airline or through amextravel.com. The Delta SkyMiles Gold Card earns just 2x SkyMiles per dollar spent on Delta flights, while the Delta SkyMiles Platinum and Reserve Cards earn 3x SkyMiles per dollar spent on Delta flights. The keyword there is on Delta flights – if you wind up flying with other carriers, a Gold Card is even more valuable.

Plus, first-timers might be able to get a whopping welcome bonus through a friend-referral on the Gold Card. And some recent changes from Amex mean you’ll want to give this card a hard look before, say, *amex platinum*.

Full Benefits of the American Express Gold Card

- Earn 4x points at restaurants on up to $50,000 spent each year (then 1x)

- Earn 4x points at U.S. supermarkets on up to $25,000 of spending per calendar year. 1x points per dollar spent after that

- Earn 1x points on other purchases

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the Gold card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That’s up to $50 in statement credits semi-annually.

- $84 Dunkin’ Credit: With the $84 Dunkin’ Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the Gold card at Dunkin’ locations.

- $120 annual dining credit: Get up to $10 per month in statement credits for charges at GrubHub, The Cheesecake Factory, Wine.com, Goldbelly & Five Guys.

- $120 in Annual Uber Cash split up into $10 monthly amounts after adding your Amex Gold Card to your Uber account.

- No Foreign Transaction Fees

- $325 annual fee (see rates & fees)

Learn more about the *amex gold*

Spending in Action

Here’s a quick example of just how many more points you can earn by using the *amex gold card* for your everyday spending as opposed to that co-branded Delta SkyMiles Card.

Let’s say you spend $150 a week on average at both U.S. supermarkets and restaurants. Because you’ll earn 4x points for every dollar you spend in both categories with the Amex Gold Card, you’ll earn 600 Membership Rewards points each week ($150 x 4 points). Over the course of a year, spending $150 a week on groceries and at restaurants would net you 31,200 Membership Rewards points annually from just dining and supermarkets.

Amex Gold Card by the Numbers:

- Weekly restaurant & grocery spending: $150

- X 4x Membership Rewards Points = 600 points

- X 52 weeks in a year = 31,200 points

Now let’s compare that same amount of spending to the co-branded Delta Cards. Since both the Gold and Platinum Delta Cards earn 2x SkyMiles per dollar spent in both categories, you would earn 300 Delta SkyMiles each week ($150 x 2 SkyMiles). Over the course of a year, that amount of spending would net you 15,600 SkyMiles.

Delta SkyMiles Cards by the Numbers:

- Weekly restaurant & grocery spending: $150

- X 2x Delta SkyMiles = 300 miles

- X 52 Weeks in a year = 15,600 miles

That’s twice as many points on the exact same spending – and given their versatility, those Amex points are more valuable than the Delta SkyMiles would be. You’re earning more of them and they’re more valuable, to boot.

What About Earning Medallion Status?

These days, Delta doesn’t care how far you fly – all that matters is how much you spend with the airline.

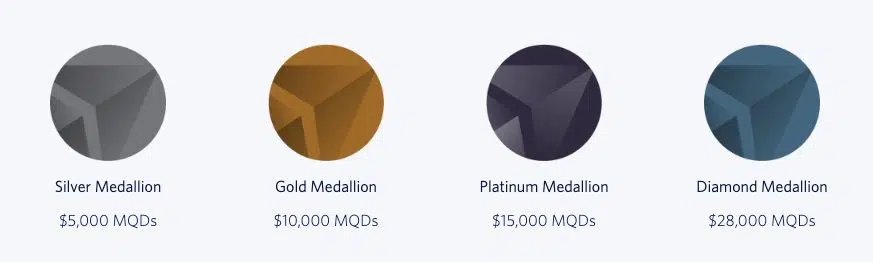

Here’s a look at what it takes at the various status levels:

You can expedite your progress by spending certain Delta co-branded cards. Exactly how many MQDs you’ll earn depends on which one you’ve got:

Regardless, having a Delta co-branded Amex card is … well, pretty much essential for earning Delta status these days, despite the spending requirements. If you don’t have one already, adding the right Delta card to your wallet could give you a huge boost.

Just for having one of these cards in your wallet, you’ll get an automatic $2,500 MQD headstart:

So if you’re done flying for the year but still $2,000 MQDs or so away from Delta Gold or Platinum status, this is by far the easiest way to get over the hump.

The Amex Gold Card is absolutely essential for a strong points-earning strategy. However, it won’t help you earn Delta Medallion Status. That’s where having a Delta card with the MQD Headstart benefit is a must.

Read more: Closing in on Delta Status? Last-Minute Tips to Level Up Your Medallion Status

How to Rethink Your Card Strategy

As you can see, Delta co-branded credit cards are far from the best for earning SkyMiles. But that doesn’t mean Delta cards don’t serve a purpose.

In fact, pairing the Amex Gold Card with one of the Delta cards can make a ton of sense. While the Amex Gold Card is really lucrative for everyday spending, it won’t provide you with free checked luggage or other inflight perks when flying Delta. Think of it this way: You could keep a Delta credit card open to get those benefits … but actually use the Amex Gold Card to earn points (or SkyMiles).

If you often check a bag when you fly with Delta, it might make sense to pair the *amex gold* with the *delta skymiles gold card*. You’ll get free baggage (even if you pay for the flight with a non-Delta card). If you want those same benefits plus an annual companion ticket, pairing the Amex Gold with the *delta skymiles platinum card* might make the most sense.

No matter which airline you’re flying, it’s important to diversify your points and miles – but with Delta, it’s critical. With the airline dynamically pricing awards, you just never know what a given flight will cost.

That’s why earning Membership Rewards (and more of them) makes so much sense. If a great Delta deal pops up, you can transfer those points to your SkyMiles account and book! And if it doesn’t, you’ve got plenty of other Amex transfer partners to make better use of those points.

Just remember to do the math and make sure you understand what exactly you are getting for the fees you are paying. Play it right and the Amex Gold and Delta co-branded cards can be a great 1-2 punch.

Related reading: The 7 Best Delta Credit Cards for Delta Travelers

Bottom Line

If you’re a Delta loyalist, the American Express Gold Card is a fantastic option to maximize your everyday spending. You can earn far more points than you would with the Delta cards alone.

Rethinking your diehard loyalty but not ready to give up on Delta just yet? Earning points that you can transfer to Delta (or nearly 20 other airlines) is a great way to hedge your bets.

Learn more about the *amex gold*