Five Low-Tax Countries for Expats in 2024

9 min read‘Going where you’re treated best’ sums up the Nomad Capitalist message.

We believe you can transport your life, money, investments, business and even your citizenship to a location where they – and you – will get the attention and treatment they deserve.

After all, if you’re a high-net-worth individual, your needs are likely very different from those of people making an income but don’t have as much capital to invest.

For you, when it comes to finding a place to settle down or set up a base, going where you’re treated best certainly involves varying personal preferences.

However, one preference we should all have in common is finding the most tax-friendly countries (or even entirely tax-free places) to call home.

As we said at the outset of this piece, going where you’re treated best is at the core of how we help people. So, if you’re after a tax-friendly country to live, work or invest your capital in, set up a call with us today and we’ll help you do just that.

Otherwise, we’ve crafted this list of tax-friendly countries. You’ll see quite a few on this list that are often called tax haven countries, but be way of the term ‘haven,’ as it is often misleading.

1. Monaco

- Income tax rate: No personal income tax

- Corporate tax rate: 28%

- Residency and citizenship path: You can secure residency by depositing €500,000 to €5 million in a Monaco bank. Permanent residency is available after 10 years, and then you could be eligible for citizenship.

Right off the bat, Monaco is a tax-free country. This means that, for the most part, the taxman will leave you alone as long as you’re not a French citizen.

But there’s a caveat – you can’t just have a paper residence there – you actually need to spend time there in the flesh.

Even though Monaco is the second smallest state after the Vatican, with a population of roughly 38,000, it offers one of the highest standards of luxury. That said, this exclusivity comes with a hefty price tag.

In Monaco, you’ll trade high taxes for a high cost of living.

And it’s not only the cost of living. To reside in this beautiful South Mediterranean country, you must deposit at least €500,000 in a bank account under your name.

Be warned, some banks will request significantly more, so you can anticipate having to deposit between €2-5 million.

You can also expect to have to submit additional supporting documents, like proof of your bank deposit and previous residencies you’ve held for the past five years.

You’ll also need to complete an interview with the police department and pass a criminal background check. If you’re over 70, you’ll also need to submit a clean medical report.

Then, after ten years, you will receive your permanent residence and can potentially apply for citizenship if you wish.

Monaco is an option primarily aimed towards ultra-high-net-worth individuals who wouldn’t mind leaving several million euros on the table for the sake of convenience.

2. Jersey

- Income tax rate: 20%, then 1% on any income above £1,250,000

- Corporate tax rate: 0%

- Residency and citizenship path: Obtain residence as a high-net-worth individual by paying £250,000 annually in tax. After five years, you can apply for indefinite leave to remain.

Is Jersey a tax haven? Again, we’re pretty wary of using that term these days, but Jersey is a tax-friendly option that people don’t talk about much.

It’s connected to the United Kingdom as it’s a British Crown dependency, but it governs its own affairs, which allows it to have a very tax-friendly system.

High-net-worth individuals can run a company from Jersey and pay basically no tax. You can also get residence as a person of means, whereby you essentially pay £250,000 per year in tax. Foreign-sourced income is taxed at 1%.

So, if you’re making millions, this is certainly an interesting option, particularly because of its close relationship with the UK and its proximity to London. This means you can still enjoy one of the most vibrant cities while retaining some privacy.

In other words, you can have a manor house with beautiful gardens, top-of-the-line infrastructure and close proximity to where the action is. All this while enjoying extremely low taxes.

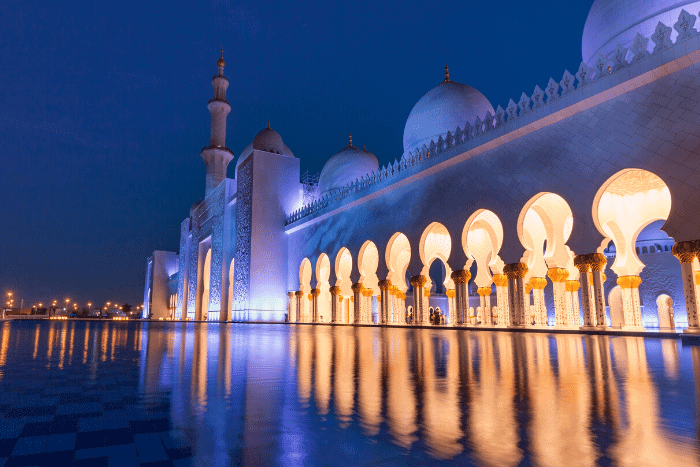

3. The UAE

- Income tax rate: 0% personal income tax

- Corporate tax rate: 9% (exceptions for some free zone companies)

- Residency and citizenship path: You can obtain residency via an investment visa, real estate purchase or employment. Longer-term residence by investment or golden visas are available for substantial investors.

The United Arab Emirates (UAE) has long been a popular choice for folks who want the best tax haven combination: a relatively hassle-free residency permit and no personal income tax.

However, with the introduction of 5% VAT and the new corporate tax rate of 9%, it’s becoming less hospitable for businesses. Unfortunately, not all free zone companies will be exempt from these taxes.

You can choose the type of atmosphere you enjoy day-to-day, as the two main cities of Dubai and Abu Dhabi have distinct vibes.

As you can read in our expat guide to the UAE, Dubai is more entertainment-focused. On the other hand, Abu Dhabi is a bit more ‘old money,’ traditional and calm.

Whichever location you ultimately pick, you will notice that their standard of service is excellent.

Life is good in the UAE. You don’t need to worry about much. If anything, you can hire someone in the UAE to worry for you, as every service and product you could ever want is available there.

Some people have reservations about the Middle East. However, you’ll be treated exceptionally well when you visit.

4. Singapore

- Income tax rate: Progressive, up to 24%

- Corporate tax rate: 17%

- Residency and citizenship path: Invest SDG10 – 25 million under the Global Investor Program. Permanent residency may lead to citizenship.

Singapore attracts millionaires from all over the world with its tax-friendly policies.

Nicknamed ‘The Little Red Dot’ on the Southeast Asian Sea because it’s too small to be shown on most maps, Singapore looks somewhat unassuming at first glance.

But contrary to all expectations, Singapore has become one of the most important, as well as exciting business and cultural centres in the world.

Singapore is home to over 333,000 millionaires, 336 centi-millionaires and over 40 billionaires from all over the world and from all sorts of backgrounds.

So, if you want to rub shoulders with some of the world’s most influential people in a place with a stable political climate and world-class healthcare and transportation systems, Singapore is worth considering.

However, other emerging neighbouring countries are more vibrant and have a bit more character, as our own personal preference for Malaysia would attest.

Nevertheless, if you are looking for a place that’s very well put together and everything works, then Singapore is an excellent spot.

To qualify for the Global Investor Program requires an investment of a minimum of SDG10 million in a company or SDG25 million in an approved fund.

Overall, Singapore is a great location, especially if you are someone who wants to be near emerging markets with excellent investment potential. After all, you’re a stone’s throw away from Malaysia, Cambodia, Myanmar, Indonesia and Vietnam, to name a few.

5. Bahamas

- Income tax rate: No personal income tax

- Corporate tax rate: No corporate income tax

- Residency and citizenship path: Purchase property worth BSD750,000+ for permanent residency, or expedite this with properties valued at US$1.5 million+.

The Bahamas is an exciting option for high-net-worth individuals seeking privacy without feeling trapped, as there’s no minimum stay requirement, and the forty-five-minute flight to Miami offers an easy connection to a first-world country.

Ultimately, this pushes it to the top of our list for the top tax haven countries friendly to Americans and easy for expats to move to.

Foreign investors may be eligible for a permanent residence permit based on a residential property purchase of at least BSD750,000, which is roughly the same in USD.

If your property is worth at least US$1.5 million, you can also accelerate the bureaucratic process to be completed within under 21 days.

The Bahamas is a true tax haven – there are no direct taxes such as corporate income tax, personal income tax or net worth tax.

It’s also an excellent place for entrepreneurs, as you can incorporate your business there and benefit from the tax-neutral environment.

The Bahamas offers all four significant benefits in one: tax exemption, privacy, confidentiality and low accounting requirements.

What more could you ask for?

6. Cayman Islands

- Income tax rate: No personal income tax

- Corporate tax rate: No corporate income tax

- Residency and citizenship path: Invest at least US$2.4 million in developed real estate for a pathway to citizenship.

The whole Caribbean is well-known for its tax haven status, but the Cayman Islands has long been the crown jewel.

As an English-speaking British Overseas Territory, the Cayman Islands is an excellent choice for a luxury lifestyle.

If moving to the Cayman Islands sounds appealing to you, then we have good news – getting a Cayman Islands residency is pretty straightforward.

However, while becoming a resident of the Cayman Islands isn’t too difficult, it is expensive. If you want to move there, be prepared to spend over US$1 million – even for just a temporary residence permit.

The Cayman Islands offer numerous unique benefits not available in other Caribbean countries. For instance, as a resident, you have the opportunity to obtain a British Overseas Territories (Cayman Islands) passport and then apply for British citizenship with all its associated privileges.

As always, whether you should choose a Cayman Islands residence will depend on your needs and circumstances. While island life is tempting, there might be better choices out there.

7. Antigua and Barbuda

- Income tax rate: No personal income tax for residents

- Corporate tax rate: 25%

- Residency and citizenship path: Citizenship by investment is available, starting at US$230,000 for a family of four.

Although it’s not tax-free, Antigua and Barbuda is a relatively tax-friendly jurisdiction.

Antigua and Barbuda offers one of the cheapest CBI programs for families of up to four members, making it an excellent option for families.

If you want a hassle-free place to live with specific tax benefits, you may consider citizenship by investment in Antigua and Barbuda. Although not entirely tax-free, it’s situated in the heart of the Caribbean and offers reasonable fees and benefits.

Tax-Friendly Countries for High-Net-Worth Expats: FAQs

Monaco, the UAE, the Bahamas and the Cayman Islands have no personal income or corporate taxes.

The Bahamas and other Caribbean islands, like St Kitts and Nevis, are particularly easy for Americans due to their proximity, no language barrier and straightforward investment-based residency options.

The Bahamas and the UAE are both tax-free and offer relatively simple residency options through property investment.

Countries like the UK, Canada and Singapore have tax treaties with the US to prevent double taxation on income for expats.

The UAE is ideal, with a 0% income tax and minimal residency requirements. However, various tax-free countries exist, including various tax havens in the Caribbean.

In so many words, yes. Jersey is a top tax-friendly country with low personal and corporate tax rates, particularly for high-net-worth individuals.

Go Where You’re Treated Best in Tax-Friendly Countries

Some people like the idea of Europe and the developed world. Others enjoy island living, where they can enjoy privacy with beautiful beaches. Still, others prefer the fantastic services you can find in the UAE or an excellent local economy like Singapore.

At Nomad Capitalist, we help seven- and eight-figure entrepreneurs and investors create bespoke strategies using our uniquely successful methods.

This will allow you to keep more of your own money, create new wealth faster and be protected from whatever happens in just three steps.

If you want help determining what is ideal for you, your business, and your family, feel free to reach out to our team to discover where you’ll be treated best.